Price Of Gold Silver Platinum And Palladium Per Ounce Today: Price/cost Details & What To Expect

Hey there, metalheads! Or, you know, just folks who are vaguely curious about what’s happening with the shiny stuff. You ever find yourself scrolling through news and see a headline about gold prices and think, “Huh, wonder what that’s actually costing right now?” Yeah, me too. It’s like this mysterious world of precious metals, right? Like, are we talking about needing a second mortgage for a tiny nugget, or is it more like a reasonable splurge for a nice necklace? Let’s spill the tea, shall we?

So, what’s the scoop on gold, silver, platinum, and palladium today? It’s not exactly like checking the weather, is it? You can’t just glance out the window and say, “Yep, looks like a sunny $2000-an-ounce kind of day.” This stuff fluctuates like my mood before coffee. Seriously though, these prices are like the stock market’s fancier, slightly more intimidating cousin. Always moving, always… being something.

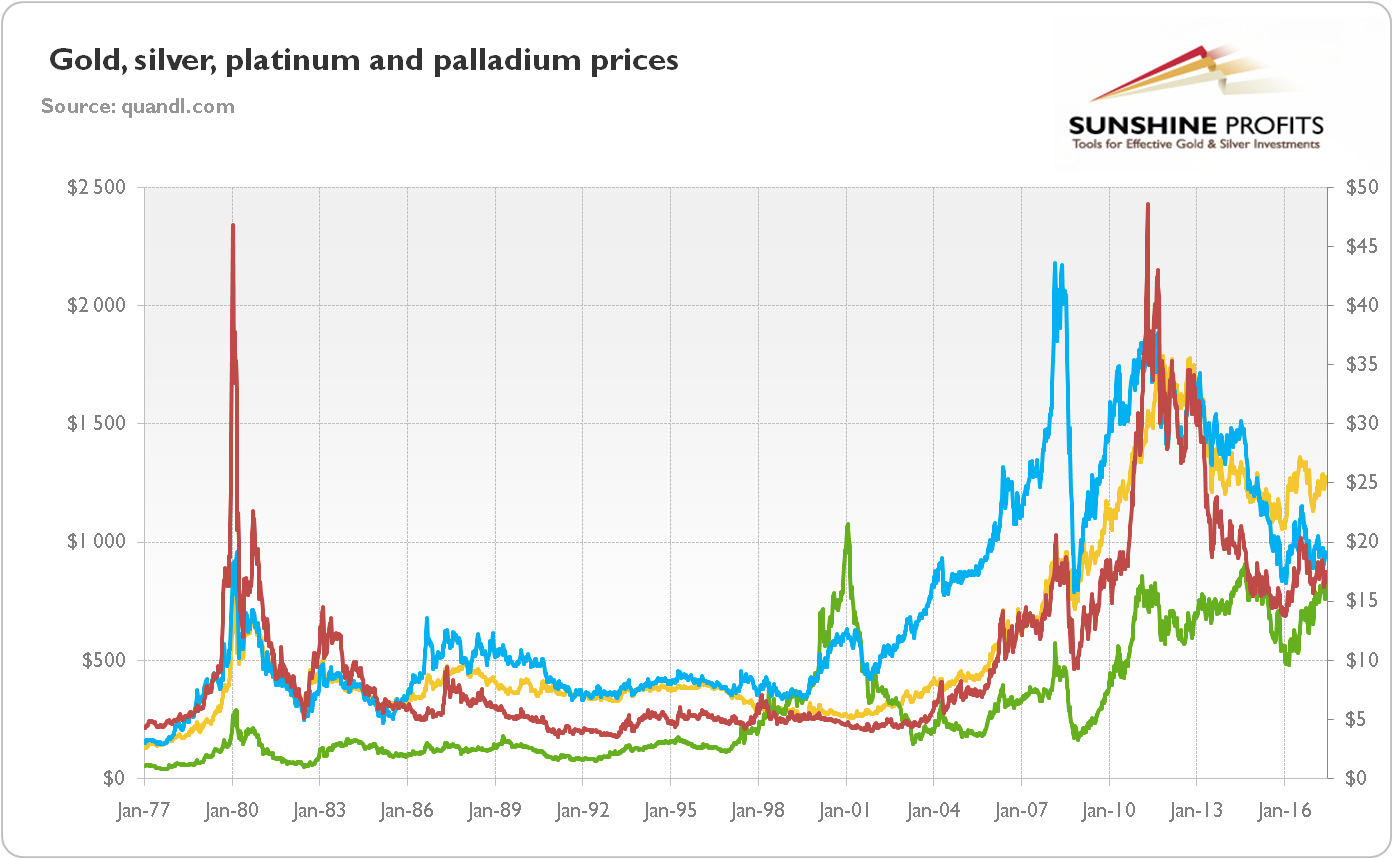

Let’s start with the OG, the classic, the bling-maker extraordinaire: gold. Ah, gold. The stuff of pirate treasure and ridiculously fancy crowns. What’s it doing today, you ask? Well, if you’re picturing piles of shiny coins just waiting to be snagged, you might need to adjust your mental treasure chest. Gold prices are generally, and I’m saying this with a slight dramatic flourish, pretty darn high. We’re talking hundreds, and oftentimes thousands, of dollars per ounce. Like, actual thousands. Wild, right?

Think about it. That little bit of metal in your favorite earrings? It’s got a price tag that’s, shall we say, significant. Today, you’re likely looking at gold prices hovering somewhere around the $2,300 to $2,400 per ounce mark. Give or take a few bucks. It’s not pocket change, that’s for sure. It’s more like… “invest in my future retirement fund and also maybe a really nice watch” kind of money.

And why is it so pricey? Well, it’s a whole mix of things. Think economic uncertainty – when the world feels a bit shaky, people tend to run to gold like it’s the ultimate safe haven. It’s like the financial world’s security blanket. Plus, central banks buy it, jewelry makers use it, and electronics… well, they need a little bit of that magic too. So, there’s demand coming from all sorts of corners. Supply and demand, baby! It’s basic economics, but with a much shinier outcome.

