How To Avoid Fees On Paypal When Receiving Money (step-by-step Guide)

Hey there, PayPal pals! Ever get that little pang of disappointment when you see your hard-earned cash arrive, only to notice a chunk of it’s gone? Poof! Vanished into the PayPal ether. It’s like finding a secret treasure map, only to discover the X marks a spot already looted. Annoying, right? Well, guess what? You don’t always have to pay those pesky fees. Let’s dive into the wonderful world of free PayPal money!

Think of it like this: PayPal is a super handy tool. It connects us all. But sometimes, it charges for that connection. We’re here to find the secret passageways. The shortcuts. The hidden exits that let your money flow in, completely fee-free. Isn't that exciting? It’s like unlocking a cheat code for your finances. Who doesn't love a good cheat code?

The Big Secret: It's All About the "Type" of Transaction

So, what's the magic trick? It’s simpler than you think. The main culprit behind those fees? Usually, it’s when PayPal sees a transaction as a business payment or a purchase. They're like, "Ooh, someone's selling something! Let's take a little slice." But when it's just a friendly hand-off between buddies? That's a different story.

Imagine you're sending your roommate cash for pizza. You're not "selling" them pizza, right? You're just splitting the cost. PayPal likes to think that way too. It’s all about the vibe of the exchange.

Receiving Money as "Friends and Family" (The Golden Ticket!)

This is your main mission, should you choose to accept it. When someone sends you money, you want them to select the "Friends and Family" option. This is the golden ticket to fee-free receiving. If they choose this, and they’re sending from their bank account or PayPal balance, you pay absolutely nada. Zilch. Zero.

Why is this so fun? Because it means more money in your pocket for that fancy coffee, that book you’ve been eyeing, or maybe just to build a magnificent pillow fort. The possibilities are endless when your money isn't being nibbled away!

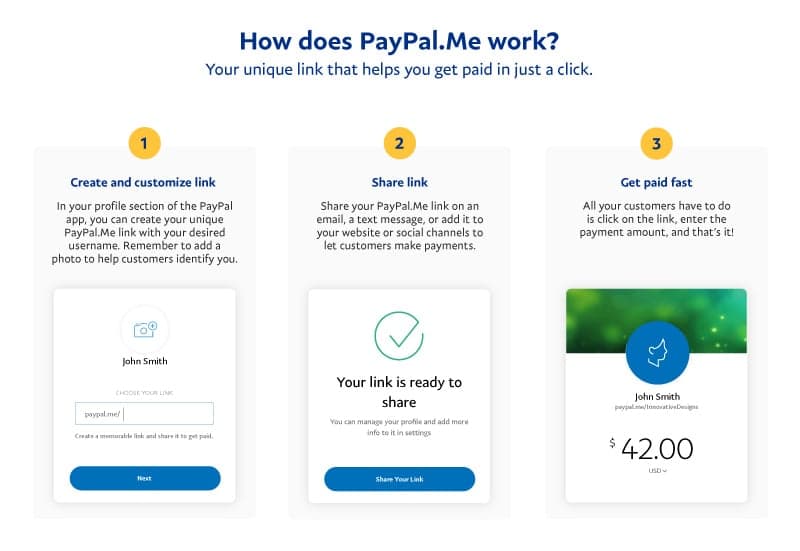

How to Make Sure It Happens (A Step-by-Step Adventure)

Okay, so how do we orchestrate this fee-free symphony? It requires a little teamwork. Mostly on the sender’s end, but you can nudge them in the right direction!

Step 1: The Gentle Nudge (Communication is Key!)

Before the money even flies, have a quick chat. If someone owes you money, or you’re collecting for a group gift, just casually mention, "Hey, when you send it over, could you select the Friends and Family option? It helps me avoid those pesky fees!" Most people are happy to oblige. It’s like a little act of kindness!

