How Much Does Mark Zuckerberg Own Of Meta

Hey there, fellow internet explorer! Ever find yourself scrolling through Facebook, Instagram, or WhatsApp and wonder, "Who really calls the shots here?" And more importantly, how much of this digital empire actually belongs to the guy who started it all, Mr. Mark Zuckerberg himself?

It's a question that pops up more often than a "you have a new memory" notification, right? We see his face, we hear his name, but the exact ownership stake can feel as mysterious as that one friend who always disappears when it's time to split the bill. Let's dive in, shall we? Grab a virtual coffee, settle in, and we'll break down how much Mark Zuckerberg actually owns of Meta, the company behind all those apps we love (and sometimes love to hate!).

So, Does He Own It All?

The short answer is: not quite all. But before you picture him with a tiny percentage, hear me out. While he doesn't hold 100% of the pie, Mark Zuckerberg is still very much the big cheese, the head honcho, the guy with the most clout. Think of Meta as a massive pizza. He might not own every single slice, but he definitely has the biggest, most important ones, and he also has the recipe!

It's a bit more complicated than just counting shares, though. You see, Meta, like many publicly traded companies, has different classes of stock. This is where things get a little nerdy, but I promise to keep it as fun as trying to explain TikTok dances to your grandma.

The Power of the Shares

When a company goes public, it sells shares of its stock to the public. Anyone can buy these shares and become a part-owner of the company. Pretty neat, huh? So, in theory, a whole lot of people own a little piece of Meta. From your neighbor who's into investing to that cool tech guru you follow online, they all contribute to the collective ownership.

But here's the twist: Mark Zuckerberg doesn't just own any shares. Oh no. He strategically created different types of shares that give him a disproportionate amount of control, even if he doesn't own the majority of the total shares. It's like having a secret handshake that gives you special privileges.

Class A vs. Class B: The Secret Sauce

Meta has two main classes of stock that matter for our discussion: Class A and Class B. You'll typically see Class A shares when you look up Meta's stock on the market. These are the ones that the general public can buy and sell. They come with voting rights, but each share usually gets one vote.

Now, enter the Class B shares. These are the special ones. Mark Zuckerberg holds a significant chunk of these, and here's the kicker: each Class B share has ten votes! Yes, you read that right. Ten votes per share. This means that even if someone owns a ton of Class A shares, Zuckerberg's Class B shares give him far more voting power. It’s like he has a magic wand that multiplies his say in important company decisions.

This dual-class structure is pretty common in the tech world, especially for companies founded by strong personalities. It allows founders to maintain control over their vision and direction, even as their company grows and more investors come on board. It’s a way to keep the ship sailing in the direction they originally intended, without getting swayed too much by short-term shareholder demands. Think of it as him having the final say on which toppings go on the pizza, even if others bought the most slices!

