Palantir Technologies' Shares Fell Wednesday On Worries Over Defense Cuts.: Complete Guide & Key Details

Hey there, fellow navigators of the digital age! Ever feel like you’re constantly juggling a hundred things, from that overflowing inbox to remembering to water your succulents? Well, that’s the modern hustle for ya. And sometimes, even the big players, the companies we hear about on the news, seem to be doing a similar tightrope walk. Today, let's dive into a little ripple that hit the tech ocean: Palantir Technologies and its recent share dip. Think of this as your chill guide to understanding what went down, why it matters, and how it’s all connected to the bigger picture, all without needing a PhD in finance.

Palantir: More Than Just a Sci-Fi Name

First off, let's get Palantir straight. You might picture wizarding towers and all-seeing orbs, and honestly, their name is that cool. It comes from Tolkien's Lord of the Rings, referring to magical seeing stones. But in reality, Palantir is all about data. They're the wizards behind the curtain, helping big organizations, especially governments and defense agencies, make sense of mountains of information. Think of them as the ultimate digital detectives, piecing together clues to solve complex problems.

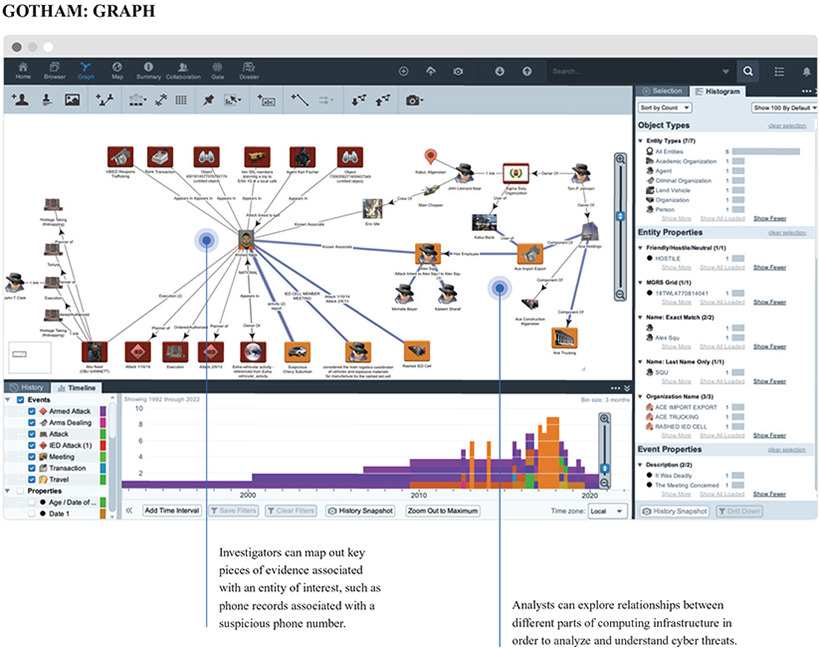

Their core products, like Palantir Gotham and Palantir Foundry, are sophisticated platforms designed to integrate and analyze vast datasets. Gotham is often associated with defense and intelligence, helping to track down threats and manage complex operations. Foundry, on the other hand, is more about enterprise data management, helping businesses streamline their operations and make smarter decisions. It’s like having a super-powered brain for your company's data.

