Release Of 4th Quarter 2023 Real Estate Statistics Ura: Complete Guide & Key Details

Alright, folks, gather 'round! It's that time of year again. You know, when the real estate world, which can sometimes feel like trying to herd cats while juggling flaming torches, finally coughs up its latest report card. We're talking about the URA's 4th Quarter 2023 Real Estate Statistics. Think of it as the housing market's yearly performance review, complete with all the nitty-gritty details that can make your head spin faster than a toddler discovering a new toy. But fear not, my friends! We're going to break this down, real estate jargon and all, into something you can actually digest over a cup of coffee (or something a little stronger, depending on how your own property dreams are faring).

So, what exactly is this URA thing? The Urban Redevelopment Authority, for those who’ve been living under a very comfortable, very un-developed rock. They’re the folks who keep tabs on all things property in Singapore, from the swanky high-rises to the humble HDB flats. And their quarterly reports? They're like the weather forecast for your wallet, especially if you're thinking about buying, selling, or just staring wistfully at property portals. It tells us whether things are heating up, cooling down, or just doing a bit of a confused shimmy.

Let’s dive headfirst into the 4th Quarter 2023 stats. Imagine the property market as a giant buffet. Last year, especially in the latter part, it felt like some dishes were flying off the shelves while others were gathering dust. The URA report aims to tell us exactly which dishes are popular and which ones are better left for a “buy one, get one free” sale.

First up, let's talk about the overall property price index. Think of this as the general mood of the market. Is it feeling optimistic, like it just aced an exam, or is it more like it’s trying to find matching socks after a laundry day gone wrong? For Q4 2023, the general vibe was one of steady growth. Not a wild, champagne-popping surge, mind you. More like a gentle, confident nod. It’s like seeing your favorite local eatery finally getting a fresh coat of paint – not a complete renovation, but definitely an improvement, and it makes you feel good about sticking around.

Now, let’s get specific, because the devil, as they say, is in the details. Or in this case, the property type. We’ve got the private residential properties, which are basically the caviar and champagne of the housing world. These are your condos, your apartments, the places where the gym is probably fancier than your living room. And guess what? Prices here saw a moderate increase in Q4 2023. It wasn't a "sold my kidney for a shoebox" kind of jump, but a respectable climb. It’s like that artisanal coffee you love – it’s a bit pricey, but you feel a certain satisfaction with every sip.

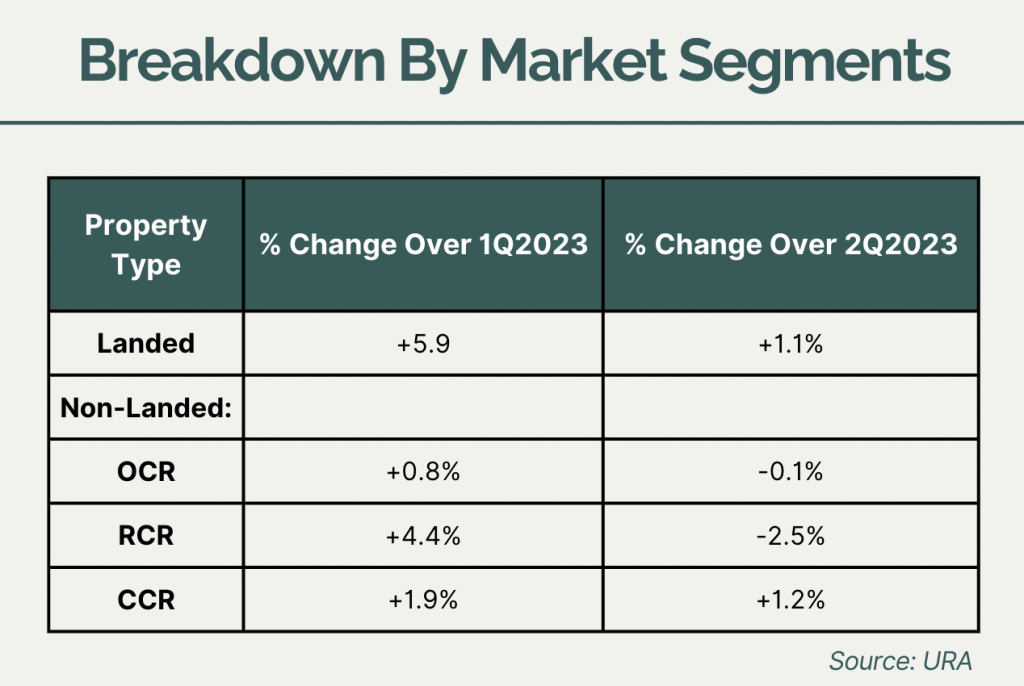

Within the private residential sector, there are further subdivisions, like breaking down a complex recipe into its individual ingredients. We’ve got non-landed properties. This is where the majority of us might be looking, or at least dreaming about looking. And within this, we have the different regions – the Core Central Region (CCR), the Rest of Central Region (RCR), and the Outside Central Region (OCR). Think of these as different neighborhoods, each with its own personality and price tag.

The CCR, the glitzy, prime areas. This is where you’d find properties that probably cost more than a small island. Prices here also showed a slight increase. It’s like the exclusive club that’s always full, but somehow, they still manage to let in a few more members who can afford the cover charge. They might not be having a wild party, but they’re definitely not shutting down the music.

Then we have the RCR, the “happening” zones, not quite as exclusive as the CCR, but still buzzing with life. Think of it as the trendy cafe district. And here, we saw positive price movements. Things are looking up! It's like finding out your favorite cafe is expanding to a bigger space – good news for everyone! People are still keen to be in these areas, and the market is responding accordingly.

