Mcdonald's Earnings Release Q1 2018 Provision For Income Taxes: Complete Guide & Key Details

Alright, gather 'round, you magnificent humans, you connoisseurs of the golden arches and masters of the McFlurry! Let's talk about something that sounds drier than a week-old McNugget but is actually, dare I say it, fascinating in its own quirky way: McDonald's Q1 2018 earnings, and more specifically, their rather spicy

So, picture this: it’s Q1 2018. The world is still trying to figure out what a fidget spinner is, and I'm pretty sure I was still wearing JNCOs (don't judge). McDonald's, meanwhile, was busy counting their pennies. And let me tell you, they were counting a lot of pennies. These folks are basically financial wizards, conjuring up billions faster than you can say "I'm lovin' it."

The Big Number That Might Make Your Eyebrows Do a Backflip

Now, the headline numbers for McDonald's Q1 2018 were looking pretty good. Sales were up, people were apparently craving more Big Macs than usual (shocking, I know), and the stock was doing a happy dance. But then, deep in the financial jargon jungle, lurks this thing called the

The provision for income taxes for McDonald's in Q1 2018 was a whopping

Why So Much Dough for Uncle Sam (or Whoever Collects the Dough)?

So, why such a hefty sum? Was McDonald's suddenly deciding to personally fund the space program? Did they accidentally buy a small moon and forget to declare it? Nope. The primary reason for this significant tax provision boils down to a few key factors, and this is where it gets a little… interesting.

First off, there was a rather significant gain on the sale of some of their company-owned restaurants. Think of it like this: McDonald's decided to sell off a few of their prime locations, kind of like trading in an old car for a brand-new, souped-up McTruck. When you sell something for more than you bought it for, well, you have to share some of that good fortune with the taxman. And when you're selling a lot of really valuable real estate, that "sharing" can be quite substantial.

This gain from the sale of assets was a major contributor to that sky-high tax bill. It wasn't just a little bit of extra pocket change; it was a serious financial windfall that came with an equally serious tax consequence. Imagine finding a buried treasure chest filled with gold coins. It's awesome! But then you remember you have to report that treasure to the authorities. Same principle, but with more quarterly reports and less swashbuckling.

The Nuances of Corporate Tax: It’s Not as Simple as Paying Your Electric Bill

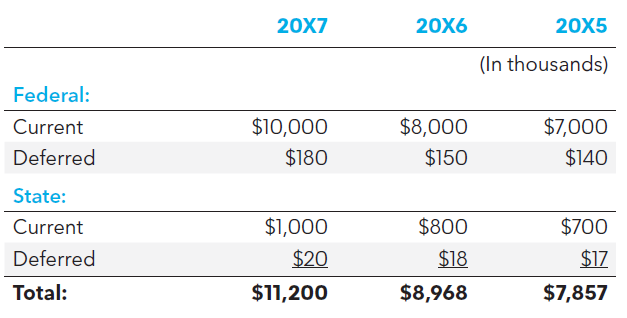

Now, the

For McDonald's in Q1 2018, several factors influenced their tax provision. Beyond the asset sales, there were also adjustments related to prior periods. Sometimes, the taxman looks back and says, "Hey, remember that thing from three years ago? We need to talk about that." It's like finding an old unpaid parking ticket from a different state. Annoying, but you gotta deal with it.

There was also a notable impact from changes in certain tax laws and regulations. Governments are always fiddling with tax codes, like kids playing with building blocks, and sometimes those changes can have a surprisingly big effect on a global corporation's bottom line. Think of it as a surprise tax audit by the International Tax Bureau of Whimsy and Wonder.

![[Solved] Reporting the Provision for Income Taxes. | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/02/65d397518ba04_1708365647477.jpg)

The "Effective" Part of the Tax Rate: It’s All About the Average

Let's talk about that elusive

It’s important to remember that this provision isn't necessarily the exact amount of cash they wrote a check for on that specific day. It's an accounting estimate, a projection of their tax liability based on various factors. Think of it as your doctor telling you your cholesterol is a little high – it’s a warning sign and an estimate of what needs to be addressed, not necessarily an immediate emergency surgery.

So, What Does This Mean for Your Next Burger Run?

Now, you might be wondering, "Why am I spending my precious time learning about McDonald's tax bill from 2018?" And that’s a fair question! The answer is, frankly, because it’s a little bit hilarious and surprisingly informative.

Firstly, it highlights the sheer scale of McDonald's operations. The fact that their tax provision alone is nearly a billion dollars is mind-boggling. It’s a testament to their global reach and their ability to generate enormous profits. Every time you hear someone complaining about the price of a McChicken, remember that a significant chunk of that revenue is being accounted for in ways that make our own tax returns look like a crayon drawing.

Secondly, it reminds us that corporate finance is a complex game. The decisions made in boardrooms and through financial statements have real-world consequences, even if they’re hidden behind reams of numbers. Those asset sales? They likely paved the way for future investments, remodeling of restaurants, or maybe even the development of a new, potentially life-altering ice cream flavor.

And finally, it’s a good story. The story of McDonald's Q1 2018 earnings and their substantial