Is A Higher Deductible Better For Auto Insurance? Here’s What’s True

Ah, auto insurance. It’s the stuff of late-night infomercials and whispered office conversations, right up there with finding matching socks and remembering where you put your keys. Today, we’re diving into a topic that might sound a little dry, but stick with me, because it’s got some surprisingly fun twists. We’re talking about those magical words: deductibles. Specifically, the age-old question: is a higher deductible actually better for your car insurance?

Imagine your insurance policy like a trusty sidekick. When your car needs a little TLC – maybe it took a tumble down a hill with a rogue shopping cart, or perhaps a rogue squirrel staged a daring daylight raid – your insurance steps in. But before your sidekick swoops in to save the day, there’s a little thing called a deductible. Think of it as your initial "thank you" contribution to the repair fund.

So, is going for a bigger deductible like giving your sidekick a cape and a jetpack? Let’s explore the truth, sprinkled with a little bit of what makes this whole insurance dance… well, interesting.

The Big Kahuna: What Exactly IS a Deductible?

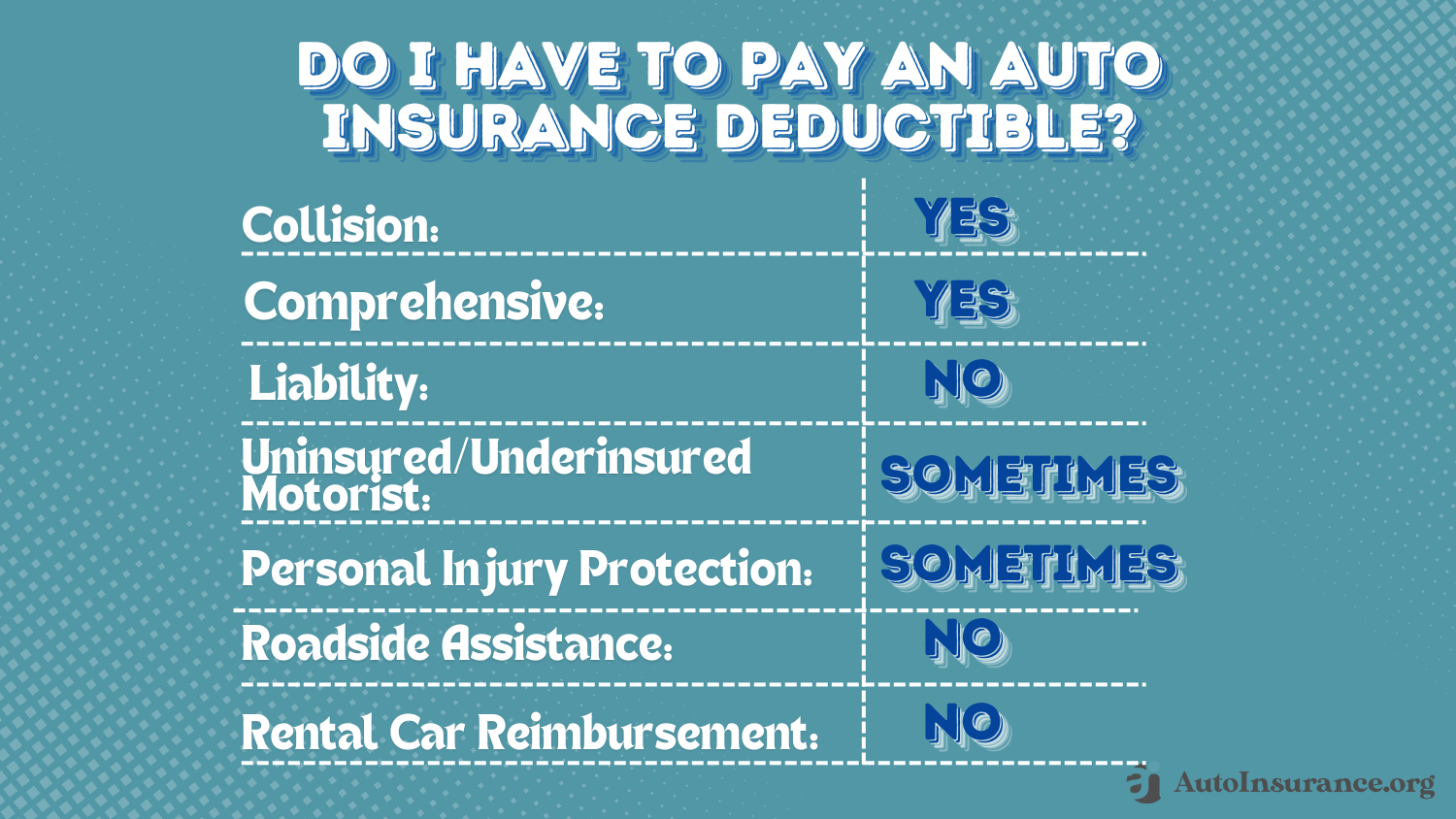

Let’s break it down super simple. When you file a claim for damage to your car (not including things like liability if you cause an accident that hurts someone else’s car, that’s a different story!), your insurance company doesn’t just magically pay for everything. You, my friend, have to pay a certain amount first. That amount? Yep, that’s your deductible.

For example, if you have a $500 deductible and your car needs $2,000 worth of repairs after a fender bender, you’ll pay the first $500, and your insurance company will cover the remaining $1,500. Easy peasy, right?

Now, here’s where things get a little juicy. You often have the choice of what that deductible amount will be. It’s like picking your own adventure for your insurance policy!

