How Much Family Tax Benefit Do I Get: Everything You Need To Know In 2026

It was a rainy Tuesday evening, the kind where the sky feels like it's weeping along with your grocery budget. Little Leo, all of five years old and with a smile that could melt glaciers (and my resolve to say "no" to that extra toy), had just declared, with the utmost seriousness, that he needed "more cookies for science experiments." My husband, bless his fiscally-conscious heart, just sighed and muttered something about the rising cost of flour. Meanwhile, I was mentally calculating how many more weeks until we could afford that slightly bigger car we desperately needed for family trips. It's funny how quickly life's little (and not-so-little) expenses add up, isn't it? And then, out of the blue, a thought popped into my head: 'Hey, what about that Family Tax Benefit? Are we getting everything we can?'

And that, my friends, is how we find ourselves diving deep into the wonderful, and sometimes slightly confusing, world of the Family Tax Benefit (FTB) in 2026. Because let's be honest, those cookie experiments and car upgrades don't pay for themselves. And if the government has a little something extra they're willing to offer to help with the cost of raising awesome little humans, well, I'm all ears. Aren't you?

The FTB: Your Financial Wingman for Parenthood

So, what exactly is this magical FTB? Think of it as a helping hand from your friendly neighborhood government to ease the financial burden of raising kids. It’s designed to help families with the everyday costs, from those aforementioned cookies and potential car upgrades to school supplies, clothes that they seem to outgrow overnight, and dare I say it, the occasional growth spurt that requires a whole new wardrobe. It’s not a handout, but a help-out. And in 2026, it’s still a pretty significant chunk of change for many families.

The FTB isn't just a single, simple payment. Oh no, life’s rarely that straightforward, is it? It’s actually broken down into two main parts, each with its own little nuances. And understanding these can make all the difference in maximizing what you receive. We’re talking about FTB Part A and FTB Part B. Let's unpack those, shall we?

FTB Part A: The Big One

This is the main component of the Family Tax Benefit, and it’s generally paid to families with children. The amount you get largely depends on a few key factors. It's not a one-size-fits-all situation, which, while a tad more complex, also means it can be tailored to your specific circumstances. Exciting, right? (Okay, maybe "exciting" is a strong word for tax benefits, but let’s go with "interestingly complex".)

The biggest player here is your income. Yes, the dreaded income test. Basically, the lower your family’s adjusted taxable income, the more FTB Part A you’re likely to receive. This is where keeping good financial records becomes your best friend. You know all those receipts you’ve been hoarding? They might just be worth their weight in gold (or at least, in increased government payments).

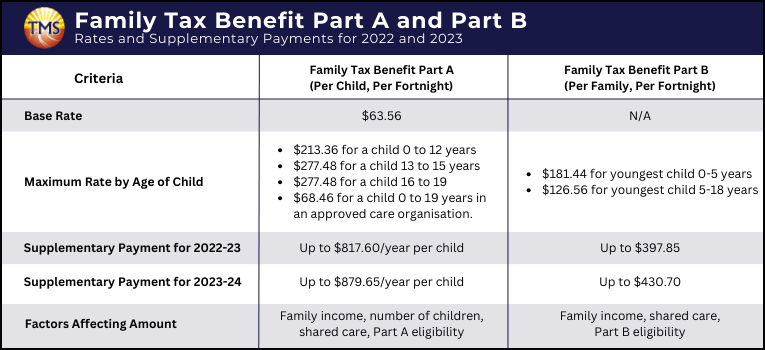

Here’s the nitty-gritty: FTB Part A has different rates depending on the age of your child and whether you’re getting a substantial amount of it. There’s a base rate, and then there are supplements. These supplements are specifically for things like having multiple children, or children with disabilities. So, if your little one has some extra special needs, make sure you’re claiming all the relevant supplements!

Another factor that influences your FTB Part A is the number of children you have. More kids, generally speaking, means a higher potential FTB Part A payment. It’s like the universe acknowledging that you’re running a small, very busy daycare out of your home. And let’s not forget the age of your children. The benefit rates are often higher for younger children and gradually decrease as they get older and, dare I say it, more independent (and expensive!).

