Regions Banking Options Are There For Small Businesses: Complete Guide & Key Details

So, you've got a brilliant idea brewing, a passion project that's ready to take flight, or maybe you're just really good at making the best darn [insert popular local food item] in town. That's fantastic! Starting a small business is like planting a tiny seed and watching it grow into something amazing. But even the most spectacular sunflowers need a little water and sunshine to thrive, and for your business seedling, that often comes in the form of money. And when it comes to getting that financial sunshine, Regions Bank has a whole garden of options for folks like you.

Think of Regions Bank not just as a place to stash your cash, but as your business buddy, ready to lend a hand (and a few dollars) to help your dream blossom. They understand that small businesses are the heartbeat of our communities, the places where we grab our morning coffee, find unique gifts, and get that friendly face that remembers our order. And Regions wants to be part of that story.

Checking Accounts: Your Business's Daily Driver

First things first, every business needs a place to keep its money organized. Forget mixing your business earnings with your grocery money – that's a recipe for a headache you don't need! Regions Bank offers a few different flavors of business checking accounts. Some are perfect for those just dipping their toes in, with low fees and easy-to-use online tools. Others are a bit more robust, ready to handle a higher volume of transactions for when your business starts to really hum. Imagine it as having a dedicated piggy bank, but way more sophisticated and with fewer sticky fingers involved (unless you have a very enthusiastic team!).

One of the cool things is how easy they make it to manage your money. You can do a lot of your banking right from your phone or computer, so no more dashing to the bank in the middle of a busy lunch rush. It’s like having a super-powered teller in your pocket, ready to go whenever you are. And for the tech-shy, don't worry, the folks at Regions are known for being super helpful and patient. They’ll walk you through it, even if your idea of advanced technology is a well-oiled abacus.

Savings Accounts: The "Just In Case" Fund & Future Dreams Jar

Just like you might have a personal savings account for that unexpected vacation or a rainy day, your business needs one too. Regions Bank offers business savings accounts that are perfect for tucking away profits, setting aside money for taxes (the necessary evil!), or building up a fund for that big equipment upgrade you've been dreaming about. It's where your hard-earned money gets to relax and grow a little, like a well-deserved spa day for your business finances.

And sometimes, just seeing that savings balance creep up can be incredibly motivating. It’s a tangible reminder of your progress and a little nudge of encouragement for what’s to come. It’s like a secret stash of confidence, waiting to be used when you need it most.

