New York Community Bank Stock Price Today

Ever found yourself idly wondering about the value of things, from that cool gadget you saw online to the price of your favorite cup of coffee? Well, the world of finance has a similar fascination, but on a grander scale. Today, we're going to peek at something that might sound a little formal, but is actually quite interesting: the New York Community Bank stock price today. It’s a bit like checking the pulse of a significant player in the financial world, and understanding it can give us a fascinating glimpse into how businesses and economies tick.

So, what exactly is a "stock price" and why should we care about New York Community Bank's? Think of a stock as a tiny slice of ownership in a company. When you buy a stock, you become a part-owner. The stock price is simply what people are willing to pay for that slice at any given moment. For a bank like New York Community Bank, its stock price reflects how investors – individuals, big funds, and institutions – feel about its current health and its future prospects. Is it growing? Is it facing challenges? These are the kinds of questions the stock price tries to answer.

Why is this relevant or fun to learn? Well, for starters, it's a real-world application of mathematics and economics. You can see abstract concepts like supply and demand in action! Plus, understanding stock prices can make you a more informed consumer and a more savvy individual, even if you're not planning to be a Wall Street mogul. It helps you understand the news better, whether it’s about economic growth, interest rates, or the performance of major industries. For a community bank, its stock price can indicate its ability to lend money, expand services, and support the very communities it serves. A strong stock price often means a healthy bank, capable of offering better rates or more accessible services.

Think about it in terms of education. In schools, students learn about fractions, percentages, and graphs. Following a stock price can be a practical way to see these concepts in action. Imagine a history lesson about economic booms and busts, and then looking at the historical stock performance of a company during those periods. In our daily lives, while we might not directly trade stocks, the performance of banks like New York Community Bank can indirectly affect us. For example, their ability to lend impacts mortgage rates and business loans. If their stock is doing well, it can be a sign of a stable financial institution that's contributing positively to the economy.

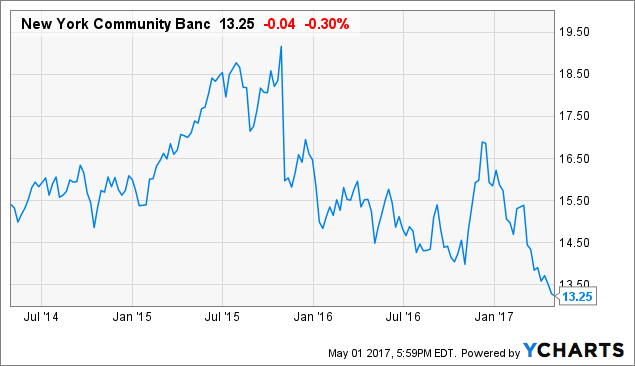

Curious to explore this yourself? It's easier than you think! You don't need to be a financial whiz. A simple way to start is by doing a quick search online for "New York Community Bank stock price." You'll likely find websites that show the current price, its change from the previous day (is it up or down?), and even a little chart showing its performance over time. You can then try comparing it to other banks or even companies in different sectors. Another fun exercise is to read the accompanying news articles. What factors are they saying are influencing the price? Is it interest rate changes? New regulations? Expansion plans? This is where the real learning happens – connecting the numbers to the real-world stories.

So, the next time you hear about a company's stock price, remember it's not just numbers on a screen. It's a dynamic story of investor confidence, business strategy, and economic currents. And taking a peek at something like the New York Community Bank stock price today can be a surprisingly engaging way to start understanding that bigger picture.