How Often Does The Federal Open Market Committee Meet: Complete Guide & Key Details

Ever feel like there's a secret society of super-smart folks whispering sweet nothings (or maybe stern warnings) about our money? Well, there kinda is! And they've got a fancy name: the Federal Open Market Committee. Sounds like something out of a spy movie, right? But these aren't your typical secret agents; they're the financial ninjas of the United States. So, how often do these money maestros gather to make decisions that can ripple through your wallet like a pebble in a pond? Let's dive in!

The FOMO is Real: How Often Do They Meet?

Here’s the super-secret (but not really!) answer: the Federal Open Market Committee, or FOMC for short (because who has time for the whole tongue-twister?), meets a pretty regular eight times a year. Think of it like a consistent schedule, kind of like your favorite TV show getting a new season every year, or your dentist reminding you it's time for a check-up every six months. These meetings are spaced out, usually every six weeks or so. This gives them enough time to see how the economy is doing, munch on some data, and then make their big pronouncements.

Now, I know what you might be thinking. "Eight times a year? That sounds like a lot of meetings!" And you're right, it is! Imagine your work team having that many meetings. You'd probably be ready to hide under your desk by the third one. But these folks are dealing with something a tad bigger than deciding who brings the donuts. They’re looking at interest rates, inflation, jobs – all the stuff that makes the economic engine hum (or sputter!).

More Than Just a Chat: What Happens in Those Meetings?

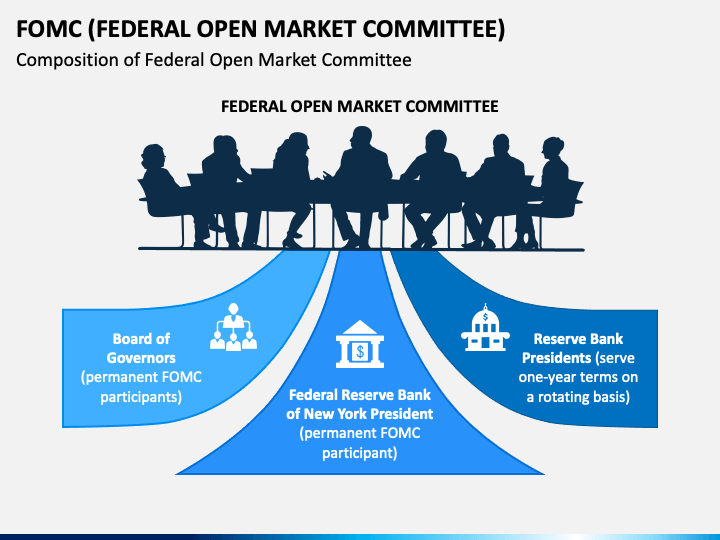

These aren't your casual coffee break chats where they discuss the latest office gossip. Oh no, my friends. These are serious, high-stakes gatherings. The main players in this economic drama are the members of the Board of Governors of the Federal Reserve and five presidents from the regional Federal Reserve Banks (the New York Fed president is always a voting member, and the other four rotate annually). Together, they’re a powerful crew, and they’re all about one thing: keeping the economy chugging along smoothly. They’re the orchestra conductors of the U.S. economy, trying to keep everything in harmony.

During these meetings, they pour over tons of economic data. Think of it like a super-advanced weather forecast, but for the economy. They look at things like how many people are employed (are we hiring like crazy or is everyone suddenly practicing their napping skills?), how much prices are going up (is your grocery bill doing the cha-cha or the slow drag?), and how much people are spending (are we all buying new yachts or are we hoarding our pennies?). It’s a massive data buffet, and they’re the esteemed guests trying to make sense of it all.

The biggest decision they make, and the one that gets all the headlines, is about interest rates. Think of interest rates like the price of borrowing money. If the FOMC decides to hike interest rates, it’s like making borrowing money more expensive. This can slow down spending and potentially cool off an overheating economy that’s getting a little too excited. If they decide to lower interest rates, it’s like making borrowing money cheaper, which can encourage people and businesses to spend more and hopefully boost the economy.

It's like they're playing a giant economic thermostat, trying to set it to "just right" – not too hot, not too cold, but perfectly comfortable for everyone!

FOMC (Federal Open Market Committee) PowerPoint and Google Slides Template

The FOMC's Superpower: Influencing Your Money

Why should you care about these eight meetings a year? Because the decisions made by the FOMC can have a huge impact on your life. When they adjust interest rates, it can affect:

- Your mortgage: Higher rates mean higher monthly payments. Boo! Lower rates mean you might be able to snag a sweet deal on a new home. Yay!

- Your car loan: Similar to mortgages, the cost of borrowing for that shiny new ride can go up or down.

- Your credit card: Those interest charges? Yep, the FOMC has a say in those too.

- Your savings: When interest rates are higher, your savings account might actually earn a little more interest. Cha-ching!

- The job market: Their decisions can influence whether businesses are hiring or holding back.

So, while they might not be out there fighting supervillains, the folks at the FOMC are definitely wrestling with some pretty big economic challenges. Their eight annual meetings are like the epic battles where they decide the fate of your finances, all in the name of a stable and growing economy. It's a pretty important gig, and they take it very seriously. And you know what? It's good to know that there are people whose job it is to try and keep everything on an even keel. Makes you feel a little more secure, doesn't it? Now, go forth and remember: eight times a year, the economic destiny of your wallet gets a little pep talk!