How Much Can I Afford For Rent Based On Salary: Complete Guide & Key Details

Hey there, apartment hunters and rent-weary folks! Ever found yourself staring at a rental listing, eyes glazing over as you try to figure out if that charming little place is actually within your financial reach? Yeah, we’ve all been there. It’s like trying to decipher a secret code, but instead of treasure, you’re hoping for a cozy home. Today, we’re going to break down the age-old question: how much can you really afford for rent based on your salary? Think of this as your friendly neighborhood guide to making smart rent decisions without needing a calculator and a nap afterwards.

Let's be honest, rent is probably one of the biggest chunks of your monthly budget. It's that big, unavoidable bill that lands on your doorstep (or in your inbox) like clockwork. And if you're not careful, it can feel like you're constantly playing catch-up, juggling bills like a circus performer trying to keep all those spinning plates in the air. We want to help you ditch that juggling act and find a place that makes your wallet breathe a sigh of relief.

The Golden Rule: The 30% Guideline (and Why It’s Not Set in Stone!)

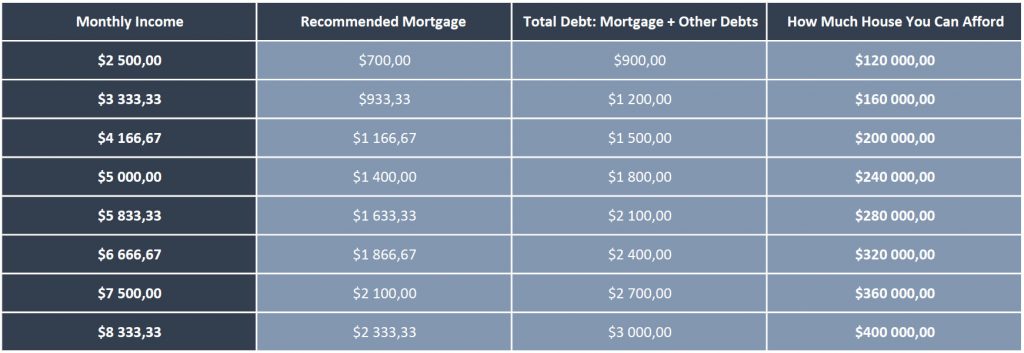

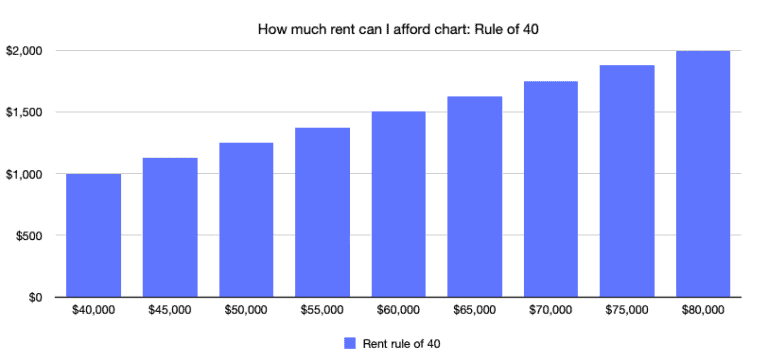

You’ve probably heard whispers of the 30% rule. It’s like the unofficial anthem of personal finance: spend no more than 30% of your gross monthly income on rent. Gross income is the money you make before taxes and other deductions get their hands on it. Think of it as your full paycheck, the big number before it shrinks a little.

So, let’s do a quick math party. If you make $4,000 a month before taxes, 30% of that is $1,200. That means, ideally, your rent (and maybe some utilities, we’ll get to that!) should be around $1,200. Easy peasy, right?

But here’s the juicy secret: this is a guideline, not a rigid law. Life is rarely that simple, is it? For some people, living in a super expensive city, that 30% might mean living in a broom closet. For others, with fewer fixed expenses, they might be able to comfortably stretch that a bit. It’s like aiming for a personal best in a race; you know the target, but your own pace and your own track conditions matter!

Beyond the 30%: What Else Do You Need to Consider?

This is where we roll up our sleeves and get a little more real. That 30% is a starting point, but your actual “affordable rent” is a puzzle with more pieces. Let’s unpack them:

Your Net Income is Your Real Best Friend

Remember that gross income we talked about? Well, taxes, health insurance premiums, retirement contributions – these all chip away at that. What’s left is your net monthly income, or your take-home pay. This is the money you actually have to spend on rent, groceries, that Netflix subscription you can't live without, and, you know, fun stuff!

