How Much Does It Cost To File Bankruptcy In Louisiana: Price/cost Details & What To Expect

Alright, let's talk about something that, let's be honest, sounds about as fun as a root canal performed by a grumpy alligator. Filing for bankruptcy. In Louisiana, no less! It’s not exactly the kind of topic you bring up at a crawfish boil, but hey, sometimes life throws you a curveball, and you find yourself staring at a mountain of bills taller than a New Orleans skyscraper. You might be thinking, "How much is this going to cost me, on top of everything else?" Well, buckle up, buttercup, because we're going to break it down in a way that’s hopefully less intimidating than a hurricane warning.

Think of it like this: You've got a leaky roof, and the rain is coming in. You could try to patch it with duct tape and a prayer, but eventually, you’ll need a proper repair. Bankruptcy is kind of like calling in the roofing crew, but for your finances. It’s a tool to help you get back on solid ground when things have gotten a bit… soggy. And like any good repair job, there’s a price tag. We’re not talking about the cost of a brand-new Mardi Gras float here, but it’s definitely not pocket change either. Let's try to make sense of it, shall we?

The Big Question: How Much Does This Whole Shebang Cost?

So, the million-dollar question, or maybe the few-thousand-dollar question, is: what’s the damage? In Louisiana, like most places, the cost of filing for bankruptcy isn't a flat rate. It’s more like a buffet – you pick and choose (or rather, your situation dictates) what you’re going to end up paying. You’re generally looking at two main buckets of costs:

- Court Filing Fees: This is the government’s fee for letting you use their courthouse to sort out your financial mess. Think of it as their "processing fee" for helping you get a fresh start.

- Attorney Fees: Unless you’re a legal whiz who moonlights as a CPA (and let’s be real, who has that kind of energy?), you’ll likely need a lawyer. This is usually the biggest chunk of the cost.

We’re going to dive into these, but remember, these are general figures. Your specific situation is like a unique recipe, and it might have a few more or fewer ingredients (and thus, a different cost). Don't get caught in the "sticker shock" of a random number you saw on a forum; it's like judging a gumbo by the color of one grain of rice. It’s just not the whole story.

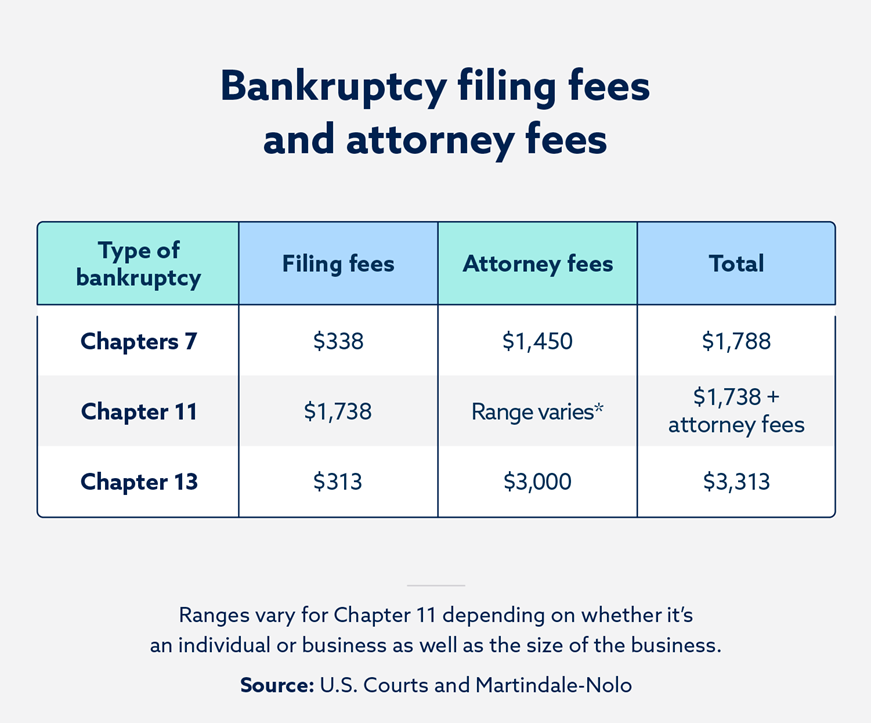

The Government's Cut: Filing Fees

Let’s talk about the official stuff. When you file for bankruptcy, the court needs its due. These are the non-negotiable fees that go straight to Uncle Sam (or, in this case, the Louisiana courts). These fees are set by the courts and can change, so always confirm with your lawyer or the court clerk for the latest numbers. But as a general ballpark:

- Chapter 7 Bankruptcy: This is the most common type, often referred to as "liquidation." You get to keep most of your stuff, and the rest is sold to pay off debts. For Chapter 7, you’re looking at filing fees around $338. This is pretty standard across the board, so it's a fairly predictable expense.

- Chapter 13 Bankruptcy: This is more of a "wage earner's plan." You propose a repayment plan to pay off a portion of your debts over three to five years. The filing fee for Chapter 13 is a bit higher, usually around $313. Seems counterintuitive, right? More complex plan, less filing fee? That's the magic of the legal system, folks! (Okay, it's more about the different processes involved, but it's still a little head-scratcher.)

Now, $300-something might seem like a lot when you’re already drowning in debt. But think of it as the "entrance fee" to get you out of the drowning zone. It's a one-time cost that unlocks the whole process. Some courts do allow you to pay these fees in installments, which is a lifesaver when every dollar counts. So, don't panic if you can't cough it all up at once.

The Lawyer's Piece of the Pie: Attorney Fees

Ah, the lawyer. This is where things can get a bit more… fluid. Attorney fees are highly variable. They depend on the complexity of your case, the lawyer’s experience, their location within Louisiana (New Orleans lawyers might charge a tad more than, say, a lawyer in a smaller bayou town, just like a fancy French Quarter restaurant versus a local diner), and what type of bankruptcy you’re filing.

Chapter 7 Attorney Fees: For a relatively straightforward Chapter 7 case, you might see attorney fees ranging from $1,000 to $3,500, and sometimes a bit more. This isn’t a casual coffee purchase; it’s a significant investment. But remember, this fee usually covers a lot more than just showing up in court. It includes:

- Initial consultations to assess your situation.

- Gathering all your financial documents.

- Explaining your options (Chapter 7, Chapter 13, or maybe something else entirely).

- Preparing and filing all the necessary paperwork (and trust me, there's a lot of paperwork. It's like trying to assemble IKEA furniture with instructions written in ancient hieroglyphics).

- Communicating with your creditors.

- Representing you at the "meeting of creditors" (the 341 meeting), which is like a formal Q&A session with the trustee.

- Negotiating with the trustee if any assets are involved.

Many bankruptcy attorneys offer a flat fee for Chapter 7 cases. This means you pay a set amount, and you know what to expect. This is great for budgeting. Some might break it down, asking for a portion upfront and the rest in installments. It’s definitely worth asking about their payment plans!

Chapter 13 Attorney Fees: Chapter 13 cases are generally more complex, as they involve creating and managing a repayment plan. Because of this, attorney fees for Chapter 13 are typically higher, often ranging from $3,000 to $5,000 or more. However, there’s a silver lining here, and it’s a pretty big one:

- In Chapter 13, a portion of the attorney's fees can often be paid through your repayment plan. This means you don't have to come up with the entire attorney fee upfront. It's paid out gradually over the life of your plan, making it much more manageable. This is a huge advantage for people who are struggling to come up with a lump sum.

Think of your lawyer as your financial quarterback. They’re the ones calling the plays, understanding the rules of the game (bankruptcy law), and making sure you don’t fumble. Their expertise can save you a lot of headaches, time, and potentially even more money in the long run by ensuring the process is done correctly the first time.

![How Much Do Bankruptcy Lawyers Cost? [2023]](https://nearu.pro/wp-content/uploads/2023/10/how-much-do-bankruptcy-lawyers-cost-filing-768x621.png)

Other Potential Costs: The "Oops, I Forgot About That!" Stuff

Beyond the filing fees and attorney fees, there can be a few other smaller costs that might pop up. These are like the little garnishes on your plate – not the main course, but they add up:

- Credit Counseling and Debtor Education Courses: Before you can file, you must complete two mandatory courses from approved agencies: a credit counseling course (before filing) and a debtor education course (after filing, before your debts are discharged). Each of these courses typically costs between $20 and $50. Some agencies offer fee waivers if you can show financial hardship, so don't let this be a roadblock!