Now, let’s slide over to its slightly less flashy, but still very important sibling: silver. Silver. The underdog? Maybe. But don’t underestimate it. Silver is like the cool younger sibling who’s got their own thing going on. It’s used in everything from fancy tableware to solar panels and, yes, electronics too. So, it’s got some serious practical applications, which keeps its value ticking along nicely.

What’s silver costing us per ounce today? Generally, silver is a lot more… accessible than gold. It’s still precious, don’t get me wrong, but you won’t need to sell your kidney to buy a decent chunk. Today, you're probably looking at silver prices in the ballpark of $28 to $30 per ounce. See? Much more manageable for us mere mortals. It’s like, “Okay, I can maybe afford a silver bracelet without taking out a second mortgage.”

So, if gold is the extravagant millionaire, silver is the comfortably well-off friend who still knows how to have a good time. It’s got a different vibe, a different price point, but it’s still undeniably valuable. And hey, sometimes a good silver investment can give you some nice returns too. It’s not always about the extreme highs, right? Sometimes it's about steady wins.

Okay, deep breaths, because we’re moving into the super-luxe territory now. Let’s talk about platinum. Ooh, platinum. It sounds so… important. Like it should be escorted by tiny uniformed guards. Platinum is used in jewelry, yes, but its real superstar status comes from its industrial uses, particularly in catalytic converters for cars. So, the automotive industry has a huge say in platinum prices. If cars are selling like hotcakes, platinum might feel that love too.

What’s platinum weighing in at today? Brace yourselves. Platinum is often, and I mean often, more expensive than gold. It’s that rare, that desirable for its industrial might. Today, you might be looking at prices in the range of $900 to $1,000 per ounce. Yeah, still a hefty chunk of change. It’s that “wow, that ring must be really special” kind of price point.