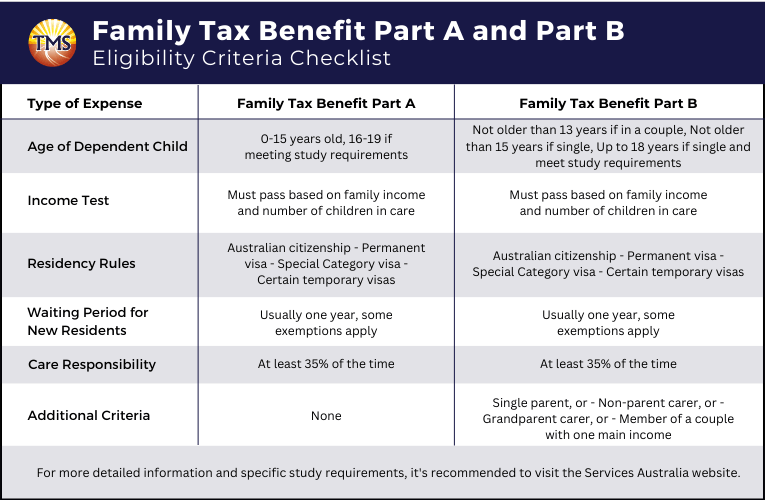

A common misconception is that you automatically get FTB Part A. Nope! You usually need to lodge a tax return. Even if your income is low and you don't think you owe any tax, lodging that return is crucial. It's how the government assesses your eligibility and calculates your entitlements. So, don't skip that step!

And what about the timing of these payments? You can choose to receive FTB Part A payments fortnightly, which is great for day-to-day budgeting, or as a lump sum after you lodge your tax return. If you’re good at saving and managing your money, a lump sum might give you a nice financial boost at tax time. If you need the cash flow throughout the year, fortnightly is probably your go-to.

FTB Part B: The Extra Support

Now, let’s talk about FTB Part B. This part of the benefit is designed to provide additional support for families with a younger child or children, or for single parents. It’s basically saying, "Hey, you've got little ones, and maybe one parent is primarily looking after them, so here's a little extra to help out."

The key eligibility criteria for FTB Part B usually revolve around having a child under a certain age (often 5 or 6 years old, but check the specifics for 2026!) or being a single parent. If you're a family where one parent earns significantly less than the other, or if one parent stays home to care for the children, you’ll likely be eligible for FTB Part B. This is where families where one parent chooses to be a stay-at-home carer can get some much-needed recognition for their valuable work!

Similar to Part A, there’s an income threshold for FTB Part B. If your family’s adjusted taxable income exceeds this threshold, your FTB Part B entitlement will reduce. It’s important to note that for FTB Part B, it’s typically the income of the higher-earning parent that’s considered when determining eligibility, but the combined family income can also play a role. So, it’s a bit of a balancing act. You’ll want to check the specific rules for 2026 to see exactly how this is calculated.

The amount of FTB Part B you receive can also vary depending on the age of your youngest child. Generally, the payment is higher if you have a very young child. Once your child reaches a certain age, your eligibility for FTB Part B will cease. Again, keeping up-to-date with the specific age cut-offs for 2026 is vital.

And here’s a cool little detail: if you’re a single parent, you might be eligible for a higher rate of FTB Part B. It’s the government’s way of acknowledging the unique challenges and demands of single-parent households. So, if this is you, make sure you’re claiming every bit you’re entitled to!

How Do I Actually Figure Out How Much I Get?

Okay, so we've talked about what FTB is, and its two parts. But the million-dollar question (or rather, the "hundreds or thousands of dollars" question) is: how do you calculate your specific entitlement for 2026? It’s not like there’s a handy-dandy calculator on the side of every cereal box, is there? (Though, imagine that! That would make mornings a lot more interesting.)

The most accurate way to find out your entitlement is through the official government channels. This usually involves your country's tax authority (in Australia, it's the Australian Taxation Office, or ATO). They are the gatekeepers of this information!

