How Much Is Renters Insurance For A One Bedroom Apartment: Price, Costs & What To Expect

So, you've snagged that perfect one-bedroom apartment. High fives all around! It's got the cozy vibes, the prime location, and maybe even a window that overlooks a particularly dramatic squirrel traffic jam. Now, before you start dreaming of all the pizza nights and binge-watching sessions, let's talk about something super important, yet surprisingly painless: renters insurance.

Think of renters insurance like your apartment's superhero cape. It swoops in to save the day when unexpected (and often slightly terrifying) things happen. And the best part? This superhero doesn't charge a king's ransom for its services. Seriously, the price might just make you do a little happy dance.

The Million-Dollar Question (That's Actually Way Less Than a Million Dollars)

You're probably wondering, "Okay, this superhero sounds cool, but how much does this cape cost?" Great question, future insured legend! For a typical one-bedroom apartment, you're looking at an average cost that's probably less than your daily latte habit. We're talking around $15 to $30 per month. Yep, you read that right. For the price of a couple of fancy coffees or maybe one slightly-too-indulgent takeout meal, you can have peace of mind.

Imagine this: your neighbor accidentally overflows their bathtub, and suddenly your precious collection of vintage comic books is doing the breaststroke. Or maybe a sneaky thief decides your brand-new gaming console looks like a tasty treat. Without renters insurance, those oopsies could turn into major financial headaches. But with it? You're covered, you're chill, and you can focus on the important stuff, like finding a new, dry spot for your comics.

What's the Magic Behind the Price Tag?

So, why is it so affordable? It's not because the insurance companies are running a charity (though sometimes they feel like it with these prices!). It's mostly because you're not insuring the actual building. That's your landlord's headache, bless their heart. Renters insurance focuses on protecting your stuff – your beloved couch, your extensive sock collection, that ridiculously expensive blender you bought on a whim.

Your premium (that's the fancy word for your monthly payment) is influenced by a few factors. Think of it like a personal recipe for your insurance. Location plays a role; if you live in an area known for, say, spontaneous meteor showers (unlikely, but hey, we're having fun!), your rate might be a tad higher. Your deductible, which is the amount you pay before your insurance kicks in, also has a say. A higher deductible often means a lower monthly bill, but remember to pick one you're comfortable with.

"My renters insurance costs less than my Netflix subscription, and it protects me from actual disasters, not just bad plot twists." - A Totally Real and Enthusiastic Renter

Another biggie is the amount of coverage you choose. This is where you tell the insurance company how much your stuff is worth. If you're rocking a minimalist lifestyle with only a toothbrush and a dream, you'll need less coverage than someone who's curated an apartment filled with antique furniture and rare vinyl records. Be honest with yourself about your belongings! Nobody wants to be underinsured, staring at the wreckage of their life with only a flimsy policy.

What Does This Magical Cape Actually Cover?

