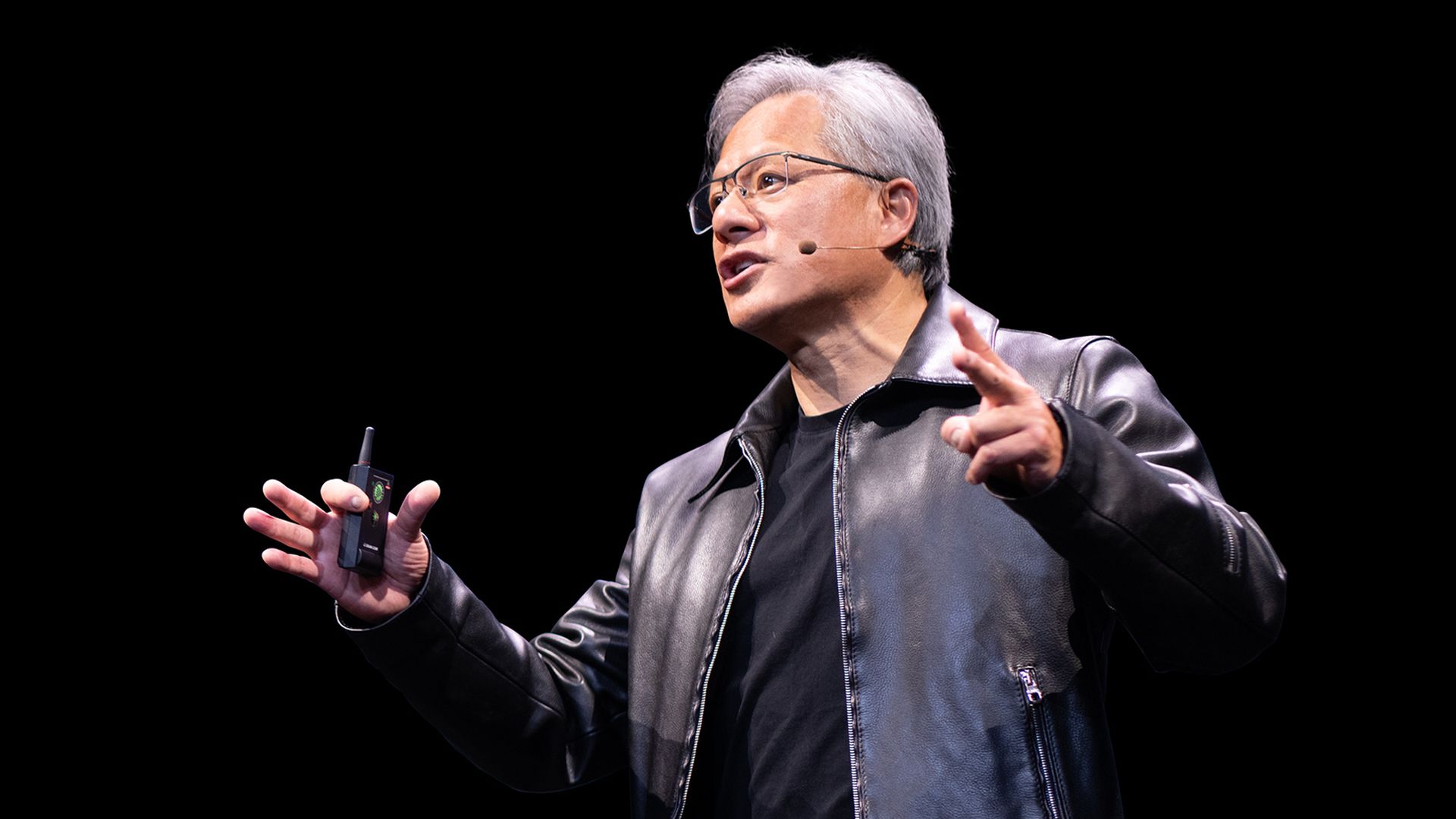

Nvidia Ceo Jensen Huang's Frequent Stock Sales Concern Investors: Complete Guide & Key Details

Hey there, tech enthusiasts and curious minds! Ever notice how the big names in tech, the ones shaping our digital world, also seem to be the ones making waves in the stock market? Well, today we're diving into a story that's got a lot of folks buzzing: Nvidia CEO Jensen Huang and his recent, shall we say, active stock selling. It's got investors scratching their heads and wondering, "What's the deal, Jensen?" Let's break it all down in a way that's as chill as a Sunday morning coffee, but just as insightful.

So, who exactly is Jensen Huang? Think of him as the mastermind behind Nvidia, the company that's basically the king of graphics processing units (GPUs). These aren't just for fancy video games anymore; GPUs are the powerhouses driving everything from artificial intelligence and self-driving cars to scientific research. Nvidia's stock has been on an absolute tear, and Jensen, as its CEO, is sitting on a pretty substantial chunk of that success. Imagine owning a piece of a rocket ship that's blasting off – that’s kind of the vibe.

Why All the Stock Selling Buzz?

