Nvidia's Strong 2024 Performance Leads Analysts To Raise Price Targets: Price/cost Details & What To Expect

Remember that scene in the old sci-fi movies where the computer suddenly goes into overdrive, lights flashing, gears whirring, and the protagonist exclaims, "It's working! It's really working!"? Well, that's kind of how I feel watching Nvidia right now. It’s like they’ve not only hit the turbo button but might have also discovered a cheat code for the universe’s simulation. Seriously, this company is on a tear, and the folks who get paid to think about these things – the analysts – are basically running around with their hair on fire, revising their numbers upwards like there’s no tomorrow. And guess what? They’re not wrong.

We’re talking about a year, 2024, that’s shaping up to be, well, legendary for Nvidia. It’s the kind of performance that makes you lean back in your chair, maybe with a cup of coffee (or something stronger, depending on the day), and just marvel. They’ve not only met expectations, they’ve absolutely obliterated them. It’s like showing up to a marathon expecting to finish, and instead, you’re setting a world record and already planning your victory lap.

The AI Boom: Nvidia's Rocket Fuel

So, what’s the magic ingredient in this incredibly potent NVIDIA-powered cocktail? It’s, as you’ve probably guessed, the all-consuming, all-transforming, all-singing, all-dancing revolution that is Artificial Intelligence. Seriously, AI is everywhere. From the chatbots that are starting to sound eerily human to the algorithms that are predicting everything from stock market movements to the next big fashion trend, AI is the engine driving so much innovation. And guess who makes the engines for these AI engines? Yep, you got it.

Nvidia’s graphics processing units (GPUs), initially designed for mind-blowing video games, have turned out to be the absolute perfect tools for the heavy lifting required by AI. Think of it like this: traditional computer chips (CPUs) are like a highly intelligent, focused mathematician working on one complex problem at a time. Nvidia’s GPUs, on the other hand, are like an entire army of mathematicians, each tackling a small piece of the same enormous problem simultaneously. This parallel processing power is exactly what AI needs to crunch through mountains of data, learn patterns, and make incredibly complex predictions.

It's almost ironic, isn't it? The company that helped us see incredibly realistic dragons and wizards on our screens is now the backbone of the technology that might one day create actual artificial consciousness. Wild, right?

Analysts Behaving Like Kids in a Candy Store

Now, when a company starts printing money like it’s going out of style, the people who watch these things for a living – the analysts – tend to get very excited. And in Nvidia's case, "excited" is an understatement. They’re practically doing cartwheels in their Bloomberg terminals. We’re seeing a consistent trend of analysts not just slightly tweaking their price targets, but giving them significant boosts. It’s like they’ve gone from "this stock is good" to "this stock is practically a digital gold mine."

Why the urgency? Because Nvidia's earnings reports are consistently blowing past even the most optimistic projections. They’re not just meeting targets; they’re setting new ones for themselves and then smashing them. This consistently strong performance signals to analysts that the demand for their AI chips is not a fleeting trend but a fundamental shift in the technological landscape. Companies across the board, from cloud giants to automotive manufacturers and healthcare innovators, are investing heavily in AI, and they all need Nvidia's hardware.

The Numbers Don't Lie (Usually)

Let’s talk a bit about the specifics, without getting too bogged down in Wall Street jargon, okay? When analysts raise a price target, they’re essentially saying, "Based on all the information we have – sales, profits, future outlook – this stock should be worth more than we thought." They look at things like revenue growth, profit margins, the competitive landscape, and the potential for future products and services. For Nvidia, the numbers are just singing.

Their revenue in the AI chip sector has been absolutely phenomenal. We’re talking about year-over-year growth figures that make other tech giants look like they’re in slow motion. And it’s not just about selling more chips; their profit margins are also incredibly healthy. These chips are complex, cutting-edge pieces of technology, and they come with a price tag to match. But because the demand is so high, Nvidia can command those premium prices and still see robust profitability. This is a classic sign of a company with significant pricing power in a rapidly expanding market.

Many analysts are pointing to Nvidia's dominant position in the datacenter market, which is the powerhouse behind all this AI development. Their H100 and upcoming Blackwell GPUs are essentially the gold standard for AI training and inference. Companies are willing to pay top dollar for these because the alternative – slower, less efficient processing – means falling behind in the AI race. And in today’s hyper-competitive tech world, falling behind is not an option.

