How Much Does It Cost To Declare Bankruptcy In California: Price, Costs & What To Expect

Ever feel like your wallet's doing a sad little tap dance to the tune of "Empty Pockets Blues"? Yeah, us too. Sometimes, life throws so many financial curveballs, you start to wonder if you accidentally signed up for a "How to Live on Instant Noodles" masterclass. Between the credit card bills that multiply faster than rabbits and those unexpected "Oh Crap!" moments (like your car deciding to impersonate a broken lawnmower), it's easy to find yourself staring at your bank account and thinking, "Is this all there is?"

When the debt monster starts whispering sweet nothings of overdue notices and collection calls in your ear, it can feel like you're trying to bail out a sinking ship with a teacup. And in California, where even a cup of coffee can set you back a small fortune, the thought of dealing with something as heavy as bankruptcy can feel like trying to climb Mount Everest in flip-flops. But hey, before you start picturing yourself living in a cardboard box labeled "Future Lottery Winner," let's break down what declaring bankruptcy in the Golden State actually looks like, price-wise. Think of this as your friendly, no-judgement tour of the financial trenches.

First things first, let's get one thing straight: bankruptcy isn't some magic wand that makes all your problems disappear into thin air. It's more like a really sturdy lifeboat. It's designed to give you a breather, a chance to get your financial footing back after a particularly rough storm. You're not suddenly going to be swimming in caviar, but you can get out from under that crushing weight of debt. And let's be honest, sometimes that feeling of breathing freely again is worth more than all the gold in Fort Knox.

So, how much does this financial lifeboat cost in California? Well, it's not as simple as popping down to your local 7-Eleven and picking up a "Bankruptcy Starter Pack" for $19.99. It’s a bit more involved, and like a good burrito, it’s got layers. The total cost can vary, but we’re generally talking about a few thousand dollars. Think of it as an investment in your sanity. A few thousand dollars now might save you years of sleepless nights and existential dread about that overdue car payment.

The Official Fees: The Government's Cut

Every journey, even a financial one, has its tolls. In the case of bankruptcy, Uncle Sam (and California, by extension) wants their share. These are the non-negotiable, official fees that go straight to the court system. They're like the entrance fee to the "Financial Reboot" convention.