Now, here's where the curiosity kicks in. Lately, Jensen Huang has been selling off a significant amount of his Nvidia stock. When the CEO of a booming company decides to cash in, it’s natural for people to pay attention. It's like when your favorite chef starts selling off their signature spice blend – you can't help but wonder if they're going on a long vacation or if there's something else brewing.

Is it a sign that Jensen thinks Nvidia's best days are behind it? Or is it just a regular part of being a high-powered executive managing their personal finances? These are the questions that swirl around the investment community, and we're here to explore them without the usual Wall Street jargon. Let's keep it simple, folks.

Decoding the Sales: The "Why" Factor

One of the most common reasons executives sell stock is for diversification. Imagine having all your eggs in one incredibly successful but still singular basket. Even if that basket is made of solid gold and currently soaring through the sky, diversifying means spreading those eggs into other baskets, just in case. It's a smart financial move for anyone, even a tech titan.

Think of it like this: if you had a wildly popular lemonade stand that was making you a fortune, would you only ever invest your profits back into more lemons and sugar? Probably not! You'd likely want to explore other ventures, maybe a cool new smoothie bar or a quirky bookshop. Jensen Huang, like any savvy individual, likely has other financial goals and personal needs that selling stock helps fulfill. It's not always a dramatic pronouncement about the company's future.

Another big driver is pre-planned selling. Many executives have stock options or grants that vest over time. When these become available, they often have pre-arranged plans for selling them. These aren't spontaneous decisions made overnight; they're often part of a long-term financial strategy that's been in place for a while. It’s like having a calendar reminder for a regular bill payment, but instead of paying a bill, it's about managing personal wealth.

Then there are tax considerations. Selling stock can trigger capital gains taxes. Executives, especially those with massive holdings, have to be mindful of how these sales impact their tax liability. Sometimes, sales are timed to optimize tax outcomes. It's a less exciting reason, but a very real one. Nobody likes paying more taxes than they have to, right?

The Investor's Perspective: A Little Bit of Worry?

So, why does this make some investors nervous? Well, it’s a classic case of "following the leader." If the person who knows the company inside and out, the one at the helm, is selling, it can feel like a red flag. It’s like seeing a seasoned chef suddenly stop eating their own cooking – it makes you pause.

Investors often look to insider buying and selling as clues about a company's health and future prospects. When insiders are buying, it signals confidence. When they're selling, especially in large quantities, the immediate reaction can be concern. Is the captain leaving the ship? Is the magic formula about to expire?

However, it's crucial to remember that insider selling doesn't automatically mean the company is in trouble. As we've discussed, there are many legitimate, non-negative reasons for these sales. It's easy to get caught up in the drama, but a truly informed investor looks beyond the headlines.

What Are the Key Details to Keep in Mind?

When we talk about Jensen Huang's stock sales, a few key details are important. Firstly, the scale of the sales is significant. We're not talking about a few hundred shares here; these are substantial amounts, reflecting his considerable ownership stake. This is what really catches the eye.

Secondly, the timing of these sales is often scrutinized. Are they happening during periods of high stock performance? Are they clustered around certain company announcements? Analysts and investors pore over these patterns, looking for any hint of an edge.

Thirdly, it’s important to look at the specific plans behind the sales, if publicly disclosed. Many executives file what are called 10b5-1 trading plans. These are pre-set, written documents that allow insiders to sell a predetermined number of shares at a predetermined time or price. This helps demonstrate that the sales are not based on any non-public, material information. It's like having a signed contract that says, "I will sell X shares on Y date for Z reason."

Finally, consider the overall market conditions and Nvidia's specific business performance. Nvidia is at the forefront of the AI revolution, a trend that shows no signs of slowing down. Even with significant insider selling, the company's fundamentals and growth prospects remain incredibly strong. It’s like a blockbuster movie director selling some of their personal ticket stubs – the movie is still a massive hit!

:max_bytes(150000):strip_icc()/GettyImages-2155127379-40585d61b7e54fa99811f946b51ef8c5.jpg)

Is It All Just a Distraction?

Perhaps the biggest takeaway here is that while these stock sales make for juicy headlines and spark intense debate, they might also be a distraction from the bigger picture. Nvidia is a company at the cutting edge of technology, powering some of the most transformative innovations of our time. The demand for their chips is skyrocketing, and their influence on the future is undeniable.

Jensen Huang's personal financial decisions, while important to him and potentially to short-term market sentiment, don't necessarily dictate the long-term success of Nvidia. It’s like reading a celebrity’s grocery list; it tells you something about them, but it doesn’t change the plot of their latest movie.

So, What's the Verdict?

The frequent stock sales by Nvidia CEO Jensen Huang have understandably raised eyebrows and sparked investor curiosity. However, digging deeper reveals that these actions are often driven by diversification, pre-planned financial strategies, and tax considerations – common practices for executives managing significant personal wealth.

While it’s wise for investors to stay informed about insider transactions, it's equally important to avoid jumping to conclusions. Nvidia's position in the booming AI market, coupled with its ongoing innovation, suggests a strong future. Jensen's personal financial maneuvers, while noteworthy, are unlikely to derail the impressive trajectory of this tech giant. It's a complex story, but one that ultimately shows the intricate dance between personal wealth management and corporate leadership. And isn't that fascinating?