How Many Points Does Credit Score Drop With Hard Inquiry? Quick Answer + Details

Hey there, credit score champions! Ever found yourself staring at a credit card offer or thinking about a sweet new car loan, only to have a little voice in your head whisper, "But what about my credit score?!" And then, like a mysterious phantom, the term "hard inquiry" pops up. It sounds a bit ominous, doesn't it? Like a tiny credit score gremlin is about to pounce.

Well, let's bust that myth right now! Understanding hard inquiries isn't just about avoiding tiny score drops; it's about becoming a financial superhero. And guess what? Knowing the "how many points" question can actually make the whole credit game a whole lot more fun!

The Million-Dollar Question: How Many Points Does a Hard Inquiry Ding Your Score?

Alright, alright, I know you're itching for the quick answer. Drumroll, please... For most people, a single hard inquiry will likely drop your credit score by a mere less than 5 points. Yep, that’s it! Sometimes, you might not see a drop at all, especially if your score is already cruising along like a well-oiled machine. Pretty anticlimactic, right? But hey, sometimes the simplest answers are the most liberating!

Now, before you go signing up for twenty new credit cards just for the heck of it (please don't do that!), let's dive a little deeper into why this is the case and what else you need to know. Think of it as leveling up your credit score knowledge!

What Exactly IS a Hard Inquiry, Anyway?

