Mortgage Rates Are Expected To Rise Again In Coming Days.: Complete Guide & Key Details

Hey there, home-buying dreamers and seasoned homeowners alike! Ever get that little tingle of curiosity when you hear whispers about mortgage rates doing their thing? Well, buckle up, because it seems like those whispers are turning into a bit of a hum – mortgage rates are expected to rise again in the coming days. Yep, you heard that right. But before you start picturing yourselves in a tiny hobbit hole, let's take a chill pill and explore what this actually means. Think of it less as a scary monster under the bed and more like a slightly more challenging level in your favorite video game.

So, what's the scoop? Why are these rates feeling a bit restless? It’s kind of like when the price of your favorite coffee goes up a dime. Usually, there's a reason, right? For mortgages, it’s a mix of things, but a big player is often what the Federal Reserve is up to. They're like the conductors of the economic orchestra, and when they tap their baton a certain way, interest rates tend to follow suit.

The "Why" Behind the Wobble: A Peek Under the Hood

Let's break it down without getting too bogged down in jargon. Imagine the economy is a busy marketplace. When things are booming and lots of people are spending, prices can start to creep up. That's called inflation, and it's a bit like the marketplace getting a little too crowded with buyers, making everything a tad more expensive. To cool things down, the people in charge (like the Fed) might nudge interest rates higher. Why? Because making borrowing money a little more expensive can slow down spending, which in turn helps to keep those prices from running away.

Think of it like this: if it costs more to borrow money for that fancy new car you've been eyeing, you might hold off for a bit, right? That’s exactly the kind of effect higher mortgage rates can have on the housing market. It's all about trying to find that sweet spot – an economy that’s growing but not overheating like a forgotten pot of soup on the stove.

And it's not just the Fed. Other things like global events, how much money is available to lend, and even how confident people are about the future can all play a part. It’s a complex dance, and the music is always changing!

So, What Does This Mean for You?

Alright, let's get to the nitty-gritty. If you're currently in the market to buy a home, or even thinking about refinancing, this is where your attention really needs to be. When mortgage rates go up, your monthly mortgage payment naturally becomes higher. It’s like the difference between buying a single scoop of ice cream versus a double scoop – the double costs you more, but you get more! In this case, you're getting the same house, but the "cost" of financing it goes up.

