Intel Stock Recent Quarter Earnings Outlook Intc Analysis: Complete Guide & Key Details

Alright, folks, let's talk about Intel. You know, that company that makes the brains of most of the computers we use every day? Yep, those guys. Think of them like the folks who bake the delicious bread that goes into our favorite sandwiches. If the bread’s a bit stale, the whole sandwich experience can go downhill, right? Well, Intel's earnings reports are kind of like the grocery store scanner telling us if that bread is flying off the shelves or gathering dust.

And right now, the scanner at the Intel store is flashing a few interesting lights. We're not talking about a full-blown fire alarm, but it’s definitely worth peeking at the ingredients list to see what’s cooking. This isn't just for the Wall Street whizzes; it’s for all of us who rely on these chips for everything from binge-watching our favorite shows to sending that important work email. After all, a slow computer is about as fun as a flat tire on a Sunday drive.

So, What's the Scoop with Intel's Latest Earnings Report?

Imagine you’re planning a big party, and you're hoping everyone rakes in their share of the party favors. Intel's earnings report is like the tally sheet after the party. Did they sell enough of their ‘party favors’ (you know, those computer chips) to make everyone happy? Did they bring in enough cash to keep the party going, or are they looking a little light on the potato salad?

The recent quarter's numbers are like the first bite of that homemade cookie you’ve been craving. Sometimes it’s perfect – sweet, chewy, exactly what you wanted. Other times, maybe it’s a little too crumbly, or you suspect they used too much salt. Intel’s report this time around has been a bit of a mixed bag, a real “you never know what you’re gonna get” kind of situation, like a box of chocolates.

They’ve been facing some challenges, no doubt about it. Think of it like trying to get a toddler to eat their vegetables. Sometimes it’s a battle. Intel’s been battling some tough competition, and the whole tech world has been a bit wobbly lately, like trying to balance a stack of pancakes. People are more careful with their spending, which means they’re not upgrading their laptops or buying that fancy new doodad as often. This puts a bit of a squeeze on sales.

But here’s the kicker: it’s not all doom and gloom. Intel is also showing some resilience. They’re working on new ways to make their chips better and faster, kind of like a chef tweaking their secret recipe. They're also trying to get into new markets, which is like a baker deciding to open a new shop in a different neighborhood.

The Nitty-Gritty: What the Numbers Are Telling Us

Let’s get a little more specific without making our eyes glaze over like they do when trying to assemble IKEA furniture. When we talk about earnings, we're usually looking at a few key things:

- Revenue: This is basically the total amount of money Intel brought in from selling its chips and other goodies. Think of it as the total amount in the cash register at the end of the day.

- Profit: This is what's left over after Intel pays all its bills (like salaries, factory costs, and research). It’s the actual money they get to keep, like the tips the server gets after paying for their shift.

- Earnings Per Share (EPS): This is the profit divided by the number of shares of stock outstanding. It’s a way to see how much profit each little piece of the company is generating.

This past quarter, Intel’s revenue was… well, it wasn’t exactly setting the world on fire. It was down compared to some previous periods. This is like looking at your bank account after a wild weekend and realizing you might need to eat ramen for a week. The demand for PCs, which is a big chunk of Intel’s business, has been a bit like a deflated balloon. People aren't buying new computers like they used to. They’re holding onto their current ones, which is understandable when you’re trying to save up for that dream vacation.

However, on the profit side, things have been a little more… creative. They’ve been working hard to cut costs and be more efficient, like finding ways to use less butter in your cookies without anyone noticing. This means that even with lower sales, they’ve managed to keep their profit margins from completely tanking. It’s like squeezing every last drop of juice from an orange.

The Future: What’s Next on the Menu?

Now, the really interesting part is looking ahead. What’s Intel’s outlook for the next quarter and beyond? This is like looking at the menu at a new restaurant and trying to decide if it’s worth the splurge.

Intel is making a big push into new areas. One of the hottest trends right now is something called Artificial Intelligence (AI). You hear about it everywhere, right? It’s like the new super-ingredient that everyone wants to add to their dishes. Intel is developing chips specifically designed for AI, which is a pretty smart move. Think of it as them trying to corner the market on the hottest new spice.

They're also continuing their efforts in the data center space. This is where big companies store all their information. It’s like the massive warehouses that hold all our online photos and videos. As more and more data is created, these data centers need more and more powerful chips. Intel is fighting hard to keep its place in this crucial market, which is like a baker defending their prime spot at the farmer’s market.

