How Much Should You Make For A 500k House

So, you've been scrolling through Zillow again, haven't you? That little voice in your head whispering, "What if?" You're staring at a gorgeous 500k house – maybe it's a charming craftsman with a porch swing that screams "iced tea and lazy afternoons," or a sleek modern condo with city views that make you feel like you're living in a movie. It’s a beautiful dream, a tangible piece of that "adulting" we’re all striving for. But then reality slaps you upside the head with a slightly less glamorous question: how much moolah do you actually need to pull this off? Let’s break it down, easy-going style, without the scary spreadsheets (mostly).

Buying a 500k house isn’t just about the sticker price, darling. It’s a whole ecosystem of costs, and understanding them is key to not living on ramen noodles for the next decade (unless, of course, you love ramen noodles, which, no judgment here!). Think of it like planning a fabulous vacation. You’ve got your flights (the down payment), your hotel (the mortgage), your fancy dinners (closing costs), and your souvenirs (moving expenses and furniture). It all adds up, and a little foresight goes a long way.

The Big Kahuna: Your Income

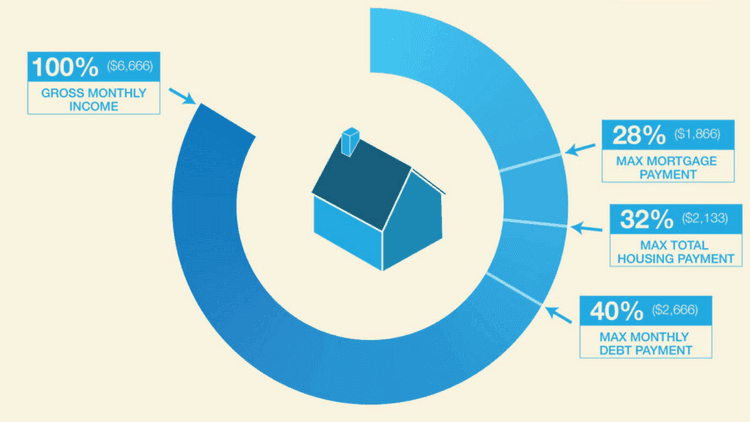

Alright, let’s get to the nitty-gritty. Lenders, bless their financially-minded hearts, have a few key metrics they like to look at. The most common rule of thumb is the 28/36 rule. This isn't some secret society handshake; it's a pretty standard guideline.

The 28% part means your total monthly housing costs – that’s your mortgage principal and interest, property taxes, homeowner’s insurance (PITI), and sometimes even HOA fees – should ideally be no more than 28% of your gross monthly income. Gross income is the big number before any taxes or deductions are taken out. So, if your PITI is, say, $2,000, you'd want your gross monthly income to be around $7,143 ($2,000 / 0.28).

The 36% part is a bit broader. It states that your total debt obligations – which includes your PITI plus any other recurring monthly debts like car loans, student loans, and credit card minimum payments – should not exceed 36% of your gross monthly income. So, if your PITI is $2,000 and your other debts are $1,000 a month, your total debt is $3,000. For this to be 36% of your income, you'd need a gross monthly income of about $8,333 ($3,000 / 0.36).

Now, these are guidelines, not ironclad laws. Some lenders might be more flexible, especially if you have a stellar credit score and a hefty down payment. But they’re a fantastic starting point for your mental calculations.

So, what does this mean for a 500k house?

Let's do some rough math. A 30-year fixed-rate mortgage at, say, 6.5% on a $500k house means your principal and interest payment alone would be around $3,160. Add in estimated property taxes (let’s guess 1.2% annually, so about $500/month) and homeowner's insurance (another $150/month), and your PITI is hovering around $3,810. This is where the numbers get a little dizzying, but stick with me!

Using the 28% rule, you’d need a gross monthly income of roughly $13,607 ($3,810 / 0.28). That translates to an annual gross income of about $163,284. Whoa. That might seem like a lot. But remember, this is just a ballpark. If you have other debts, that 36% rule will push that number up.

But wait! Don't pack up your dreams just yet. What if you don't have $163k lying around? This is where the magic of the down payment comes into play!

The Down Payment: Your Ticket to Freedom (and Lower Payments)

This is probably the biggest hurdle for most people. The more you put down, the less you have to borrow, which means lower monthly payments and less interest paid over the life of the loan. It’s like getting a discount on your future self!

Traditionally, 20% down was the gold standard to avoid Private Mortgage Insurance (PMI). PMI is essentially insurance for the lender if you default. For a $500k house, 20% is a whopping $100,000. That's a huge chunk of change, and for many, it’s simply not feasible.

The good news? You don't always need 20%. Many loan programs, like FHA loans, allow for as little as 3.5% down. Conventional loans can also go as low as 3% or 5% down. So, for a $500k house, a 5% down payment would be $25,000. That’s a much more approachable number for many!

