Kentucky Income Tax Liability Is Not Expected This Year: Complete Guide & Key Details

Alright, folks, let's talk about something that usually makes us groan louder than a teenager being asked to clean their room: taxes. Specifically, Kentucky income tax. But hold onto your hats (and your wallets, for a change!), because this year, we've got some pretty darn good news on that front. Imagine finding a twenty-dollar bill in your old jeans. That's the vibe we're going for here, but for your entire tax year!

Yep, you read that right. For many of us in the Bluegrass State, the usual dread of calculating what we owe the state government might just be replaced with a sigh of relief this year. It's like the universe decided to throw us a bone, a little pat on the back for surviving another year of… well, life. Think of it as getting a refund before you even file, a pre-emptive strike against tax season blues. We're talking about a situation where, thanks to some clever state maneuvering and potentially a bit of good luck, your Kentucky income tax liability might actually be zero this year. Pretty neat, huh?

Now, before you go out and spontaneously buy a pony (though, you know, if you were planning on it, this might be the year!), let's dig into what this actually means and what the key details are. We don't want anyone accidentally spending their "tax money" on something frivolous only to find out they were supposed to pay a little something after all. That would be like celebrating Christmas on December 24th and then realizing it's actually the 25th and you missed the main event. Oops!

So, What's the Big Deal? Kentucky's Got Our Back (This Year, Anyway!)

The short and sweet of it is that Kentucky has seen some impressive revenue collection over the past year. Think of the state's coffers as a giant piggy bank, and this year, that piggy bank got a whole lot heavier. This isn't some magical fairy dust; it's a result of a combination of factors, including a booming economy (at least for some sectors) and possibly some clever fiscal management. It's like when you're trying to save up for a big purchase, and suddenly, you get a few unexpected bonuses. Cha-ching!

Because of this healthy influx of cash, the state has been able to reduce its tax burden on its residents. Specifically, they've implemented some tax rate reductions that are so significant, for a lot of people, it means they won't owe any state income tax. It’s like finding out your favorite coffee shop is having a "buy one, get one free" on all drinks, all year. You start questioning if it's real, but then you realize, nope, it’s just a really good deal.

The main player in this tax break is the reduction in the individual income tax rate. Kentucky has been steadily working on lowering this rate, and this year, it's hitting a sweet spot for many. This is the kind of news that makes you want to do a little jig in your living room, maybe even a slightly embarrassing one you’d only do when no one's watching. You know the one.

Who's Getting This Awesome Tax Break?

Now, the million-dollar question (or rather, the "zero-dollar tax liability" question): who exactly benefits from this? It's not quite a universal "everyone gets a free pony" situation, but it's pretty darn close for a large chunk of Kentuckians. Generally, if your income falls within a certain range and you're not claiming a ton of complex deductions that drastically alter your tax picture, you're likely to see that $0 liability pop up on your return.

Think about it like this: imagine a buffet where they've got a special deal. Most people can go and fill their plates without breaking the bank. But if you're ordering the lobster thermidor and a dozen oysters, well, you might still be paying a bit extra. The analogy here is that most everyday earners will be in the clear. If you're a wage earner, a small business owner with modest profits, or someone living off a comfortable salary, chances are you’re in the sweet spot.

The actual threshold where you might start owing a tiny bit of tax can vary based on a few things, but the general idea is that the lower your taxable income, the more likely you are to owe nothing. It’s like when you’re trying to get a free appetizer with a minimum spend. Most of us will easily hit that minimum, but if you’re ordering a single side salad, maybe not. This year, the "minimum spend" for owing tax seems to have gone up significantly!

Key Details You Can't Ignore (Unless You Want to Be Surprised Later!)

While the news is fantastic, it's always wise to be informed. We're talking about taxes, after all, and "ignorance is bliss" doesn't always translate well when the IRS (or in this case, the Kentucky Department of Revenue) comes knocking, even if it's just to say, "Actually, you owe us nothing!"

The Individual Income Tax Rate Reduction: This is the star of the show. Kentucky’s individual income tax rate has been a hot topic for a while, and it's been steadily declining. This year, it's dropped to a level where, for many, it effectively zeros out their state tax obligation. Think of it as a discount so big, the original price seems like a distant memory.

Taxable Income is Still King: Even with the lower rates, your taxable income is still the magic number. This is what you get after all your deductions and credits. If your taxable income is low enough, even a tiny tax rate will result in zero tax owed. It’s like a puzzle where all the pieces are falling into place perfectly for you.

What About Other Taxes? This good news specifically applies to the Kentucky Individual Income Tax. This means things like sales tax, property tax, and other local taxes are still very much in play. So, while you might be saving on your state income tax return, don’t go out and buy that yacht with your newfound "tax freedom" money unless you've already budgeted for those other expenses. It’s important to differentiate. This is like getting a great deal on plane tickets but still having to pay for your hotel and food at your destination.

