How Much Does Medical Collections Affect Credit Score: Price/cost Details & What To Expect

Let's talk about that pesky little thing called medical debt. It's not exactly the stuff of dinner party conversations, is it? Usually, when we think about credit scores, our minds drift to mortgages, car loans, and maybe that impulse credit card purchase we're still sort of paying off. But what about those unexpected doctor visits, those emergency room runs, or those little (or not so little!) bills that seem to multiply like rabbits?

Here's a fun little secret: medical collections can indeed have a say in how your credit score is looking. Now, don't get us wrong, we're not trying to scare anyone. Think of it more like a quirky, unexpected character making a guest appearance in your credit score's dramatic movie. Sometimes, this character is a grumpy old landlord who's a bit behind on rent, and sometimes, it's a well-meaning but slightly forgetful friend who keeps borrowing your favorite sweater. The impact can range from a gentle nudge to a more forceful shove, depending on the situation.

So, how much does this medical debt drama actually cost your credit score? Well, it's a bit like asking how much a hug is worth. It's hard to put an exact dollar figure on it, and it's not a fixed price tag that applies to everyone. What we can say is that medical collections can be a significant factor. If a medical bill goes unpaid and gets sent to a collection agency, that information can land on your credit report. And guess what? Lenders, those folks who decide if you get that dream home or that zippy new car, tend to frown upon unpaid bills, even if they were for a life-saving procedure or a cast for a broken arm.

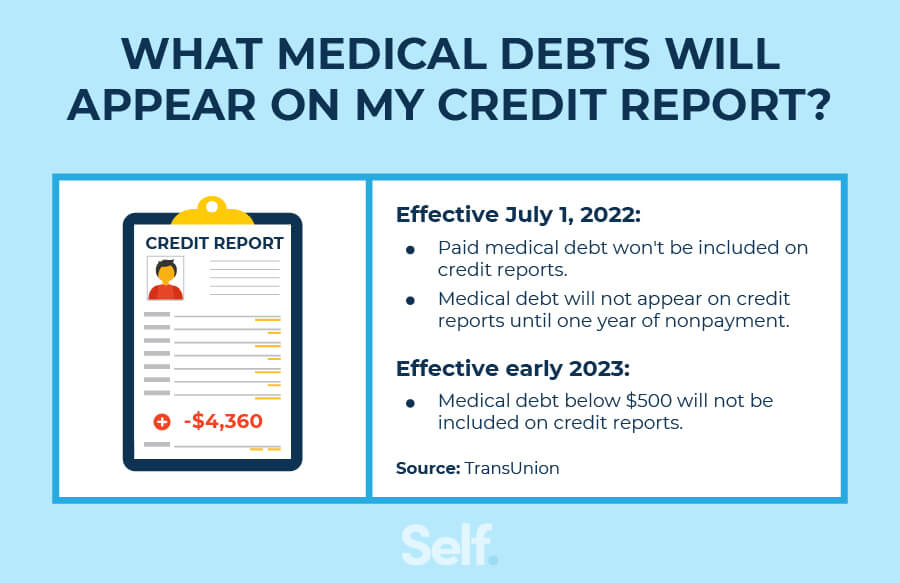

The scary part? Sometimes, even if you eventually pay off that medical collection, the negative mark can linger. It's like that awkward memory of tripping in front of your crush – it happened, and for a while, it feels like everyone remembers it. However, there's some really good news on this front that might warm your heart like a cup of hot cocoa on a chilly evening. Recent changes in the credit reporting world have made things a little more forgiving when it comes to medical debt.

For example, the big three credit bureaus – Equifax, Experian, and TransUnion – have made some adjustments. Generally, they've implemented a waiting period before a medical collection account can even show up on your credit report. This gives you a breathing room, a chance to sort things out, maybe even negotiate a payment plan or get some assistance. It's like the universe giving you a little wink and a nudge, saying, "Hey, let's not jump to conclusions here." Also, here's a heartwarming twist: if you do pay off a medical collection, it's supposed to be removed from your credit report! That's right, it's like a magic eraser for that particular chapter of your financial story.

"It's not about the debt itself, but how you handle it that truly matters."

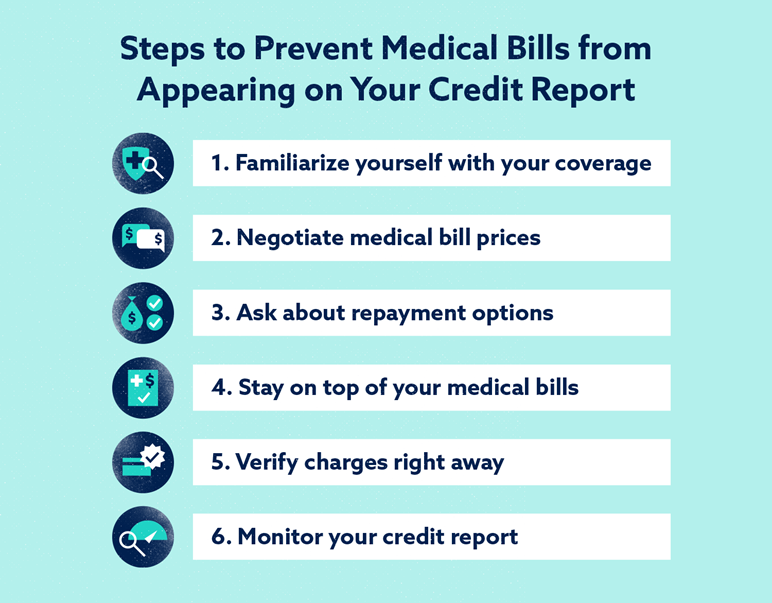

The key thing to remember is that communication is your superpower. If you receive a medical bill that seems overwhelming, don't just stuff it in a drawer and hope it disappears. Reach out to the healthcare provider or the billing department. They often have payment plans, financial assistance programs, or can help you navigate the complexities. Think of them not as antagonists, but as potential allies in your financial journey. You might be surprised at how willing they are to work with you.

Now, let's talk about what to expect if a medical bill does end up in collections. It’s less of a dramatic courtroom scene and more of a quiet, persistent phone call or a letter in the mail. The collection agency's goal is to get paid. They might offer to settle the debt for a lower amount, which can be a good option if you're struggling. It's like finding a slightly bruised apple at a good price – still perfectly edible! You can also try to negotiate a payment plan, spreading out the cost over time. This is often a win-win: you get to pay off your debt, and the collection agency gets their money.

What's the actual "price" of a medical collection on your credit score? It's not like a menu with fixed prices. A single medical collection, especially if it's a smaller amount, might have less impact than multiple collections or larger ones. It's all about the overall picture. However, even a small ding can be disheartening. The good news is that credit scores are also dynamic. They can bounce back! By consistently paying your other bills on time and managing your finances responsibly, you can gradually rebuild your creditworthiness. It’s like tending to a garden – with consistent care and attention, it will flourish again.

So, while medical collections can feel like a looming storm cloud, remember that there are often solutions. Be proactive, communicate, and understand your rights. And don't forget to celebrate the small victories, like that time you successfully haggled down a bill or set up a manageable payment plan. These little triumphs are just as important as the big ones when it comes to building a strong financial future. It’s a journey, and sometimes, the most unexpected detours lead to the most valuable lessons, and surprisingly, even a touch of financial resilience and perhaps, a good story to tell later.