How Much Does Insurance Go Up After At Fault Accident: Price/cost Details & What To Expect

Oh, the dreaded “at-fault accident.” It’s like that one embarrassing karaoke performance you can’t seem to live down. You know, the one where you hit a note so wrong, the dog started howling in sympathy. Well, after a fender-bender where you’re the main character, your car insurance is likely to stage its own little sequel.

Let’s be honest, nobody wants to be at fault. It’s right up there with finding out your favorite jeans shrunk in the wash. But accidents happen, and when they do, your insurance premium might do a little hop, skip, and a jump up the price ladder. Think of it as your insurance company adjusting its expectations, like a movie director realizing your initial script needs a few more explosions (and maybe a dramatic slow-motion car flip).

The Price Tag: It’s Not a Flat Fee, Folks!

So, how much does this little oopsie cost you in the long run? Well, it’s not a simple “add $50 and call it a day” situation. It’s more like a choose-your-own-adventure novel, with each path leading to a slightly different price. We’re talking about potential increases that can range from a gentle nudge to a full-on shove.

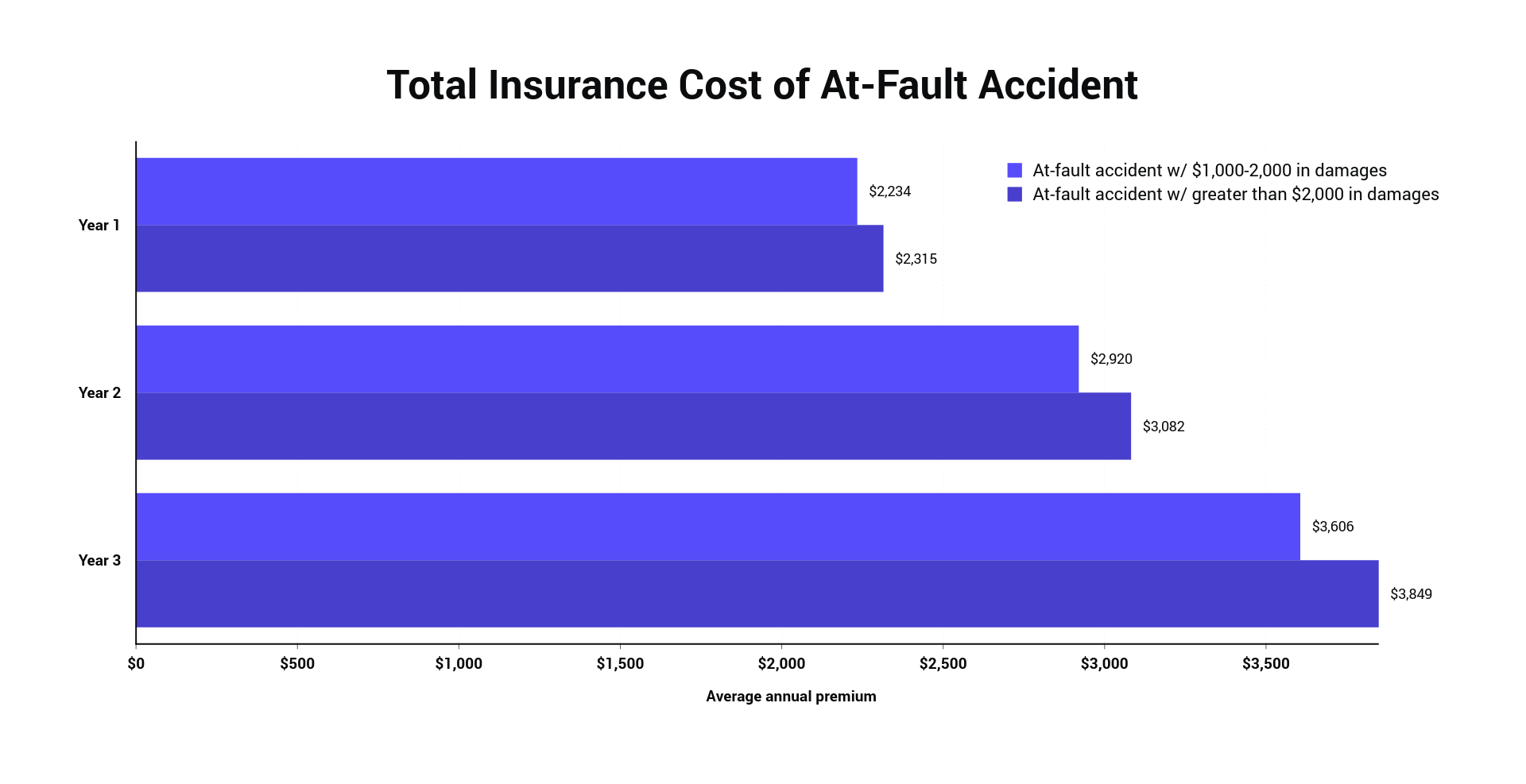

Some studies suggest an at-fault accident could bump your premiums by an average of 20% to 50%. Ouch! But remember, that’s an average. For some, it might be a bit less, a small price to pay for learning a valuable lesson. For others, it might be more, especially if you’ve got a history of… let’s call them “enthusiastic driving moments.”

