## That "Oops" Moment: How Your Insurance Premium Becomes a "Whoa!" Moment After an Accident

Let's face it, we've all been there. The split-second of panic, the screech of tires, the sickening crunch. Whether it was a fender-bender that barely nudged a mailbox or a more significant collision, that moment of "Oops!" can quickly morph into a "Whoa!" when you start thinking about your car insurance.

You've done the right thing by filing a claim, getting repairs done, and generally being a responsible adult. But now, a little voice in the back of your head is whispering, "How much is this going to cost me in the long run?" And that little voice is usually a harbinger of a not-so-pleasant conversation with your insurance provider.

So, you're wondering, "How much does my insurance actually increase after an accident?" Buckle up, buttercups, because we're about to take a ride through the often-turbulent world of post-accident insurance premiums.

### The Not-So-Secret Ingredient: Your Premium's Transformation

Think of your car insurance premium like a perfectly brewed cup of coffee. It's a delicate balance of many ingredients: your driving record, your age, your car, your location, and yes, your claims history. When an accident happens, it's like someone just dumped a whole bag of sugar into that perfect brew. The taste changes, and the price reflects it.

The Price Tag of "At-Fault" vs. "Not-At-Fault": A Tale of Two Premiums

This is the biggest differentiator. If the accident was deemed

your fault, prepare for a more significant sting. Insurance companies see at-fault accidents as an indicator of increased risk. You're more likely to have another incident, so they need to compensate for that.