However, putting down less than 20% usually means you'll have to pay PMI. PMI can add anywhere from 0.5% to 1.5% of the loan amount to your monthly payment each year. So, on a $475,000 loan (5% down on $500k), PMI could add anywhere from $198 to $594 per month. Ouch. But! PMI can usually be removed once you reach 20% equity in your home. It's a trade-off, a temporary expense for homeownership.

Fun fact: The concept of PMI actually started in the 1930s during the Great Depression to encourage banks to make more home loans. It’s been helping aspiring homeowners achieve their dreams ever since!

So, if you put down, say, 10% ($50,000) on a $500k house, you'd be financing $450,000. With that same 6.5% interest rate, your P&I would be about $2,845. Add taxes and insurance, and you're looking at around $3,595 per month for PITI. This would mean a gross monthly income of about $12,839 ($3,595 / 0.28), or an annual gross income of approximately $154,068. See how that down payment makes a difference?

Beyond the Monthly Payment: Other Costs to Consider

This is where the article gets real. It’s not just about the PITI. Think of all the other little bits and bobs that make up the homeownership pie.

Closing Costs: The Unsung Heroes (or Villains)

These are the fees you pay to finalize your mortgage and transfer ownership. They typically range from 2% to 5% of the loan amount. For a $500k house, this could be anywhere from $10,000 to $25,000. Yes, really.

What’s included? Things like loan origination fees, appraisal fees, title insurance, attorney fees, recording fees, and prepaid items like homeowner's insurance premiums and property taxes. It’s a whole production!

You'll need cash on hand for these. Sometimes, you can negotiate with the seller to cover some of these costs, especially in a buyer's market. It's all part of the dance!

Moving Expenses: The Physical Transition

Unless you're channeling your inner minimalist and can fit all your worldly possessions into a very stylish tote bag, you'll have moving costs. Whether it’s a professional moving company, renting a U-Haul, or bribing friends with pizza and beer, factor this in. Let’s say $1,000 to $5,000, depending on the scale of your move.

Furnishings and Decor: Making it Your Own

You’ve bought the house, now you need to make it a home! New furniture, paint, maybe that fancy chandelier you saw in a magazine? This is where your aesthetic dreams (and your budget) come to life. This is a highly variable cost, but it's good to have a little buffer for those must-have items.

Homeowner’s Association (HOA) Fees: The Community Contribution

If you’re looking at a condo or a home in a planned community, you’ll likely have HOA fees. These can range from $100 to $1,000+ per month, depending on the amenities offered (pool, gym, landscaping, etc.). Make sure you factor these into your monthly budget. They’re usually a part of that PITI calculation for lenders.

Emergency Fund: The Safety Net

This is crucial, people! Life happens. Your AC unit could decide to take a vacation in July. A tree might fall on your fence. Having an emergency fund, ideally 3-6 months of living expenses, is essential. This isn't directly related to the house purchase, but it's a vital part of being a responsible homeowner.

The Cultural Context: What's Your "Lifestyle" Worth?

We're talking about an "easy-going lifestyle." What does that really mean to you? For some, it’s a quiet suburban oasis with a garden. For others, it’s a vibrant urban loft with easy access to the best restaurants and cultural events. The "lifestyle" you want will influence the location and type of 500k house you choose, and therefore, the income you need.

