How Much Money Should You Have In A Checking Account: Price/cost Details & What To Expect

Let's talk about that magical little number sitting in your checking account. You know, the one that dictates whether your morning latte is a splurge or a sensible sip. For some, it's a source of constant anxiety, a digital tightrope walk. For others, it's a well-oiled machine, humming along without a second thought. But for most of us, it's a bit of a mystery. How much should you actually have in there? It’s a question that doesn’t have a one-size-fits-all answer, but we're going to unpack it, California-road-trip-style, with the windows down and the tunes up.

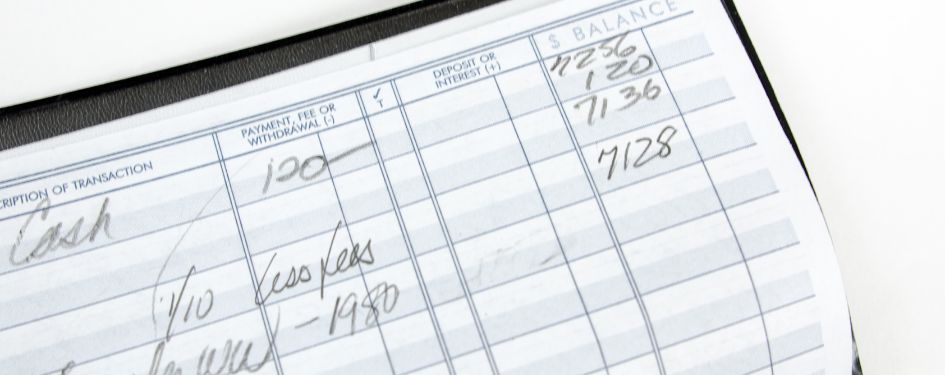

Think of your checking account as your financial base camp. It’s where you’ll be launching your daily expeditions, from grabbing that avocado toast (because, let's be honest, it's a lifestyle) to paying the bills that keep a roof over your head. It needs to be robust enough to handle the expected, but also have a little wiggle room for the unexpected. Nobody wants their debit card to do a dramatic mic-drop at the grocery store checkout, right?

So, ditch the spreadsheets and the stress. We're going to break down what goes into this magic number, keeping it as breezy as a Sunday morning. We'll explore the practicalities, the potential pitfalls, and maybe even sprinkle in a fun fact or two that'll make you feel like a financial guru, or at least someone who can confidently answer the question at your next dinner party. Ready to level up your checking account game? Let's dive in.

The Art of the Buffer: Why Zero Balance is a No-Go

First things first, let's debunk the myth of the perfectly zeroed-out checking account. While it might feel satisfyingly "lean" and organized, in reality, it's a recipe for disaster. Imagine trying to run a marathon on an empty stomach – not pretty. Your checking account needs a buffer. This isn't about hoarding cash; it's about having breathing room. It’s the financial equivalent of leaving the house with an umbrella on a cloudy day – just in case.

What’s a buffer, exactly? It's that extra cash you keep in your checking account beyond what's immediately needed for upcoming bills. Think of it as your personal financial safety net. It's there to catch you if something unexpected pops up, like a car repair, a sudden medical bill, or even just a really tempting sale on those sneakers you’ve been eyeing. The biggest cost of not having a buffer? Overdraft fees. And trust me, those can add up faster than you can say "oops, I forgot to check my balance."

Banks love overdraft fees. They're a significant revenue stream for them. While some banks offer overdraft protection that links to your savings or credit card, these often come with their own fees or interest charges. The best defense? Keeping enough in your checking account to prevent overdrafts altogether. It’s like paying a small, invisible insurance premium to yourself, every single day.

The "What Ifs" and the "You Betcha's": Cost Details to Consider

When we talk about the "cost" of keeping money in your checking account, it’s not just about the potential for missed investment opportunities (we'll get to that later). It's also about the very real costs of not having enough. Let's break down some of the price points and what to expect:

Overdraft Fees: The Usual Suspects

These are the boogeymen of the checking account world. While they vary by bank, a typical overdraft fee can range anywhere from $25 to $35 per transaction. If you have a few of these in a month, you can easily rack up over $100 in fees. That's enough for a really nice dinner out, or a decent chunk of your streaming subscriptions for the year. Imagine that: paying for Netflix and a penalty for accidentally overspending on groceries. No thank you.

Non-Sufficient Funds (NSF) Fees: The Bigger Badder Brother

These are even more serious. If your bank declines a transaction because you don't have enough funds, you might incur an NSF fee, which can be similar to or even higher than overdraft fees. Beyond the bank fee, the merchant might also charge you a returned item fee. So, that $5 coffee could suddenly cost you $50. This is where the "ease" in our easy-going lifestyle gets a serious dent.

