If The Government Implements An Expansionary Fiscal Policy: Complete Guide & Key Details

Hey there! So, have you ever heard the government talk about "fiscal policy"? It sounds super serious, right? Like something only economics professors with elbow patches would understand. But guess what? It's actually pretty interesting, and today we're gonna break down one specific type: expansionary fiscal policy. Think of it like the government giving the economy a little pep talk and a shot of espresso when it’s feeling a bit sluggish. Ready to dive in? Let’s go!

What's This "Expansionary" Thing All About?

Alright, first things first. When we say "expansionary," it means we're trying to make the economy grow, or expand. Imagine the economy is like a car that's sputtering along. The government, in this scenario, is trying to hit the gas pedal to get it moving faster and smoother.

Why would the government even want to do this? Well, usually it’s when things are a bit… well, blah. Maybe people aren't spending as much money, businesses aren't hiring as many folks, and generally, the economy feels like it’s stuck in neutral. This is often called a recession or an economic slowdown. Nobody likes that, so the government steps in with its economic toolkit.

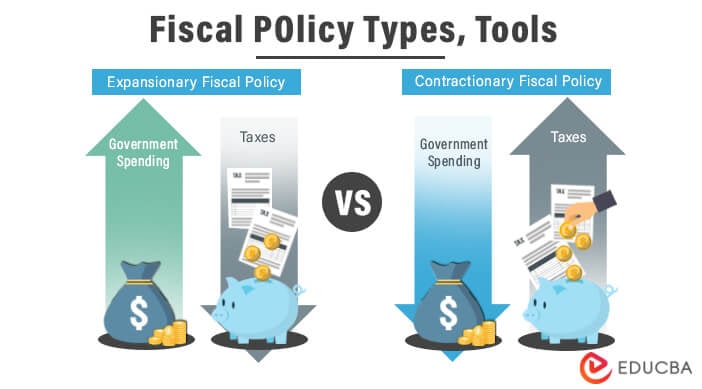

The Two Main Tools in the Expansionary Toolbox

So, how does the government actually do this "expansionary" thing? They’ve got two main tricks up their sleeve:

1. Spending More Money (The "Big Spender" Move)

This one’s pretty straightforward. The government can decide to increase its own spending. Think about it: if the government decides to build a new highway, fund more research into, I don’t know, making super-fluffy clouds, or hire more teachers, that money has to go somewhere, right?

It goes to construction companies, researchers, teachers, and all the people who work for them. And what do these people do with the money they earn? They go out and spend it! They buy groceries, maybe get a new phone, or even just treat themselves to an extra scoop of ice cream. This increased spending, or aggregate demand (fancy term for total spending in the economy), helps businesses sell more, which in turn encourages them to produce more and maybe even hire more people.

It’s like a ripple effect. The government throws a pebble (its spending) into the pond of the economy, and the ripples spread out, creating more activity. Pretty neat, huh?

Examples of Increased Government Spending:

- Infrastructure Projects: Roads, bridges, public transport – these all create jobs and make it easier for businesses to operate. Plus, who doesn't love a smoother commute?

- Education and Research: Investing in schools or science labs can lead to a more skilled workforce and future innovations. It’s like planting seeds for future economic harvests!

- Social Programs: Sometimes, increasing spending on things like unemployment benefits or aid can give people a safety net and boost their spending power when they need it most.

Now, you might be thinking, "But where does all this extra money come from?" That's a great question, and we’ll get to that a little later. For now, let's focus on the "what" and the "why."

2. Cutting Taxes (The "Money Back Guarantee" Move)

The other big lever the government can pull is tax cuts. This is where they decide to lighten the load on individuals and businesses. If you have more money in your pocket because you’re paying less in taxes, what are you more likely to do? Exactly! You’re more likely to spend it.

Think about it from a personal perspective. If your paycheck suddenly had an extra $50 or $100 because your taxes went down, you might think, "Ooh, maybe I can finally go see that movie I've been wanting to or buy that little gadget I've had my eye on." That’s exactly the kind of behavior the government is hoping to encourage.

And it’s not just individuals. When businesses pay less in taxes, they have more profit. What do they do with that extra profit? They might decide to invest in new equipment, expand their operations, or, you guessed it, hire more employees.

So, both spending more and taxing less are designed to do the same thing: put more money into the hands of people and businesses, so they’ll spend it and get the economy humming again.

Examples of Tax Cuts:

- Income Tax Reductions: Lowering the percentage of your paycheck that goes to taxes.

- Corporate Tax Reductions: Making it cheaper for companies to do business.

- Tax Credits or Rebates: Giving people specific amounts of money back or allowing them to deduct certain expenses.

Why Do We Need This "Expansionary" Stuff Anyway?

We’ve touched on this, but let’s make it super clear. The main goals of expansionary fiscal policy are:

:max_bytes(150000):strip_icc()/expansionary_policy-FINAL-a00b207b3c604a3b8303abe44ca571ae.png)

- Boosting Economic Growth: Getting the economy producing more goods and services.

