How To Make A Withdrawal From A Savings Account (step-by-step Guide)

Ah, the savings account. It’s that magical little piggy bank, but instead of a cheerful ceramic pig, it’s a sleek digital space where your hard-earned pennies go to have little baby pennies. And today, we're going to perform a very important ritual: the withdrawal! Think of it as a carefully orchestrated liberation of your funds, not unlike a troop of tiny, determined ants carrying away a crumb of cake.

This isn't some epic quest, mind you. It's more like a leisurely stroll through your personal financial garden, picking the ripest money-fruit you’ve been nurturing. So, let's get your hands on that sweet, sweet cash (or, you know, digital cash).

The Grand Unveiling: Getting Ready for Your Money Mission

First things first, you'll need to know where your money is hiding. Most likely, it's nestled within a trusted institution, let's call it "The Vault of Dreams". This could be your local bank or an online money haven. The key is knowing its name!

Next, you'll need your secret handshake. Not literally, of course. This is usually your account number. It’s like your savings account’s unique fingerprint. Keep it handy, perhaps written on a slightly-sticky note you’ll forget about until you need it.

And finally, the magic word, or rather, the magic combination of letters and numbers: your username and password. These are your golden tickets into the digital realm of your savings. Guard them like you would the last slice of pizza.

Option 1: The Digital Dash (Online Banking)

This is where the magic truly happens, right from the comfort of your couch. You're basically a financial wizard, conjuring money with a few clicks. It’s surprisingly empowering!

Open up your trusty web browser. Navigate to the website of The Vault of Dreams. You’ll see a login page that looks friendly, perhaps even smiling at you. Go ahead and greet it back.

Now, it’s time for the secret handshake. Carefully type in your username. No peeking over shoulders, or even at your reflection in the screen! We're going for stealth and precision here.

Then comes the password. This is the moment of truth. Type it in with the same reverence you'd use when whispering a wish into a dandelion. If it’s wrong, don't despair! Think of it as a friendly reminder to double-check your wish-writing skills.

Once you’re in, you’ll see a dashboard. This is your financial command center. Look for something that screams “Accounts” or “My Finances.” It’s usually pretty obvious, like a neon sign pointing to treasure.

Find your savings account. It might be listed with a friendly nickname you gave it, like “Vacation Fund” or “Emergency Awesome-Sauce Fund.” Click on it. Admire your growing nest egg for a moment. You’ve earned this!

Now, the crucial step: look for a button or link that says “Withdraw,” “Transfer,” or “Move Money.” It’s the gateway to your financial freedom. Imagine it as the big red button that makes your dreams a reality.

You’ll then be asked how much money you want to liberate. Enter the amount. Be precise! If you’re aiming for a new video game, type in the exact price. Don’t accidentally withdraw enough for a small island unless that’s part of the plan.

You’ll also need to tell the system where the money should go. This is usually to your checking account. Think of it as directing your liberated funds to their new, active duty base. It’s like sending a happy little money-messenger to your spending account.

Before you hit the final confirmation button, take a deep breath. Review everything. Did you enter the right amount? Is it going to the correct destination? This is your final chance to avoid any money-related mischief.

And then, with a triumphant click, you’ll confirm the withdrawal. Poof! Your money is on its way. You might get a confirmation message, or perhaps a little confetti animation. Celebrate your small victory!

Option 2: The Personal Touch (Visiting the Bank)

Sometimes, you just want to talk to a real human. Perhaps you’re feeling a bit nostalgic for the days of bank tellers with charmingly dated name tags. This is perfectly acceptable and, dare I say, quite charming.

Head on over to your local branch of The Vault of Dreams. You might want to wear something nice, like you're going to a very important meeting about… well, about your money. It’s a power move.

When you arrive, look for the friendly faces behind the counter. They are the guardians of the cash. Approach them with a smile and a polite greeting. They appreciate a good “hello!”

You'll likely need a withdrawal slip. This is a special piece of paper where you'll write down all the important details. It’s like a treasure map for your money.

On the slip, you'll write your account number. Remember that fingerprint we talked about? This is where it goes. Accuracy is key here, no artistic interpretations allowed.

Next, you'll specify the amount you wish to withdraw. Write it clearly, both in numbers and, often, in words. This ensures there’s no room for confusion. “Fifty dollars and zero cents” is very different from “Five hundred dollars and zero cents”!