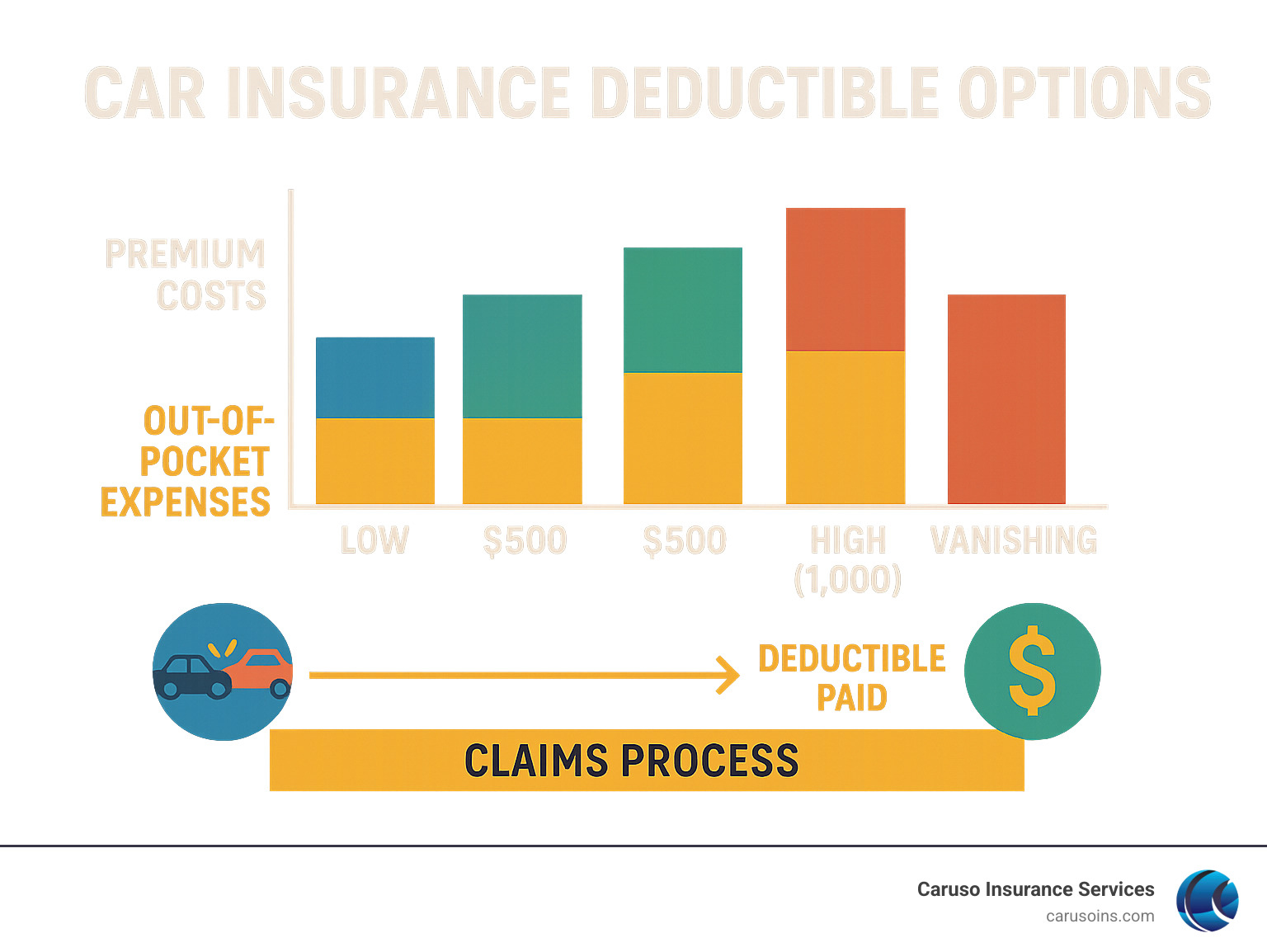

The "Higher Deductible, Lower Premium" Sweet Spot

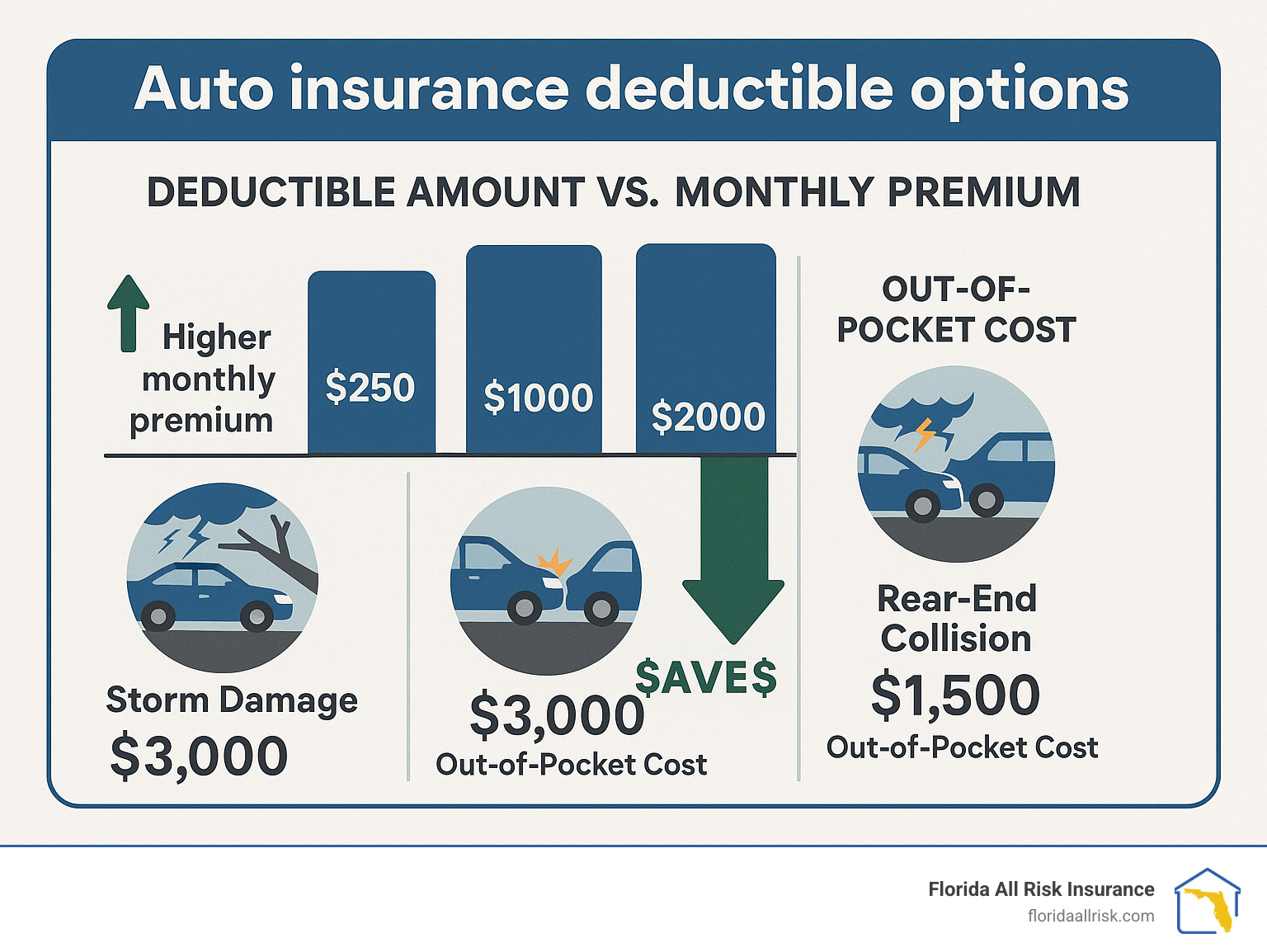

This is where the common wisdom comes in, and it’s generally true. If you opt for a higher deductible, like $1,000 instead of $500, your monthly or annual insurance premium (that’s the price you pay for the insurance) will usually be lower. It’s like a cosmic trade-off.