Think of platinum as the sophisticated older sibling of gold. It’s got that understated elegance, that quiet power. It’s not as flashy as gold, perhaps, but its utility and rarity give it a hefty price tag. It’s like the perfectly tailored suit versus the dazzling sequined gown. Both have their place, but one definitely costs more to create and maintain. And when you’re talking platinum, you’re talking about serious craftsmanship and critical industrial application.

And now, for the wild card, the one you might not think about as much but is actually super important: palladium. Palladium. Has a nice ring to it, doesn’t it? Like a secret agent’s codename. Palladium is another one of those unsung heroes of the industrial world, also playing a big role in catalytic converters. Its price can be, shall we say, volatile. Like, really, really volatile. It’s seen some wild swings over the years.

So, what’s palladium’s story today? This one’s a bit trickier because it can jump around more than a toddler on a sugar rush. However, as of recent trends, you’re probably looking at palladium prices in the vicinity of $900 to $1,000 per ounce. It’s often in a similar ballpark to platinum, sometimes even higher, sometimes a bit lower. It’s a bit of a diva, this metal. It keeps you on your toes.

Palladium is the metal that can surprise you. It’s been incredibly expensive in recent years, even surpassing gold at one point. Why? Because of its crucial role in emission control technology and supply chain issues. If there’s a hiccup in its production or a surge in demand for cleaner vehicles, boom, palladium prices can go stratospheric. It’s like the temperamental artist of the precious metal world. You never quite know what you're going to get, but when it’s good, it’s really good. And when it’s bad… well, let’s just say the price drops can be dramatic.

So, what can you expect moving forward? This is the million-dollar question, isn’t it? (Or, you know, the $2300-an-ounce question). Honestly, nobody has a crystal ball for precious metals. If they did, they’d probably be living on a private island made of solid gold. Ha!

But, we can talk about general trends and what influences these prices. For gold, think of it as a safe bet during turbulent times. If global markets are looking dicey, or there's geopolitical tension, gold usually likes that. Inflation can also be a friend to gold prices, as it’s seen as a store of value when currency loses its purchasing power. So, if the economy is feeling a bit wobbly, expect gold to hold its ground, or even climb.

Silver, being a bit more industrial, is more tied to manufacturing and technology sectors. When the economy is humming along nicely, and demand for things like electronics and solar panels is high, silver tends to do well. It’s also influenced by gold prices – they often move in the same direction, though not always in lockstep. So, a strong economy generally bodes well for silver.

Platinum and palladium are heavily influenced by the automotive industry. New car sales, stricter emission regulations – these are big drivers for these metals. If the world is pushing for cleaner cars, and the supply of these metals is constrained, prices can go up. If there’s a slowdown in car manufacturing or a shift in technology that uses less of them, prices can dip. It’s a bit of a rollercoaster, especially with palladium.

And then there’s the whole interest rate thing. When interest rates are low, holding cash isn’t as attractive, and assets like gold can become more appealing as an alternative store of value. When interest rates are high, bonds and other interest-bearing investments start to look more tempting, potentially drawing money away from precious metals. It’s a delicate balance, you see.

The US dollar also plays a role. Generally, when the dollar is strong, precious metals tend to be priced lower in other currencies, which can reduce demand. When the dollar weakens, metals become cheaper for international buyers, potentially increasing demand and prices. It's a bit of a tug-of-war!

So, to sum it up, today’s prices are just a snapshot. They’re a reflection of a complex web of global events, economic sentiment, industrial demand, and even a bit of human psychology. It’s like a really fancy, really expensive puzzle.

If you're thinking about buying or selling, it’s always a good idea to do your homework. Look at reputable sources, understand what’s driving the markets, and don’t make impulsive decisions based on a single day’s price. Unless, of course, you’re buying a solid gold yacht, in which case, a few dollars here or there might not matter. Jealous!

Ultimately, these precious metals aren't just about shiny objects. They're indicators of economic health, hedges against uncertainty, and critical components in the technology that shapes our world. So, next time you see a gold price on the news, you can nod knowingly, like you’re in on the secret. You're not just looking at a price; you're looking at a story. And what a story it is!