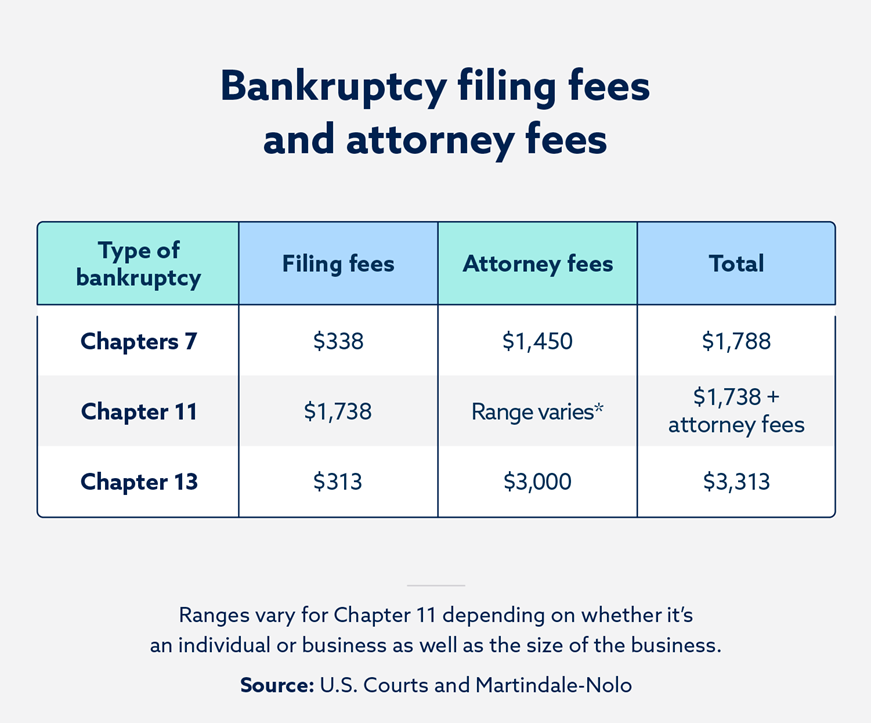

For filing Chapter 7 bankruptcy, the most common type for individuals drowning in unsecured debt (think credit cards, medical bills), the filing fee itself is currently set at $338. Now, $338 might sound like a lot, especially if you're counting pennies, but compared to the total debt it can help you shed, it's like a tiny gnat buzzing around a jumbo jet. It’s the initial splash you make to get the ball rolling.

If you're looking at Chapter 13 bankruptcy, which is more for folks who want to keep their assets (like a house or a car) and have a regular income to repay a portion of their debts over time, the filing fee is a bit higher at $313. Wait, what? It’s actually less? Don't get too excited; there are other costs that often make Chapter 13 a bit more involved, which we'll get to. Think of it as the upfront ticket price versus the full concert experience.

But wait, there's more! On top of the filing fee, there are other administrative fees. These include things like the trustee's administrative fee (they're the folks who oversee your case) and the cost for credit counseling and debtor education courses. These mandatory courses are like a "Financial CPR" class – they teach you how to breathe again after a debt-induced coma. These add another chunk, usually around $50 to $100 for each course, totaling about $100-$200 for both.

So, when you add it all up, the official government fees for filing bankruptcy in California, just the basic paperwork and mandatory courses, can range anywhere from roughly $400 to $550. This is the baseline, the "bare minimum to get through the door" cost. It’s like buying the basic ticket to an amusement park; you get in, but the real fun (and the real cost) often comes with the extras.

The Lawyer's Tab: Your Financial Navigator

Now, this is where the cost can really start to spread its wings. While it is possible to file for bankruptcy pro se (that's fancy legal talk for "on your own"), it's generally about as advisable as performing your own appendectomy. Bankruptcy law is complicated. It's like trying to assemble IKEA furniture without the instructions, but instead of a wobbly bookshelf, you could end up with your bankruptcy case being thrown out, leaving you right back where you started, only poorer.

Hiring an attorney is where most of your bankruptcy costs will likely go. Think of your bankruptcy lawyer as your seasoned guide through the dense jungle of legal jargon and court procedures. They're the ones who know the safe paths, the dangerous pitfalls, and how to charm the grumpy gatekeeper (the judge). Without them, you're essentially wandering around in the dark, hoping you don't step on a financial snake.

The fees for bankruptcy attorneys in California can vary wildly depending on their experience, the complexity of your case, and where in California you live. Los Angeles or San Francisco lawyers might charge more than someone in a smaller city, just like a gourmet truffle costs more than a bag of chips. But for a typical Chapter 7 case, you're generally looking at attorney fees in the range of $1,500 to $3,500. Some might even go up to $4,000 or more for particularly complex situations.

For Chapter 13, the attorney fees can be a bit higher, sometimes ranging from $3,000 to $5,000 or more. This is because Chapter 13 cases are generally more involved. You're not just filing paperwork; you're negotiating a repayment plan, attending court hearings, and the attorney is actively working on your case for the entire duration of the plan (which can be 3 to 5 years!). So, they're practically your financial therapist for half a decade.

Many attorneys offer payment plans for their fees, which is a lifesaver for people already struggling with debt. You might be able to pay a portion upfront and then pay the rest in installments, sometimes even before your bankruptcy is officially discharged. It’s like spreading out the cost of that fancy new sofa you’ve been eyeing.

It’s also a good idea to get a few consultations with different attorneys before you commit. Ask them about their fees, what’s included, and if they offer payment plans. Think of it like test-driving a car; you want to find the one that fits your budget and your needs perfectly.