*

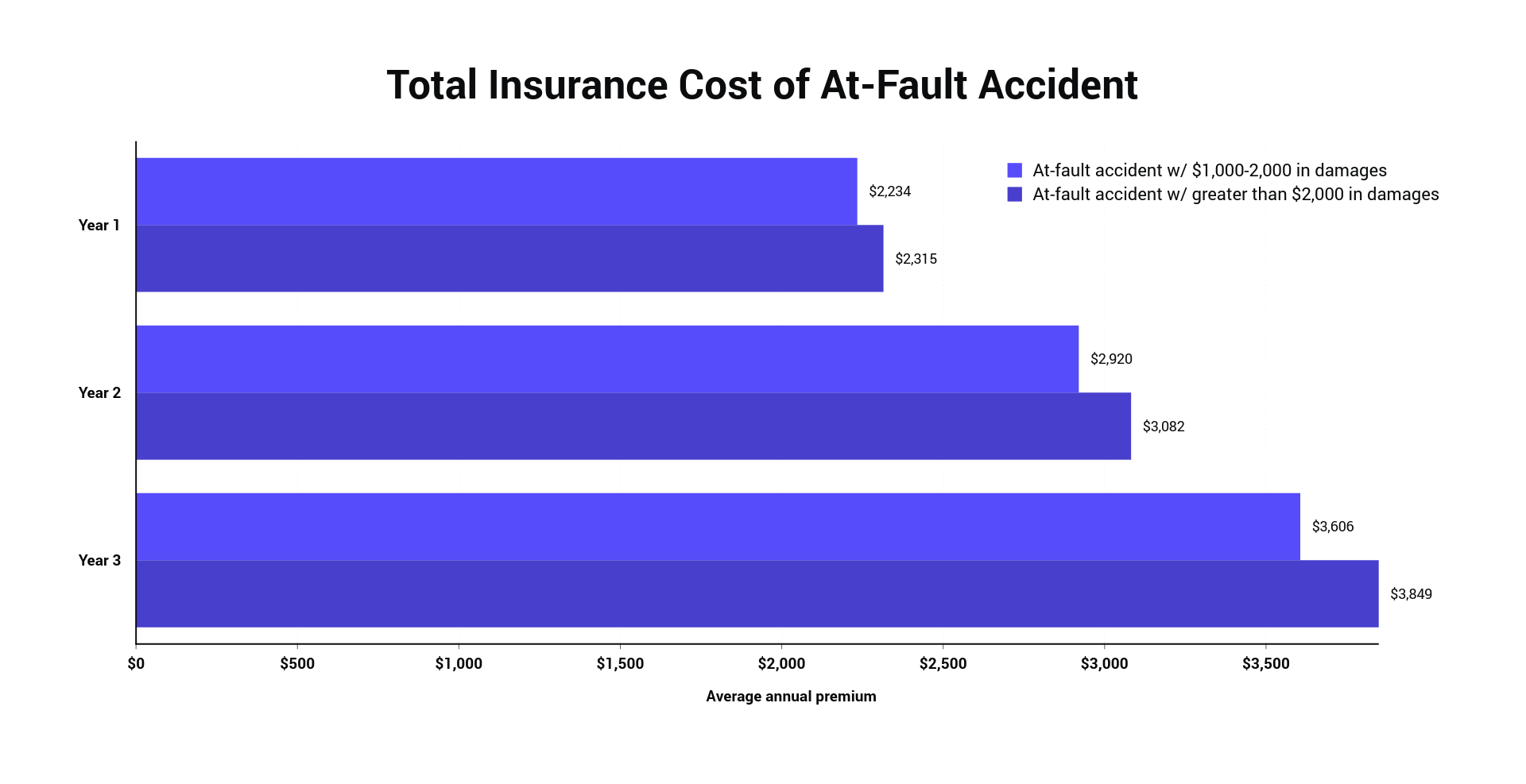

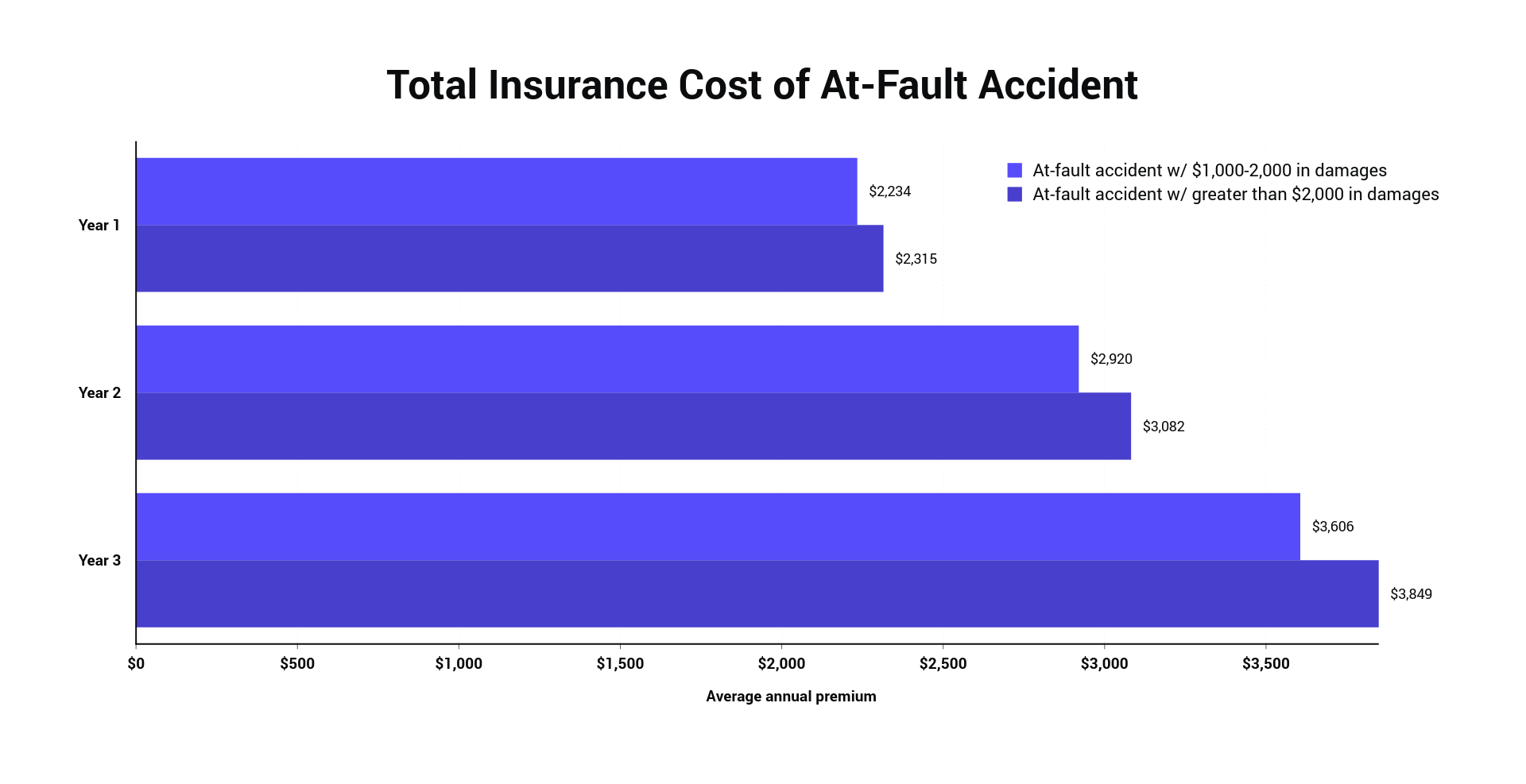

At-Fault Accidents: Expect an increase that can range from

10% to a whopping 50% or even more, depending on the severity of the accident, your insurance company's policies, and your past driving history. A minor fender-bender might be a 10-15% bump, while a more serious collision could send your premium sky-high.