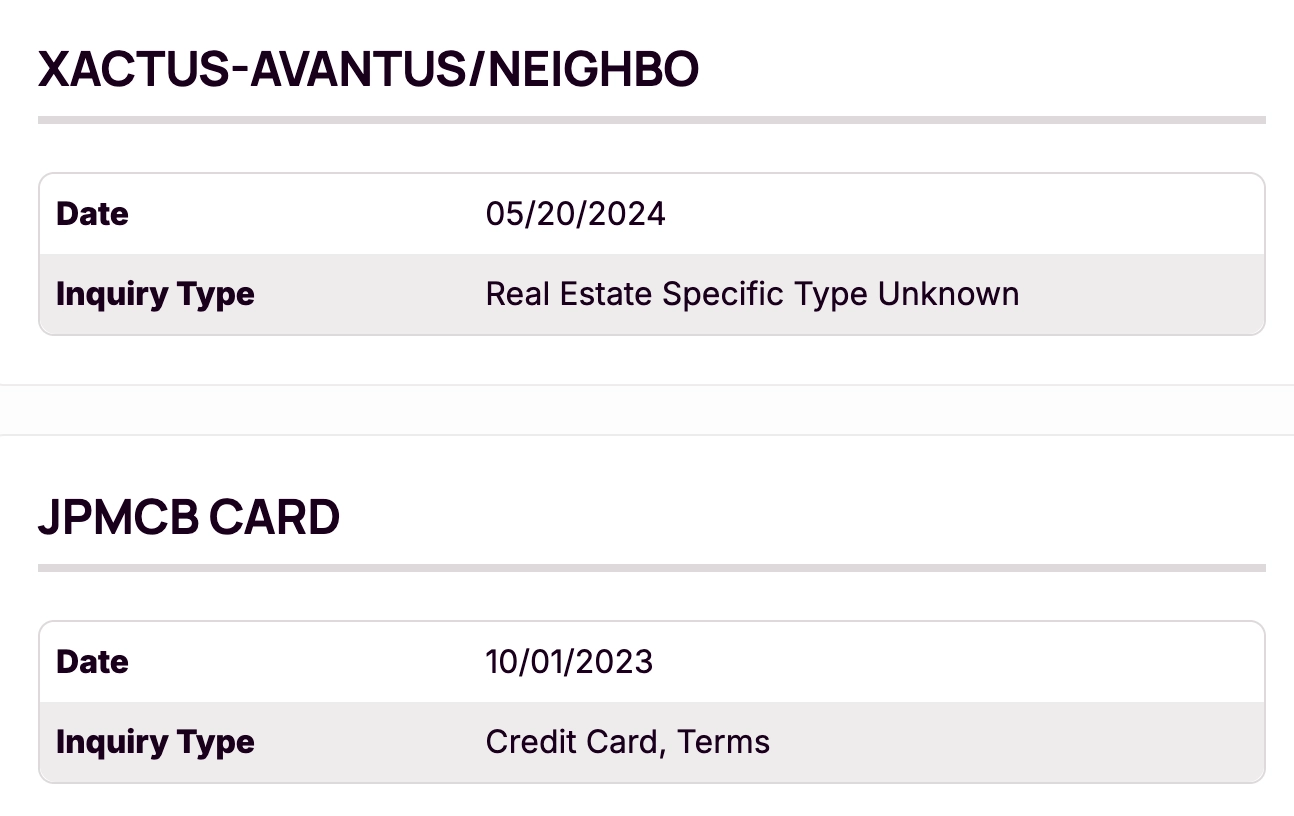

Let's break down this "hard inquiry" business. Imagine you're applying for new credit. This could be a credit card, a mortgage, a car loan, or even some personal loans. When you submit that application, the lender needs to check out your credit history to decide if they want to lend you money. That check? That's a hard inquiry. They're literally hard-boiling your credit report to see what you're made of!

It's a signal to other lenders that you're actively seeking new credit. And because having too much new credit sought out all at once can sometimes indicate a higher risk, credit scoring models give it a little tap on the wrist. Think of it like a referee giving a player a warning for entering the game too aggressively. It's not a red card, just a reminder to play smart!

Why the Small Drop? It's All About Context!

So, why is the score drop usually so small? It's because credit scoring models are pretty darn smart! They know that sometimes, people need to shop around for the best deals. If you're applying for a mortgage or a car loan, it’s perfectly normal to compare offers from a few different lenders to snag the best interest rate. Credit scoring systems are designed to recognize this smart shopping behavior.

They usually have a grace period for rate shopping. For example, if you apply for multiple mortgages or auto loans within a 14- to 45-day window (depending on the scoring model), they're often treated as a single inquiry. Pretty neat, huh? It's like saying, "We get it, you're being a savvy consumer!" This is where knowing the details makes the process way less stressful and way more empowering.

When Does It Matter More? The Multi-Inquiry Scenario

Now, let's talk about when multiple hard inquiries might have a slightly more noticeable effect. This usually happens when you're applying for different types of credit in a short period. For instance, applying for three new credit cards and a personal loan all in the same week could lead to a more significant, though still generally manageable, dip in your score.

Remember, credit scoring models look at the big picture. A sudden flurry of applications for various credit products can be seen as a sign of potential financial distress, and that's something they want to be cautious about. So, while a few points might be lost, it’s usually temporary. It’s like a short pause in your credit score’s upward trajectory, not a full-blown plummet.

The Real Impact: It's Not Just About the Points!

Beyond the immediate point drop, it’s important to remember that hard inquiries are just one small piece of the credit score puzzle. Your payment history (paying bills on time!), credit utilization (how much credit you’re using versus how much you have available), the length of your credit history, your credit mix, and new credit are the big players. Hard inquiries are more like the supporting cast.

The impact of a hard inquiry is also generally short-lived. Most credit scoring models only consider inquiries from the last 12 months. And even then, their influence diminishes over time. After a year, their impact is often minimal, and they usually fall off your credit report entirely after two years.

So, Should You Fear the Hard Inquiry? Absolutely Not!

This is where the fun really kicks in! Instead of fearing hard inquiries, let's reframe them as opportunities to win. You're not just applying for credit; you're taking steps to achieve your financial goals. Whether it’s a down payment on your dream home, a reliable car to explore new adventures, or a credit card that helps you earn awesome rewards, these are exciting milestones!

By understanding that a single hard inquiry has a minimal impact, you can feel more confident shopping around for the best rates and terms. This proactive approach is what truly builds a strong and healthy credit score. It’s about making informed decisions, not playing it safe to the point of missing out on great opportunities.

Making Credit Score Management a Game

Think of managing your credit like playing a video game. You have different metrics to track, levels to achieve, and power-ups to earn. Hard inquiries are just one of the "mechanics" of the game. Knowing how they work allows you to strategize and play smarter.

The real "win" isn't avoiding every single inquiry. It's about understanding their role and using them strategically. It's about knowing when to "pull the trigger" on an application because you've done your research and found a deal that truly benefits you. This knowledge empowers you to take control of your financial journey.

The Uplifting Takeaway: You've Got This!

So, the next time you see that "hard inquiry" mentioned, don't let it scare you. Instead, let it empower you! You're not passively waiting for your credit score to do its thing; you're actively participating in its growth and health. You're learning the rules of the game and becoming a master player.

The world of credit scores might seem complex, but with a little knowledge and a positive attitude, you can navigate it with confidence and ease. Embrace the learning process, celebrate your financial wins, and remember that understanding your credit score is one of the most powerful tools you have for building the life you want. Go out there and make those smart financial moves! You've got this!