- Copying and Document Fees: You might need to make copies of documents, or your attorney might charge a small fee for them. It's usually not a significant amount, but it's good to be aware.

- Credit Report Fees: Your attorney will likely pull your credit report, and there might be a small charge for this.

- Trustee Fees (Chapter 7): In some rare cases in Chapter 7, if there are non-exempt assets that are sold, the bankruptcy trustee may take a fee from the proceeds of that sale. But in most cases where there are no assets to liquidate, you won't see a trustee fee.

These are the smaller players on the field, but it's always best to get a clear understanding from your attorney about any potential ancillary costs. It’s like packing for a trip – you pack the essentials, but you also throw in a few extras just in case.

What to Expect When You're Expecting… a Bill

So, you've decided to go for it. What does the financial journey look like from the moment you decide until the dust settles?

Initial Consultation: Most bankruptcy attorneys offer a free initial consultation. This is your chance to spill your financial guts, ask all your burning questions, and see if you click with the lawyer. It’s like a first date for your finances and legal help. No commitment, just information gathering.

Retainer and Payment Plans: If you decide to move forward, your attorney will typically ask for a retainer fee. This is an upfront payment that goes towards their total fee. Many attorneys are flexible and offer payment plans, especially for Chapter 7. Don't be afraid to discuss your financial limitations. They’ve heard it all before, and they’re there to help.

Filing Day: Once all the paperwork is ready, you’ll sign it, and your attorney will file it with the court. At this point, you'll have paid at least a portion of the filing fees and attorney fees, depending on your agreement.

The "Automatic Stay": The moment your case is filed, an "automatic stay" goes into effect. This is like a force field that instantly stops most creditors from calling you, suing you, or garnishing your wages. It’s a huge relief, and it’s immediate! Imagine all those annoying calls suddenly going silent. Bliss!

The 341 Meeting of Creditors: This is a mandatory meeting where a bankruptcy trustee will ask you a few basic questions about your bankruptcy petition and your financial situation. It’s usually short, informal, and not nearly as scary as it sounds. Your attorney will be there with you, holding your hand (figuratively, of course).

Chapter 13 Repayment Plan: If you filed Chapter 13, you'll be working with your attorney to propose and get your repayment plan approved by the court. This is a multi-year commitment, and your payments will be made through the trustee.

![How Much Do Bankruptcy Lawyers Cost? [2023]](https://nearu.pro/wp-content/uploads/2023/10/how-much-do-bankruptcy-lawyers-cost-and-other-costs.png)

Discharge: After all the requirements are met (including the debtor education course), the court will grant you a discharge. This is the magic word that means most of your eligible debts are gone. Poof! Like a magician’s trick, but real!

Is it Worth It? The ROI on a Fresh Financial Start

Now, the big picture. Is spending a few thousand dollars on bankruptcy worth it? For many people, the answer is a resounding yes. Think about it: if you're being crushed by debt, facing lawsuits, or living in constant fear of creditors, bankruptcy offers a way out. It's not a magic wand, but it’s a structured process to get you back on your feet.

Consider the alternative: relentless stress, potential wage garnishment, losing your home or car. The emotional toll of overwhelming debt can be devastating. The cost of bankruptcy, while significant, is often far less than the ongoing costs (both financial and emotional) of staying in debt. It’s an investment in your peace of mind and your financial future.

It’s also important to remember that Louisiana has specific laws regarding bankruptcy, and the cost can be influenced by those. The best advice is always to consult with a qualified Louisiana bankruptcy attorney. They can give you a precise breakdown of costs based on your unique circumstances, explain the payment options, and guide you through the entire process. Don’t try to navigate this complex system alone; it’s like trying to catch a greased pig at a festival – messy and usually unsuccessful!

So, while the idea of bankruptcy might sound like a financial black hole, understanding the costs and what to expect can make it seem much more manageable. It’s a step towards reclaiming control of your finances and, ultimately, your life. And who wouldn't want that? You might even get to sleep through the night again without a herd of creditors stampeding through your dreams.