How Many Years To Become A Certified Public Accountant? Quick Answer + Details

Ever wondered what it takes to become one of those super-smart folks who understand all about money and taxes? We're talking about Certified Public Accountants, or CPAs! They’re like the financial superheroes of the business world.

You might be curious, "How long does this superhero training take?" Well, buckle up, because we're about to spill the beans on this exciting journey. It's not a quick sprint, but more of an epic adventure with some cool milestones along the way.

The Speedy Answer You're Craving!

So, you want the quick scoop? Drumroll please... it typically takes about four to five years to become a CPA. But wait, there's a little more to the story, and that's where the fun really begins!

Think of it like leveling up in a video game. You have to complete different quests and challenges to reach the final boss – in this case, becoming a fully certified CPA. And trust me, the rewards are totally worth it!

The Not-So-Secret Ingredient: Education!

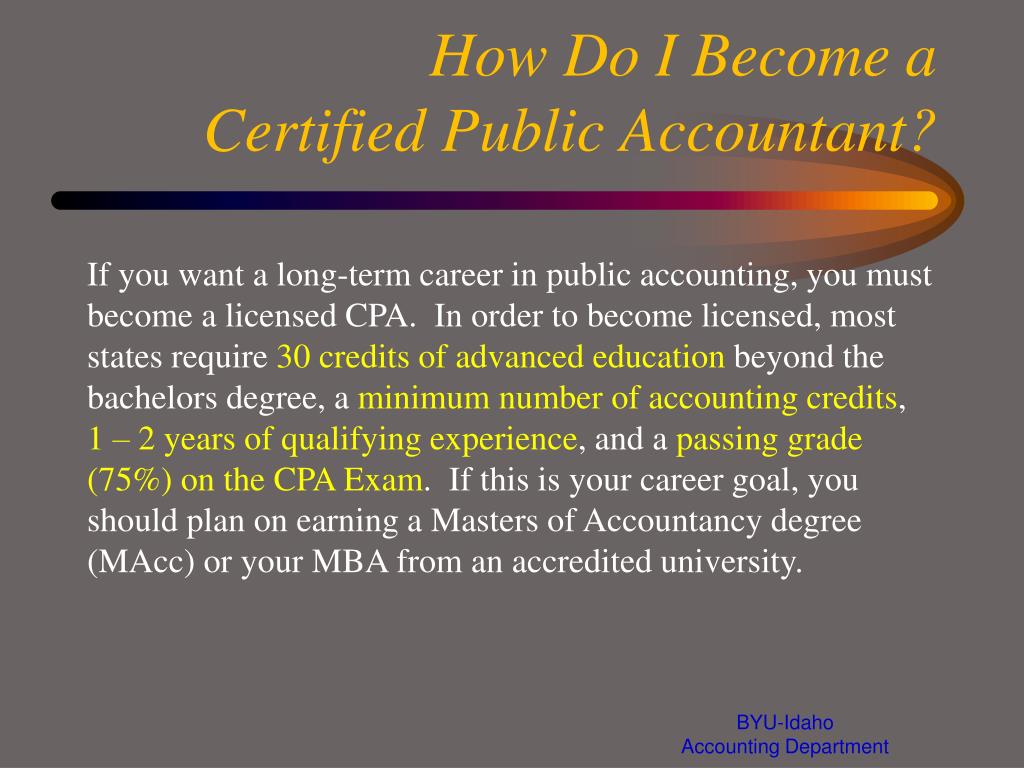

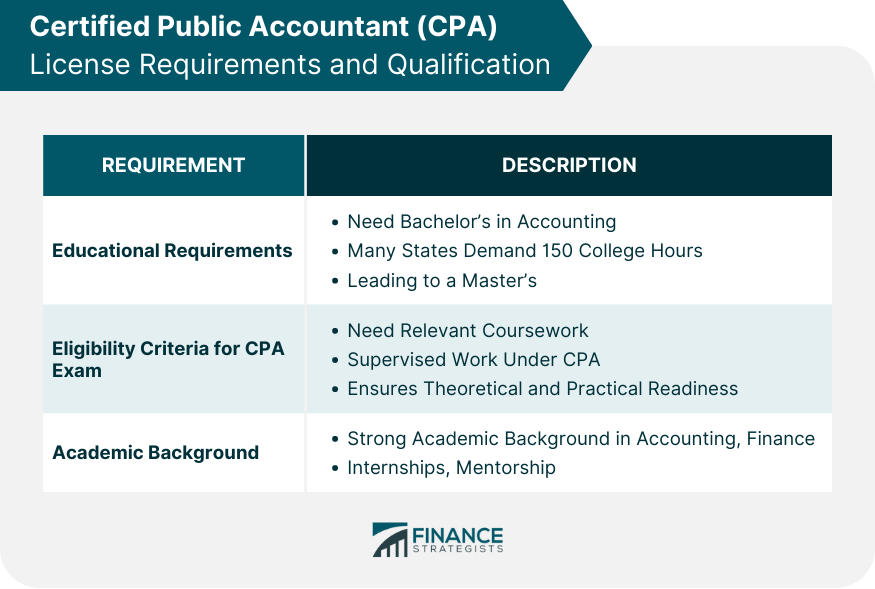

The biggest chunk of your CPA journey involves hitting the books. You'll need a college degree, and not just any degree. Most states require you to have at least 150 college credit hours.

