How Much Does Medical Collections Affect Credit Score: Price, Costs & What To Expect

Ever gotten a medical bill and just… froze? You know, the kind that makes your eyes widen and your wallet do a little jig of panic? Well, guess what? Those little paper (or digital) reminders of your doctor visits can have a surprising impact on something else that makes us sweat: our credit score.

Think of your credit score like a popularity contest for your finances. Lenders and landlords are the judges. A high score means you’re a star! A low score? Not so much. And those pesky medical bills, if not handled carefully, can totally tank your popularity.

So, how much do these medical collections actually mess with your score? It’s not a simple number, but it’s definitely something you don’t want to ignore. Let's dive into this surprisingly dramatic financial saga!

The Plot Twist: Medical Bills and Your Credit

You had a medical procedure. Ouch. Then the bill arrives. Double ouch. If you can’t pay it right away, it might get sent to a collections agency. This is where the drama really begins.

When a debt goes to collections, it’s like a red flag waving furiously at credit bureaus. They see it as a sign that you haven’t paid your obligations. And, unfortunately, this can significantly drag down your credit score.

The good news? Things have gotten a bit more forgiving lately. The major credit bureaus are trying to be a little kinder to folks dealing with medical debt. But it’s not a magic wand, folks!

The Price of the Mishap: How Much is Too Much?

What’s the magic number that triggers a credit score tumble? For a long time, any medical collection, no matter how small, could hurt. Even a $5 bill from a forgotten doctor’s visit could land on your credit report.

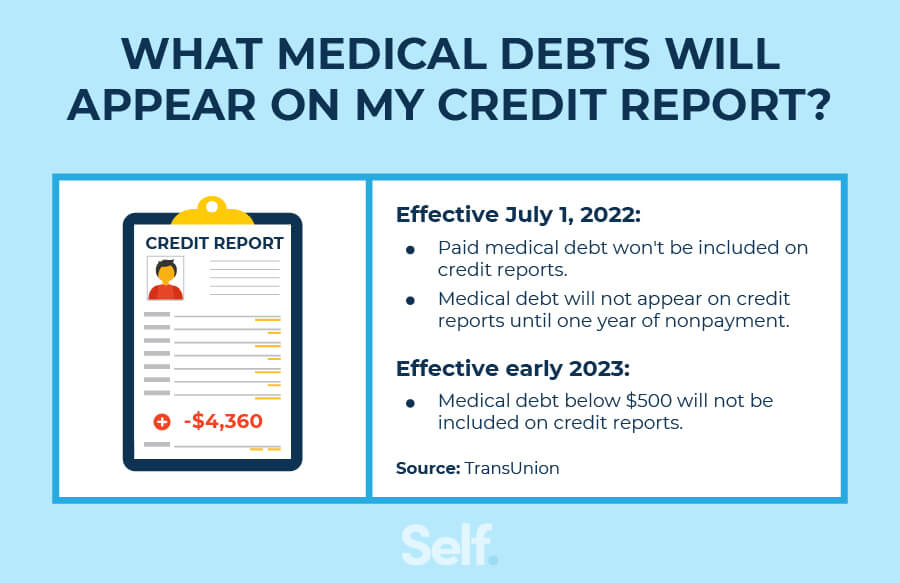

But here’s a glimmer of hope: Equifax, Experian, and TransUnion, the big three credit bureaus, have made some changes. Now, medical collections usually have to be at least $500 before they’re even reported to credit bureaus.

And here’s an even better plot twist: if a medical collection is paid off, it will no longer be on your credit report! This is a huge win for people who can settle their debts. So, if that $600 bill finally gets paid, poof! It can disappear from your credit history.

The Cost of Waiting: Procrastination’s Price Tag

You might think, “Okay, so it takes a while for it to hurt my credit, I’ll just wait.” Big mistake. Huge. The longer a medical collection hangs around, the more damage it can do.

Generally, a collection account can stay on your credit report for up to seven years. That’s a long time to carry that financial burden. Think of it as a stubborn stain on your credit report’s otherwise pristine reputation.

The impact on your score can vary. It might be a few points, or it could be a significant drop. It depends on your overall credit history and how much debt you already have. But it’s never a good look.

What To Expect: The Drama Unfolds

So, you’ve got a medical bill that’s gone sideways. What happens next? First, you might get calls from the collections agency. They’re the debt collectors, the characters in this story who want their money.

If you don’t pay, they can eventually report the debt to the credit bureaus. This is when the real credit score damage starts. Your score can drop, making it harder to get approved for loans, credit cards, or even rent an apartment.

Imagine trying to get a new phone plan and getting rejected because of an old, forgotten medical bill. It’s the kind of plot twist nobody wants!

The Resolution: How to Tame the Financial Beast

Don’t panic! There are ways to manage this. The first step is to communicate. Talk to the medical provider or the collections agency.

See if you can set up a payment plan. Many are willing to work with you, especially if you show you’re trying. You might even be able to negotiate a settlement for less than the full amount owed. It’s like finding a loophole in the financial labyrinth!

If you have medical debt in collections, it’s crucial to check your credit reports. You can get free copies from AnnualCreditReport.com. Look for any errors and dispute them if you find any.

When It All Clears Up: The Happy Ending

Once a medical collection is paid, it should be removed from your credit report. This is the triumphant moment! Your credit score can start to recover.

The sooner you address medical debt, the better. Don’t let it linger and cast a shadow over your financial future. Think of it as a health check for your credit!

Dealing with medical bills and collections can feel overwhelming, but it’s a story with a potential happy ending. By staying informed and proactive, you can navigate this financial drama and keep your credit score looking its best.

The Unexpected Star: Why This Matters to You

Why is this whole medical collections thing so intriguing? Because it’s a part of life most of us will face at some point. We all get sick. We all need medical care. And sometimes, that care comes with a hefty price tag.

This isn't just about abstract numbers on a report. It’s about real-life consequences. A lower credit score can mean higher interest rates on loans, making everything from buying a car to buying a house more expensive. It can even affect your insurance premiums.

So, understanding how medical collections work is like having a secret superpower. It allows you to protect your financial well-being and make smarter decisions when those unexpected medical bills arrive.

The Hidden Drama: The Nuances of Reporting

It’s not always straightforward. Sometimes, medical bills might be sent to collections and then later returned to the original provider. The reporting on your credit report can get a bit… complicated.

Also, there’s a difference between having medical debt and having a medical collection. Having a large bill you haven’t paid yet might not show up on your credit report. But once it goes to a collections agency and they report it, that’s when the credit score impact happens.

It’s a whole financial ecosystem, and medical bills are just one, sometimes thorny, branch. Staying aware of the rules and how these agencies operate is key.

The Final Act: Taking Control of Your Credit

The biggest takeaway is this: don’t ignore medical bills. Ever. Treat them with the same respect you’d give any other financial obligation.

If you know you can’t pay immediately, reach out. Explain your situation. Most medical providers and collections agencies would rather work out a payment plan than have it go to a full-blown credit dinger.

And remember, knowledge is power. The more you understand about how medical collections affect your credit score, the better equipped you’ll be to handle them. So go ahead, check those credit reports, and take charge of your financial story!