How To Declare Bankruptcy On Credit Cards

Hey there, friend! So, you’re staring down a mountain of credit card debt and feeling a tad… well, overwhelmed? Maybe a lot overwhelmed. It’s okay, we’ve all been there, or at least know someone who has. Think of it like this: sometimes, the best way to rebuild is to clear the slate and start fresh. And in the world of grown-up finances, that can sometimes mean a little thing called…

Now, before you picture yourself in a dusty law office signing away your dreams, let’s reframe this. Think of declaring bankruptcy on your credit cards not as an ending, but as a

Let’s ditch the doom and gloom, shall we? Because, believe it or not, navigating this process can actually be a surprisingly

So, What Exactly Are We Talking About?

Alright, so when we talk about declaring bankruptcy on credit cards, we’re generally referring to a couple of main types of personal bankruptcy: Chapter 7 and Chapter 13. Don't let the numbers scare you; they're just labels for different pathways. Each has its own set of rules, kind of like different levels in a fun, albeit slightly more serious, video game.

Chapter 7 is often called "liquidation." Basically, a trustee might sell some of your non-essential assets (don't worry, your teddy bear collection is probably safe!) to pay off a portion of your debts. The rest of your eligible debts, like those pesky credit cards, are then discharged. Poof! Gone. Like a magic trick, but with actual legal backing. Pretty neat, huh?

Chapter 13 is more like a "reorganization" or a repayment plan. If you have a steady income, this might be your jam. You'll work out a plan to repay a portion of your debts over three to five years. Think of it as a structured savings plan, but with the weight of that credit card debt lifted. It's like paying off your student loans, but with a little more… oomph.

Making the Decision: Is It the Right Move for You?

This isn't a decision to take lightly, of course. It’s like choosing the perfect outfit for a big event – you want to make sure it fits and makes you feel fantastic. You’ll want to consider your overall financial picture. Are you drowning in credit card debt, but still have decent income? Or is your debt so overwhelming it feels like a lead blanket?

Talking to a

If bankruptcy does seem like the path for you, then it’s time to gather your financial troops. You'll need to understand your income, your expenses, and all those credit card statements. It's like preparing for a treasure hunt, but the treasure is a debt-free future!

The "Fun" Part (Yes, Really!) - Navigating the Process

Okay, "fun" might be a strong word, but let's call it…

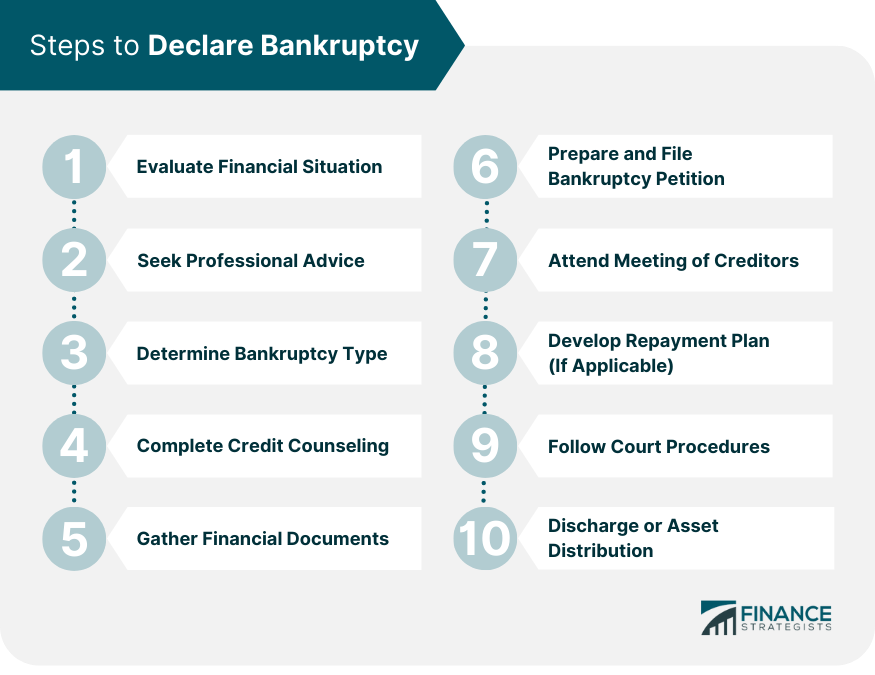

- Credit Counseling: You'll have to take a credit counseling course from an approved agency. This is usually done online or over the phone, and it’s about educating yourself on financial management. Think of it as your financial refresher course, making sure you’re armed with all the knowledge you need for your comeback.

- Filing the Petition: This is where you officially file the paperwork with the court. It's like sending your application for a new financial life. You'll provide a detailed look at your finances. Be honest and thorough – think of it as filling out a really important questionnaire for your future self.

- The Meeting of Creditors: Don't let the name spook you! This is usually a brief meeting with a bankruptcy trustee. They’ll ask you some questions about your filing. It’s often more of a formality than a dramatic courtroom scene. Imagine it as a quick check-in with your financial manager.

- Debt Education Course: After filing, you'll take another course, this time focusing on personal financial management. It’s like your graduation ceremony for financial responsibility!

- Discharge: And then, the magic happens! If all goes well, the court will issue a discharge order, and your eligible debts will be wiped clean. Cue the confetti! This is the moment you’ve been working towards, the grand prize of your financial effort.

Throughout this, honesty and transparency are your best friends. Think of yourself as a detective, uncovering all the financial clues to build your case for a fresh start. It's a bit of work, sure, but the payoff is huge!

What Happens After the Bankruptcy Dust Settles?

So, you’ve officially declared bankruptcy on your credit cards. Woohoo! Now what? Well, the world doesn't end, and neither does your ability to manage money. In fact, you’re probably more financially savvy than ever!

Your credit score will take a hit, it's true. But think of it as a temporary blemish, not a permanent scar. Like a zit that fades, your credit score will start to recover. And here’s where the fun really begins: rebuilding your credit!

You can start small. Think

You might also consider

The key is

The Inspiring Takeaway

Declaring bankruptcy on credit cards might sound intimidating, but it's a powerful tool for reclaiming your financial life. It's not about giving up; it's about

Imagine the relief of not having those credit card bills looming over you. Imagine the freedom of making financial decisions based on what you can afford, not what you owe. This is the joy of a fresh start. It’s the feeling of the sun on your face after a long, cloudy spell.

So, if you’re feeling the weight of credit card debt, know that there are options, and there is hope. Don't let fear hold you back from exploring the path to a debt-free life.