Think of it as a friendly public service announcement. You’re educating your pals about the financial wonders of PayPal. You’re practically a guru! This is where the fun really begins. You’re actively shaping your financial destiny, one friendly transaction at a time.

Step 2: The Sender's View (What They See)

When your friend goes to send you money on PayPal, they’ll typically see two main options after entering the amount and your details:

- Paying for an item or service (This is the fee-taker. Big no-no for us!)

- Sending to a friend or family member (Hooray! This is our goal!)

They need to actively choose the "Sending to a friend or family member" option. If it defaults to something else, they might need to click around a bit. It's like a mini-game!

Imagine their screen. It’s a little crossroads. One path leads to higher fees, the other to fee-free bliss. You’re their friendly guide, pointing them to the sunnier path. It’s a noble quest.

Step 3: Funding Source Matters (The Secret Ingredient!)

Here’s a quirky fact for you: The "Friends and Family" option is usually fee-free only if the sender is paying from their PayPal balance or their linked bank account. If they use a credit card or debit card linked to their PayPal account, there might still be a fee for them, and sometimes it can sneakily get passed on to you if they’re not careful or if they choose the wrong option. It’s a bit of a PayPal mystery!

So, the best bet is for them to have funds already in their PayPal balance or to link their bank account for the transfer. It’s like having the right ingredients for a perfect recipe. Without them, it just won’t taste as good.

Why is this fun? Because it adds a layer of strategy. You’re not just passively receiving money; you’re actively influencing how it gets sent. It’s a subtle art form!

What If They Can't Select Friends and Family?

Sometimes, for various reasons (maybe they’re buying something from you, or PayPal’s algorithm is feeling particularly strict that day), the "Friends and Family" option might be grayed out or unavailable. What then?

This is where you might have to accept a fee. But don’t despair! It's not the end of the world. Just a small tax on your transaction.

Option A: The Sender Absorbs the Fee

If you're receiving money for something you sold, and the buyer wants to avoid PayPal fees on their end, they might choose the "Goods and Services" option. In this case, you will likely incur a fee. However, some sellers will factor this fee into their price, so they aren't out of pocket. It’s a negotiation!

Think of it as a transparent pricing model. Everyone knows what’s going on. No hidden surprises.

Option B: You Accept the Fee Gracefully

If it's a small amount, or if the sender is already doing you a huge favor, you might just shrug it off. Sometimes, the convenience of a quick PayPal transfer outweighs the small fee. Life’s too short to sweat the small stuff!

This is where your personal tolerance for fees comes in. It’s your own little financial compass. Are you a fee-avoider extraordinaire, or do you value speed and simplicity above all else?

When Does PayPal Always Charge a Fee (Even for Friends)?

There are a few scenarios where fees are pretty much unavoidable, even with the "Friends and Family" trick. These are the PayPal overlords at their finest:

- International Transfers: Sending money to someone in another country? Brace yourself. PayPal often adds a fee for international transactions. It’s like a border tax on your digital cash.

- Currency Conversion: If the money needs to be converted from one currency to another, PayPal will likely apply a conversion rate that includes a fee. They’re the middleman, after all!

- Commercial Transactions: As we’ve hammered home, if PayPal flags it as a business transaction or a sale, there will be a fee. They’re in the business of making money, and this is one of their prime revenue streams.

These are the non-negotiables. The laws of the PayPal universe. But knowing them helps you plan! It’s like knowing the rules of a board game before you start playing.

The Fun Part: Saving Money and Being Smart!

Learning to navigate PayPal fees isn’t just about saving a few bucks. It’s about understanding how these digital platforms work. It’s about being a savvy user. And honestly, it’s just plain fun to outsmart a system!

Every time you successfully receive money without a fee, give yourself a little pat on the back. You’ve unlocked a secret level. You’re a PayPal ninja!

So, next time you’re expecting a payment, remember the golden rule: Friends and Family. A quick chat, a clear instruction, and voila! More money in your account. Happy fee-free sending and receiving, everyone!