Legal & General Group Plc Analyst Price Target Disagreement: Price/cost Details & What To Expect

Imagine a bunch of super-smart folks, the analysts, staring intently at a company called Legal & General Group Plc. They're like financial detectives, trying to figure out its future. But here's the funny part: they can't quite agree on how valuable it is right now!

It’s like a bunch of friends trying to guess how many jellybeans are in a giant jar. Some say, "Oh, it's got to be at least 500!" while others are convinced it's closer to 1,000. This little disagreement among the analysts about Legal & General Group Plc is causing a bit of a buzz. They're all looking at the same company, but seeing slightly different futures, which is kind of like them having superpowers but using them on slightly different dimensions!

So, what’s the big deal? Well, these analysts, armed with their calculators and spreadsheets that probably hum with mysterious financial energy, put a "price target" on stocks. Think of it as a suggested price tag for a share of Legal & General Group Plc. But when they can't agree, you get a whole range of these suggested price tags. It’s like a buffet of opinions, and everyone’s grabbing different plates!

Let's dive into the nitty-gritty, but don't worry, we'll keep it as simple as making toast. The main ingredient in this analyst debate is often about how much the company is worth today versus how much it could be worth tomorrow. They look at things like how much money Legal & General Group Plc is making right now – that's the "cost" part, in a way, or rather, the current value. They also try to predict its future earnings, which is where the "price" target comes in, the dream of where it's heading.

Some analysts are like seasoned gardeners who see a tiny seedling and already envision a magnificent tree laden with financial fruit. They're probably saying, "Look at the potential! The future is so bright, we need sunglasses for our portfolios!" They might set a really high price target for Legal & General Group Plc, believing it's undervalued, like finding a diamond in your backyard. They're seeing all the sunshine and rain that will make it grow!

On the flip side, you have the more cautious observers, like folks who double-check the weather forecast before planning a picnic. They might be a bit more grounded, looking at the current conditions and potential hurdles. These analysts might have a lower price target for Legal & General Group Plc, feeling that some of the future potential is already baked into the current stock price.

It’s like trying to buy a vintage comic book. One collector might say it's a steal at $100 because they know its rarity and potential to increase in value. Another collector, perhaps more focused on immediate gratification, might think $100 is too much and would only pay $75. Both are looking at the same comic, but their valuation methods and expectations differ. That’s the magic (and sometimes the madness!) of financial analysis.

So, what are these analysts actually looking at when they argue about Legal & General Group Plc? They pore over things like the company's earnings per share (how much profit each share makes), its dividends (the goodies they share with shareholders), and its overall financial health. It’s like they’re dissecting a delicious cake, each ingredient representing a different aspect of the company's performance and future prospects.

The "price" in their price target is the actual number they predict the stock will trade at. The "cost" details they consider are all the underlying factors – the current profits, the assets the company owns, and the way it’s managed. Think of it as the ingredients and the baking process for that cake. Are the ingredients top-notch? Is the oven set to the right temperature? These are the questions they're asking.

This disagreement is actually quite healthy for the market! It means that many different perspectives are being considered. If everyone agreed, it would be a bit like a monotonous song. A little bit of discord makes things interesting and can help investors make more informed decisions, like choosing the best song from a playlist.

When you see a range of price targets for Legal & General Group Plc, it's not a sign of doom and gloom. It's a sign that the market is actively discussing and valuing the company. It's like a lively debate in a town hall meeting – everyone has a voice, and the best ideas (and stock prices!) hopefully emerge from the discussion.

What should you expect when you see these differing price targets? Well, for starters, don't panic! It's the nature of the beast. It's like looking at two weather reports that give slightly different predictions for the weekend. One might say sunny, another partly cloudy. You still know it’s probably going to be decent weather for a barbeque.

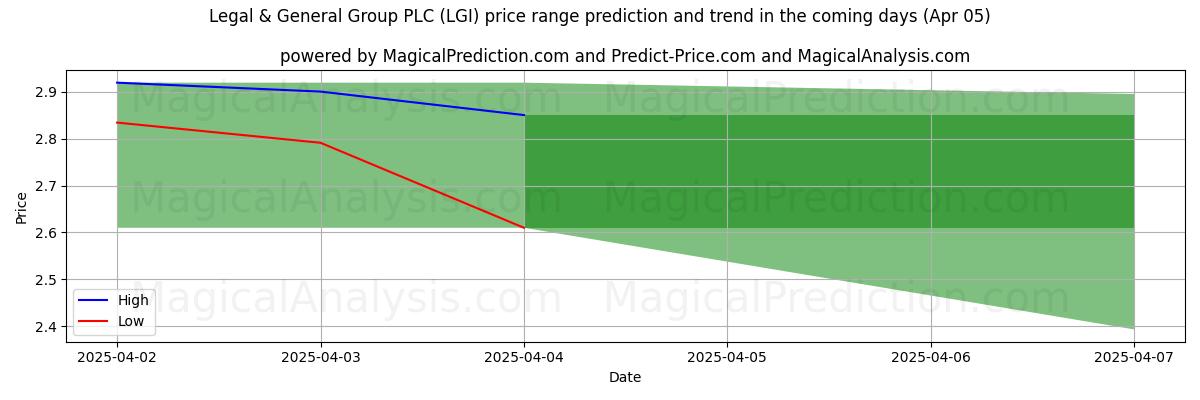

For Legal & General Group Plc, this disagreement among analysts means there's a spectrum of potential outcomes. Some investors might lean towards the higher targets, feeling optimistic and ready to ride the wave of potential growth. Others might be more cautious, preferring to wait and see or perhaps focusing on the current "cost" or value of the company's existing operations.

It also means that the actual stock price can fluctuate. If more analysts start revising their targets upwards, it can put upward pressure on the stock. Conversely, if negative news emerges and analysts start lowering their expectations, the stock price might dip. It's a dynamic dance between expectations and reality, and Legal & General Group Plc is right in the middle of the ballroom!

Think of it like this: if a popular restaurant has a few different reviews, some raving and some saying it's just okay, what do you do? You might check out their menu, see what their specialties are, and then decide if it's worth a try. Similarly, with Legal & General Group Plc, you can look at the range of price targets and then do your own digging into the company's fundamentals.

This whole analyst price target game is a bit like a sporting event. There are different teams (the analysts), each with their own strategy and predictions. The "price target" is the final score they're hoping for. The "cost" details are the players' performance, the team's training, and the game conditions. And the stock price itself is the actual score as the game unfolds.

So, the next time you see that Legal & General Group Plc is a hot topic with differing price targets, don't be intimidated! It's simply a sign of a company being thoroughly scrutinized by a variety of sharp minds. It's a sign of life, of debate, and of the ever-fascinating world of finance unfolding before our eyes.

Ultimately, these price targets are just educated guesses. They are fantastic starting points for your own research, like a treasure map that might lead you to a hidden gem. The real adventure is in understanding why these analysts have their opinions. It's about the story they're telling about Legal & General Group Plc's journey ahead.

So, embrace the disagreement! It's what keeps things interesting and helps us all learn. The analysts might be debating the exact value, but their collective efforts shine a spotlight on Legal & General Group Plc, giving us all a chance to understand it better. It's a win-win for curious minds!