You'll also need to tell them where you want the money to go. Usually, this is simple: you want to take it with you. You might tick a box that says “Cash” or indicate you want it deposited into another account.

And then comes the moment of truth: your signature. This is your personal seal of approval. Sign it with confidence, like you’re signing a contract for a million-dollar deal. Because, in a way, you are!

Hand the slip and your identification (like your driver’s license) to the teller. They’ll likely verify your identity. This is to make sure you’re actually you, and not some mischievous money-munching imposter.

The teller will then perform their own magic. They’ll consult their mystical computer screens and, after a moment, present you with your hard-earned cash. Feel the weight of it! It’s a tangible reward for your saving efforts.

Sometimes, if you’re withdrawing a larger sum, they might ask you a few clarifying questions. This is just to be thorough, like a financial detective ensuring all loose ends are tied. Don’t be alarmed!

Option 3: The Handy Helper (ATM)

For quick, on-the-go needs, the ATM is your trusty sidekick. It’s like a vending machine for cash, but much more sophisticated. And usually, it doesn't require you to insert exact change.

Find an ATM associated with The Vault of Dreams or one that’s part of a network your bank uses. It’s like finding a friendly face in a crowd.

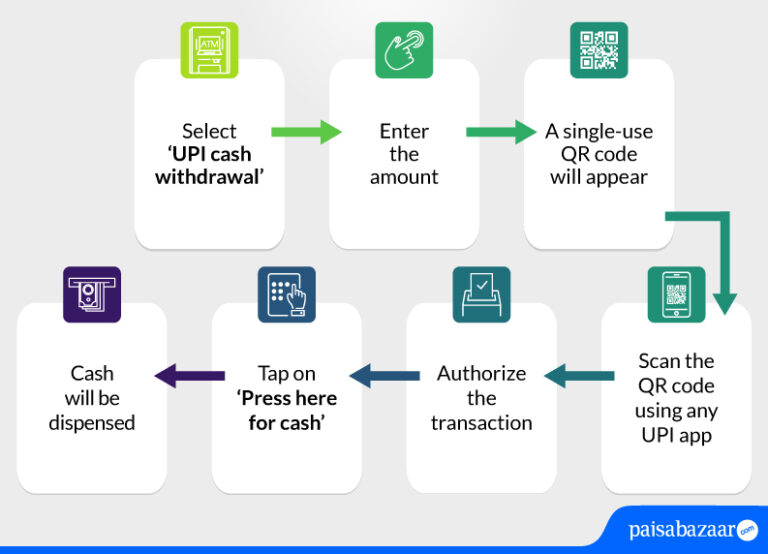

Insert your debit card or a card linked to your savings account. It’s the key to unlocking the ATM’s treasures. Make sure it’s facing the right way, like a polite guest entering a room.

Enter your PIN. This is your secret code, your personal digital handshake with the machine. Guard it closely!

You’ll see a menu of options. Look for “Withdrawal” or “Transfer.” It's usually a prominent choice, beckoning you towards financial liberation.

Select the account you want to withdraw from, which will be your savings account. It's like choosing which treasure chest to open.

Enter the amount you wish to withdraw. ATMs usually have pre-set amounts, but you can often type in a custom amount. Think about your budget, or that irresistible impulse buy.

The ATM will then ask you where you want the money to go. Most likely, you want it as cash. This is the simplest route to immediate funds.

Confirm the transaction. The ATM will crunch the numbers and, if all is well, dispense your cash. A satisfying whirring sound, a gentle rumble, and there it is!

Don't forget to take your card and your cash. It’s like leaving a party with your goodie bag. And there you have it! Your money is now out in the world, ready for its next adventure.

The Grand Finale: What to Do With Your Freed Funds

Now that you’ve successfully liberated some of your savings, what’s next? This is where the fun really begins!

Maybe you’ve been eyeing a new gadget. Or perhaps you’re planning a much-needed vacation. Whatever your goal, this withdrawn money is your tool to achieve it. It’s like having a magic wand for your desires.

Or, if you’re feeling particularly responsible, you might transfer it to your checking account to cover upcoming bills. Think of it as a strategic deployment of your financial troops. They’re going in to win the battle against expenses!

Whatever you decide, remember the joy of having saved that money in the first place. It’s a testament to your diligence and foresight. So go forth and spend, invest, or save even more! Your savings account will be there, patiently waiting for its next deposit, ready to grow again.