*

Not-At-Fault Accidents: The good news! If you were clearly not at fault (think rear-ended at a red light or a deer decided to play chicken with your car), your premium might see

little to no increase, or a very minor one. Some insurers even have "accident forgiveness" programs that shield you from premium hikes for your first at-fault accident. It's like a "get out of jail free" card for your wallet!

### The Ripple Effect: Beyond the Premium Increase

It's not just about the monthly bill going up. An accident can have other financial implications:

*

Increased Deductible: If you have collision or comprehensive coverage, you'll likely have to pay your deductible to get your car repaired. This is a fixed amount you pay out-of-pocket before your insurance kicks in.

*

Higher Future Premiums: That accident isn't a one-and-done event for your premium. Many insurers look at your claims history over the past 3-5 years. That "Oops!" could haunt your premium for a while.

*

Potential for Policy Cancellation: In extreme cases, especially with multiple at-fault accidents or very severe ones, your insurer might deem you too risky and decide not to renew your policy. This is where shopping around for new insurance becomes crucial, though it might be more expensive.

*

Impact on Accident Forgiveness: If you have accident forgiveness, using it for a minor fender-bender might seem like a good idea. However, some policies have conditions. Understand when and how your accident forgiveness applies.

### What to Expect: The Post-Accident Timeline

So, what's the typical journey after you've reported that accident?

1.

The Immediate Aftermath: You'll file your claim. Your insurer will investigate, determine fault (if applicable), and assess the damage.

2.

Repair and Settlement: Your car gets fixed, or if it's a total loss, you'll receive a settlement.

3.

The Premium Wake-Up Call: This is when the insurance company recalculates your premium. It might happen immediately after the claim is settled, or it could be reflected in your next renewal cycle. Be prepared for a notification or a revised bill.

4.

The "Why?": If you're confused or unhappy with the increase, don't hesitate to call your insurance agent or company. Ask for a clear explanation. Sometimes, there might be a misunderstanding, or they can explain the specific factors that led to the hike.

### Can You Dodge the Premium Bullet? (Mostly!)

While you can't erase the fact that an accident happened, there are ways to soften the blow:

*

Drive Safely (Duh!): This is the most obvious, but also the most effective. A clean driving record is your golden ticket to lower premiums.

*

Shop Around (Like a Savvy Shopper): Once your premium increases, it's the perfect time to compare quotes from different insurance companies. Your current insurer might not be the most competitive anymore.

*

Ask About Discounts: After an accident, some discounts might become more valuable. Explore options like defensive driving courses, multi-car discounts, or loyalty programs.

*

Understand Your Policy: Know your deductibles, coverage levels, and any accident forgiveness clauses. This knowledge empowers you to make informed decisions.

*

Bundle Your Policies: If you have other insurance needs (home, renters), bundling them with your car insurance can often lead to discounts.

### The Bottom Line: Accidents Happen, But So Do Smart Choices

An accident can feel like a financial punch in the gut. While your insurance premium will likely increase, especially if you're at fault, it's not the end of the world. By understanding the factors that influence your premium, being prepared for the potential costs, and actively seeking ways to mitigate the impact, you can navigate this rocky patch with a bit more confidence and a lot less "Whoa!"

Remember, safe driving is your best defense against a soaring insurance bill. But when "Oops!" inevitably happens, a little research and proactive effort can go a long way in keeping your wallet from feeling too much of a hit. Now go forth and drive defensively – your future self (and your bank account) will thank you!

## That "Oops" Moment: How Your Insurance Premium Becomes a "Whoa!" Moment After an Accident

Let's face it, we've all been there. The split-second of panic, the screech of tires, the sickening crunch. Whether it was a fender-bender that barely nudged a mailbox or a more significant collision, that moment of "Oops!" can quickly morph into a "Whoa!" when you start thinking about your car insurance.

You've done the right thing by filing a claim, getting repairs done, and generally being a responsible adult. But now, a little voice in the back of your head is whispering, "How much is this going to cost me in the long run?" And that little voice is usually a harbinger of a not-so-pleasant conversation with your insurance provider.

So, you're wondering, "How much does my insurance actually increase after an accident?" Buckle up, buttercups, because we're about to take a ride through the often-turbulent world of post-accident insurance premiums.

