Is Nova Credit Legit For Apartment Application? Here’s What’s True

Hey there, future apartment hunter! So, you’ve been scrolling through listings, picturing yourself in that perfect pad, only to see the dreaded phrase: "Credit check required." Ugh, right? And then, BAM! Nova Credit pops up. You’re probably thinking, "What in the… is this legit? Can I trust this thing with my rental dreams?" Well, lean in, my friend, because we're about to spill the tea on Nova Credit, and by the end of this, you'll be a Nova Credit ninja. No cap.

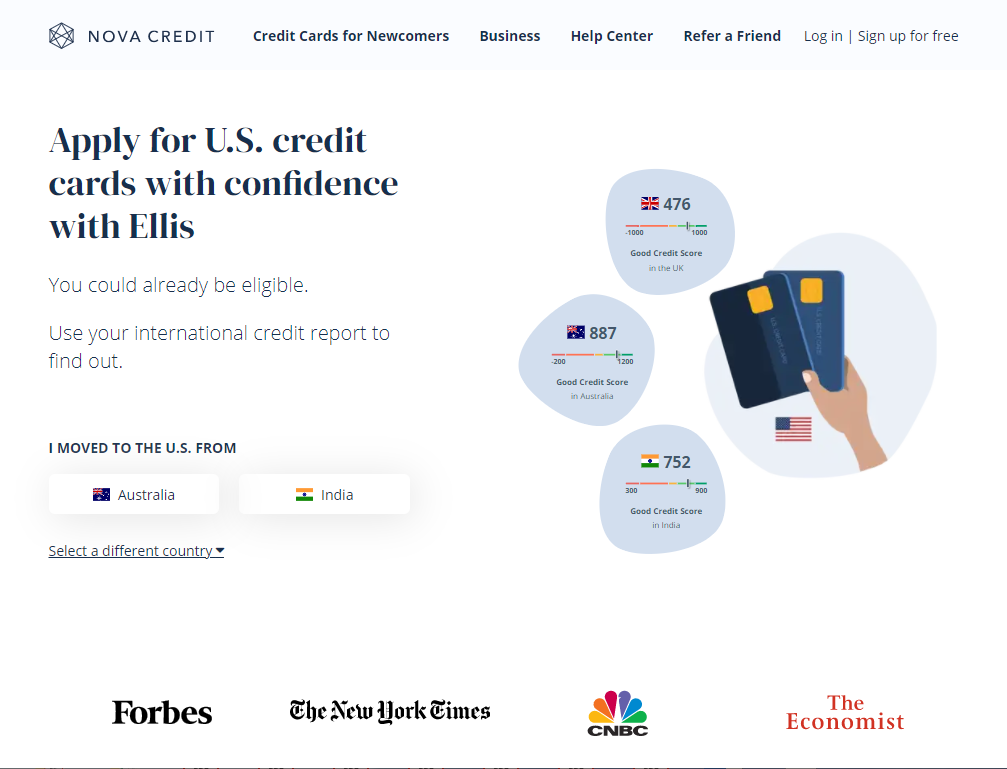

Let’s cut to the chase: Is Nova Credit legit for apartment applications? Absolutely! Think of them as your friendly neighborhood credit report translator, especially if you’re coming to the U.S. from another country, or if your credit history is a bit… shall we say, international?

Now, you might be wondering, "Why would a landlord even need this Nova Credit thingy?" Great question! Landlords, bless their hearts, want to know if you're a responsible human being who pays their bills on time. It's like a job interview, but for your rent-paying prowess. But here’s the kicker: if your credit history is locked away in, I don’t know, a vault in France, or if you’re new to the whole U.S. credit system, your landlord might not be able to see your awesome track record. It’s like having a Michelin star chef’s resume but it’s written in ancient hieroglyphics – nobody can read it!

This is where Nova Credit swoops in like a superhero in a cape made of… well, probably more credit reports. They specialize in taking those international credit histories and translating them into something U.S. landlords and property managers can actually understand. Pretty neat, huh? It’s like Rosetta Stone for your credit score, but instead of learning a new language, you’re learning how to impress your future landlord. Science!