:max_bytes(150000):strip_icc()/why-isn-t-my-money-available-at-my-bank-2385979_final_HL-d88006a3fb414ae28c80ef9211848bf3.jpg)

Minimum Balance Requirements: The Club Membership Fee

Some checking accounts, especially those with perks like no monthly service fees or interest-earning capabilities, might have a minimum daily balance requirement. If you dip below this threshold, you could be hit with a monthly maintenance fee, often in the range of $10 to $25. While this isn't a "per-transaction" cost, it's a consistent drain if you're not mindful. It’s like paying an annual membership fee for a gym you rarely visit – just not worth it.

ATM Fees: The Convenience Tax

If you find yourself needing cash and reaching for an ATM that isn't part of your bank's network, expect to pay. Out-of-network ATM fees can be anywhere from $2 to $5 per transaction. Then, your own bank might slap on another fee! It’s like paying double for the privilege of withdrawing your own money. A little planning can save you a surprising amount here.

What to Expect from Your Bank: The Fine Print Fun

Banks are required to disclose their fee structures, but it's often buried in dense documents. The best approach? Proactively check your bank’s website or ask a teller about their fee schedule. Understand the grace periods for minimum balances, the cut-off times for transactions, and the exact amounts of their fees. Knowledge is power, and in this case, it's also money saved.

Finding Your Sweet Spot: How Much is "Enough"?

Alright, so we know we need a buffer. But how big should this buffer be? This is where we get personal. It’s less about a rigid dollar amount and more about a mindful approach tailored to your life. Think of it like choosing the right size for your favorite comfy sweater – it needs to fit you.

The "Rent/Mortgage & Bills" Rule: The Foundation

The absolute baseline for your checking account buffer is to comfortably cover your essential recurring bills. This includes your rent or mortgage payment, utilities (electricity, water, gas), internet, phone bill, car payment, and any loan payments. Ideally, you want enough in your account to cover at least one full cycle of these payments without breaking a sweat.

How to calculate this? Grab your last few bank statements and list out all your fixed monthly expenses. Add them up. This gives you your absolute minimum to have on hand. For instance, if your essential bills total $2,500 per month, you want to aim to always have at least $2,500 in your checking account, if not more.

Cultural Note: This is the modern-day equivalent of a medieval lord keeping enough grain in his granary to feed his household through the winter. It’s about ensuring basic survival and stability.

The "Unexpected Expenses" Cushion: The Peace of Mind Layer

This is where we add that extra layer of comfort. Beyond just bills, life throws curveballs. A good rule of thumb is to aim for an additional one to two weeks of living expenses as a cushion. This covers your variable spending – groceries, gas, entertainment, and those impulse buys that make life interesting.

How to calculate this? Track your spending for a couple of weeks to get a realistic average of your non-bill expenses. Let's say you spend around $1,000 on groceries, gas, and fun stuff each month. That's roughly $250 per week. So, adding $500 to $1,000 on top of your bill coverage would be a solid buffer.

Fun Fact: The average American spends around $300-$500 per month on dining out and entertainment. That's a lot of lattes and movie tickets! Having this cushion ensures those enjoyable expenses don't send you into a financial tailspin.

The "Emergency Fund" Connection: Not in Checking, But Crucial

Now, let's be clear: your checking account is not your emergency fund. An emergency fund is a separate stash of money, typically 3-6 months of living expenses, kept in a high-yield savings account or money market fund. This is for true emergencies – job loss, major medical issues, natural disasters. Your checking account buffer is for the daily, weekly, and monthly unexpected, not the life-altering ones.

Think of your checking account buffer as a well-maintained tire repair kit. Your emergency fund is the spare tire itself, and maybe even roadside assistance. You want the repair kit readily accessible for small punctures, but the spare for the big blowouts.

Your Personal Algorithm: Tailoring the Number to You

Here's where the "easy-going" part really comes in. Your ideal checking account balance is a blend of your income stability, spending habits, and risk tolerance.

- Stable Income, Predictable Spending: If you have a steady paycheck and your expenses are consistent, you might be comfortable with a slightly smaller buffer, perhaps just enough to cover your bills and one week of variable spending.

- Variable Income, Fickle Spending: If your income fluctuates (hello, freelancers and gig workers!) or your spending can be spontaneous, you'll want a larger buffer to absorb the shocks. Aim for at least two weeks of variable expenses, if not more.

- Risk-Averse Personalities: If the thought of an overdraft makes your palms sweat, it’s perfectly okay to keep a larger cushion. There’s no shame in prioritizing peace of mind.

- The "Savvy Saver" Approach: Some people like to keep their checking account at the exact minimum to cover bills and then sweep any extra into a savings or investment account. This requires diligence but can maximize returns. It's like having a perfectly organized closet, but you have to meticulously put everything back in its place.

Cultural Reference: Think of it like packing for a trip. Some people are minimalists, packing only essentials. Others are prepared for any eventuality, with extra socks and a raincoat. Both are valid, as long as you arrive at your destination comfortably.