His Personal Stake

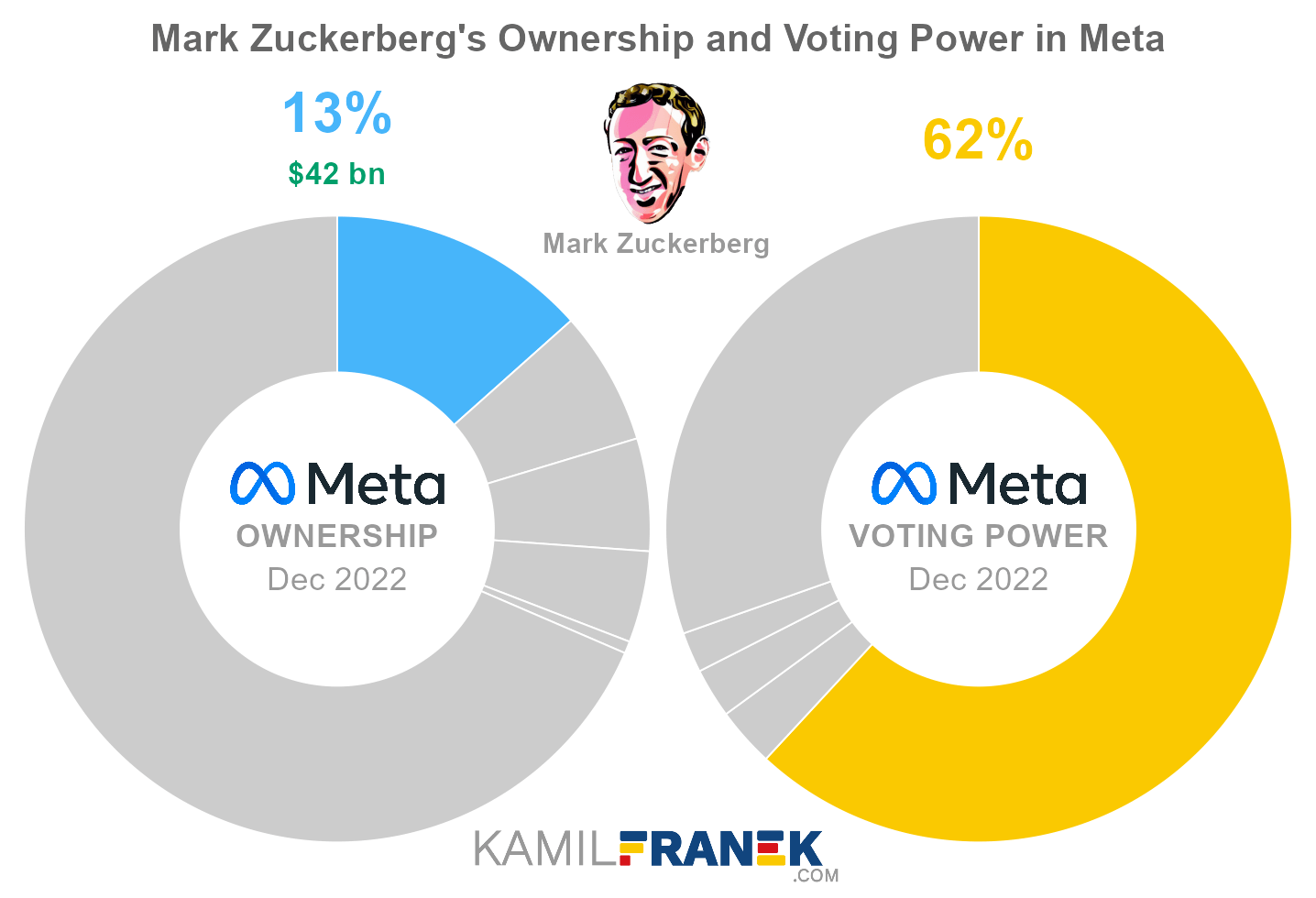

So, how much does he personally own? As of recent reports (and these numbers can fluctuate, so take them with a grain of digital salt!), Mark Zuckerberg directly owns a significant portion of Meta's Class B shares. This gives him about 54% of the voting power. Yeah, over half! This is the real magic number when it comes to who's really in charge.

In terms of actual economic ownership (meaning, if Meta were to be sold, how much of the money would go to him), his stake is a bit lower. He owns a substantial amount of Class A shares as well, but the voting power of the Class B shares is what truly cements his control.

It’s a brilliant, albeit complex, way to structure ownership that allows him to steer the ship while still raising capital and having public investors. He’s essentially saying, "You can buy a piece of my pizza, but I still get to decide how it’s cut and what goes on it."

Why the Big Control?

You might be thinking, "Why does he need that much control?" Well, it's a combination of things. First, there's the whole vision thing. Zuckerberg founded Facebook when he was just a college student, and he’s been instrumental in shaping its trajectory. He believes in the long-term goals of Meta, like building the metaverse, and he wants to ensure that those ambitious plans aren't derailed by short-term market pressures or dissenting voices.

Think about it: Imagine you had an incredible idea for a game. You poured your heart and soul into it. Then, as it got popular, people started asking you to change the rules all the time. You'd want to be able to stick to your original vision, right? That's kind of what Zuckerberg is doing. He wants to build the future of connection, and he believes he knows best how to get there.