That's a bit more than the standard 120 hours for a typical bachelor's degree. So, you might be thinking, "More school? Boo!" But think of it as an extended adventure where you gain super-powered knowledge.

Many aspiring CPAs choose to get a bachelor's degree in accounting. It's like getting your starter pack for the CPA world. You'll learn all about numbers, how businesses make money, and the fascinating art of keeping everything tidy.

Then, to reach that 150-credit mark, you can either pursue a master's degree or take additional undergraduate courses. A master's degree is like the deluxe edition of your education, giving you even deeper insights and making you a financial whiz.

Or, you can simply pick up extra credits by taking more accounting classes or even courses in related fields like finance or business law. It’s like collecting bonus points to boost your score!

The Big Kahuna: The CPA Exam!

Once you've got your fancy education sorted, it's time for the ultimate challenge: the Uniform CPA Examination. This isn't your average pop quiz; it's a beast of an exam, but a totally conquerable one!

The CPA Exam is divided into four tough sections. We're talking about Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG).

Each section is designed to test your knowledge and skills in different areas of accounting. It’s like facing four different bosses, each with their own unique attack patterns. But with the right preparation, you can totally defeat them.

The FAR section is where you dive deep into the nitty-gritty of financial statements. It's like learning the secret language of how companies report their financial health. You’ll become fluent in debits and credits in no time!

Then there's AUD, where you learn how to be a financial detective, making sure everything adds up and is on the up-and-up. It's all about ensuring fairness and accuracy, which is a pretty cool superpower to have!

BEC is your ticket to understanding the broader business world. You'll learn about economics, corporate governance, and how businesses make smart decisions. It's like getting a peek behind the curtain of how the corporate world ticks.

And finally, REG, where you become a master of tax laws and business ethics. You'll learn how to navigate the complex world of taxes, which, believe it or not, can be quite fascinating when you know what you're doing!

The Not-So-Scary Prep Work

Passing the CPA Exam is no joke. It requires serious dedication and smart preparation. Many candidates spend months, sometimes even a year or more, studying for it.

There are tons of excellent CPA review courses out there that are like your personal trainers for the exam. They break down the material into digestible chunks and offer practice questions that are super similar to the real thing.

Think of it as having a guide on your quest. These courses will show you the best paths to take and help you avoid any hidden traps. It’s all about working smarter, not just harder.

Many aspiring CPAs also form study groups. It’s like forming your own fellowship of the ring, where you can share notes, quiz each other, and motivate one another. Plus, explaining a concept to someone else is a fantastic way to solidify your own understanding.

Experience: The Secret Sauce!

Beyond education and the exam, most states also require you to have some real-world work experience. This is where you get to put all that book smarts into practice!

Typically, you’ll need about one to two years of relevant accounting experience. This experience often needs to be supervised by a licensed CPA. It’s like having a seasoned mentor guiding you as you gain hands-on experience.

This experience can be gained in various settings, such as public accounting firms, private industry, or even government agencies. So, you can choose the path that most excites you!

During your experience, you’ll be doing things like auditing financial statements, preparing tax returns, or providing management consulting services. It’s like getting your hands dirty and learning the ropes in a real professional environment.

This practical experience is crucial because it shows you can apply your knowledge to real-world scenarios. It’s the bridge between knowing about accounting and actually doing accounting like a pro.

Putting It All Together: The Timeline

So, let’s recap this epic journey. You start with your education, aiming for those 150 credit hours. This usually takes around four years if you’re on a traditional college path.

Then comes the CPA Exam. You can start taking sections of the exam once you’ve met certain credit hour requirements, even before you graduate. Some super-motivated students even tackle parts of it during their degree.

:max_bytes(150000):strip_icc()/terms_c_cpa.asp-FINAL-44d586c6065c4346a6c0290cfab18574.jpg)

After passing all four sections of the exam, you’ll need to complete your required work experience. If you do this concurrently with your studies or right after graduation, it can fit within that four-to-five-year timeframe.

However, if you take a bit longer to finish your education or if your work experience is spread out, it might lean closer to five years or even a bit more. Everyone’s journey is a little different, and that’s perfectly okay!

Why It’s Actually Pretty Cool!

Now, you might be asking, "Why would anyone go through all this?" Well, becoming a CPA is like unlocking a secret level of career opportunities! CPAs are in high demand, and the job prospects are fantastic.

They play a vital role in helping businesses thrive, ensuring financial integrity, and guiding individuals through the often-confusing world of finances. It’s a career that offers stability, good earning potential, and the chance to make a real impact.

Plus, the learning never stops! The world of finance is always evolving, so CPAs are constantly learning and adapting. It’s a career that keeps your brain sharp and your skills relevant.

So, while the journey to becoming a CPA might seem long, it’s an incredibly rewarding one. It’s a path that combines rigorous education with practical experience, culminating in a highly respected and valuable professional designation. It's truly a credential that opens many doors!

The CPA designation is more than just a title; it's a testament to dedication, expertise, and a commitment to ethical financial practices. It’s a badge of honor for those who master the intricate world of numbers and business.

So, if you have a knack for numbers, an analytical mind, and a desire to be a trusted financial advisor, the CPA path might just be your calling. It’s an exciting adventure, and the rewards are as substantial as a well-balanced balance sheet!