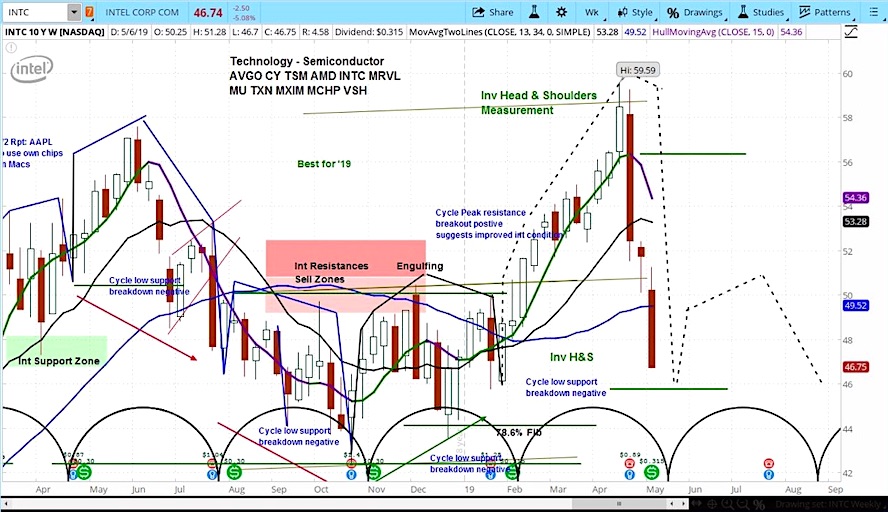

But it’s not a walk in the park. They’re up against some seriously tough competitors, like a seasoned chef who’s always got a new trick up their sleeve. Companies like AMD are giving Intel a run for its money in the CPU market, and in the AI chip world, NVIDIA is the reigning champion, kind of like the undisputed king of the chili cook-off.

Analyst Opinions: The Critics’ Corner

What do the folks who get paid to analyze these things think? Analysts are like the food critics who come to review your restaurant. Some give glowing reviews, while others are a bit more… critical.

Many analysts are watching Intel closely. They’re looking for signs that Intel’s new strategies, especially in AI and manufacturing, will actually pay off. Some are optimistic, pointing to the potential of their new chip designs and their efforts to diversify. They might say, "This new recipe has promise!"

Others are more cautious. They might point out that it takes time for new products to gain traction and that the competition is fierce. They could be saying, "It's a good start, but let's see if they can really deliver." It’s like waiting to see if that new cake recipe actually tastes as good as it sounds.

The key things analysts are focused on are Intel’s manufacturing capabilities (can they actually make these new, advanced chips reliably and at scale?) and their ability to win back market share, especially in the PC segment. They also want to see strong adoption of their new AI-focused products.

Key Details to Keep Your Eye On

So, if you’re someone who likes to keep tabs on this sort of thing, what should you be paying attention to?

- PC Market Recovery: If people start buying more laptops and desktops again, that’s good news for Intel. Think of it as a bump in demand for bread at your local bakery.

- AI Chip Performance: How well do Intel’s new AI chips perform against the competition? Are they a genuine threat, or just a blip on the radar? This is like tasting a new artisanal cheese – is it sharp, creamy, or just… meh?

- Manufacturing Progress: Intel has been talking a lot about improving its chip manufacturing technology, known as process technology. This is super important. If they can make chips that are smaller, faster, and more power-efficient, they’ll be in a much stronger position. It's like a baker who figures out how to bake bread in half the time with half the fuel.

- Customer Wins: Who is Intel signing new deals with? Are big companies choosing Intel’s chips for their servers or AI systems? This is like seeing which restaurants are putting your favorite new ingredient on their specials board.

- Guidance: This is what Intel tells investors they expect to happen in the future. If they give a rosier outlook than expected, that’s usually a good sign. If they’re more conservative, it might mean they’re bracing for a bit of a bumpy road. It's like the weather forecast – you plan your picnic based on what they say.

It’s also worth remembering that the semiconductor industry is cyclical. It goes through booms and busts. Right now, we’re in a bit of a softer period for some parts of the market, but that doesn’t mean the long-term growth story is over. Think of it like a garden; sometimes things are in full bloom, and other times they’re in winter, but they’ll come back.

The Bottom Line (Without Being Boring)

Look, Intel isn't the flashy startup anymore. They’re the seasoned veteran, the company that’s been around the block. They’ve had their ups and downs, like any long-standing business. Sometimes they’re hitting home runs, and other times they’re just trying to get on base.

Their recent earnings report shows they're navigating a tricky landscape. Sales haven't been stellar across the board, but they're fighting hard, especially by investing in future growth areas like AI and trying to improve their manufacturing game. It’s like a chef who’s facing a tough economy but is still experimenting with new flavors and trying to be more cost-effective in the kitchen.

Whether you’re an investor or just someone who uses a computer, understanding these trends helps put things in perspective. It’s about seeing the bigger picture, the behind-the-scenes efforts that keep our digital world running. So, next time you’re waiting for your computer to boot up, you can nod and say, “Ah yes, Intel. They’re still in the kitchen, tinkering with the recipe.” And that, my friends, is a pretty good place to be.