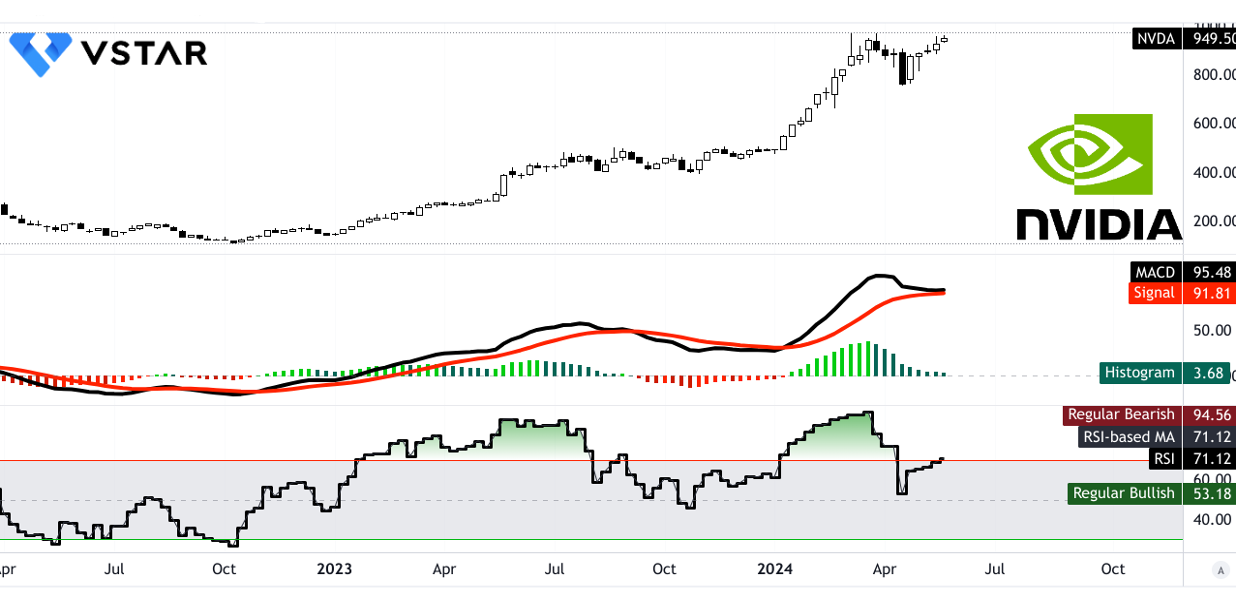

You might see headlines with specific price targets, like "$1,000" or "$1,200" per share. These numbers are derived from intricate financial models, but the core idea is simple: Nvidia's current earnings and its projected future earnings are so strong that, in the eyes of these analysts, the stock is currently undervalued at its previous price points. It's like finding a hidden gem at a yard sale that you later realize is worth a fortune.

What Does This Mean for You (and Your Portfolio)?

Okay, so Nvidia is doing great, and analysts are cheering. What’s the takeaway for the average person, maybe someone who’s just trying to figure out where to put their savings, or heck, just curious about what’s happening in the world of big tech? Well, a few things.

Firstly, it confirms that the AI revolution is not just hype. It's a real, tangible economic force that’s driving demand for specific technologies and companies. If you’re interested in investing, understanding which companies are enabling this revolution is key. Nvidia is clearly one of the front-runners.

Secondly, it highlights the importance of innovation and specialization. Nvidia didn't become the AI chip king by accident. They focused on a specific area (initially graphics, then parallel processing) and poured resources into developing best-in-class technology. This focus, coupled with their ability to adapt and capitalize on new opportunities like AI, is a powerful lesson.

Thirdly, and this is where things get a bit more nuanced, it means that companies like Nvidia can command significant premium valuations. When a company is this dominant in such a high-growth sector, the market is willing to pay a higher price for its earnings. This can make the stock look expensive on traditional metrics, but for growth-oriented investors, the potential for future expansion justifies it. It's a bit of a balancing act, really.

Looking Ahead: What’s Next on the AI Highway?

So, what can we expect going forward? It’s unlikely that the AI gold rush is ending anytime soon. As AI applications become more sophisticated and widespread, the demand for the underlying hardware will only continue to grow. Nvidia isn’t just resting on its laurels, either. They are constantly investing in research and development, pushing the boundaries of what’s possible with their next-generation chips.

We’re already hearing about their Blackwell platform, which is poised to be even more powerful than their current offerings. This suggests a continuous cycle of innovation, where Nvidia keeps delivering more powerful and efficient solutions, further cementing their leadership position. Think of it as a technological arms race, and Nvidia is currently holding all the advanced weaponry.

However, it’s not all smooth sailing on the AI highway. Competition is always a factor. While Nvidia has a substantial lead, other companies are undoubtedly working hard to catch up or carve out their own niches. Intel is making a strong push with its own AI accelerators, and custom chip designs from hyperscalers like Google and Amazon could also pose challenges down the line. Plus, there’s always the possibility of market saturation or a slowdown in AI investment if the economic climate shifts drastically. These are the things that keep those analysts up at night, even after they’ve raised their price targets.

But for now, the narrative is overwhelmingly positive for Nvidia. Their 2024 performance has been nothing short of spectacular, and the analysts, in their wisdom (and perhaps a bit of FOMO – Fear Of Missing Out), are reflecting this in their updated outlooks. It's a compelling story of technological prowess meeting unprecedented market demand, and it’s a story that’s still being written, chip by powerful chip.