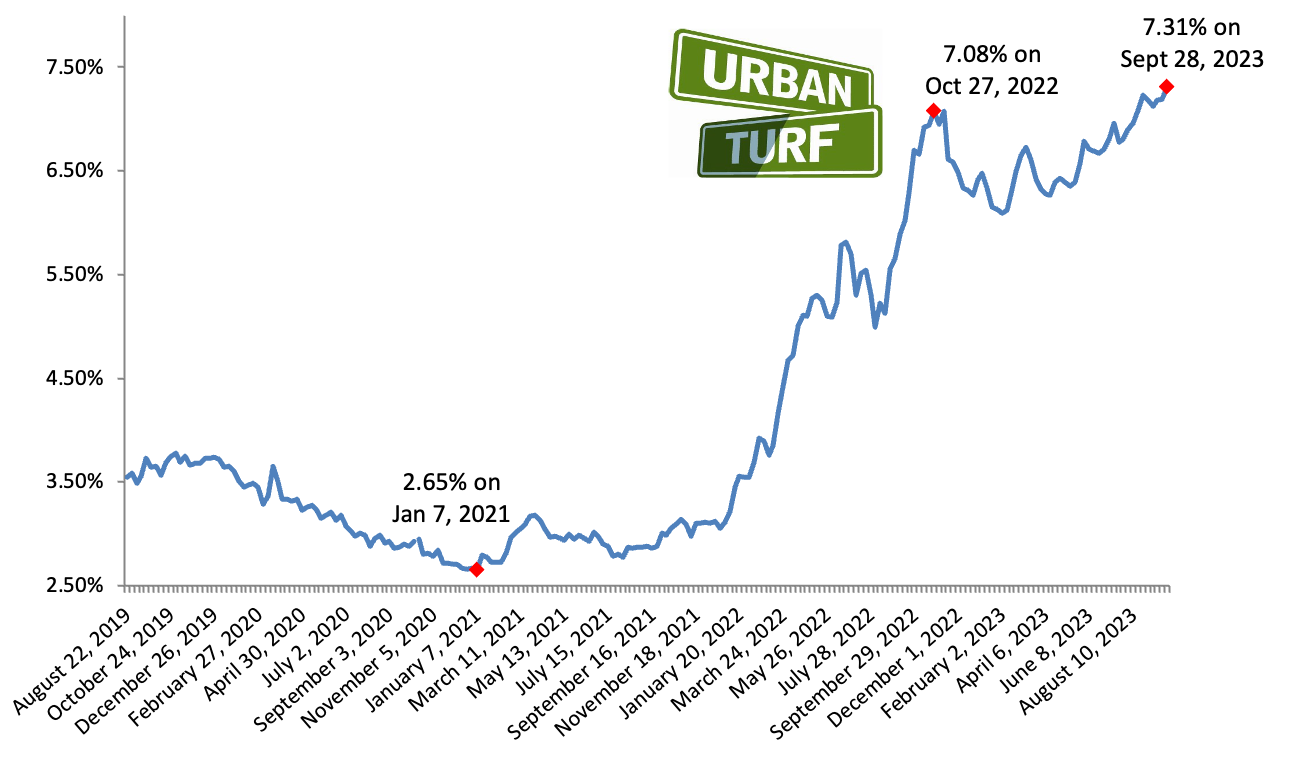

Let’s do some quick (and super simplified) math. If you were looking at a $300,000 mortgage and the rate jumped from, say, 6% to 7%, that could mean an extra hundreds of dollars out of your pocket each month. Ouch, right? It's enough to make you re-evaluate your budget, maybe swap out that daily gourmet coffee for a home-brewed one, or perhaps reconsider that second vacation home you were dreaming of. It’s a significant chunk of change, and for many people, it's the difference between affording a home or not.

But hey, don't despair! This is where understanding the details comes in handy. It's like knowing the cheat codes for your favorite game. If you’re a first-time buyer, this might mean adjusting your expectations a little. Perhaps you'll need to look at homes in a slightly different price range, or maybe you’ll have to put your dream mansion on hold for a bit and focus on a more modest starter home. It’s all about finding what works for your financial reality.

The "Complete Guide" Bits: What to Keep in Mind

So, you’re curious and you want to be prepared. That’s the spirit! Here’s your quick-and-dirty guide to navigating these rising rates:

For Prospective Homebuyers:

Get Pre-Approved, Pronto! If you're serious about buying, get that pre-approval letter from your lender as soon as possible. This locks in a rate for a certain period, giving you a bit of a safety net before rates climb even higher. Think of it as getting your boarding pass before the flight prices skyrocket.

Shop Around Like a Pro. Don’t just go with the first lender you talk to. Rates can vary between lenders, even for the same loan amount. It’s like comparing prices at different grocery stores for the same loaf of bread. You might be surprised by the savings!

Understand the Total Cost. Remember, it’s not just the mortgage rate. There are closing costs, property taxes, insurance, and potential HOA fees. Get a full picture of all the expenses involved in homeownership. It’s the whole enchilada, not just the spicy pepper!

Be Realistic with Your Budget. With higher rates, your buying power might decrease. Be honest with yourself about what you can comfortably afford each month, not just what a lender says you can afford. Your peace of mind is worth more than a bigger house.

For Current Homeowners:

Refinancing Might Be Less Appealing. If you recently refinanced at a lower rate, pat yourself on the back! For those who haven't, refinancing to get a lower rate might not be as attractive right now if current rates are higher than what you already have. It’s like trying to sell your perfectly good umbrella during a drought – not very useful!

Consider Your Existing Mortgage. If you have a fixed-rate mortgage, these upcoming rate hikes won't affect your monthly payments. Phew! You’re locked in at your current rate, which is pretty sweet. It’s like having a cozy blanket that stays the same temperature even when the weather outside gets wild.

Adjustable-Rate Mortgages (ARMs) Need Attention. If you have an ARM, your interest rate will adjust periodically based on market conditions. This means your payments could go up as rates rise. Keep a close eye on your ARM’s terms and consider if refinancing to a fixed rate makes sense before rates climb too much higher. It’s like keeping an eye on your car’s gas gauge – you need to know when it’s getting low.

The Bigger Picture: Is This the End of the World?

Absolutely not! Economic cycles are a thing, and interest rates ebb and flow like the tides. While it might feel a bit unsettling, these adjustments are a normal part of how the economy works. For some, it might mean a temporary pause in their home-buying plans, while for others, it might be a signal to act faster before rates jump even more.

Think of it as a shift in the game. You might need to adjust your strategy, re-evaluate your goals, and make smarter moves. The key is to stay informed, be proactive, and make decisions that align with your personal financial situation. So, take a deep breath, do your homework, and remember that even in a changing landscape, your dreams of homeownership or financial stability are still achievable. It just might require a slightly different path!