The News That Sent Waves

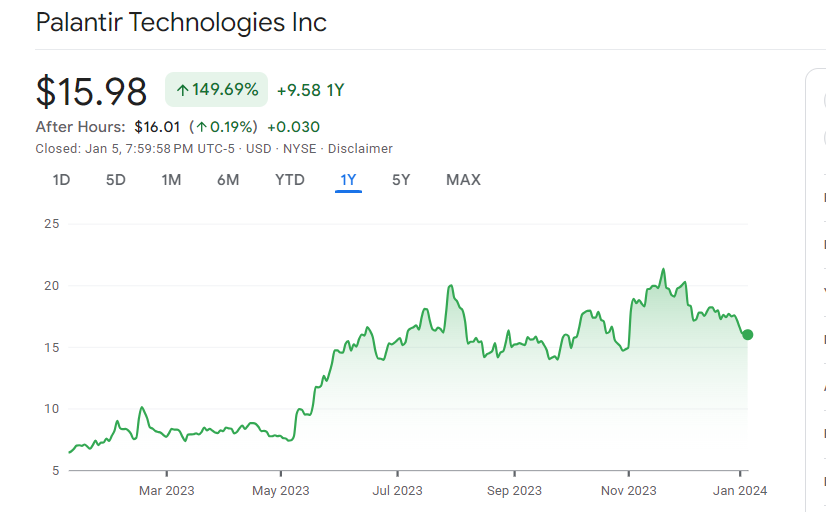

So, what was the buzz on Wednesday? The headlines blared: Palantir Technologies' shares fell. The main culprit? Worries over defense cuts. This might sound like a dry topic, but it’s got some real-world implications, especially for a company like Palantir, which has a significant chunk of its business tied to government contracts, particularly with the U.S. Department of Defense.

When governments face budget constraints, the first things that often come under scrutiny are large expenditures, and defense spending is a prime candidate. If budgets tighten, it means less money for new projects, fewer opportunities for expansion, and potentially even a reduction in existing contracts. For Palantir, this translates directly into potential headwinds for their revenue and growth. It’s like when your favorite streaming service suddenly decides to hike its prices – you start to wonder about the long-term commitment, right?

Why Defense is a Big Deal for Palantir

It’s no secret that Palantir has deep roots in the defense and intelligence sectors. Their early days were heavily influenced by their work with agencies like the CIA. This partnership helped them hone their skills in dealing with sensitive, complex, and often unstructured data. It gave them a unique advantage and a reputation for being able to handle the toughest analytical challenges.

These government contracts aren’t just small change. They often represent large, multi-year commitments that provide a stable and significant portion of a company’s revenue. For Palantir, a potential slowdown in defense spending could mean a slower pace of growth or even a need to pivot more aggressively towards their commercial offerings.

Think about it like this: Imagine you’ve built your entire culinary empire around catering exclusive royal banquets. If the monarchy suddenly has to cut back on lavish feasts, you’d definitely start thinking about offering more casual brunch options to keep the business thriving, wouldn’t you? Palantir is in a similar position, albeit with algorithms and artificial intelligence instead of soufflés.

The Stock Market's Mood Swings

The stock market, as we all know, can be a bit of a drama queen. It reacts to news, rumors, and even just the general sentiment of investors. When the prospect of defense cuts looms, investors get nervous. They start to question the future earnings potential of companies heavily reliant on that sector. This nervousness can lead to a sell-off, driving the stock price down.

It’s important to remember that a single day’s stock movement doesn't always tell the whole story. Markets are influenced by a complex web of factors, and sometimes, a company’s stock price can be like a pendulum – swinging back and forth based on various forces. The key is to look beyond the immediate fluctuation and understand the underlying dynamics.

This isn't just about Palantir. Companies across various sectors can experience dips due to broader economic or geopolitical concerns. It’s a reminder that even the most innovative companies operate within a larger ecosystem.

Palantir's Strategic Balancing Act

While the defense sector is crucial, Palantir has been actively working to diversify its revenue streams. Their commercial business, powered by Palantir Foundry, has been growing steadily. They are increasingly targeting industries like manufacturing, healthcare, and energy, helping these businesses optimize their operations, improve efficiency, and gain a competitive edge through data analytics.

This diversification is a smart move. It reduces their reliance on any single sector and makes them more resilient to market shifts. Imagine a musician who only plays classical music. If the demand for classical music dips, they’re in a tough spot. But if they also dabble in jazz and rock, they’ve got more gigs to fall back on.

The company’s leadership has often spoken about this dual focus. They see the power of their technology extending far beyond the realm of national security. In fact, the same analytical capabilities that help track down adversaries can also help a pharmaceutical company discover new drugs or a logistics firm optimize its supply chain. It’s all about seeing the patterns hidden within the data.

Key Details You Might Find Interesting

Let's break down some of the nuts and bolts that investors and curious onlookers might be pondering:

- Revenue Mix: Understanding the percentage of Palantir's revenue that comes from government contracts versus commercial clients is key. A higher percentage from government means more exposure to potential defense cuts.