Here are your best bets for getting the real numbers:

1. The ATO Website and Online Calculators

The ATO website is your best friend when it comes to all things tax and benefits. They usually have online estimators or calculators specifically for the Family Tax Benefit. You’ll need to input information like your family’s income, the number and ages of your children, and any relevant circumstances (like single parenthood or disability). These calculators are designed to give you a good ballpark figure. They’re a fantastic starting point!

Pro-tip: Make sure you’re looking at the information specifically for the 2025-2026 financial year. Tax laws and benefit rates can change, so always double-check the dates. You don’t want to be working with last year’s numbers, do you?

2. Lodging Your Tax Return

As mentioned earlier, lodging your tax return is often the definitive way to determine your FTB entitlement. When you file your taxes, the tax office will use the information you provide to calculate your exact FTB Part A and Part B entitlements. They’ll then either pay you a lump sum or adjust your fortnightly payments accordingly.

This is why it’s so important to be honest and accurate with your income and family details. Any discrepancies could lead to incorrect payments, either too much (which you’ll have to pay back – yikes!) or too little (which is just frustrating).

3. Contacting the Tax Office Directly

If you’re still feeling a bit lost or have a particularly complex situation, don’t hesitate to contact the tax office directly. They have dedicated phone lines and customer service teams who can help you understand your eligibility and calculate your entitlements. They’ve seen it all before, so don’t be shy!

Important Things to Keep in Mind for 2026

Now that we’ve armed ourselves with some knowledge, let’s talk about some crucial points to remember as we head into 2026. This is where we move from the theoretical to the practical. Because knowing is one thing, but doing is another!

Keep Your Information Up-to-Date

This is HUGE. Your family situation can change. You might have a new baby, your child might start school, your income might fluctuate. It is absolutely critical that you notify the tax office of any changes as soon as they happen. Failure to do so can result in incorrect payments and potential debt. Think of it as a running dialogue with your friendly tax authority.

For example, if your income significantly drops, you might become eligible for more FTB. If your child turns 18 and is no longer eligible, your payments will change. Keeping them in the loop ensures you're always receiving what you're entitled to, and avoids any nasty surprises down the line.

Understand the Income Test Thresholds

I’ve mentioned income tests a few times, and for good reason. These thresholds are the gatekeepers. For 2026, you’ll need to be aware of the specific income thresholds for both FTB Part A and Part B. These are the points at which your entitlement starts to decrease. Knowing these numbers can help you plan your finances, especially if you’re nearing a threshold and considering a change in work hours or a pay rise.

Sometimes, a small decrease in work hours could actually result in a net gain when you factor in the increased FTB. It’s all about the numbers, and sometimes those numbers work in surprising ways!

Don’t Forget About Supplements and Absences

Beyond the base rates, there are often supplements you might be eligible for. These can include things like a child disability allowance if your child has a disability, or specific payments for multiple births. Make sure you’re exploring all the potential extras. Don't leave money on the table!

Also, the tax office understands that life happens. If your child is temporarily away from home (e.g., for a hospital stay, or at boarding school for a short period), you can often still receive FTB for them. There are rules around absences, so if this applies to you, check the specifics to ensure you continue to get your payments.

Review Your Payments Regularly

Even if you receive your FTB fortnightly, it's a good idea to periodically review your payments. Are they still in line with what you expect based on your circumstances? Sometimes, errors can occur, or your situation might have changed without you fully realizing its impact on your entitlement. A quick check-in every few months can save you a lot of hassle later.

The Bottom Line: Plan, Prepare, and Claim!

Raising a family in 2026, like any year, comes with its financial challenges. But by understanding the Family Tax Benefit, and by being proactive in checking your eligibility and keeping your information updated, you can ensure you’re receiving the financial support you deserve. It’s not about getting rich quick; it’s about making those everyday costs a little more manageable, so you can focus on what truly matters: those precious moments with your little ones. So, go forth, explore those government websites, do your calculations, and claim what’s rightfully yours. Your future self (and your cookie-loving child) will thank you for it!