Many Direct Deposits Are Processed Through Which Of The Following: Requirements, Steps & Tips

Imagine this: it’s Friday, and you’re practically humming with anticipation. That feeling when you check your bank account, and poof! Your hard-earned cash is just… there. It’s like a little bit of magic happening in your digital wallet, and most of the time, we just accept it. But have you ever stopped to wonder where all that direct deposit goodness actually comes from? It’s not Santa Claus delivering paychecks, though sometimes it feels that way!

The unsung heroes behind this everyday miracle are the folks who make sure your money lands precisely where it should. Think of them as the super-efficient postal workers of the financial world, but instead of letters, they’re zipping around electronic blips of cash. And the main network that makes this happen is a fascinating, behind-the-scenes operation that keeps our economy humming. It’s a complex dance, but thankfully, it’s pretty much invisible to us, which is part of its charm.

The Mighty Network That Makes It All Happen

So, what’s the secret sauce? When your employer says "direct deposit," they’re not just waving a magic wand. They’re sending your payroll information through a sophisticated system. The overwhelming majority of these direct deposits, the ones that fill your bank account with cheerful green, are processed through the Automated Clearing House network, or ACH for short.

Think of ACH as the superhighway for electronic payments in the United States. It’s not a single company, but rather a network of banks and financial institutions working together. This is where the magic of moving money from your employer’s bank to your bank happens seamlessly and (usually) without a hitch. It’s pretty amazing when you consider how many billions of dollars zip around this network every single day.

How Your Money Embarks on its ACH Adventure

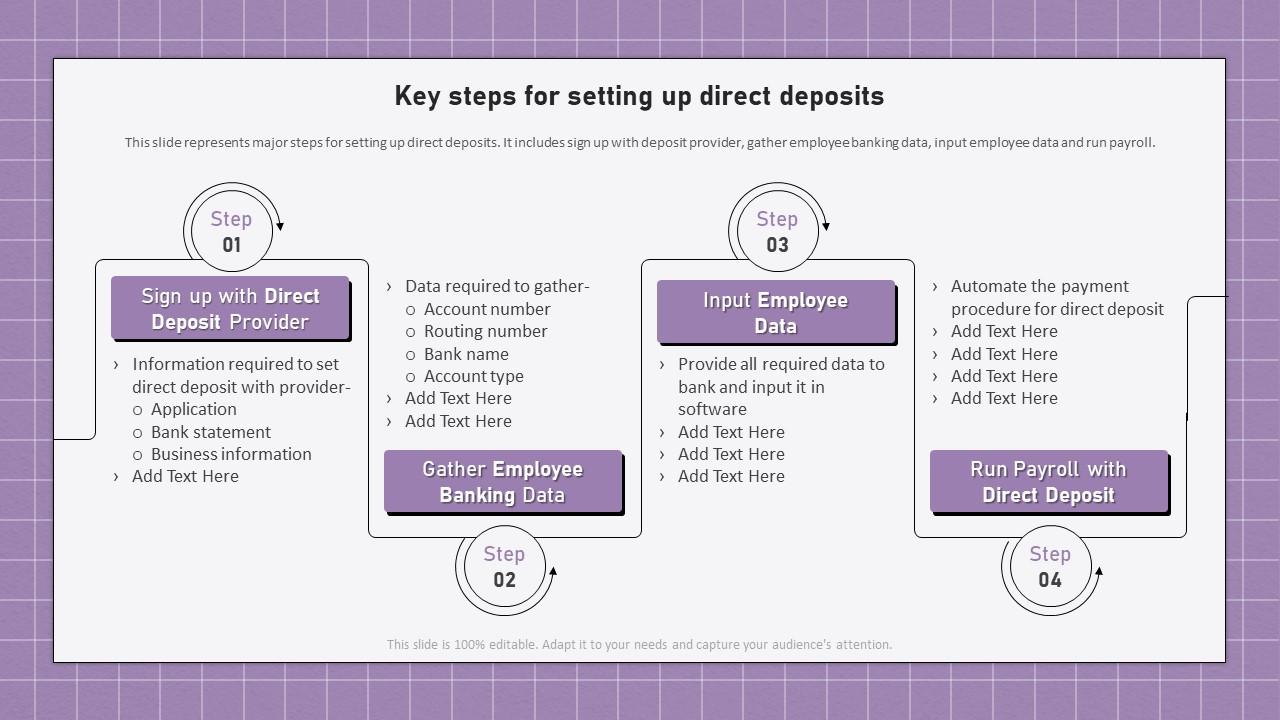

So, how does your paycheck go from your boss’s bank account to your eagerly awaiting digital one? It’s a journey, and while it sounds technical, it’s actually quite logical. Let’s break down the steps without getting lost in the financial jargon!

First, your employer’s payroll department gathers all the necessary information for your direct deposit. This includes your bank’s routing number (that nine-digit code that tells money where to go) and your account number. They also include the amount you’re supposed to be paid. It’s like filling out a very important, very secure form.