So, how does this magical translation happen? Basically, Nova Credit partners with various credit bureaus from different countries. They can access your credit information from these international sources and then create a U.S.-friendly credit report. This report is designed to give landlords a clear picture of your financial responsibility, even if your credit journey started on a different continent.

Why Landlords Are Using Nova Credit (Spoiler: It’s Not Just For Fun)

Let’s get down to the nitty-gritty. Landlords are busy. Like, really busy. They’ve got leaky faucets to deal with, tenants who want to paint their living room neon green (true story!), and a stack of applications taller than Mount Everest. Anything that makes their job easier and reduces their risk? They’re all over it.

Before Nova Credit, if a landlord had a potential renter with no U.S. credit history, they had a few not-so-great options. They could either:

- Take a gamble: Which, let’s be honest, is not great business.

- Ask for a HUGE security deposit: Which is a bummer for you, and might make you feel like you’re entering witness protection.

- Deny the application outright: Which is super unfair if you’re actually a total rockstar renter!

Nova Credit solves this by providing a standardized, reliable way for landlords to assess renters who might otherwise be overlooked. They’re essentially bridging a gap in the system, making it easier for everyone. Think of it as leveling the playing field. It’s like when your favorite video game introduces a new character that suddenly makes the whole game more balanced and fun. You’re that character!

One of the biggest benefits for landlords is that Nova Credit helps them reduce the risk of rent default. It’s a tough job, but someone’s gotta do it, and landlords are trying to make sure they’re renting to people who will pay their rent on time. Who would have thought? Paying bills on time leads to good credit, which leads to a sweet apartment. It’s a beautiful, interconnected world!

Who Benefits the Most from Nova Credit? (Hint: Probably You!)

Okay, so we know landlords are stoked, but what about us, the renters? This is where it gets really interesting, especially for a few key groups:

The International Rockstars (aka Newcomers to the U.S. or Canada

If you’ve just landed in the U.S. or Canada from abroad, you probably have a stellar credit history back home. But in the eyes of a U.S. landlord, that history might as well be written in invisible ink. Nova Credit is your secret weapon. They can translate that European, Asian, or Australian credit genius into something understandable, proving you’re not just a tourist but a responsible resident-to-be.

Imagine this: you’ve been paying your rent, your utilities, your phone bill like clockwork for years in your home country. You’ve got a reputation for being reliable. But your U.S. credit report? It’s a blank canvas. A really, really blank canvas. Nova Credit paints that canvas for you, showing off all your financial superpowers. It’s like finally getting your driver’s license after years of using public transport – you have the proof you can handle the road!

It’s a game-changer for people who are just starting out and want to establish credit in their new country. Instead of starting from scratch with a mountain of skepticism from landlords, you can leverage the credit history you’ve already built. Major win!

The "My Credit History is a Mystery Novel" Crew

Sometimes, even if you’ve lived in the U.S. for a while, your credit history might be a bit… sparse. Maybe you’re a young professional who’s been focused on saving, or you’ve had periods where you didn’t use credit much. Or perhaps you’ve moved around a lot and your credit history is scattered across different states or old addresses that are harder to track.

Whatever the reason, if your traditional U.S. credit report doesn’t fully reflect your financial stability, Nova Credit can still be a lifesaver. They can sometimes pull in alternative data points or work with bureaus that might have a more comprehensive view, giving you a more complete picture. It’s like finding a lost chapter of your own biography that proves you’re actually a literary genius!

This is especially helpful if you’re looking to rent in a competitive market. Landlords have their pick of applicants, and a more complete credit report can make you stand out from the crowd. It’s the difference between being just another applicant and being the star applicant.

The "I Just Moved Here and Don't Have a SSN Yet" Squad

This is a big one! If you’re new to the U.S. and don’t have a Social Security Number (SSN) yet, getting a traditional credit report can be a nightmare. SSNs are often tied to U.S. credit reporting. Nova Credit can help bridge this gap by using other identifying information to access and translate your international credit data. This is HUGE for those who are still navigating the bureaucratic maze of becoming a U.S. resident.

