How Much Does Venmo Charge For Instant Transfer Of $500: Price/cost Details & What To Expect

Okay, let's talk turkey – or rather, let's talk Venmo, and specifically, that oh-so-tempting button: Instant Transfer. You know the one. You just got paid, or maybe you're about to snag that perfect concert ticket before it sells out, and you need that cash now. But then that little whisper of doubt creeps in: "How much is this instant gratification going to cost me?" It’s a fair question, and one we're about to tackle with a smile and a whole lot of clarity!

So, you've got a cool $500 in your Venmo balance, ready to be liberated and put to good use. Maybe it's for a last-minute weekend getaway, a much-deserved treat for yourself, or to finally pay back your bestie for that amazing dinner. Whatever the reason, the siren song of "Instant Transfer" is calling your name. But before you hit that button, let's demystify the price tag.

The Nitty-Gritty: How Much Does It Actually Cost?

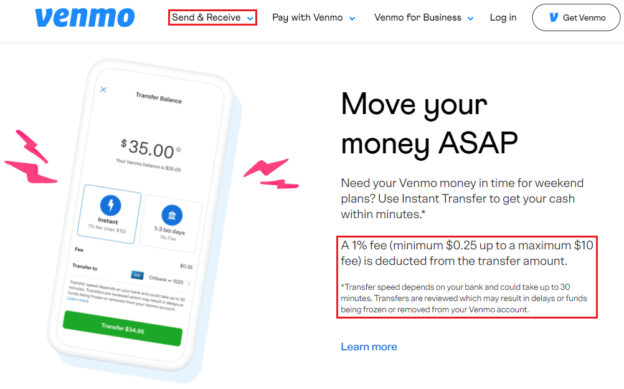

Prepare yourself for some good news, my friends! When you want to move a solid $500 from your Venmo balance to your linked bank account or debit card instantly, Venmo charges a fee of 1.75% of the transfer amount.

Let’s do the math, shall we? For $500, that’s a grand total of $8.75. Yep, that’s it! Think of it as a small convenience fee for instant joy. It’s like paying a tiny bit extra for express shipping on that must-have item, but instead, it’s express shipping for your hard-earned cash directly into your hands (or, you know, your bank account). Pretty sweet, right?

Now, before you start hyperventilating about that $8.75, let's put it in perspective. What else can you get for less than ten bucks these days? A fancy coffee? A couple of avocado toasts? Suddenly, that instant access to your $500 feels like a steal! It's the difference between waiting a business day or two (which, let's be honest, can feel like an eternity when you're on a mission) and having that money available to spend or save immediately.

What to Expect When You Hit That Button

So, you've mentally (and perhaps even enthusiastically) agreed to the $8.75 fee. What happens next? It’s smoother than a jazz solo, I promise!

First, you’ll navigate to your Venmo balance. You'll see your available funds, looking all shiny and ready for action. Then, you’ll tap on "Transfer Money." From there, you’ll select "Transfer to Bank." This is where the magic happens. You’ll be given the option between a Standard Transfer (which is blessedly free but takes 1-3 business days) and the star of our show: Instant Transfer.

Go ahead and select "Instant Transfer." Venmo will clearly show you the fee that will be deducted. It’ll be that $8.75 for your $500 transfer. You'll get a final confirmation screen. Just give it a quick glance to make sure everything looks as it should, and then... drumroll, please... hit that confirmation button!

And voilà! Your money is on its way to your linked bank account or debit card. You'll typically see it arrive within minutes, usually less than 30. It’s like a digital magic trick where your money appears almost out of thin air, ready to be used for whatever your heart desires.

Why This Little Fee Can Make Life More Fun

Let's be real, we live in a world that moves fast. Waiting for money can feel like being stuck in traffic on a Friday afternoon – utterly frustrating! Venmo’s instant transfer feature is designed to keep up with your life, not hold it back.

Think about those spontaneous moments. Your friend texts: "Emergency pizza party, $20 contribution needed ASAP!" Or you spot a limited-edition item online that’s about to sell out. With instant transfer, you can be that hero, that trendsetter, that person who always has the funds ready.

It’s about seizing opportunities. It’s about the freedom to react to life’s little (or big!) demands without a financial bottleneck. That $8.75 isn't just a fee; it’s a small investment in immediacy and the peace of mind that comes with knowing your money is where you need it, when you need it.

Plus, it can really take the stress out of managing your finances. Need to cover an unexpected bill before your next payday? Instant transfer to the rescue! It’s a tool that empowers you to be in control, to pivot, and to make sure your financial life flows as smoothly as your social life.

The Bottom Line: Is It Worth It?

For a $500 transfer, paying $8.75 for instant access is a pretty compelling deal. It depends entirely on your needs and the urgency of your situation. If you can afford to wait a few business days for a free transfer, then that’s a perfectly sensible choice. But if you need that cash now, then that 1.75% fee is a small price to pay for that instant financial flexibility.

It’s about understanding the tools available to you and using them to your advantage. Venmo offers both speed and cost-effectiveness, giving you the power to choose what works best for you in any given moment. It’s a win-win, really – you get your money fast, and Venmo gets a small fee for providing a super convenient service.

Ready to Explore More?

Learning these little financial hacks can genuinely make managing your money feel less like a chore and more like a strategic game. Understanding the fees, the options, and the benefits empowers you to make smarter decisions and keep your financial life moving forward, without unnecessary delays.

So, next time you find yourself with a Venmo balance and a need for speed, you’ll know exactly what to expect. And who knows? This newfound knowledge might just inspire you to dive deeper into other features and tools that can make your financial life even more streamlined and, dare I say, enjoyable! Keep exploring, keep learning, and keep that money flowing!