Loans: When Your Seedling Needs a Little More Sunshine

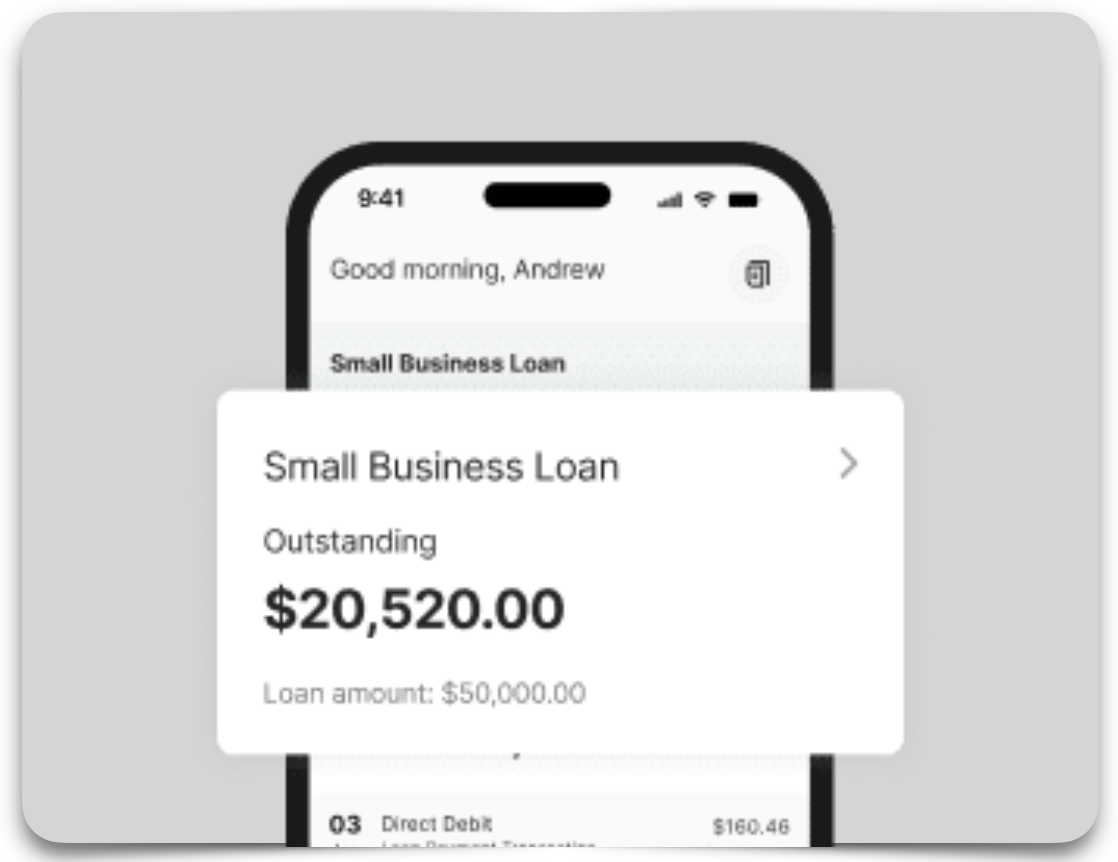

Now, let's talk about the big leagues: business loans. This is where Regions Bank really steps up to help your business grow. They have a variety of loan options, designed for different needs and stages of your business journey. It’s not a one-size-fits-all situation. Whether you need a little boost to buy more inventory, a bigger chunk to expand your storefront, or even a helping hand to get a new venture off the ground, Regions has solutions.

"It's amazing how a little bit of financial support can make a huge difference. It's like giving your business wings!"

One of the surprising things is how approachable the loan process can be with Regions. They don't just hand you a stack of confusing paperwork and leave you to fend for yourself. Their business bankers are there to listen to your story, understand your vision, and help you find the right loan that fits your specific situation. They’re like financial matchmakers, connecting your business needs with the perfect loan solution.

And here's a heartwarming part: many of these loans are designed with small businesses in mind. They understand the unique challenges and opportunities you face. So, whether you’re a bakery owner looking to buy a bigger mixer or a freelance graphic designer needing a new, super-fast computer, Regions Bank has likely seen something similar before and is ready to help you make it happen. It's a testament to their commitment to fueling local economies and supporting the entrepreneurial spirit.

Lines of Credit: Your Business's Flexible Friend

Think of a business line of credit as a flexible safety net or a handy credit card for your business. It’s a pre-approved amount of money that you can borrow from as needed, and you only pay interest on the amount you actually use. This is fantastic for managing cash flow fluctuations, those times when you have big expenses but the income hasn’t quite caught up yet. It’s your business’s secret weapon for staying afloat and thriving, even when things get a little bumpy.

Imagine you're running a seasonal business, and you need to stock up on supplies before your busiest months. A line of credit allows you to do just that, without having to come up with all the cash upfront. Once your sales pick up, you can pay back what you borrowed and have that credit line ready to go again. It’s like having a reliable friend who’s always there to spot you a little cash when you need it, no questions asked (well, okay, a few sensible questions, but you get the idea!).

The beauty of it is the flexibility. You're not locked into a large loan payment if you don't need it. You can draw from it, repay it, and draw again. It’s a dynamic tool that grows and adapts with your business, much like a skilled entrepreneur adapts to changing market demands. It’s a smart way to keep your business moving forward without being held back by unexpected financial dips.

So, whether you’re just starting out or looking to expand, Regions Bank has a whole toolbox of financial options designed to help your small business shine. They’re not just a bank; they're a partner, ready to invest in your dreams and help you write your own success story. And that, my friends, is something truly worth celebrating.