National Debt Relief Better Business Bureau Reviews: What To Expect (pros & Cons)

Ever feel like your finances are doing the cha-cha, and not in a good way? You're not alone! Lots of us have dealt with debt that feels like a runaway train. So, when you hear about companies like National Debt Relief, it’s natural to wonder if they’re the superhero you need.

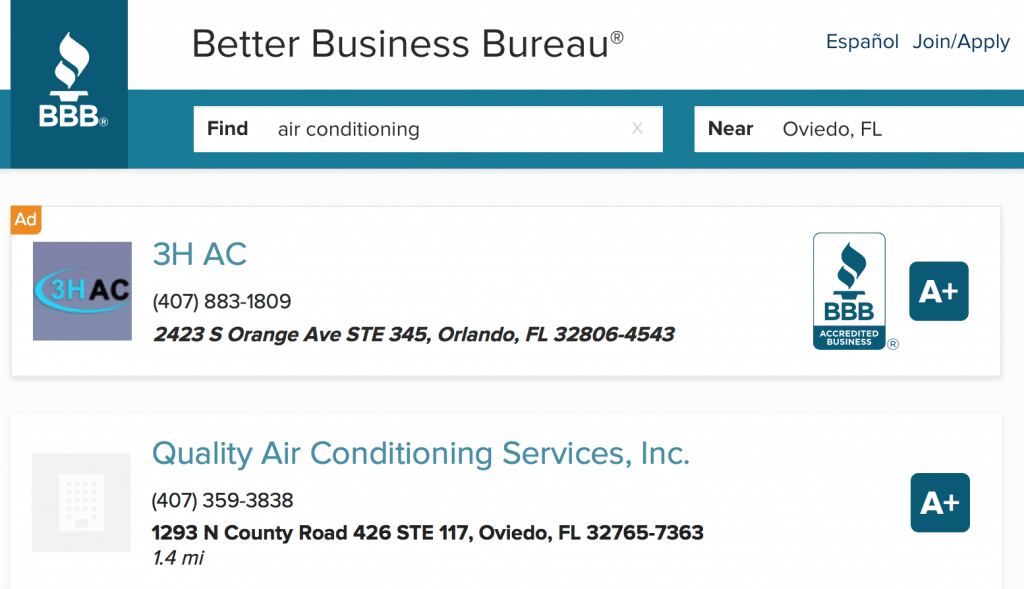

But before you sign on the dotted line, it’s smart to do your homework. And where’s one of the best places to peek behind the curtain? Yep, you guessed it: the Better Business Bureau (BBB). Think of the BBB as your friendly neighborhood fact-checker for businesses.

Today, we’re going to spill the tea on what people are saying about National Debt Relief over at the BBB. We'll dish out the good stuff and the not-so-good stuff, so you can make a well-informed decision. It’s like getting the inside scoop before you commit!

The Buzz from the BBB: What’s the Deal?

So, what's the overall vibe when you look up National Debt Relief on the BBB? Well, it’s usually a mixed bag, which is pretty standard for most companies. No one’s perfect, right? But seeing those reviews can tell you a lot.

Generally, National Debt Relief tends to have a pretty good reputation. They often get praised for their customer service and their efforts to help people get out of debt. It’s nice to see a company making a real difference, isn't it?

The BBB is where real people share their experiences. Some folks have stories that sound like a fairytale ending to their debt struggles. Others, well, their stories might have a few plot twists.

The Sunny Side: What Makes People Cheer

Let's start with the good stuff, because who doesn't love a happy story? Many customers of National Debt Relief talk about how supportive the staff was. It’s like having a helpful guide through a confusing maze.

One of the biggest wins people mention is the feeling of hope. When you're drowning in debt, it’s easy to feel hopeless. Companies like National Debt Relief can offer a lifeline and a clear path forward.

Customers often feel a sense of relief because the company helped them negotiate lower interest rates or even reduce the total amount they owed. Imagine that! Less money owed sounds pretty amazing, doesn't it?

"They were so understanding. I felt like I could actually breathe again after talking to them." - A happy customer on the BBB.

Another pro is how National Debt Relief breaks down the process. They make it seem less daunting. They explain things clearly, so you don’t feel like you’re lost in a financial fog.

People also appreciate when a company is upfront about fees and what to expect. Transparency is key, and many reviews suggest National Debt Relief does a decent job here. No hidden surprises – that’s always a win!

The goal is usually to consolidate your debt into one monthly payment. This can make managing your money so much simpler. Instead of juggling multiple bills, you have just one to worry about.

Think of it like this: you’re tired of juggling too many balls. National Debt Relief helps you put most of them down and focus on one, making it easier to catch. It’s about simplifying your life when it feels anything but simple.

Many customers also feel that the company’s dedication to helping them achieve financial freedom is genuine. They’re not just selling a service; they’re trying to help you build a better future. That kind of commitment is hard to find.

The sense of accomplishment and pride that comes from getting debt-free is huge. And knowing that a company helped you get there makes the victory even sweeter. It's a journey, and they're there to walk with you.

The Not-So-Sunny Side: What Gives People Pause

Now, let’s talk about the other side of the coin. No company gets perfect scores, and it's important to be aware of potential downsides. Sometimes, things don’t go as smoothly as planned.

Some customers have reported issues with communication. Maybe they didn't get returned calls, or they felt like they weren't kept in the loop. That can be frustrating when you're already stressed about money.

There have also been comments about the fees associated with debt relief programs. While these companies do provide a valuable service, there are costs involved. It's crucial to understand exactly what you're paying for.

"I wish I had understood the fees more clearly upfront. It was a bit of a surprise." - A BBB reviewer.

Another point some people raise is the time it takes to see results. Debt relief is not an overnight fix. It’s a process that requires patience and consistency.

Some reviews mention that their credit score took a dip during the debt relief process. This can happen because the company might advise you to stop making payments to your creditors while they negotiate. It’s a trade-off that needs careful consideration.

It’s also worth noting that not everyone’s situation is a perfect fit for debt relief. Sometimes, your debt might be too small, or your income might be too high. These companies have specific criteria they work with.

There can be a learning curve for the customer too. You need to be disciplined with your spending habits to avoid falling back into debt. The company can help, but you have to do your part.

Some reviews might express disappointment if the promised outcome wasn't fully achieved, or if the negotiations with creditors didn't go as hoped. Every creditor is different, and outcomes can vary. It’s like trying to get the best deal on a car – sometimes you get a great price, and sometimes you have to walk away.

The BBB can sometimes show complaints that were filed and resolved, or some that are still pending. It's important to look at how the company handles these issues. Do they try to make things right?

It's also vital to remember that debt relief programs aren’t the only way to tackle debt. There are other options, like debt consolidation loans or DIY budgeting. It’s about finding what works best for you.

The BBB: Your Go-To for the Real Scoop

So, why is checking the BBB so important? Because it gives you a peek into the real world of a company, beyond their shiny advertisements. It’s where the unfiltered opinions live.

The BBB rating and reviews can help you gauge a company's trustworthiness. Are they generally doing right by their customers? Or are there consistent red flags?

Think of it as reading reviews for a restaurant before you go. You want to know if the food is good and if the service is friendly, right? The BBB is the same, but for financial services.

By reading these reviews, you can prepare yourself for what to expect. You’ll be more aware of potential hiccups and better equipped to ask the right questions. It’s like having a cheat sheet for your financial journey.

Ultimately, the goal is to find a company that genuinely wants to help you. And the Better Business Bureau is a fantastic tool to help you find those reputable ones. It empowers you to make an informed choice and get your financial life back on track. Happy reviewing!