The Cost of Idle Cash: When Enough is Too Much

While we've stressed the importance of a buffer, it's also true that having too much money sitting in a low-interest checking account can be a missed opportunity. This is where the concept of "opportunity cost" comes into play. It's the value of the next best alternative that you give up when you choose one option over another.

What's the cost of letting cash sit idly?

Lost Investment Growth: Your checking account typically earns a minuscule amount of interest, often less than 0.1%. Meanwhile, investments like stocks, bonds, or even high-yield savings accounts can offer significantly higher returns. If you have $10,000 sitting in a checking account earning 0.05%, you're earning a measly $5 a year. That same $10,000 in a high-yield savings account earning 4% would net you $400 a year. That's a noticeable difference!

Inflation Erosion: Inflation is the silent thief that erodes the purchasing power of your money over time. If your money isn't growing at least as fast as inflation, it's effectively losing value. Keeping large sums in low-interest checking accounts means your money is likely shrinking in real terms.

The "Just Enough" Mindset: The goal isn't to have a massive checking account balance, but rather a sufficient one. Once you've comfortably covered your bills and your buffer, consider moving any excess into accounts that can help your money grow. This is where smart financial planning comes in.

Fun Little Fact: The History of Checking Accounts

Checking accounts as we know them have evolved significantly. The concept of a "cheque" (or check) originated in medieval times as a written order to pay someone from money held by a third party, often a goldsmith. The modern checking account, with its associated banking infrastructure, really took off in the 18th and 19th centuries as commerce grew. Imagine a world where you had to physically carry all your wealth or rely solely on handwritten promises!

Practical Tips for Maintaining Your Checking Account Zen

Now that we've armed you with the knowledge, let's talk about practical ways to keep your checking account in that sweet spot, without feeling like you're constantly micromanaging your finances.

1. Automate Your Savings and Bill Pay: Set up automatic transfers from your checking account to your savings (your emergency fund and investment accounts) on payday. Also, automate your bill payments. This ensures you're always saving and your bills are paid on time, reducing the need to manually track everything.

2. Use a Budgeting App or Spreadsheet: Even a simple system can provide clarity. Track your income and expenses. Many apps link to your bank accounts and categorize your spending automatically. It's like having a financial assistant that never sleeps.

3. Schedule Regular "Money Dates": Once a week or every two weeks, take 15-30 minutes to review your checking account balance, upcoming bills, and spending. This proactive approach prevents surprises and keeps you in control. Think of it as a mini-retreat for your finances.

4. Set Up Low Balance Alerts: Most banks offer alerts that notify you when your balance drops below a certain threshold. Set this threshold a bit higher than your absolute minimum to give yourself ample warning.

5. Understand Your Bank's Fee Schedule Inside and Out: Seriously, bookmark that page. Knowing the rules of the game is crucial to avoiding costly mistakes.

6. Consider a "Zero-Based" Budgeting Approach (with a twist): This popular method assigns every dollar a job. However, for your checking account, the "job" of your buffer dollars is to provide security and peace of mind. They have a crucial role, even if they aren't actively "working" in the investment sense.

7. Opt for Mobile Banking: Being able to check your balance and transactions on the go is incredibly empowering. It allows for quick decisions and prevents those "oh no!" moments.

The "Two-Bucket" Strategy: A Simpler Approach

For those who prefer simplicity, consider a two-bucket approach for your liquid cash:

- Bucket 1: Checking Account (The "Operating Fund"). This holds enough to cover your upcoming bills and a comfortable buffer for 1-2 weeks of variable spending.

- Bucket 2: High-Yield Savings Account (The "Future Fund"). This holds your emergency fund and any savings for short-to-medium-term goals.

On payday, you first ensure Bucket 1 is adequately funded, and then you move any excess to Bucket 2. It's a clean, straightforward way to manage your cash flow.

A Final Reflection: Money as a Tool, Not a Master

Ultimately, how much money you should have in your checking account is a personal decision that reflects your financial situation, your comfort level with risk, and your lifestyle. It’s not about achieving some arbitrary millionaire status in your checking account. It’s about creating a sense of control and reducing unnecessary stress.

Think about your checking account balance as a reflection of your relationship with money. Is it a source of anxiety, or is it a tool that empowers you to live the life you want? By understanding the costs, setting realistic goals, and implementing a few smart strategies, you can transform your checking account from a potential pitfall into a reliable ally. It's about finding that sweet spot where you have enough to live comfortably, handle the unexpected, and still have a little left over for those spontaneous moments that make life truly rich.

So, the next time you’re looking at that number, don't just see digits. See the freedom it provides. See the peace of mind it offers. See the quiet confidence it instills. That, my friends, is what a well-managed checking account is all about – making your money work for you, not the other way around.