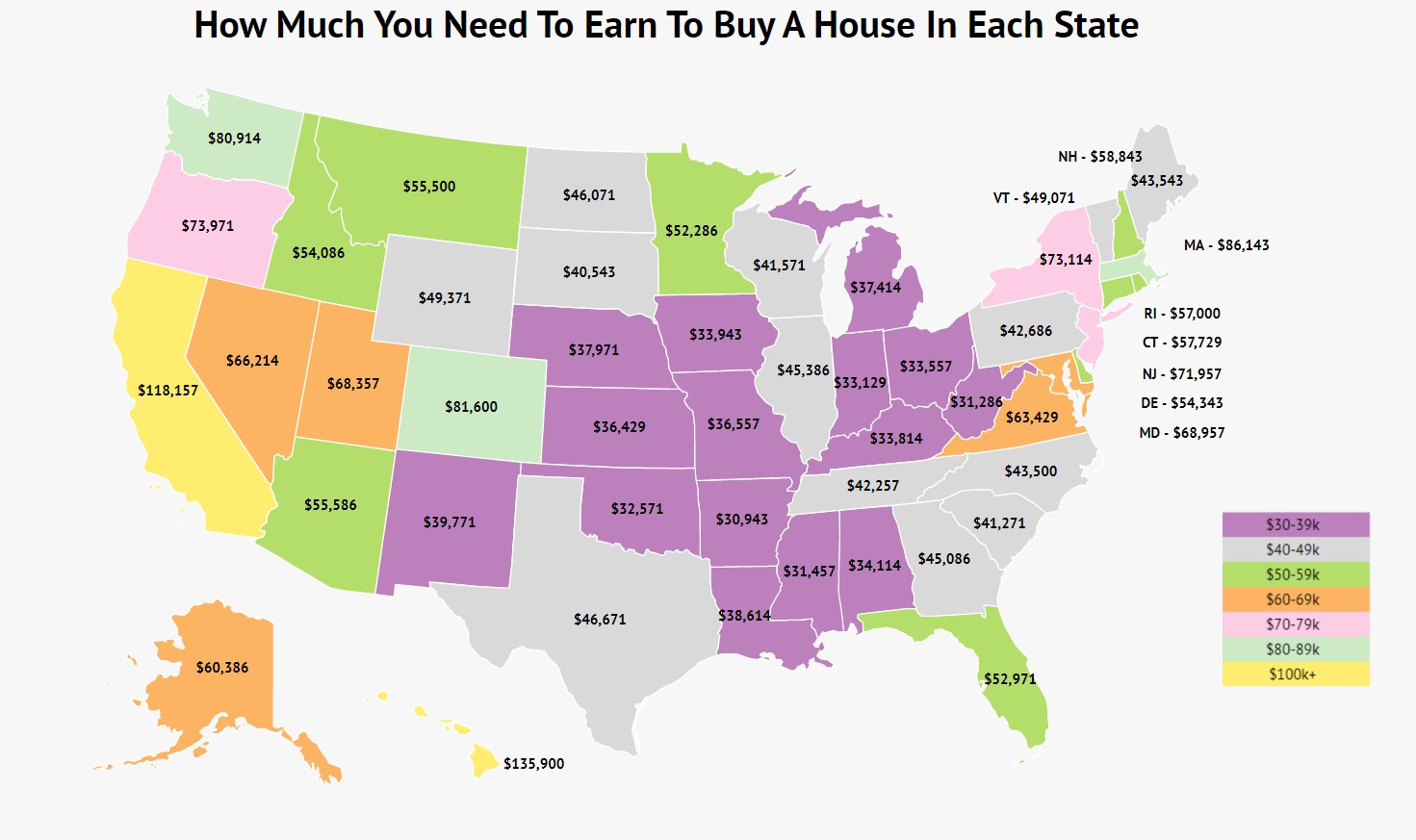

In some high-cost-of-living areas, $500k might get you a cozy starter home. In others, it might be a sprawling estate. That $163k income might be perfectly normal in a major metropolis but feel astronomical in a more rural setting. It’s all about perspective and where you want to plant your roots. Think about your daily commute, your preferred weekend activities, and your overall vibe. Are you a "farmer's market on Saturdays" person or a "late-night jazz club" devotee? The house should complement that.

And let's not forget about student loans. The student debt crisis is a real thing, and for many, those monthly payments can significantly impact their ability to qualify for a mortgage. If you have substantial student debt, you might need a higher income or a larger down payment to offset it.

So, How Much Should You Make? The Grand Finale!

Let's recap. For a $500k house, depending on your down payment, your existing debt, and lender flexibility, you're generally looking at needing a gross annual income somewhere in the ballpark of:

- With a 20% down payment ($100k): You’d be financing $400k. PITI around $3,174. Required gross monthly income: ~$11,336. Annual: ~$136,032.

- With a 10% down payment ($50k): You’d be financing $450k. PITI around $3,595. Required gross monthly income: ~$12,839. Annual: ~$154,068.

- With a 5% down payment ($25k): You’d be financing $475k. PITI around $3,810 (plus PMI, which we'll estimate at $300/month). Total housing costs ~$4,110. Required gross monthly income: ~$14,678. Annual: ~$176,136.

These are rough estimates, and your actual numbers could vary based on interest rates, property taxes in your specific area, and insurance costs. The best advice? Talk to a mortgage lender! They can give you personalized pre-approval and a much clearer picture of what you can afford. They're the pros, and they've seen it all.

It’s also worth noting that lenders aren't just looking at your income; they're looking at your credit score. A good credit score (generally 740+) can unlock better interest rates, saving you tens of thousands of dollars over the life of the loan. It's like getting a VIP pass to lower mortgage payments.

A Little Reflection: It's More Than Just the Numbers

Buying a 500k house is a significant life decision, and it’s easy to get bogged down in the numbers. But remember what that house represents: a place to call your own, a space for your life to unfold, a sanctuary from the everyday hustle. Whether your ideal income puts you squarely in the luxury lane or requires a bit more savvy saving, the goal is to find a home that supports your desired lifestyle without causing undue stress. It’s about finding that sweet spot where your financial reality meets your lifestyle aspirations. Because at the end of the day, a beautiful home is even more beautiful when you can truly relax and enjoy it, without your bank account breathing down your neck.