Why? Because when you agree to pay more out-of-pocket if something happens, you’re taking on a bit more of the financial risk yourself. The insurance company sees this and thinks, “Okay, this person is a little more… self-reliant. We can offer them a slightly better deal.”

It’s kind of like being on a rollercoaster. You pay a little less for the ticket if you’re willing to ride in the front row where the bumps might be a little more… exciting. The insurance company is betting that you won’t need to pay that big deductible too often.

The "What If?" Moment: When a Higher Deductible Might Not Be Your BFF

Here’s the flip side, and it’s important. Imagine your car is your beloved chariot, your trusty steed that gets you to work, to the grocery store, and on those spontaneous ice cream runs. If you have a high deductible, say $2,000, and you have a little fender bender that requires $2,500 in repairs, you’re looking at paying that full $2,000 yourself.

Now, for some, that $2,000 is no biggie. They have a healthy savings account, and they can easily absorb that cost without a second thought. For others, however, that $2,000 could be a significant chunk of their emergency fund, leading to some serious ramen noodle dinners for a while.

This is where we get to the heartwarming (and sometimes a little nail-biting) part. The decision really boils down to your own financial comfort zone and your personal love affair with your vehicle.

The "Surprise!" Factor: Unexpected Costs

Life, as they say, is full of surprises. Sometimes those surprises are a surprise birthday party with your favorite cake. Other times, it’s a tree deciding to take a nap on your car’s hood during a hurricane.

If you have a high deductible and a tree does decide to redecorate your car, you’ll need to have that deductible money readily available. Insurance is all about peace of mind, and for some, that peace of mind comes from knowing they have a lower deductible that’s easier to manage in an emergency. For others, it’s the peace of mind that comes from saving money on premiums every single month, knowing they can handle a larger repair bill if the worst happens.

It’s a bit like deciding how much cash you like to keep in your wallet. Some people like a lot, just in case. Others prefer to keep it lean and rely on plastic.

Is It Always About the Money? Sometimes It's About the Car!

Let’s talk about your car. Is it a vintage beauty that’s practically a member of the family? Or is it a reliable workhorse that you wouldn’t shed a tear over if it got a few more dings? Your emotional attachment to your vehicle can also play a role.

If your car is an antique, like a lovingly restored 1967 Mustang, you’ll likely want to ensure repairs are done perfectly. You might opt for a lower deductible to make sure you can get it fixed up quickly and properly, without a huge upfront cost hanging over your head.

On the other hand, if you have a car that’s seen better days but still runs like a champ, you might be more comfortable with a higher deductible. You’re thinking, “As long as it gets me from A to B, a little scratch here and there is no biggie.”

The Humorous Side: Deductibles and Your Driving Habits

Let’s be honest, sometimes the biggest surprise with insurance is how much we actually use it. If you're a “calm driver,” someone who glides through life and traffic with the grace of a swan, you might be less likely to file a claim. In that case, a higher deductible could be your friend.

But if you’re someone who’s had a few… adventures on the road (we’re not judging!), you might find that a lower deductible feels like a much safer bet. It’s like having a soft landing pad for your driving escapades.

Think of it this way: if you’re a daredevil rock climber, you invest in top-notch gear. If you’re more of a gentle stroll-in-the-park kind of person, your gear needs are a bit different. Your deductible is a bit like your insurance gear.

The Sweet Spot: Finding YOUR Perfect Balance

So, is a higher deductible better? The short, sweet, and true answer is: it depends entirely on YOU.

It depends on your savings, your financial comfort level, your driving habits, and even your emotional attachment to your car. There's no single "right" answer, just the answer that's right for your unique life.

Many people find a happy medium. Perhaps a $750 deductible strikes the perfect balance between saving on premiums and having a manageable amount to pay if something unfortunate happens. It’s about finding that sweet spot where you feel secure and financially sound.

The key is to sit down, take a deep breath, and look at your own situation. Don't just blindly follow advice; think about what makes sense for your wallet and your peace of mind. After all, your auto insurance is there to help you navigate life's bumps, big and small, so make sure it's set up in a way that truly serves you.

So, go forth and ponder your deductible! May your premiums be low and your repairs be few!