Interest Rate For Navy Federal Certificate Of Deposit: Complete Guide & Key Details

Ever feel like your money is just sitting there, doing absolutely nothing? Like it's on a permanent vacation without you? Well, what if your money could work for you, maybe even have a little adventure of its own? That's where a Navy Federal Certificate of Deposit, or CD, swoops in like a superhero for your savings! And let's talk about the star of the show: the interest rate.

Think of a Navy Federal CD as a super-safe piggy bank. You lock your money away for a set amount of time, and in return, Navy Federal Credit Union promises to pay you a little extra – that's the interest! It's like planting a money seed and watching it grow into a slightly bigger money plant. Pretty neat, huh?

Now, what makes a Navy Federal CD so special, especially when we're talking about those juicy interest rates? Well, for starters, Navy Federal is a credit union. That means it's not some giant, impersonal bank. It's built for its members, and that often translates into better deals. Imagine getting a special perk just because you're part of the club! That's the vibe.

So, let's dive into the nitty-gritty of these interest rates. They're not just random numbers. They're like the secret sauce that makes your savings sweet. The higher the interest rate, the more money your money makes! It’s like finding a shortcut to a bigger reward.

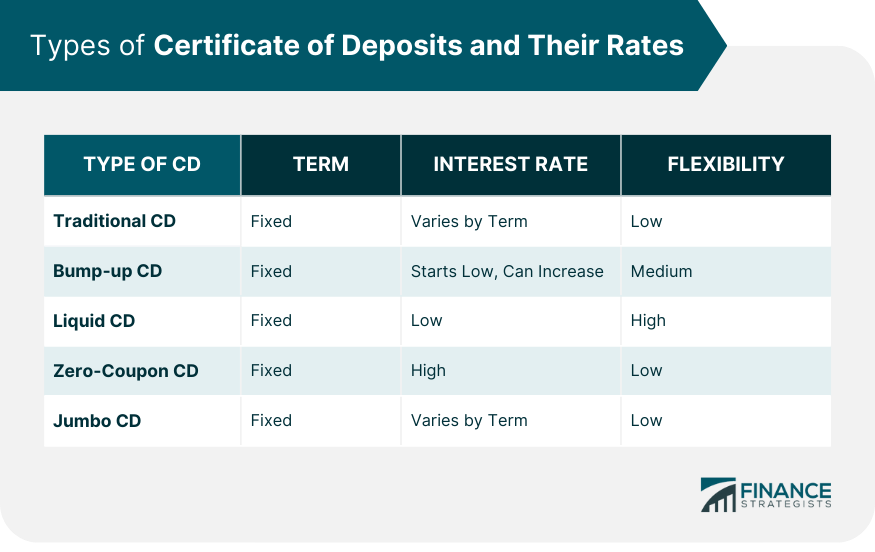

What influences these rates? A few things. One biggie is the term of the CD. A term is just how long you agree to keep your money tucked away. Think of it like this: the longer you're willing to let your money chill in the CD, the more interest Navy Federal is usually willing to pay you. It's their thank you for your commitment.

So, if you lock your money up for, say, a year, you'll likely see a different interest rate than if you chose a five-year CD. It's like choosing between a quick sprint and a marathon. The marathon often gets you a bigger prize at the end, in this case, a higher interest rate.

Another fun factor is the amount you deposit. Sometimes, putting in a larger chunk of change can unlock even better interest rates. It's like a bulk discount for your money! So, if you have a good-sized savings nest egg, you might be able to snag an even sweeter deal.

But here’s the really cool part: Navy Federal often has some seriously competitive rates. They really try to look out for their members. Sometimes, you might find their CD rates are a bit higher than what you'd see at a regular bank. It's like finding a hidden gem in the savings world. You feel like you've stumbled upon a secret tip!

"It's like your money is getting a little vacation and coming back with more!"

Now, before you get too excited, let’s talk about what makes a CD, well, a CD. It’s that "lock-up" period. Once you put your money in, it's not like your regular checking account where you can just grab it whenever. If you need to take it out before the term is up, there's usually a penalty. Think of it as a little "oops" fee. So, it's super important to only put money into a CD that you know you won't need for a while. This is where planning comes in, and it makes you feel super smart and organized when you get it right.

Why would you even bother with a CD when you could just put your money in a savings account? Because of that interest rate! While a regular savings account might offer a tiny bit of interest, a CD, especially a well-chosen one from Navy Federal, can offer a significantly higher rate. Over time, that difference can add up to a noticeable amount of extra cash. It’s like choosing between a gentle breeze and a gust of wind for your money’s growth.

And the best part? It’s incredibly low-risk. Unlike investing in the stock market, where things can go up and down like a rollercoaster, your money in a CD is safe. Navy Federal is insured, so even if the world throws a curveball, your principal (the original amount you deposited) is protected. It’s the financial equivalent of wearing a seatbelt and a helmet!

So, how do you find the exact interest rates and figure out which CD is right for you? The easiest way is to head straight to the source: the Navy Federal Credit Union website. They usually have a clear section detailing their current CD rates, with different options for different terms. You can see the numbers right there, plain as day.

It's like browsing a menu at your favorite restaurant – you can see all the delicious options and pick the one that suits your taste (and your savings goals!). You might even find special promotions or "specials" on certain CD terms that offer even higher interest rates for a limited time. These are like happy hour deals for your money!

Remember, understanding CD interest rates isn't rocket science. It's about understanding how your money can work a little harder for you. It's about making smart choices that can lead to a slightly fatter wallet down the road. And with Navy Federal, you've got a partner that’s generally looking out for your best interest – pun intended!

So, if you're tired of your money just lounging around, why not give a Navy Federal Certificate of Deposit a peek? You might be surprised at how much fun your money can have, and how much more of it can come back to you. It’s a simple way to add a little excitement and growth to your savings!