Nvidia And Broadcom Ai Stocks' Performance Post Stock Splits: Complete Guide & Key Details

Okay, let's dive into the exciting world of tech giants and what happens when their stock prices get a little… well, split! Imagine you have a giant chocolate bar, and suddenly, instead of one huge piece, you have many smaller, more manageable squares. That’s kind of what a stock split is, but for the shares of super-popular companies like Nvidia and Broadcom. It might sound a bit technical, but trust us, it's a pretty cool thing to understand, especially when these companies are at the forefront of the AI revolution. Why is it fun? Because it’s all about growth, innovation, and how the big players in tech keep making waves. Plus, for anyone even remotely interested in the future of technology and investing, knowing how these stock splits play out can be super useful!

The Magic of a Stock Split

So, what's the big deal with a stock split? At its core, a stock split is when a company increases the number of its outstanding shares by dividing each existing share into multiple new shares. Think of it like slicing that chocolate bar again. If a company announces a 2-for-1 stock split, for every one share you owned, you now have two. The total value of your investment remains the same at the moment of the split, but you have more shares, each trading at a lower price. For instance, if a share was trading at $1,000 before a 2-for-1 split, it would then trade around $500 per share, with you holding twice as many shares.

But why would a company do this? The main reason is to make their stock more accessible and affordable to a wider range of investors. When a stock price gets very high, it can seem out of reach for individual investors who might not have thousands of dollars to buy a single share. By lowering the per-share price, companies like Nvidia and Broadcom can attract more buyers, potentially increasing demand and liquidity for their shares. It’s a strategic move to broaden their investor base.

Beyond accessibility, stock splits are often seen as a sign of confidence from the company's management. They typically happen when a stock price has performed exceptionally well, and the company believes it will continue to do so. It's like saying, "We're doing great, and we want more people to be able to join us on this journey!" This positive signal can sometimes lead to increased investor interest and, consequently, further stock price appreciation, though this isn't guaranteed.

Nvidia's AI Dominance and Post-Split Buzz

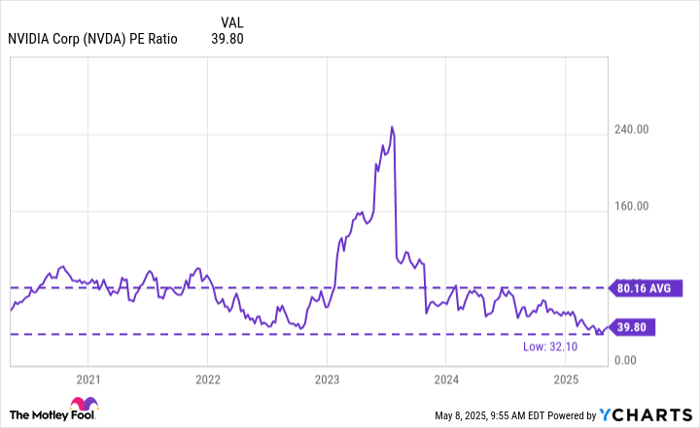

Nvidia, the undisputed king of AI chips, has been on an incredible run. Their graphics processing units (GPUs) are the workhorses powering everything from advanced gaming to the complex computations needed for artificial intelligence. Their performance has been nothing short of spectacular, and it was this stellar performance that led to their recent 10-for-1 stock split. Before the split, Nvidia shares were trading at eye-watering prices, making them less accessible. The split effectively brought that price down, making it easier for more everyday investors to grab a piece of the Nvidia pie.

Post-split, the excitement around Nvidia hasn't waned. Investors often view splits as a precursor to further growth, and in Nvidia's case, the fundamental drivers of its success – the insatiable demand for AI hardware – remain incredibly strong. The company continues to innovate, securing massive orders and expanding its reach in the burgeoning AI market. While stock prices fluctuate, the underlying strength of Nvidia's business suggests that the post-split performance is a continuation of its impressive trajectory. It’s a testament to how crucial their technology is for the future of computing and artificial intelligence.

Broadcom's Strategic Moves and AI Integration

Broadcom, another powerhouse in the semiconductor and infrastructure software space, has also been a significant player in the AI ecosystem. They provide essential components and software that enable the very infrastructure upon which AI applications run. Broadcom recently underwent a 10-for-1 stock split, a move that, similar to Nvidia, aims to boost the stock's accessibility. Their business is diverse, encompassing everything from networking chips to custom silicon for cloud giants, all of which are increasingly vital for AI development and deployment.

The post-split performance for Broadcom is also being watched closely. The company is strategically positioned to benefit from the long-term trends in data center expansion and the growing need for high-performance connectivity and computing. Their integration of various technologies allows them to offer comprehensive solutions that are in high demand. As AI continues to permeate various industries, companies like Broadcom, which provide the foundational building blocks, are set for sustained growth. The split, in this context, is another step in ensuring their stock is available to a broad base of investors who recognize their strategic importance in the evolving tech landscape.

What It Means for You

For the average investor, understanding these stock splits can demystify the market. It's not about the stock suddenly becoming "cheaper" in terms of value, but rather more "approachable." It’s a signal that these companies are thriving and want to share their growth with more people. While past performance and stock splits are not guarantees of future results, seeing giants like Nvidia and Broadcom execute these moves indicates a strong belief in their ongoing success, especially within the booming AI sector. So, next time you hear about a stock split, you’ll know it’s more than just a number change; it’s a sign of a company's momentum and a strategic play to bring more investors into their exciting journey.