Think about it: you’ve got the job, you’ve got the funds, you’re ready to settle down, but the SSN is still pending. It can feel like you’re stuck in limbo. Nova Credit offers a way out of that limbo, allowing your existing financial credibility to speak for itself, even without the magic numbers. It’s like having a passport that lets you bypass certain checkpoints. Freedom!

So, Is Nova Credit the Golden Ticket?

While Nova Credit is definitely a legitimate and valuable tool, it's important to set realistic expectations. It’s not a magic wand that instantly grants you any apartment you desire. It’s a translator. The quality of the translation depends on the information available from your international credit history.

Here’s what’s true:

- Nova Credit is a real company that partners with international credit bureaus to provide U.S.-style credit reports. They are not a scam.

- It’s primarily designed for individuals with international credit histories who are applying for housing in the U.S. or Canada.

- Landlords use it to assess risk and make informed decisions about renters who might not have a traditional U.S. credit report.

- It can significantly improve your chances of getting approved for an apartment if you’re an international applicant or have a limited U.S. credit history.

What’s not true (or rather, what’s a misunderstanding) is that Nova Credit guarantees approval. Your landlord still has the final say. They’ll look at your Nova Credit report, your income, your rental history, and other factors before making a decision. Think of it as one very important piece of the puzzle, but not the whole picture.

Also, it’s crucial to understand that Nova Credit charges for their services. So, there will be a fee involved. This is standard for credit reporting services, and it’s worth it if it means landing your dream apartment. It’s an investment in your future cozy nest!

The process typically involves you authorizing Nova Credit to access your international credit data. They then process this data and generate a report that can be shared with the landlord. It’s usually pretty straightforward, and they often have clear instructions on their website.

Tips for Using Nova Credit to Your Advantage

If you’re facing an apartment application that requires Nova Credit, here are a few pointers to make the process smoother:

- Be proactive: Don’t wait until the last minute. If you know a Nova Credit report is needed, start the process as soon as possible. These things can sometimes take a little time.

- Understand the fees: Know what you’re paying for and why. The investment is usually well worth it.

- Communicate with your landlord: If you have questions about the Nova Credit report or the process, don’t hesitate to ask your landlord or property manager. Transparency is key!

- Have supporting documents ready: Even with a Nova Credit report, landlords might still ask for proof of income, pay stubs, or references. Be prepared to provide these. It’s like bringing extra snacks to a party – always a good idea!

- Check your international credit report if possible: If you have access to your credit report from your home country, review it beforehand. This way, you’ll know what information Nova Credit will be seeing, and you can address any discrepancies if they arise.

It’s all about making sure your financial story is told in the clearest, most compelling way possible. Nova Credit is the storyteller, and you’re the protagonist!

The Bottom Line: Nova Credit is Your Friend!

So, to wrap it all up with a big, happy bow: Yes, Nova Credit is a legit and incredibly helpful service for apartment applications, especially for international renters or those with limited U.S. credit history. It’s a legitimate company that bridges a significant gap in the rental market, allowing more people to prove their financial responsibility and secure a place to call home.

Think of it this way: the rental market can sometimes feel like a tough puzzle. You’ve got all the pieces of your financial life, but the landlord can only see some of them. Nova Credit helps you put all the right pieces into place so the landlord can see the full, beautiful picture of your reliability. It’s about making sure your hard-earned financial reputation gets the recognition it deserves, no matter where in the world you started building it.

So, if you see Nova Credit come up in your apartment search, don't panic! Embrace it. It's a sign that the landlord is open to understanding your unique financial journey. It's a step towards making your apartment dreams a reality. Go forth, get that apartment, and start decorating! Your perfect home is waiting, and Nova Credit is just one step on that exciting path. Now go make that place your own and fill it with laughter and good vibes. You’ve earned it!