Secondly, it's about stability. With a dual-class structure, the company is less susceptible to hostile takeovers or activist investors who might try to force drastic changes. This provides a sense of security and allows Meta to invest heavily in research and development, even if those investments don't pay off immediately. It's like having a sturdy foundation for a very tall building.

The "Metaverse" Factor

And then there's the whole metaverse. This is Zuckerberg's big bet for the future. He's pouring billions into developing virtual and augmented reality technologies. This is a long-term play, and it requires a steady hand and a clear vision. Having concentrated voting power ensures that Meta can keep pushing forward with these ambitious projects, even when they are expensive and the returns aren't immediate.

It's like he's building a whole new digital world, and he wants to make sure he has the blueprints and the construction crew all working in harmony, guided by his original design. He’s not just managing apps; he’s trying to build the next era of the internet, and that requires a certain level of unilateral decision-making power.

What About Other Big Shareholders?

Of course, Zuckerberg isn't the only one with a stake. There are other major institutional investors, like Vanguard and BlackRock, who own significant amounts of Class A shares. These are giant investment firms that manage money for millions of people. They are important stakeholders, and their opinions matter. However, due to the voting power of Zuckerberg's Class B shares, his vote ultimately carries more weight.

It's a bit like a town hall meeting. Everyone gets to voice their opinion, and many people have important insights. But there's still that one person who, by the rules of the meeting, has the deciding vote on the most critical issues. That's Zuckerberg.

These institutional investors are crucial for Meta's financial health and growth. They provide capital and can exert influence through their large holdings. But the structure is designed so that Zuckerberg's vision isn't easily overridden. It's a delicate balance of power, with a clear tilt towards the founder.

The Public's Say

Even with Zuckerberg's control, the public still has a voice. Class A shareholders can vote on certain matters, and their collective opinion can sometimes sway decisions or at least highlight concerns. Plus, the stock price itself is a constant feedback mechanism. If investors aren't happy with Meta's performance or direction, they can sell their shares, which impacts the company's value.

So, while he holds the reins firmly, he's not operating in a vacuum. The market, the public, and other major investors all play a role. It’s more like a really well-choreographed dance where Zuckerberg is the lead choreographer, but the rest of the dancers' movements still matter!

Is It Fair?

The fairness of this ownership structure is a topic of much debate. Some argue it's a brilliant way for founders to maintain control and build long-term value. Others believe it's undemocratic and concentrates too much power in the hands of one person. It’s like arguing whether pineapple belongs on pizza – everyone has an opinion!

For founders like Zuckerberg, it’s a way to ensure their company stays true to its original mission and can pursue ambitious, sometimes risky, long-term goals without constant pressure from shareholders focused on quarterly profits. It allows for a more consistent and potentially innovative approach.

On the other hand, critics worry about accountability. When one person has so much control, who can truly check their power? What if their vision leads the company astray? These are valid concerns in the world of massive tech companies that impact billions of lives.

The Future is Now (or Soon!)

Ultimately, Mark Zuckerberg's ownership of Meta is a fascinating case study in corporate governance and founder control. He owns enough voting power to largely dictate the company's direction, especially as it pivots towards the metaverse. He's not just an employee; he's the architect, the builder, and the chief visionary.

And you know what? There’s something kind of inspiring about that. Imagine having a dream so big, so audacious, that you build an empire around it and retain the power to shape its future. It’s a testament to perseverance, innovation, and a really, really good idea (even if it started with dorm room shenanigans!).

So, the next time you're liking a friend's vacation photos or sending a silly GIF on WhatsApp, take a moment to appreciate the intricate web of ownership and control that makes it all possible. Mark Zuckerberg might not own every single byte, but he definitely owns a massive, and critically important, chunk of our digital world. And who knows, maybe his vision for the metaverse will be the next big thing that changes how we all connect. Pretty cool, right? Keep scrolling, keep connecting, and keep dreaming big – just like Mark!