- Contract Renewals: The status of existing government contracts and the likelihood of their renewal are critical. Are these contracts secure, or are they vulnerable to budget reductions?

- Commercial Growth: How fast is their commercial business growing? A robust commercial sector can offset any potential slowdowns in government work. This is their "Plan B," if you will, and it looks promising.

- New Contracts: Is Palantir securing new, significant contracts, both in defense and commercial sectors? New deals can signal future revenue streams and investor confidence.

- Technological Advancements: Palantir isn't standing still. Their continued innovation in AI and data analytics is crucial for staying competitive, regardless of which sector they’re serving.

It’s like following your favorite sports team. You want to know their star players (their products), their recent wins and losses (financial performance), and their long-term strategy (diversification). All these details paint a clearer picture.

Navigating the AI Landscape

The world of artificial intelligence and data analytics is booming, and Palantir is right at the heart of it. They’re not just analyzing data; they’re building platforms that empower users to make better decisions. This is where the real magic happens, and it’s a trend that’s only going to accelerate.

Think about the rise of personalized recommendations on streaming services or the sophisticated algorithms that power online shopping. Palantir’s technology, at its core, is about enabling similar levels of insight and predictive power for much larger and more complex organizations.

The recent dip in their stock doesn’t diminish the fundamental value of their technology. It’s a reminder that even cutting-edge companies face market realities. The long-term story for AI and data analytics is still very much being written, and Palantir is a significant author in that narrative.

What Does This Mean for You?

Okay, so you’re not an institutional investor with millions on the line. Why should you care about Palantir’s share price? Well, it’s about more than just stock tickers. It’s about understanding how the world works, how technology shapes our lives, and how global events can have ripple effects.

Palantir’s story touches on themes that are relevant to all of us:

- The Importance of Diversification: Just like you wouldn’t put all your eggs in one basket, businesses need to spread their risks. This is a lesson applicable to personal finance and career planning too.

- The Power of Data: We live in a data-driven world. Understanding how data is collected, analyzed, and used is becoming increasingly important for everyone.

- The Interconnectedness of Global Events: Defense budgets in one country can impact the stock price of a tech company, which can then influence hiring and innovation. It’s all connected!

- Technological Innovation: Palantir is at the forefront of AI and big data. Keeping an eye on these advancements helps us understand the future of work and society.

Think of it like following a popular TV show. You’re not just watching for the plot twists; you’re invested in the characters, their journeys, and the underlying themes. Palantir’s journey is a fascinating one, full of complex characters (their technology and clients) and compelling plotlines (market dynamics and innovation).

A Little Fun Fact

Did you know that one of Palantir’s co-founders, Peter Thiel, is also a co-founder of PayPal? He’s a serial entrepreneur who has had a significant impact on the tech landscape. His involvement highlights the caliber of talent and vision behind Palantir.

It’s a bit like finding out your favorite indie band’s lead singer also produced that iconic album you love from years ago. It adds another layer of appreciation for their creative output!

Looking Ahead: The Crystal Ball (Or Lack Thereof)

Predicting the stock market is a fool’s errand, and that’s especially true for a company like Palantir, which operates in a dynamic and often unpredictable space. However, what we can do is understand the factors at play.

The concerns over defense cuts are real and will likely continue to be a talking point. But Palantir's ability to adapt, its strong position in commercial markets, and its continued innovation in AI will be crucial for its future success. It’s a story of resilience and strategic adaptation.

They’re not just a defense contractor; they’re a data intelligence company with a broad vision. The path forward will likely involve a continued push for commercial adoption, alongside their existing government work. The market will be watching closely.

A Final Thought for Your Daily Grind

We’ve spent some time dissecting a news blip about Palantir and its share price. But what’s the takeaway for our own lives? It’s a gentle nudge to remember that even the giants face challenges, and adaptation is key. Whether it's your career, your personal goals, or even just managing your household budget, being aware of potential shifts and being flexible enough to adjust your sails is a superpower.

So, the next time you hear about a company’s stock dipping, take a moment. Understand the context. It’s not just about numbers on a screen; it’s a story about strategy, innovation, and the ever-changing world we live in. And just like Palantir is working to make sense of complex data, we can all work to make sense of the complex world around us, one easy-going insight at a time.