Next, this information is sent to your employer’s bank. This bank then bundles up all the direct deposit requests for that pay period. Think of it as a big digital sack of money requests, all ready to be sent on their way. This bundling process is what helps make the ACH network so efficient.

Then, this bundle of payments heads over to the ACH network. This is where the real inter-bank communication happens. The ACH network acts as a central hub, sort of like a giant switchboard, directing the funds to the correct destination banks.

Your bank receives the ACH transaction instructions. They then credit your account with the deposited amount. And voilà! Your money is there, ready for you to use. It all happens surprisingly quickly, usually within one business day.

It’s a testament to the power of collaboration between financial institutions, ensuring that your hard-earned cash arrives safely and soundly, allowing you to finally buy that latte you’ve been dreaming of.

What You (Sort Of) Need to Make it Happen

While you don’t need to be a financial wizard to get a direct deposit, there are a few key pieces of information that are essential. It’s like needing your address for the mailman to find you!

The most important things are your bank’s routing number and your bank account number. These are the critical identifiers that tell the ACH network precisely where to send your money. Your employer will definitely need these.

You can usually find these numbers on your physical checks if you have them. If not, your bank’s website or your mobile banking app will have them readily available. Some banks even have a specific section for direct deposit information. It’s all about making it as easy as possible for you.

Your employer will also need your full legal name, as it appears on your bank account. This is an extra layer of security to ensure the money goes to the right person. It’s like making sure the birthday card is addressed to the correct recipient.

Sometimes, there might be additional requirements depending on your employer or their payroll system. But generally, those two numbers and your name are the core requirements. It’s surprisingly simple once you know what to look for!

Tips to Make Your Direct Deposit Experience Even Smoother

Now that you know the basics, let’s talk about making sure your direct deposit experience is as smooth as silk. A few little tricks can make a big difference!

Double-check your information before submitting it to your employer. A single typo in your routing number or account number can cause delays or even send your money to the wrong place. Imagine the panic! It’s like proofreading an important email before hitting send.

Ask your employer about their payroll schedule. Knowing when they submit direct deposit requests can help you anticipate when your money will arrive. This way, you can plan your spending accordingly and avoid any “where’s my money?” moments.

Consider setting up direct deposit for all your income. This includes paychecks, government benefits, and even freelance payments. Consolidating your income into one or two accounts makes budgeting a breeze and ensures you always know where your money is.

Keep an eye on your bank statements. While direct deposits are generally very reliable, it never hurts to verify that your deposit has been made and that the amount is correct. It’s a good habit for anyone managing their finances.

This simple habit can help you catch any errors quickly and give you peace of mind knowing your finances are in order. Plus, it’s a great way to celebrate each successful deposit!

Explore direct deposit options for other services. Many companies now offer direct deposit for things like tax refunds or insurance payouts. This can save you time and hassle compared to waiting for a paper check.

Understand your pay stub. Your pay stub usually details your gross pay, deductions, and the net amount that will be directly deposited. Familiarizing yourself with it helps you understand where your money is going and can help you spot any discrepancies.

Talk to your bank if you have questions. Your bank is your partner in managing your money. If you’re unsure about your routing number, account number, or any other direct deposit-related matter, don’t hesitate to reach out. They’re there to help!

The Heartwarming Side of Electronic Cash

Beyond the efficiency and convenience, there’s a surprisingly heartwarming aspect to direct deposits. It’s about the consistent reliability that allows people to plan their lives. It’s the guarantee that the rent will be paid, the groceries will be bought, and maybe, just maybe, there will be a little extra for that treat.

For many, especially those on fixed incomes or living paycheck to paycheck, direct deposit provides a crucial sense of security. It’s the knowledge that their money will arrive on time, every time, allowing them to manage their household budgets with more predictability. This stability can be a huge relief and a source of immense comfort.

It’s also about the small joys. That direct deposit hitting your account might mean you can finally afford that new pair of shoes, take your family out for a nice dinner, or simply have the peace of mind knowing you have enough to cover unexpected expenses. These are the moments that direct deposit enables.

Think about the small businesses and freelance workers who rely on timely payments. The ACH network ensures they can keep their operations running smoothly, pay their own bills, and continue to provide their services. It’s a chain reaction of financial well-being, all thanks to this invisible infrastructure.

So, the next time your paycheck magically appears in your account, take a moment to appreciate the incredible, often unseen, effort that goes into it. It’s more than just money; it’s the facilitator of dreams, big and small.

The ACH network is a marvel of modern finance, a testament to what can be achieved when institutions work together. It’s the silent engine that powers so much of our daily financial lives, ensuring that the fruits of our labor are readily available when and where we need them. It’s a system built on trust, accuracy, and a whole lot of electronic coordination, all designed to make our lives just a little bit easier and a whole lot more secure.