When Does This Go Into Effect? This tax year's benefits are generally for income earned during the 2023 tax year, which is what you'll be filing in 2024. So, if you've already filed your 2022 taxes, this is about the income you've earned since then. It’s like getting a coupon for a future purchase – it applies to what you’re buying now.

Filing Still Matters! Even if you expect to owe nothing, you still need to file your Kentucky income tax return. Think of it as a declaration of your tax independence. It’s your official notification to the state, "Nope, not this year, thanks!" Not filing could lead to missing out on future benefits or even penalties if the state eventually determines you did owe something and you didn’t report it. It’s like getting a free pass but still having to show your ticket at the gate.

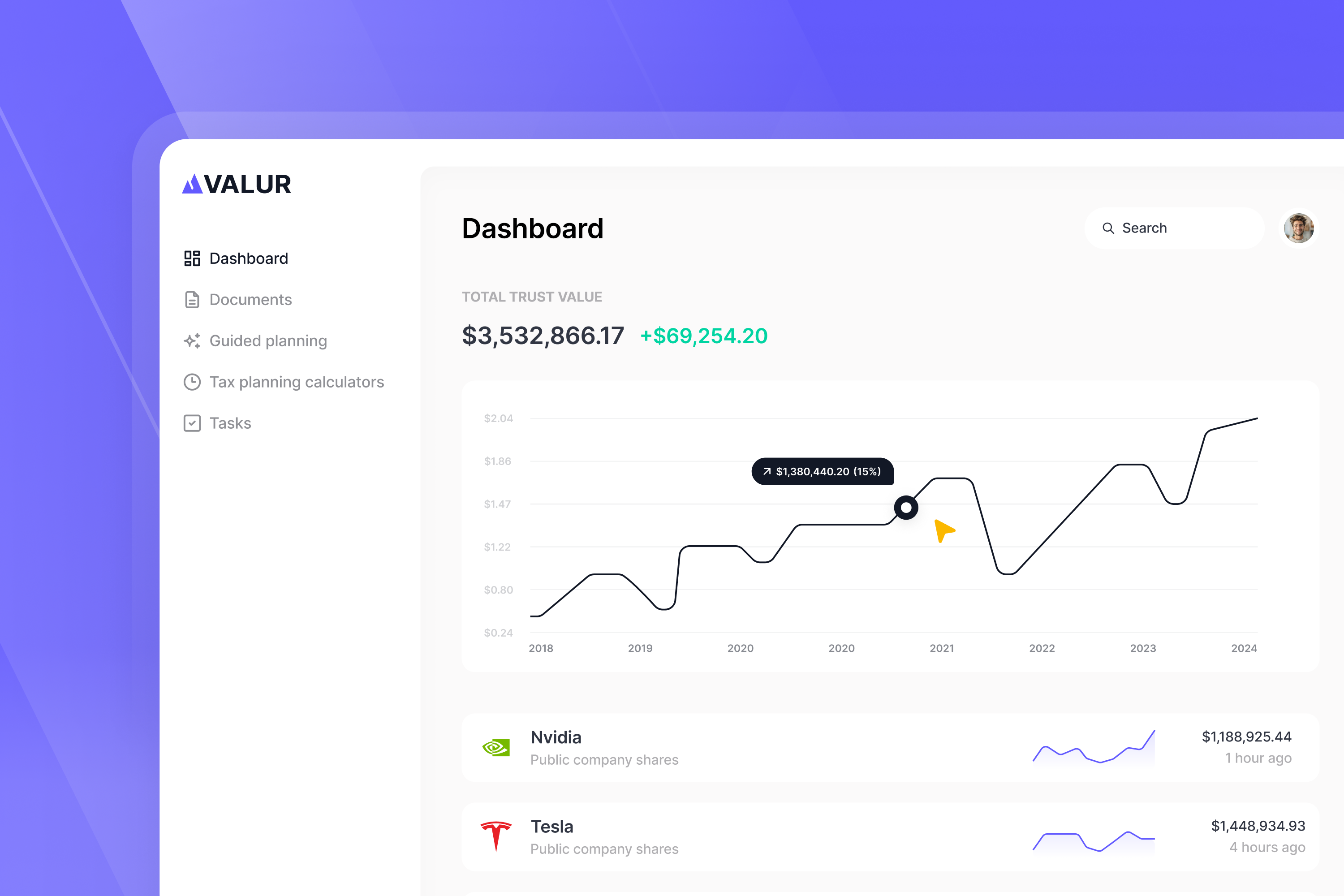

A Step-by-Step (Mostly Relaxed) Guide to Your Kentucky Tax Situation

Okay, let’s break down how you can figure out your own situation without needing a degree in rocket science. We're going for a "walk in the park" vibe here, not a "marathon through a tax code jungle."

