Insurance That Pays Off Mortgage If I Die

Alright, settle in, grab your lukewarm latte and let’s have a little chat. You know that giant, looming, often-paper-cut-inducing beast we call a mortgage? That thing that whispers sweet nothings about homeownership and then screams “PAY ME” at the top of its lungs every month? Yeah, that one. Well, imagine a world where, if you suddenly decided to become one with the great beyond (hopefully not too soon, eh?), that beast… just… vanished.

Sounds like something out of a fairy tale, right? “And so, the homeowner departed, and their mortgage was instantly paid off by a magical insurance policy!” While there isn't a sprinkle of fairy dust involved, there is something pretty darn close, and it’s called mortgage protection insurance. Or, if you want to sound fancy,

So, What's the Deal with This Mortgage Fairy Godmother?

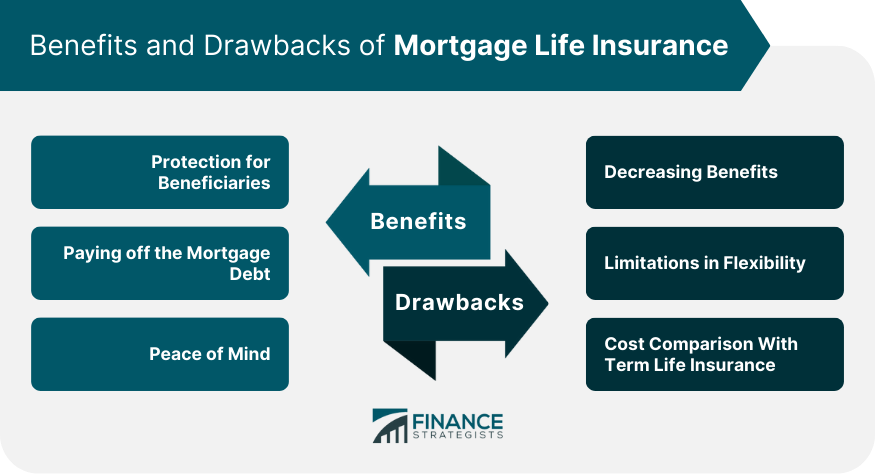

Basically, it’s a type of life insurance policy specifically designed to do one super-important thing: pay off your outstanding mortgage balance if you kick the bucket. Think of it as a superhero cape for your loved ones, specifically tailored to fight the villain of debt. No more spectral landlords demanding rent from your grieving spouse!

Here’s the lowdown, served with a side of sarcasm. When you get a mortgage, the bank is all smiles and handshakes. But deep down, they’re thinking, “What if this person suddenly develops an uncontrollable urge to explore the Mariana Trench without a submarine?” They want their money back, and they want it pronto. This insurance is their peace of mind, and, more importantly, your family’s financial breathing room.

Why Should I Even Care About This Now?

“But I’m young! I’m invincible! I’m pretty sure I can outrun a zombie horde armed with just a baguette!” you might be thinking. And I salute your optimism! But let’s be real, life has a funny way of throwing curveballs. Sometimes they’re little league foul balls, and sometimes they’re… well, let’s just say they’re the kind that make you wish you’d invested in a really good helmet.

If you have a mortgage, and you have people who rely on you – a spouse, kids, that incredibly spoiled but lovable golden retriever who demands artisanal dog biscuits – then this is for you. Because the alternative to this magical insurance is your family suddenly inheriting a house that comes with a hefty, hefty payment plan. Imagine their joy: “Honey, we’re so sad you’re gone, but hey, guess who gets to pay the mortgage for the next 25 years? You! Oh, wait…”

Types of Mortgage Life Insurance: It's Not Just One-Size-Fits-All

Now, before you run off and start Googling “insurance that makes mortgage disappear,” let’s break down the main players. It’s not a huge cast, so you won’t need a scorecard.

The two main categories are usually tied to traditional life insurance:

- Term Life Insurance: This is like renting a really good umbrella for a specific period. You pay a premium for a set number of years (e.g., 10, 20, 30 years), and if you meet your untimely end during that term, bam! The payout covers the remaining mortgage balance. It's generally cheaper because it’s for a limited time. It's like buying pizza for a party – you get exactly what you need for that specific event.

