How To Claim Tax Return In Australia Explained — What It Means And Why It Matters

So, you've heard the buzz. Tax return time. Sounds a bit dry, right? Like watching paint dry. But guess what? It's actually kinda cool. And it means good things for your wallet.

Let's dive into the nitty-gritty. Or should I say, the tax-y gritty?

What's a Tax Return, Anyway?

Think of it like this. You've earned some money. Your awesome job, side hustle, that lemonade stand you secretly still run. The Australian government wants a slice. They've been taking bits off your pay as you go. This is called PAYG – Pay As You Go. Clever name, right?

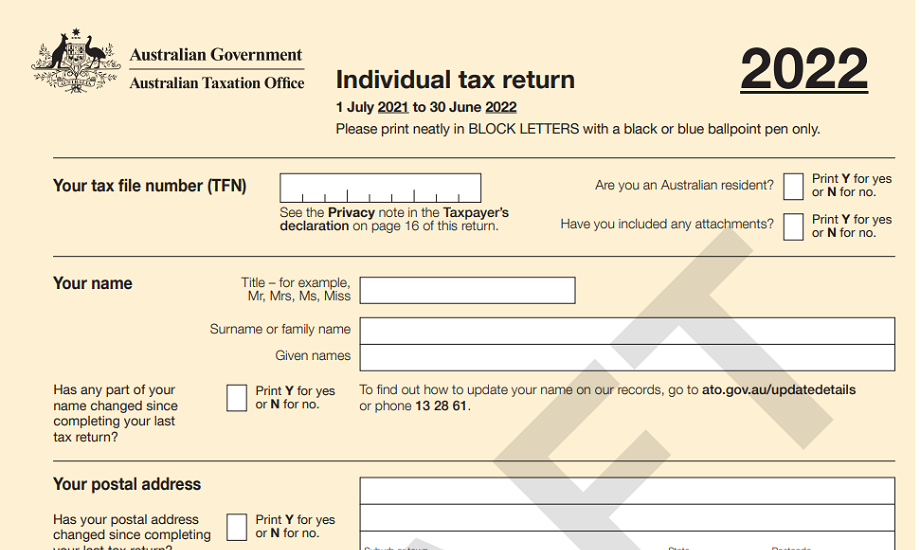

A tax return is your chance to tell the Australian Taxation Office (ATO) the real story. It’s like a financial report card for the year. You tell them everything you earned. And importantly, you tell them about all the stuff you spent money on that might be deductible.

It’s not just about handing over cash. It’s about getting some back!

Why Does it Matter? (Spoiler: It Means Free Money!)

Okay, not free money, but money you're owed. This is the exciting bit. Most Aussies get a tax refund. Yep, you read that right. The government often takes out a bit too much during the year. So, when you lodge your return, they do the maths and say, "Oops, our bad! Here's your extra cash back."

Imagine a surprise birthday gift, but it’s from the taxman. Pretty neat, eh?

This refund can be a game-changer. Big ticket item? Holiday fund? That new gadget you’ve been eyeing? Your tax return could be the secret sauce.

The Quirky Side of Tax

Did you know that before the ATO had fancy computers, people used to send in their tax returns by post? Imagine a mountain of paper! And some of the deductions people have tried to claim over the years are legendary. Like the bloke who tried to claim his pet kangaroo as a dependent. The ATO wasn't impressed, obviously.

It's also a chance to understand where your tax dollars go. Roads? Hospitals? Schools? Your contribution is part of the bigger picture. It's like being a shareholder in Australia Inc.

Who Needs to Lodge a Return?

Generally, if you earned income from working, you probably need to lodge. Even if you only earned a little bit. There are a few exceptions, like if you're under 18 and earned less than a certain amount. But for most of us, it's a yearly ritual.

Think of it as your civic duty, but with the potential for a nice cash injection. Win-win!

How Do You Actually Claim It?

This is where it gets practical. You've got options, my friend.

Option 1: The DIY Route

You can do it yourself using the ATO's free online service, myTax. It's pretty user-friendly. They pre-fill a lot of your information, like your salary details from your employer. So, you’re not starting from scratch.

It’s like assembling IKEA furniture, but with less swearing and a better outcome. You’ll need your TFN (Tax File Number). Don't lose that! It's your golden ticket.

Option 2: Get a Professional Buddy

If the thought of numbers makes your eyes water, there are tax agents or accountants. They're the tax wizards. They know all the ins and outs, all the deductions you might be missing.

This is particularly useful if you have a more complex financial situation, like investments or a business. They take the stress away. And their fee is often tax-deductible itself! See? It's a loop of tax brilliance.

What Kind of Stuff Can You Claim?

This is where the real fun begins! Deductions are your secret weapon. They reduce your taxable income, meaning less tax to pay and a bigger refund.

Think about it. Did you have to buy work uniforms? Special tools for your job? Did you drive your own car for work purposes? Did you study to improve your skills at work? These are all potential deductions.

Even things like the cost of managing your tax affairs (like paying for a tax agent) can be claimed. It’s all about things you spent money on to earn your income.

Always keep your receipts! This is the golden rule. The ATO loves proof. A shoebox full of receipts is a badge of honour during tax time.

Common Deductions to Keep an Eye On

- Work-related clothing and laundry: If you wear a uniform or protective clothing.

- Tools and equipment: For your job.

- Travel expenses: For work-related trips.

- Self-education expenses: If it relates to your current job.

- Gifts and donations: To registered charities.

- Home office expenses: If you work from home.

It’s like a treasure hunt for your money. You're uncovering the costs that the government acknowledges as part of your earning journey.

When Does All This Happen?

The tax year in Australia runs from 1 July to 30 June. After that, you have until 31 October to lodge your return. If you use a registered tax agent, they often get an extension, sometimes until May of the following year. Plenty of time, right?

Don't leave it to the last minute though. Last-minute tax lodging is like trying to cram for an exam the night before. Stressful and probably not your best work.

The ATO: Not the Evil Empire

Okay, so they collect taxes. But the ATO is also there to help. They have heaps of information on their website. They run webinars, have fact sheets, and their staff can answer questions. They want you to get it right, not get in trouble.

Think of them as a slightly intimidating but ultimately fair referee. They’re just making sure the game is played by the rules.

So, Why is This Fun?

Because it’s about you. It’s about your hard work paying off. It’s about understanding your finances a little better. And it’s about that sweet, sweet refund landing in your bank account.

It’s a chance to be a bit of a financial detective. To unearth those deductions. To feel a sense of accomplishment when you hit ‘lodge’ and know you've squared up with the government.

So, next time you hear ‘tax return’, don’t groan. Smile. Because it’s your chance to get a little bit of your hard-earned cash back. And who doesn't love that?