Perpetua Resources Corp. Analyst Price Target Disagreement: Price/cost Details & What To Expect

Ever found yourself staring at the stock market ticker, a little bewildered by the numbers dancing before your eyes? You're not alone! For many, the world of investing, and specifically understanding analyst price targets, can feel like deciphering an ancient code. But once you crack the secret, it’s incredibly satisfying and can even be downright fun, like finally solving a tricky puzzle!

What exactly are these analyst price targets, and why should you care? Think of them as expert opinions, essentially educated guesses from financial professionals who spend their days dissecting companies. They analyze a company's financials, its industry, its competitive landscape, and then come up with a predicted future stock price. The primary purpose of these targets is to provide investors with a benchmark for their own decision-making. Are they looking for potential opportunities? Are they concerned about a particular stock? Analyst targets can offer a helpful perspective.

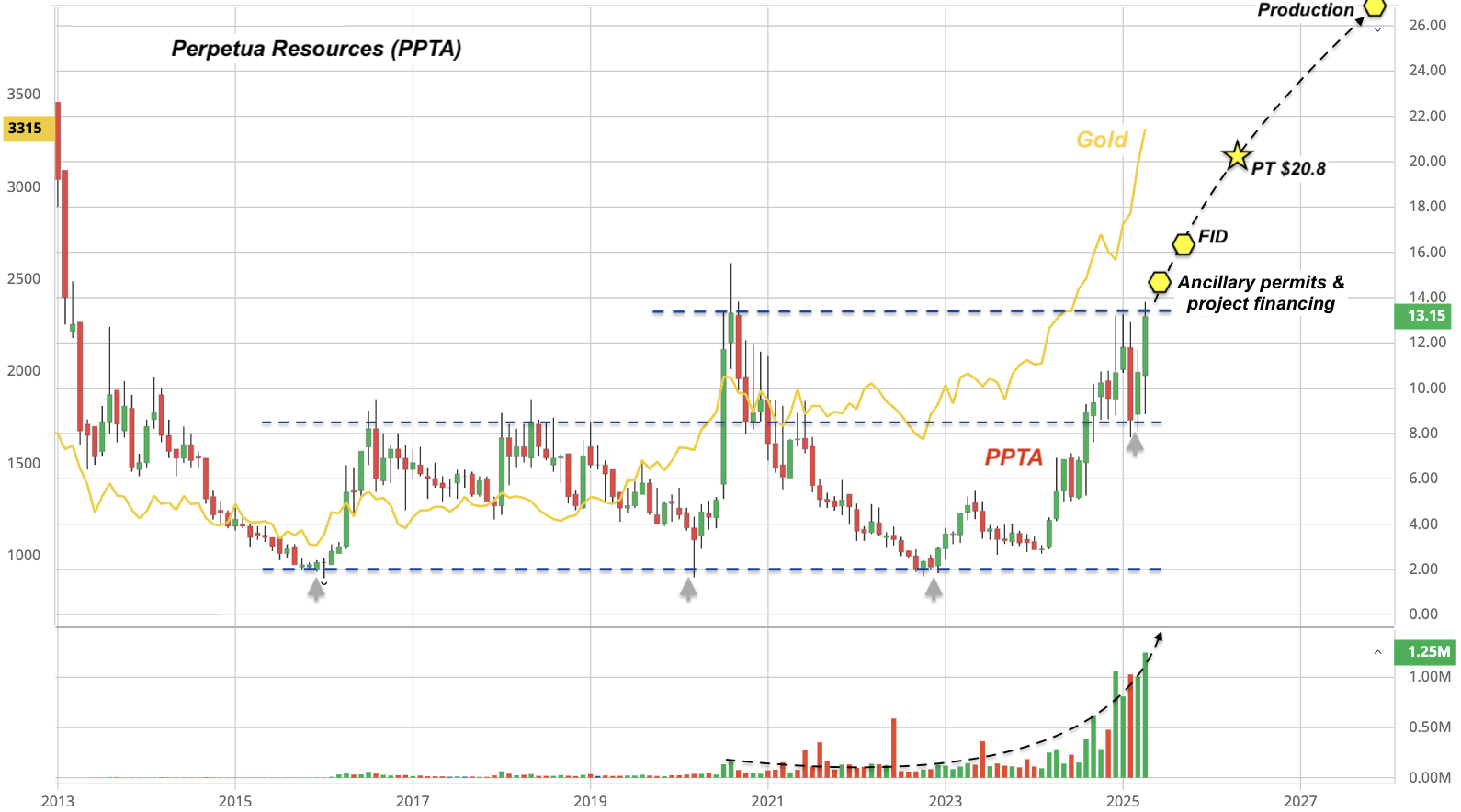

We see this play out all the time with companies like Perpetua Resources Corp. You might hear that one analyst has a price target of $10, while another suggests $15. This disagreement isn’t a sign of chaos, but rather a reflection of the complex and nuanced nature of financial analysis. Different analysts might weigh certain factors more heavily than others. For instance, one might be particularly optimistic about Perpetua's potential to extract valuable resources, while another might be more cautious about the associated costs of production or regulatory hurdles.

Let’s dive a little deeper into the "price/cost details." When analysts are setting their targets, they're not just pulling numbers out of thin air. They're looking at things like the estimated cost of mining or processing materials, the potential market price of those materials once extracted, and the overall financial health of the company. For Perpetua Resources, this could involve assessing the cost of developing their mining operations versus the projected revenue from selling the materials they discover. A higher projected selling price or lower extraction cost would naturally lead to a higher price target.

So, what can you expect when you see these differing price targets for a company like Perpetua Resources? It’s a signal that there’s not a single, universally agreed-upon future for the stock. It encourages you to do your own due diligence. Instead of blindly following one analyst, use their targets as a starting point for your research. Read the reports, understand their reasoning, and then form your own informed opinion. Think of it as a buffet of insights – you pick and choose what makes the most sense to you.

To enjoy this process more effectively, here are a few practical tips: diversify your sources. Don't just rely on one analyst firm. Explore reports from different institutions. Second, focus on understanding the underlying rationale behind the price targets, not just the numbers themselves. What are the key assumptions? What are the potential risks? Finally, remember that analyst targets are not guarantees; they are simply projections. The stock market is inherently unpredictable, and many factors can influence a stock's performance. By approaching these targets with a critical and curious mind, you can turn what might seem like a dry financial discussion into an engaging and empowering part of your investment journey.