Other Potential Costs: The Unexpected Detours

Just when you think you've got a handle on the numbers, life throws in a few more curveballs. There are a few other minor costs that can pop up during the bankruptcy process. These are the little surprise expenses, like finding out your favorite ice cream flavor is discontinued – annoying, but not a dealbreaker.

Sometimes, the court might require you to provide copies of certain documents, and there can be a small fee for that. It's usually just a few dollars per page. Think of it as paying for the printing costs of your financial comeback story.

If your case is particularly complicated, or if there are creditors who want to challenge things, you might incur additional legal fees. This is rare for straightforward cases, but it’s something to be aware of. It's like hitting a traffic jam on your way to your vacation destination; it slows you down and might cost you a bit more in gas and time.

For Chapter 7, there's also the possibility of a "means test" attorney fee. This is part of the legal services to determine if you qualify for Chapter 7 based on your income. Sometimes this is included in the overall fee, but it’s good to clarify.

And don't forget the cost of getting your financial life back in order after bankruptcy. While not a direct bankruptcy cost, it’s an important consideration. You'll need to budget for rebuilding credit, which might involve secured credit cards or small loans. It’s like getting your car repaired; the repair itself has a cost, but you also need to factor in the ongoing maintenance to keep it running smoothly.

Putting It All Together: The Grand Total

So, let's do some back-of-the-envelope math. For a typical Chapter 7 bankruptcy in California, you're looking at:

- Filing Fees & Administrative Costs: ~$400 - $550

- Attorney Fees: ~$1,500 - $3,500 (can be more)

- Other Minor Costs: Variable, but usually minimal

This puts the total cost for a Chapter 7 bankruptcy in California somewhere in the ballpark of $2,000 to $4,000. For Chapter 13, the attorney fees can push the total closer to $3,500 to $6,000 or even more, depending on the complexity and attorney rates.

Now, I know what you're thinking: "$4,000? That's a lot of avocado toast!" And you're right, it is. But let's put that into perspective. If you're drowning in, say, $30,000 of credit card debt, that $4,000 is essentially buying you out of that debt for a fraction of the cost. It's like paying a small fee to get off a rollercoaster that's making you sick.

Think about the peace of mind. The ability to sleep at night without that nagging worry. The freedom from harassing phone calls. The chance to start fresh. For many people, that’s priceless. It’s the difference between feeling like you’re treading water in a storm and finally reaching dry land.

What to Expect in Terms of the Process

Beyond the price tag, what else can you expect? The bankruptcy process, even with a lawyer, can feel a bit like a marathon. There’s paperwork. Lots and lots of paperwork. You’ll need to gather financial documents, income statements, tax returns, and lists of all your creditors. It can feel like you're organizing your entire financial life for a public viewing, which, let's face it, isn't always the most fun activity.

You'll have to attend a meeting of creditors, also known as the "341 meeting." Don't let the name scare you; it's usually not as dramatic as it sounds. In most cases, the trustee asks a few standard questions about your petition, and creditors rarely show up. It’s more like a quick check-in than a courtroom showdown. You might even find yourself chuckling at how anticlimactic it all is.

For Chapter 7, once you've completed your courses and the trustee hasn't found anything to object to, you'll likely receive your discharge within a few months. It's like finally getting the all-clear after a long illness. For Chapter 13, it's a longer haul, as you'll be making payments for 3 to 5 years, but the relief of having a structured plan and a light at the end of the tunnel is significant.

The most important thing is to be honest and upfront with your attorney. Don't try to hide anything. The bankruptcy laws are designed to help people who are genuinely struggling, and trying to game the system will only backfire. Your attorney is there to help you navigate the system, not to help you cheat it.

So, while the cost of declaring bankruptcy in California might seem daunting at first glance, it's important to remember what you're getting in return: a chance at a fresh financial start. It's an investment in your future well-being, a way to escape the debt monster's lair and emerge with your sanity intact. And who knows, maybe after all this, you'll finally be able to afford that extra scoop of ice cream without guilt. Now wouldn't that be something?