- Permanent Life Insurance: This is more like buying a house with a garden that never stops producing… well, maybe not fruit, but definitely cash value. This type of policy stays with you for your entire life, and a portion of your premium builds up

cash value . If you pass on, it pays out. It’s usually more expensive than term life, but you get that lifelong coverage and a little nest egg. Think of it as a lifetime subscription to peace of mind, with bonus features.

Within these, you might also find policies that are specifically named

What's the Difference Between This and Regular Life Insurance?

Good question! Think of it this way: Regular life insurance is like a big, versatile toolbox. You can use the hammer for nails, the screwdriver for screws, and the wrench for… well, wrenches. The payout can be used for anything – college tuition, your epic llama farm, that yacht you’ve been eyeing.

Mortgage protection insurance, on the other hand, is like a very specialized, incredibly well-made hammer. Its sole purpose is to knock that mortgage right on the head. The payout is typically designated to go directly towards the mortgage balance.

Now, here's a fun fact: Many financial gurus will tell you that a

How Does This Magic Actually Work?

It’s not like your insurance agent sprouts wings and flies to the bank. It’s a bit more… administrative. When you pass away, your beneficiaries will file a claim with the insurance company. They’ll need to provide a death certificate and proof of the mortgage. The insurance company will then verify everything and issue a payout, usually directly to the lender to settle the mortgage. Poof! The debt is gone.

Imagine your family’s relief. Instead of drowning in paperwork and financial anxiety during a time of grief, they can focus on… well, grieving. And maybe planning that llama farm after all.

Surprising Facts That Might Make You Want This

Did you know that statistically, your mortgage is one of the largest debts most people will ever carry? Bigger than that credit card bill from your impulse purchase of a life-sized cardboard cutout of a famous movie star? Probably. And if you’re the primary breadwinner, its absence could be a real financial gut-punch for your family.

Also, here’s a slightly morbid but important thought: The average lifespan in many developed countries is ticking upwards. That means our mortgages might be getting paid off later in life, meaning there’s a longer period where this debt could become an issue if something were to happen.

And get this: sometimes, lenders might require you to have some form of life insurance if they deem you a higher risk. So, this isn't just a nice-to-have; it can occasionally be a must-have.

The Nitty-Gritty: Costs and How to Get It

Okay, let’s talk brass tacks. How much does this peace of mind cost? It varies wildly. Factors include your age, your health (smokers, I'm looking at you!), the amount of coverage needed (your mortgage balance), and the length of the term.

Think of it like buying a used car. You can get a clunker for cheap, or a pristine vintage model that costs a pretty penny. For a healthy 30-year-old with no major health issues, a term life policy to cover a $300,000 mortgage for 30 years might be surprisingly affordable – perhaps less than your Netflix subscription. Seriously! So, don't let the idea of high costs scare you off before you even look.

Getting it is usually straightforward. You’ll shop around, get quotes from different insurance companies, and fill out an application. They’ll likely ask about your health and lifestyle. Some policies might require a medical exam, others might be

A Word of Caution (Because Life Isn't Always a Comedy)

While this insurance is a fantastic tool, it’s not a magic wand that solves all financial woes. It’s specifically for the mortgage. Your family will still have other expenses: food, utilities, that lingering subscription to a magazine about competitive dog grooming. So, consider this as part of a larger financial plan, not the entire plan.

Also, be wary of policies that seem too good to be true. Always read the fine print. Understand what's covered, what's not, and how the payout process works. Don't be afraid to ask questions until you feel like you’re speaking the same language as the insurance agent. They might even appreciate it!

The Final Verdict: Is It Worth It?

In my humble, caffeine-fueled opinion? Absolutely. For the peace of mind it offers you and your loved ones, the cost is often a small price to pay. It’s about ensuring that if the worst happens, the roof over your family’s head remains just that – a roof, not a crushing financial burden.

So, go ahead. Chat with an insurance professional. Get some quotes. And then, with a clearer head and maybe a stronger coffee, decide if this is the right magical shield for your family’s financial castle. Because a mortgage-free home, even if it’s paid for by insurance, is still a pretty sweet deal for those you leave behind.