Step 1: Gather Your Documents (The Usual Suspects)

This is where you pull out all the usual tax-related papers. W-2s from your employer(s), 1099s for any freelance or contract work, receipts for potential deductions (if you’re itemizing, though many won’t need to this year), and any other income statements. Think of it as collecting all your report cards from the year. You need to see what grades you got in the "earning money" department.

Step 2: Calculate Your Gross Income

This is simply all the money you earned from various sources. Add up your W-2 wages, 1099 income, interest, dividends, etc. This is your starting point. It’s like the total score you got on all your tests combined before any bonus points.

Step 3: Determine Your Deductions (Standard vs. Itemized)

This is where things might get a little more personal. Most people in Kentucky will likely benefit from taking the standard deduction. This is a fixed amount that the state allows you to subtract from your gross income. It’s a simplification that works for the majority. For most Kentuckians this year, the standard deduction is so generous that it’s likely to bring your taxable income down significantly, potentially to zero.

If you have a lot of deductible expenses (like significant medical bills or charitable donations), you could itemize. However, with the current tax structure and the generous standard deduction, for many, itemizing won't be beneficial. It’s like choosing between a pre-set meal that’s delicious and a full à la carte menu where you might end up ordering more than you wanted and paying more.

Step 4: Calculate Your Taxable Income

Subtract your determined deduction (likely the standard deduction) from your gross income. This is your taxable income. If this number is zero or negative, congratulations! You’ve likely hit the jackpot for Kentucky state income tax. It's like reaching the finish line and seeing a big sign that says "You Won!"

Step 5: Apply the Tax Rate (And See the Magic Happen)

If your taxable income is still a positive number, you'll apply the current Kentucky individual income tax rate. But here’s the kicker: this rate is so low now that for many, the calculated tax will be a very small amount, or even zero if your taxable income is below a certain threshold. This is the moment of truth. It’s like the grand finale of a fireworks show – bright and hopefully, a pleasant surprise.

Step 6: File Your Return!

As mentioned before, you must file. Use your preferred tax software, consult a tax professional, or download the forms from the Kentucky Department of Revenue website. The important thing is to submit it. It’s your official report card to the state, letting them know you’ve done your homework.

Anecdotes from the Tax Front Lines (Okay, Maybe Just Our Living Rooms)

I was talking to my neighbor, Brenda, the other day. She’s a retired schoolteacher, and every year, she usually has a small amount of state tax to pay. She was bracing herself for it, muttering about how it always felt like a little chunk of her Social Security was disappearing. But when she plugged her numbers into her tax software this year, she yelped. Not a scared yelp, more like a "holy cow, is this real?" yelp. Turns out, her tax liability was $0. She actually called me, convinced she’d done something wrong. We went through it together, and nope, it was legit. She was so happy, she said she might finally buy that fancy bird feeder she'd been eyeing. See? Small joys!

Then there’s my cousin, Dave. He’s a freelance graphic designer and sometimes his income can be a bit… unpredictable. He’s used to owing a bit here and there. This year, he was dreading doing his taxes because he had a few good months, but he also had some slower ones. When he ran his numbers, he was shocked to see that his state tax obligation was minimal, almost negligible. He said it felt like he’d gotten away with something, but in a good way. He’s now planning a slightly more ambitious fishing trip this summer, all thanks to the state’s tax generosity.

These are just everyday folks, not tax wizards. And for them, this year's tax season is a breath of fresh air. It’s the kind of news that makes you feel a little lighter, a little more hopeful, and definitely ready to tackle whatever the next year throws your way. It's like finding out your car suddenly got a significant boost in its MPG – it doesn't change your destination, but the journey just got a whole lot more affordable and enjoyable.

The Bottom Line: Enjoy the Reprieve!

So, there you have it. Kentucky's individual income tax liability is looking remarkably low for many this year. It's a testament to smart fiscal planning and a growing economy. This isn't a time to get complacent, but it is a time to celebrate the win.

Take advantage of this. If you were expecting to owe money, use that money for something that brings you joy – a home improvement project, a vacation, or even just a really good steak dinner. It's a rare treat, and it’s important to acknowledge it. It’s like getting a surprise day off work – you don’t question it, you just enjoy it!

Remember to file your return, even if you owe nothing. Be informed, stay on top of your finances, and enjoy this little bit of breathing room. Kentucky is giving us a break, and that’s something worth smiling about. Now go forth and have a tax season that’s less about stress and more about a happy sigh of relief. You’ve earned it!