### The Not-So-Secret Ingredient: Your Premium's Transformation

Think of your car insurance premium like a perfectly brewed cup of coffee. It's a delicate balance of many ingredients: your driving record, your age, your car, your location, and yes, your claims history. When an accident happens, it's like someone just dumped a whole bag of sugar into that perfect brew. The taste changes, and the price reflects it.

The Price Tag of "At-Fault" vs. "Not-At-Fault": A Tale of Two Premiums

This is the biggest differentiator. If the accident was deemed your fault, prepare for a more significant sting. Insurance companies see at-fault accidents as an indicator of increased risk. You're more likely to have another incident, so they need to compensate for that.

* At-Fault Accidents: Expect an increase that can range from 10% to a whopping 50% or even more, depending on the severity of the accident, your insurance company's policies, and your past driving history. A minor fender-bender might be a 10-15% bump, while a more serious collision could send your premium sky-high.

* Not-At-Fault Accidents: The good news! If you were clearly not at fault (think rear-ended at a red light or a deer decided to play chicken with your car), your premium might see little to no increase, or a very minor one. Some insurers even have "accident forgiveness" programs that shield you from premium hikes for your first at-fault accident. It's like a "get out of jail free" card for your wallet!

### The Ripple Effect: Beyond the Premium Increase

It's not just about the monthly bill going up. An accident can have other financial implications:

* Increased Deductible: If you have collision or comprehensive coverage, you'll likely have to pay your deductible to get your car repaired. This is a fixed amount you pay out-of-pocket before your insurance kicks in.

* Higher Future Premiums: That accident isn't a one-and-done event for your premium. Many insurers look at your claims history over the past 3-5 years. That "Oops!" could haunt your premium for a while.

* Potential for Policy Cancellation: In extreme cases, especially with multiple at-fault accidents or very severe ones, your insurer might deem you too risky and decide not to renew your policy. This is where shopping around for new insurance becomes crucial, though it might be more expensive.

* Impact on Accident Forgiveness: If you have accident forgiveness, using it for a minor fender-bender might seem like a good idea. However, some policies have conditions. Understand when and how your accident forgiveness applies.

### What to Expect: The Post-Accident Timeline

So, what's the typical journey after you've reported that accident?

1. The Immediate Aftermath: You'll file your claim. Your insurer will investigate, determine fault (if applicable), and assess the damage.

2. Repair and Settlement: Your car gets fixed, or if it's a total loss, you'll receive a settlement.

3. The Premium Wake-Up Call: This is when the insurance company recalculates your premium. It might happen immediately after the claim is settled, or it could be reflected in your next renewal cycle. Be prepared for a notification or a revised bill.

4. The "Why?": If you're confused or unhappy with the increase, don't hesitate to call your insurance agent or company. Ask for a clear explanation. Sometimes, there might be a misunderstanding, or they can explain the specific factors that led to the hike.

### Can You Dodge the Premium Bullet? (Mostly!)

While you can't erase the fact that an accident happened, there are ways to soften the blow:

* Drive Safely (Duh!): This is the most obvious, but also the most effective. A clean driving record is your golden ticket to lower premiums.

* Shop Around (Like a Savvy Shopper): Once your premium increases, it's the perfect time to compare quotes from different insurance companies. Your current insurer might not be the most competitive anymore.

* Ask About Discounts: After an accident, some discounts might become more valuable. Explore options like defensive driving courses, multi-car discounts, or loyalty programs.

* Understand Your Policy: Know your deductibles, coverage levels, and any accident forgiveness clauses. This knowledge empowers you to make informed decisions.

* Bundle Your Policies: If you have other insurance needs (home, renters), bundling them with your car insurance can often lead to discounts.

### The Bottom Line: Accidents Happen, But So Do Smart Choices

An accident can feel like a financial punch in the gut. While your insurance premium will likely increase, especially if you're at fault, it's not the end of the world. By understanding the factors that influence your premium, being prepared for the potential costs, and actively seeking ways to mitigate the impact, you can navigate this rocky patch with a bit more confidence and a lot less "Whoa!"

Remember, safe driving is your best defense against a soaring insurance bill. But when "Oops!" inevitably happens, a little research and proactive effort can go a long way in keeping your wallet from feeling too much of a hit. Now go forth and drive defensively – your future self (and your bank account) will thank you!

## That "Oops" Moment: How Your Insurance Premium Becomes a "Whoa!" Moment After an Accident

Let's face it, we've all been there. The split-second of panic, the screech of tires, the sickening crunch. Whether it was a fender-bender that barely nudged a mailbox or a more significant collision, that moment of "Oops!" can quickly morph into a "Whoa!" when you start thinking about your car insurance.

