Is There A Penalty For Withdrawing Money From Acorns Invest? Here’s What’s True

Thinking about dipping into your Acorns savings? You know, those little bits of change you've been squirreling away for a rainy day, or maybe for that fancy new gadget? It’s totally natural to wonder if taking that money out comes with a big, scary penalty. After all, investing can feel a bit like a secret club with its own set of rules, right? Well, get ready for some good news, because diving into your Acorns funds is surprisingly painless.

Here’s the real scoop, no confusing jargon, no hidden clauses. The short answer to "Is there a penalty for withdrawing money from Acorns?" is a resounding no! That's right, you can take your money out whenever you feel like it, without the dread of losing a chunk of it to fees. This is one of the coolest things about Acorns. It’s designed to be super accessible. They want you to feel in control of your money, not trapped by it.

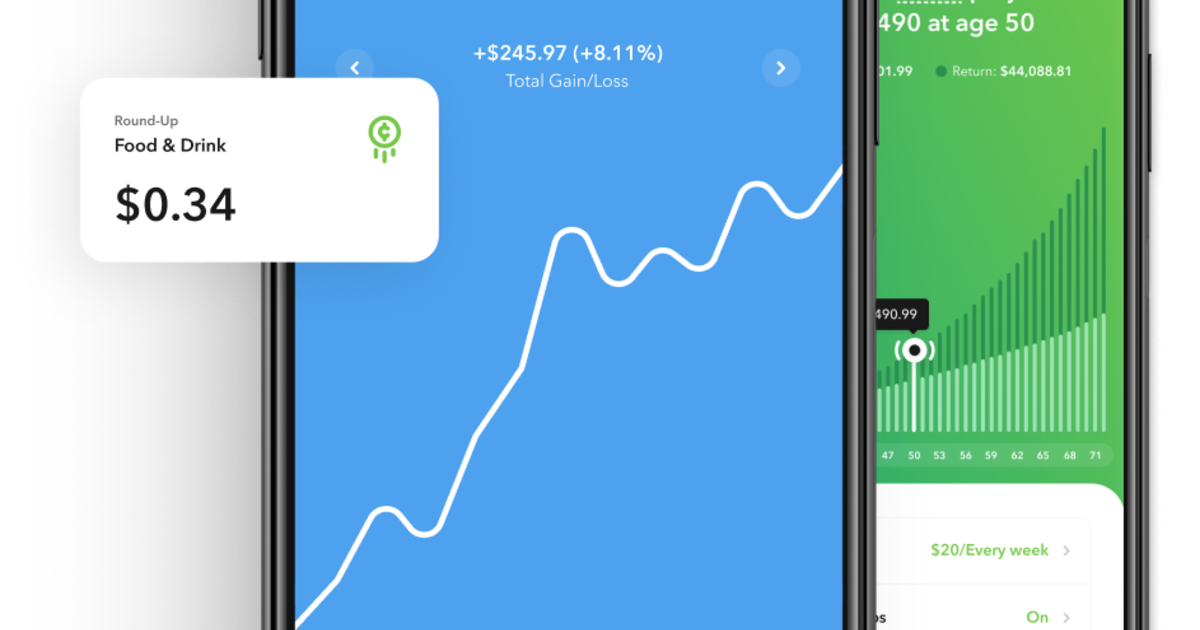

Think of it this way: Acorns is all about making saving and investing easy for everyone. They even round up your purchases and invest the spare change. It’s like magic money growing in the background! So, if you need that money for something important, or even just for a fun treat, Acorns isn't going to slap you with a hefty fee for taking it back.

Now, let's be clear. While there's no penalty in the traditional sense, there are a few tiny things to keep in mind. It’s more about understanding how the process works than avoiding a punishment.

When you decide to withdraw, Acorns will sell a portion of your investments to get you your cash. This selling process takes a little bit of time. They don't instantly teleport your money to your bank account. It usually takes about 3-5 business days for the money to land in your linked bank account. So, if you need cash tomorrow, Acorns might not be the best option for that immediate need. But for planning ahead, it’s perfect!

This 3-5 business day window is standard for most investment platforms. It's because of how the stock market works. When Acorns sells your investments, those trades need to be processed. It’s like ordering something online; it doesn’t appear on your doorstep the second you click “buy.” It takes time for the system to work its magic.

The other thing to consider, and this is a big one, is that if your investments have grown, you'll be taking out that growth too! That's the whole point of investing, right? But if you happen to withdraw when your investments are down, well, you'll be withdrawing less than you put in. Again, this isn't a penalty from Acorns. It's just the nature of the stock market. The market goes up, and the market goes down. Acorns can't control that, and they certainly don't charge you for market fluctuations!

The exciting part of investing is seeing your money grow. When you withdraw, you get all of it – the original amount plus any gains. It’s your money, after all!

So, what makes Acorns so special that they can offer penalty-free withdrawals? It’s their whole philosophy. They're all about making investing approachable. They know that for many people, the idea of investing can be intimidating. Traditional investing accounts often have minimums, complex fees, and a steep learning curve. Acorns removes all of that. They make it as simple as using an app on your phone.

Their clever "round-ups" feature is a game-changer. Imagine buying your morning coffee for $2.75. Acorns rounds that up to $3.00 and invests the extra $0.25. It's so small, you barely notice it, but it adds up over time. And because it's so effortless, you're more likely to stick with it.

This ease of use extends to withdrawals. They want you to feel comfortable accessing your funds. It’s like having a savings account that also happens to be invested in the stock market, but without the scary withdrawal fees you might expect from a brokerage.

Think about the peace of mind this offers. Life happens. Sometimes you need that money for an unexpected car repair, a medical emergency, or even a spontaneous vacation. Knowing you can access your Acorns savings without a penalty means you can use your investments as a flexible tool, not just a long-term lockbox.

The Acorns app itself is designed to be super user-friendly. Navigating through your investments and initiating a withdrawal is straightforward. You select how much you want to withdraw, choose your linked bank account, and that's pretty much it. The app guides you through the process clearly. No hidden menus, no confusing forms.

So, to recap: no direct penalty from Acorns for withdrawing. Just a short waiting period for the funds to clear and the usual ups and downs of the stock market to consider. This flexibility is a huge part of what makes Acorns so popular. It democratizes investing, making it accessible and usable for everyday people. It's an investment platform that trusts you with your money, allowing you to access it when you need it. Pretty cool, right?

If you've been hesitant to start investing because you're worried about getting your money back, Acorns might just be the perfect solution for you. It’s an easy, fun, and flexible way to make your money work for you, and best of all, you can access it when life calls. So go ahead, check out Acorns! You might be surprised at how simple and rewarding it can be.