So, a more accurate calculation is to aim for 30% of your net monthly income. Let's say after taxes and deductions, your take-home pay is $3,000. Then, 30% of that would be $900. See? That $300 difference can be a huge deal when you're crunching numbers.

Imagine you get paid, and it feels like a nice, fat wad of cash. Then, BAM! Deductions. It’s like ordering your favorite pizza, and then they tell you there’s a “service fee” on top of everything. You still love the pizza, but that fee makes you think twice.

The Dreaded "Other Expenses" (aka Your Life!)

Rent isn't the only thing that costs money. This is where we have to be honest with ourselves about where our hard-earned cash is actually going. Think about:

- Student Loans: If you're still paying off those hard-earned degrees, that monthly payment is a significant chunk.

- Car Payments & Insurance: Got wheels? Those payments and insurance premiums add up faster than you can say "road trip!"

- Credit Card Debt: Those little plastic temptations can turn into big monthly payments if you’re not careful.

- Groceries: Unless you're living on instant noodles (which, hey, we've all been there in college!), food costs are a reality.

- Utilities: This is a big one! Electricity, gas, water, internet – these can sneak up on you. Sometimes landlords include some of these, sometimes they don't. Always ask!

- Transportation: Beyond car payments, think gas, public transport passes, ride-sharing services.

- Healthcare: Even with insurance, there can be co-pays and unexpected medical bills.

- Childcare: If you have little ones, this can be one of the biggest expenses.

- Savings & Investments: Don't forget to plan for your future! Even a small amount saved regularly makes a difference.

- Fun Money!: Because life isn't just about bills and work! That movie night, that weekend getaway, that fancy coffee – these are important for your sanity!

Let’s imagine your rent is $1,500. If you spend $800 on groceries, $400 on car payments, and $200 on student loans, that’s already $2,900 just for those essentials. If your take-home pay is $3,500, you're only left with $600 for everything else, including savings and fun. Suddenly, that $1,500 rent feels a lot less comfortable.

Location, Location, Location (and How It Affects Your Wallet)

This is a no-brainer, but it bears repeating. Rent prices vary WILDLY depending on where you live. A charming studio in a bustling city center will cost a lot more than a spacious apartment in a quiet suburban town. It's like comparing the price of a designer handbag in Paris to one at a local market.

The key is to research average rental prices in your desired areas. Websites like Zillow, Apartments.com, and even local Facebook groups can give you a good idea of what to expect. This will help you set a realistic rent target before you even start searching.

The "Rent vs. Buy" Sidestep (Just a Quick One!)

While this article is all about renting, it's worth a fleeting thought that sometimes buying a home can be cheaper in the long run than renting, especially in certain markets. But that's a whole other can of worms filled with mortgages, down payments, and property taxes. For now, let's stick to the rental quest!

Putting It All Together: Your Personalized Rent Budget

So, how do you figure out your perfect rent number? Here’s a simple way to approach it:

- Calculate Your Net Monthly Income: Look at your pay stubs and add up your take-home pay for a month.

- List Your Fixed Monthly Expenses: Write down every single bill that you know you have to pay each month (loans, car payments, insurance, etc.).

- Estimate Your Variable Monthly Expenses: This is where groceries, utilities, gas, and fun money come in. Be realistic here! Maybe look at your bank statements from the last few months to get an average.

- Subtract Expenses from Income: Your net income minus your total fixed and estimated variable expenses will tell you how much you have left for rent and savings.

- Decide on Your Rent "Comfort Zone": Now, take that leftover money. How much of that are you comfortable allocating to rent? Remember that 30% of net income guideline, but also consider if you have any major savings goals or unexpected expenses on the horizon. It’s better to err on the side of caution and have a little extra wiggle room.

Think of it like packing for a trip. You know you need clothes, toiletries, and maybe a good book. But you also need space for souvenirs and that extra bag of snacks you might need. You don't want to pack your suitcase so full that you can't zip it closed!

The Bottom Line: Rent Smart, Live Happy!

Understanding how much you can afford for rent isn't just about avoiding financial stress; it's about building a life you love. When your rent is manageable, you have more freedom to save for your dreams, pursue your hobbies, and enjoy life without that nagging worry about where your next dollar is going.

So, take a deep breath, grab a pen and paper (or your favorite spreadsheet app), and crunch those numbers. You’ve got this! And remember, finding the right place at the right price is a huge win. Happy apartment hunting!