How Is Capital Gains Tax Calculated On Sale Of Property: Complete Guide & Key Details

So, you've done it! You've sold a property. High fives all around! It's a big deal, and often, it means a nice chunk of change. But before you start planning that tropical vacation, there's a little something called capital gains tax to chat about. Now, don't let the fancy name scare you off. Think of it as the government's way of saying, "Hey, you made a profit here, let's share a tiny bit of the fun!" It might sound a bit dry, but honestly, understanding this is like unlocking a secret level in your financial game. It's surprisingly empowering!

Let's dive into the nitty-gritty of how this capital gains tax thing actually works when you sell your home or an investment property. It's not as complicated as it sounds, and once you get the hang of it, you'll feel like a seasoned pro. Ready to become a tax-savvy seller?

The Big Kahuna: What Exactly is a Capital Gain?

First things first, what's a capital gain? It's basically the profit you make when you sell something for more than you originally paid for it. So, if you bought a house for $300,000 and sold it for $400,000, that extra $100,000? That's your capital gain. Simple, right? It's like finding a hidden treasure in your backyard, but instead of gold coins, it's cash profit!

Calculating Your Profit: The Purchase Price is Key!

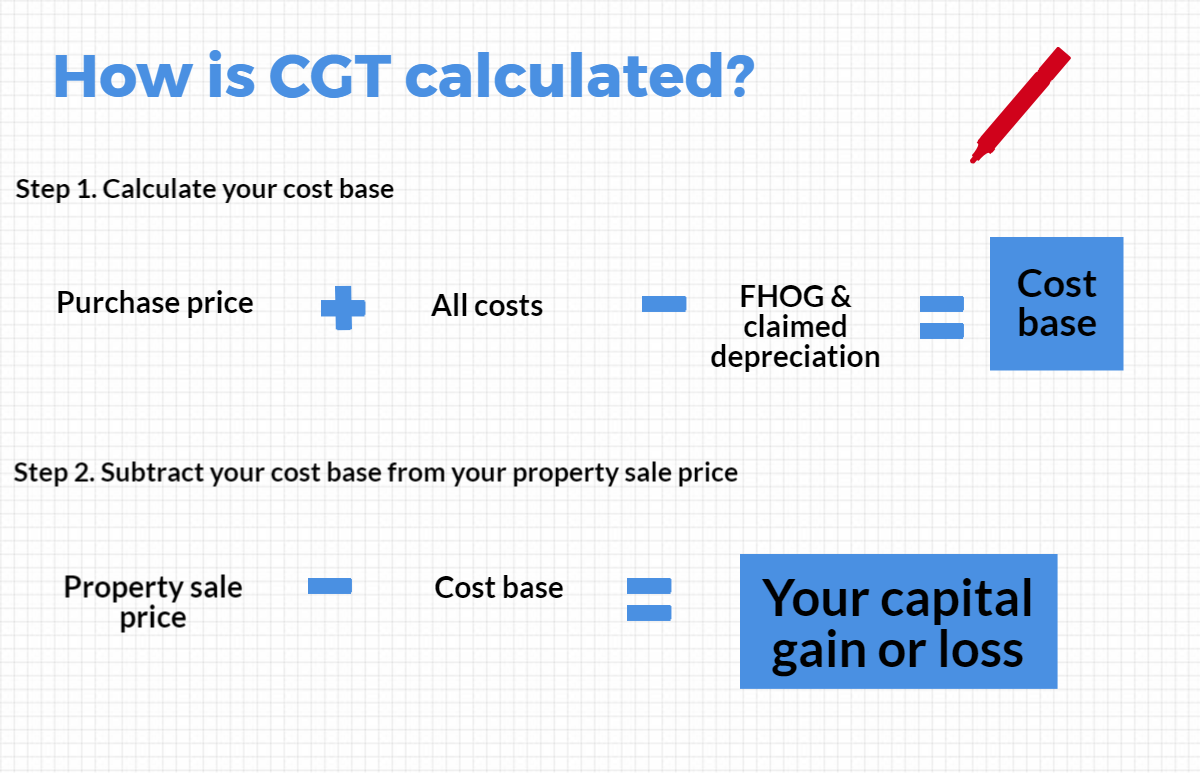

To figure out your profit, you need to know your cost basis. This is generally the price you paid for the property. But wait, there's a little twist! Your cost basis isn't just the sticker price. It also includes things like closing costs from when you bought it, any major improvements you made (like that fabulous new kitchen or a fancy backyard renovation), and even some legal fees. Think of it as the total investment you've put into your property over time. The more you've invested, the higher your cost basis, and the lower your taxable profit will be. It’s like building up your points for a bigger reward!