You've done the right thing by filing a claim, getting repairs done, and generally being a responsible adult. But now, a little voice in the back of your head is whispering, "How much is this going to cost me in the long run?" And that little voice is usually a harbinger of a not-so-pleasant conversation with your insurance provider.

So, you're wondering, "How much does my insurance actually increase after an accident?" Buckle up, buttercups, because we're about to take a ride through the often-turbulent world of post-accident insurance premiums.

### The Not-So-Secret Ingredient: Your Premium's Transformation

Think of your car insurance premium like a perfectly brewed cup of coffee. It's a delicate balance of many ingredients: your driving record, your age, your car, your location, and yes, your claims history. When an accident happens, it's like someone just dumped a whole bag of sugar into that perfect brew. The taste changes, and the price reflects it.

The Price Tag of "At-Fault" vs. "Not-At-Fault": A Tale of Two Premiums

This is the biggest differentiator. If the accident was deemed your fault, prepare for a more significant sting. Insurance companies see at-fault accidents as an indicator of increased risk. You're more likely to have another incident, so they need to compensate for that.

* At-Fault Accidents: Expect an increase that can range from 10% to a whopping 50% or even more, depending on the severity of the accident, your insurance company's policies, and your past driving history. A minor fender-bender might be a 10-15% bump, while a more serious collision could send your premium sky-high.

* Not-At-Fault Accidents: The good news! If you were clearly not at fault (think rear-ended at a red light or a deer decided to play chicken with your car), your premium might see little to no increase, or a very minor one. Some insurers even have "accident forgiveness" programs that shield you from premium hikes for your first at-fault accident. It's like a "get out of jail free" card for your wallet!

### The Ripple Effect: Beyond the Premium Increase

It's not just about the monthly bill going up. An accident can have other financial implications:

* Increased Deductible: If you have collision or comprehensive coverage, you'll likely have to pay your deductible to get your car repaired. This is a fixed amount you pay out-of-pocket before your insurance kicks in.

* Higher Future Premiums: That accident isn't a one-and-done event for your premium. Many insurers look at your claims history over the past 3-5 years. That "Oops!" could haunt your premium for a while.

* Potential for Policy Cancellation: In extreme cases, especially with multiple at-fault accidents or very severe ones, your insurer might deem you too risky and decide not to renew your policy. This is where shopping around for new insurance becomes crucial, though it might be more expensive.

* Impact on Accident Forgiveness: If you have accident forgiveness, using it for a minor fender-bender might seem like a good idea. However, some policies have conditions. Understand when and how your accident forgiveness applies.

### What to Expect: The Post-Accident Timeline

So, what's the typical journey after you've reported that accident?

1. The Immediate Aftermath: You'll file your claim. Your insurer will investigate, determine fault (if applicable), and assess the damage.

2. Repair and Settlement: Your car gets fixed, or if it's a total loss, you'll receive a settlement.

3. The Premium Wake-Up Call: This is when the insurance company recalculates your premium. It might happen immediately after the claim is settled, or it could be reflected in your next renewal cycle. Be prepared for a notification or a revised bill.

4. The "Why?": If you're confused or unhappy with the increase, don't hesitate to call your insurance agent or company. Ask for a clear explanation. Sometimes, there might be a misunderstanding, or they can explain the specific factors that led to the hike.

### Can You Dodge the Premium Bullet? (Mostly!)

While you can't erase the fact that an accident happened, there are ways to soften the blow:

* Drive Safely (Duh!): This is the most obvious, but also the most effective. A clean driving record is your golden ticket to lower premiums.

* Shop Around (Like a Savvy Shopper): Once your premium increases, it's the perfect time to compare quotes from different insurance companies. Your current insurer might not be the most competitive anymore.

* Ask About Discounts: After an accident, some discounts might become more valuable. Explore options like defensive driving courses, multi-car discounts, or loyalty programs.

* Understand Your Policy: Know your deductibles, coverage levels, and any accident forgiveness clauses. This knowledge empowers you to make informed decisions.

* Bundle Your Policies: If you have other insurance needs (home, renters), bundling them with your car insurance can often lead to discounts.

### The Bottom Line: Accidents Happen, But So Do Smart Choices

An accident can feel like a financial punch in the gut. While your insurance premium will likely increase, especially if you're at fault, it's not the end of the world. By understanding the factors that influence your premium, being prepared for the potential costs, and actively seeking ways to mitigate the impact, you can navigate this rocky patch with a bit more confidence and a lot less "Whoa!"

Remember, safe driving is your best defense against a soaring insurance bill. But when "Oops!" inevitably happens, a little research and proactive effort can go a long way in keeping your wallet from feeling too much of a hit. Now go forth and drive defensively – your future self (and your bank account) will thank you!