Think of your insurance premium like a well-loved teddy bear. It’s usually cuddly and predictable. But after a major mishap, it might get a little scuffed up, and you might have to shell out a bit more for its upkeep. This isn’t a punishment, but rather the insurance gods adjusting their risk assessment. They’re basically saying, “Okay, you’ve shown us your adventurous side. Let’s talk about how we can keep you covered, but maybe with a slightly heftier hug of a premium.”

Factors That Play the Premium Game

What makes your premium decide to go on a diet? Several things. The severity of the accident is a biggie. A minor tap that only requires a tiny dab of paint is different from a crash that looks like it belongs in a Fast & Furious movie. The more expensive the repairs, the more the insurance company’s wallet might feel the pinch, and guess who gets to help them recover?

Your driving record is like your report card for the road. If you’ve been a perfect student with a spotless record, the increase might be more manageable. But if you’ve had a few speeding tickets or previous claims, that at-fault accident might be the cherry on top of a not-so-sweet sundae. Your insurance company might see you as a higher risk, like a baker who keeps burning the cookies – they’re going to be more cautious about giving you another batch.

The type of coverage you have also matters. If you have a comprehensive policy with all the bells and whistles, the increase might be more pronounced than if you’re rocking the bare minimum. It’s like choosing between a fancy gourmet meal and a quick sandwich; the bill is going to reflect the upgrade. Plus, where you live can play a role. Urban areas with more traffic might see higher increases than quieter rural settings.

And let’s not forget the insurance company itself! Each company has its own algorithms and policies. Some are more forgiving than others. It’s like having different teachers with different grading scales. You might get a slightly different outcome depending on which “classroom” you’re in.

What to Expect: The Aftermath of the Accident

So, you’ve had your moment of automotive drama. What happens next? First, your insurance company will investigate, like a detective trying to figure out who ate the last cookie. They’ll look at police reports, witness statements, and maybe even the angle of the fender bend. It’s all part of their quest for the truth.

Once they’ve determined you’re at fault, you’ll likely receive a notification. This might come in the form of a letter or an email, often accompanied by a sense of dread. It’s like getting that dreaded report card in the mail, where you secretly hope the teacher forgot about that one pop quiz.

The actual premium increase usually kicks in at your next renewal. So, you might not see the price hike the very next day. It’s more of a gradual reveal, like the final episode of a suspenseful TV series. This gives you some time to prepare, maybe start a secret “accident fund” for future car-related surprises.

Some insurers offer a “claims forgiveness” program. This is like a special pass, a magical amulet that protects your premium from a single at-fault accident. It’s not universally available, and it often comes with its own set of rules and conditions. Think of it as a VIP pass to the insurance club, but you have to be on the guest list.

Finding a Silver Lining (and Maybe a Cheaper Premium)

Now, before you start weeping into your coffee, there are ways to navigate this. The most obvious is to drive defensively. This is your superpower, your shield against future premium hikes. Be aware of your surroundings, avoid distractions, and let’s all try to avoid becoming a statistic.

If your premium does go up, it’s a good time to shop around. Your current insurer might not be the cheapest anymore. It’s like finding out your favorite restaurant has a competitor that offers the same delicious food for less. Comparison shopping can be your best friend here.

Consider increasing your deductible. This is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible usually means a lower premium. It’s a trade-off: you take on more risk upfront for a cheaper ongoing cost. Just make sure you can afford that deductible if you ever need to use it!

Some companies offer discounts for things like good grades, safe driving habits (like not getting tickets), or even bundling your home and auto insurance. It’s like getting bonus points for being a good citizen of the road. You might be surprised at how many discounts you qualify for. It’s like a treasure hunt for savings!

Ultimately, an at-fault accident is a learning experience. It’s a reminder that the road can be unpredictable, and we all have our clumsy moments. While your insurance premium might take a hit, think of it as the cost of admission to a valuable life lesson. And who knows, maybe the next time you’re tempted to rush, you’ll remember this and take a deep breath, allowing your premium (and your stress levels) to stay a little calmer. It’s all about evolving, one careful mile at a time. You might even find yourself telling the story of your accident with a wry smile someday, a testament to your resilience and your newfound appreciation for safe driving!