So, let's say you bought a property for $300,000. You then spent $50,000 on a beautiful extension and $10,000 on new landscaping. Add in $5,000 in closing costs from when you bought it. Your cost basis is now $365,000 ($300,000 + $50,000 + $10,000 + $5,000). If you then sell it for $450,000, your capital gain is $85,000 ($450,000 - $365,000). See? It’s like a treasure hunt for deductions!

The Tax Rate: It Depends on How Long You Owned It!

Now, here's where it gets really interesting, and frankly, quite clever. The tax rate you'll pay on your capital gain depends on how long you owned the property. This is a crucial detail, and it’s designed to encourage people to hold onto investments for a while.

If you owned the property for one year or less, that profit is considered a short-term capital gain. And guess what? Short-term gains are taxed at your ordinary income tax rate. This can be a bit of a sting, as income tax rates can be higher. So, if you're in the 20% income tax bracket, your short-term gain will be taxed at 20%. It’s like paying the full price for a hurried purchase.

However, if you owned the property for more than one year, congratulations! You’ve qualified for the much more favorable long-term capital gains tax rates. These rates are significantly lower. For most people, these rates are either 0%, 15%, or 20%, depending on your overall taxable income. This is where the real magic happens! Holding onto your property can save you a substantial amount of money. It’s like getting a bulk discount!

Why is this distinction so important? Because the government wants to reward long-term investors. They believe that holding onto assets for longer periods contributes to a more stable economy. So, the longer you wait to sell, the more you can potentially save on taxes. It’s a win-win!

Putting It All Together: The Grand Calculation

So, let's recap. You sold your property for more than you paid, plus improvements. That difference is your capital gain. Then, you determine if it’s a short-term (1 year or less) or long-term (more than 1 year) gain. If it’s short-term, you pay your regular income tax on it. If it’s long-term, you pay the lower long-term capital gains tax rate.

Let's use our previous example. You sold the property for $450,000, and your cost basis was $365,000, making your capital gain $85,000. If you owned it for less than a year, and your income tax rate is 20%, you'd owe $17,000 in tax ($85,000 x 0.20). But, if you owned it for more than a year, and let's say your long-term capital gains rate is 15%, you'd only owe $12,750 ($85,000 x 0.15). That's a saving of $4,250! It really adds up!

Special Rules for Your Primary Residence

Now, there's a super-duper important exception for the place you call home – your primary residence! The government understands that selling your main house isn't usually about making a huge profit like you might with an investment property. It's often just about life happening – a new job, a growing family, or needing a change of scenery.

Because of this, there are fantastic exemptions that can significantly reduce or even eliminate the capital gains tax you owe. For individuals, you can exclude up to $250,000 of your profit from taxes. For married couples filing jointly, that exclusion jumps up to a whopping $500,000! To qualify for this, you generally need to have lived in the home for at least two out of the five years before you sell it.

This primary residence exclusion is a game-changer! So, if your profit is within these limits, you might not owe any capital gains tax at all on the sale of your family home. It’s like a special bonus from the tax man!

Keep Good Records: Your Future Self Will Thank You!

The key to navigating this whole capital gains tax thing smoothly is to keep excellent records. Seriously, don't toss those old receipts! Keep everything related to the purchase of your property, all the renovation bills, closing documents, and any other expenses that might add to your cost basis. This meticulousness will make calculating your tax obligation so much easier and ensure you don’t miss out on any potential deductions. It's like having a treasure map for your finances!

Understanding capital gains tax on property sales might seem daunting at first, but once you break it down, it's quite manageable. It’s all about knowing your numbers, understanding the holding period, and taking advantage of the special rules for your home. So, go ahead, pat yourself on the back for your smart selling move, and use this guide to navigate the tax landscape with confidence. Happy selling!