- Increasing Employment: Getting more people jobs so they can earn a living and contribute to the economy.

- Preventing or Shortening Recessions: Helping the economy recover faster when it’s feeling down in the dumps.

Imagine a runner who's starting to lag behind in a race. Expansionary fiscal policy is like giving that runner a little boost – maybe a cheering crowd, a quick sip of water, or even just telling them they’re doing great! It’s about giving the economy a helping hand when it needs it.

The "Buts" and "What Ifs": Potential Downsides to Consider

Okay, so it sounds pretty good, right? More jobs, more spending, a happier economy. But, like most things in life, there’s a flip side. When the government decides to spend more or tax less, it’s not without its potential consequences. Let’s chat about those:

1. The Inflation Monster (Don't Feed It Too Much!)

This is probably the biggest concern. When you inject a lot of money into the economy, and everyone suddenly has more to spend, what can happen? Prices can start to go up. Think about it: if everyone wants to buy the same limited number of T-shirts, the T-shirt seller might notice they can charge a bit more. This is called inflation.

A little bit of inflation isn't necessarily bad. It’s often a sign of a healthy, growing economy. But if inflation gets out of control, it can erode the purchasing power of money. That means your dollar doesn’t buy as much as it used to, which can be a real bummer for people, especially those on fixed incomes.

The government and the central bank (like the Federal Reserve in the US) are always trying to find that sweet spot – enough growth without too much inflation. It’s like trying to bake a cake perfectly; too little time and it’s gooey, too much and it’s burnt!

2. Government Debt (The "Who's Paying For This?" Question)

Remember our earlier question about where all this extra government money comes from? Well, when the government spends more than it collects in taxes, it has to borrow money. This is how it accumulates government debt.

:max_bytes(150000):strip_icc()/Monetary-Policy-ca2313abbf3646e38301b40f3a53a476.png)

Think of it like running up a credit card bill. While it might be necessary to buy something you really need, you eventually have to pay it back, and often with interest. High levels of government debt can be a concern because it means a portion of future government revenue will have to go towards paying off that debt instead of funding other important programs or services.

It’s a balancing act. The government needs to stimulate the economy, but it also needs to be mindful of how much debt it’s accumulating. It’s like a homeowner deciding whether to take out a mortgage to renovate their house – it can increase the value, but it's a big commitment!

3. Crowding Out (When Private Investment Gets Squeezed Out)

This one is a little more technical, but bear with me. When the government borrows a lot of money, it can sometimes increase the demand for loanable funds. This can lead to higher interest rates. If interest rates go up, it becomes more expensive for businesses to borrow money to invest in new projects. This can potentially "crowd out" private investment, meaning the government’s borrowing might discourage businesses from doing their own investing.

It’s like going to a popular restaurant on a Saturday night. If a huge party books the entire main dining room (the government borrowing a lot), it might be hard for smaller groups (businesses) to get a table and enjoy their meal (invest). Of course, economists debate how significant this "crowding out" effect really is, but it’s a factor to consider.

How Do We Know If It's Working?

So, how can we tell if this expansionary fiscal policy is actually doing its job? We look at the key indicators:

- GDP Growth: Is the Gross Domestic Product (the total value of everything produced in the country) going up?

- Unemployment Rate: Are more people finding jobs?

- Consumer Spending: Are people and businesses spending more money?

- Inflation Rate: Is inflation within a manageable range?

It’s like being a doctor checking a patient’s vital signs. If the numbers are improving, then the medicine (expansionary policy) is likely working. If they’re not, well, the doctor might need to adjust the prescription.

Who Decides on This Stuff?

In most countries, it’s a collaborative effort, but the legislative branch (like Congress in the US) and the executive branch (like the President) usually play a big role in deciding on government spending and tax policies. Sometimes, they work together, and sometimes, well, they have spirited debates! It’s all part of the democratic process, folks!

The central bank also plays a crucial role in the broader economic picture, often working in conjunction with fiscal policy through its own set of tools (like adjusting interest rates, which is monetary policy). Think of them as a team, trying to steer the economic ship in the right direction.

So, What's the Takeaway?

Expansionary fiscal policy is essentially the government’s way of trying to give the economy a little boost when it needs one. By either spending more money or cutting taxes, they aim to encourage more spending, create more jobs, and get the economy growing. It’s a powerful tool, but like any powerful tool, it needs to be used wisely.

There are potential downsides, like the risk of inflation and increased government debt, so it’s a constant balancing act. Economists and policymakers are always debating the best approach, and there's no single "perfect" answer for every situation.

But here’s the uplifting part: the fact that governments have these tools and are willing to use them to try and improve the economic well-being of their citizens is pretty darn commendable. They’re constantly learning, adapting, and trying to make things better. So, next time you hear about fiscal policy, you’ll have a much clearer picture of what’s going on. And who knows, maybe you’ll even find yourself humming a little economic tune! Keep an eye on those indicators, and remember, the economy is always on the move!