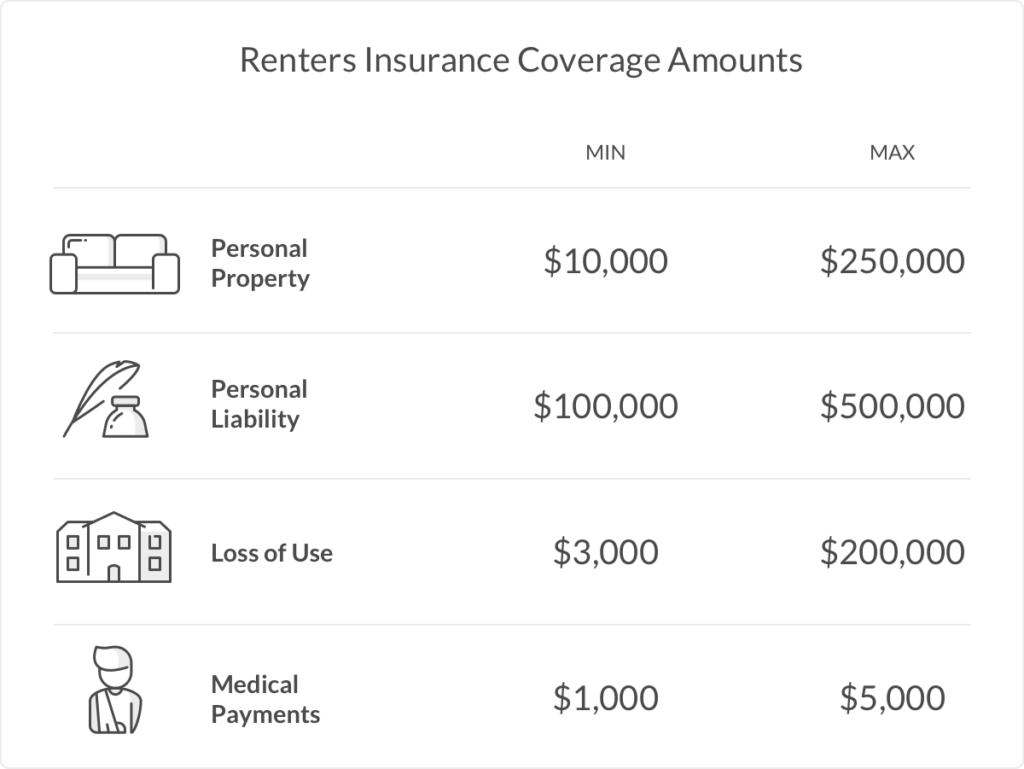

Alright, let's get down to the nitty-gritty of what your renters insurance policy actually does. It's basically split into a few awesome parts. First up is personal property coverage. This is the star of the show, protecting your belongings if they're stolen, damaged by fire, windstorms, or even a rogue water balloon fight gone wrong in your living room. So, if your laptop takes a dive into a spilled soda, or if a hailstorm decides to redecorate your windows, your insurance has your back.

Then there's liability coverage. This is the "oops, I accidentally set my neighbor's prize-winning petunias on fire with my experimental grilling" insurance. If someone gets injured in your apartment and sues you, or if you accidentally cause damage to your landlord's property, this coverage can help pay for legal fees and damages. It’s like having a built-in excuse generator that actually works financially.

Next up is additional living expenses (ALE). This is your "oh no, my apartment is a disaster zone and I need a place to crash" fund. If your apartment becomes uninhabitable due to a covered event, like a major fire or flood, ALE can help pay for temporary housing, like a hotel, and other essential expenses like meals and laundry. It means you won't be sleeping on a park bench, contemplating your life choices.

Some policies even offer medical payments coverage. This can help pay for minor medical expenses if a guest is injured in your apartment, regardless of who's at fault. It’s the ultimate "sorry about that!" money, helping you be a good neighbor even when things go sideways.

What to Expect When You're Expecting to Be Insured

Getting renters insurance is usually pretty straightforward. Most insurance companies offer online quotes, which are as easy as ordering takeout. You'll answer a few questions about your apartment, your belongings, and your lifestyle. Then, poof! You'll get a quote.

Don't be afraid to shop around! Just like you'd compare prices for that perfect espresso machine, compare quotes from different insurance providers. You might find a company that offers a fantastic rate or even bundles your renters insurance with your car insurance for extra savings. It’s like finding a hidden discount at your favorite store.

Once you find a policy you like, the signup process is usually quick. You can often start your coverage almost immediately. Then, you can relax and enjoy your apartment knowing you're protected. It’s a small price to pay for big peace of mind.

So, there you have it! Renters insurance for your one-bedroom apartment is not some daunting, expensive ordeal. It’s a practical, affordable way to protect your stuff, your finances, and your sanity. It’s your little financial safety net, ready to catch you if you stumble. Go forth and get insured, you responsible superstar! Your future self, snug in a non-soaking-wet apartment, will thank you.