And finally, the OCR, the heartland, the places where many Singaporeans actually live and thrive. These are your more accessible neighborhoods, the familiar streets you walk down every day. And in Q4 2023, the OCR also saw a healthy uptick in prices. This is great news because it means that even in the more affordable segments, there’s still a sense of value and demand. It's like discovering your favorite hawker stall is now offering a loyalty card – you get more bang for your buck!

Now, let’s not forget the landed properties. These are the landed houses, the ones with gardens and maybe even a small patch of grass you can call your own. These are often considered the crown jewels of the property market. And in Q4 2023, prices for landed properties also climbed. It’s like a classic car; it might be expensive, but its value tends to hold, and sometimes even appreciate, because there's a finite supply and a certain timeless appeal.

What’s driving this steady upward trend? A few things. For starters, there’s the ever-present demand for housing in Singapore. It’s a small island, folks, and everyone needs a roof over their head. It’s like trying to find a parking spot during a major festival – demand is always high!

Another factor is the resilience of the Singapore economy. Even when the global economy is doing the cha-cha-cha, Singapore often manages to keep its cool. This confidence trickles down into the property market. People feel more secure about their jobs and their finances, which means they’re more willing to make that big commitment of buying a home. It’s like knowing your favorite team is in good form; you’re more likely to place your bets on them.

And then there's the rental market. While the URA report focuses on sales, the rental market is also a good indicator of overall demand. If rents are high, it often means more people are looking to buy, or at least that there's a shortage of available units. The rental market in Q4 2023 was also quite active, which likely contributed to the sales figures.

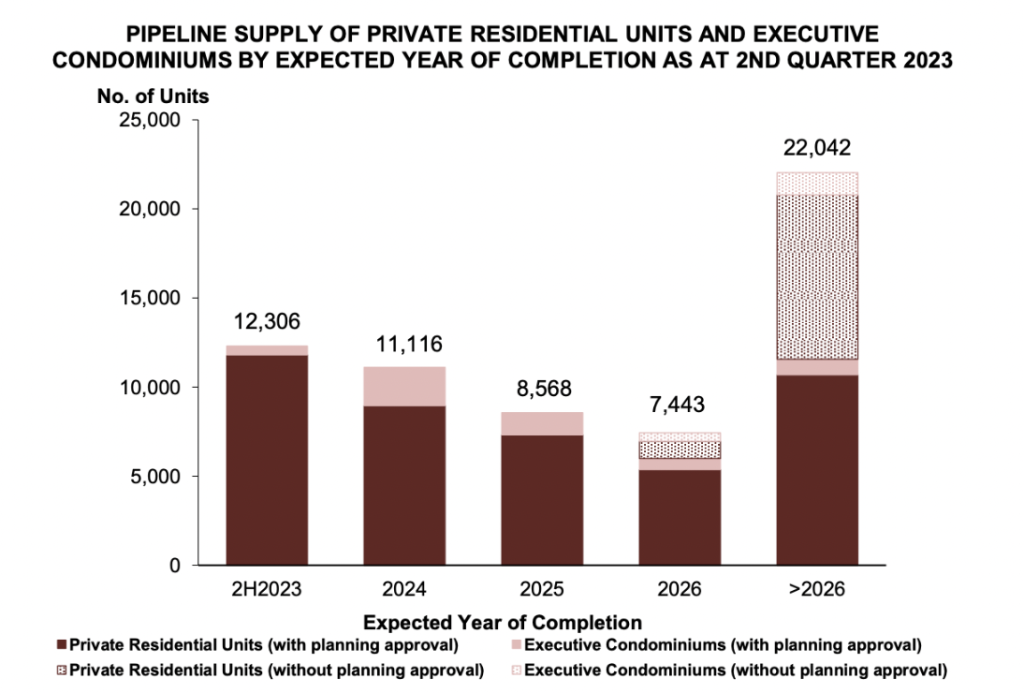

Now, for some of the more specific numbers that might make your eyes water if you’re not careful. The URA also tracks the number of new uncompleted private residential units launched and sold. Think of this as the pipeline of new homes coming onto the market. In Q4 2023, there was a significant number of units launched and sold. This indicates a healthy level of activity and confidence from developers, who are essentially betting on future demand. It’s like a bakery introducing a whole new range of pastries; they wouldn’t do it unless they thought people would buy them.

The take-up rates for these new launches were also quite good, especially for some of the more attractive projects. This means that when a new development hits the market, people are snapping up the units. It’s like when that limited-edition sneaker drops – people are lining up to get their hands on it!

However, and this is an important “however,” it’s not all smooth sailing. The URA report also touches on potential challenges. One of them is the rising interest rates. Remember how mortgage rates went up? That’s like the price of your favorite comfort food suddenly doubling. It makes people think twice, and it can cool down demand. So, while the market showed growth, it was likely a more measured growth than if interest rates were low.

Another factor is the government cooling measures. These are policies designed to prevent the market from overheating, like putting a lid on a boiling pot. While not drastically changed in this period, their presence always looms, reminding everyone to keep things in perspective. It’s like having a strict but fair teacher in class; they keep you in line, but they also help you learn.

Let’s talk about the rental market statistics in a bit more detail. The URA report showed a slowdown in the rate of rental increase in Q4 2023, compared to previous quarters. This is interesting. It means that while rents are still high, the pace at which they’re going up has eased. It's like when your favorite sports team is still winning, but not by as wide a margin as before. It’s still good, but you notice the change.

This slowdown in rental growth could be due to a few things. Perhaps more rental units have become available, or maybe some tenants are finding the high rents unsustainable and are looking for alternatives. It’s like a popular restaurant finally opening up a second branch, which can ease the pressure on the first one.

The report also provides details on vacancies. In Q4 2023, the vacancy rate for private residential properties remained relatively low. This is a sign that demand for housing, both for ownership and rental, is still strong. A low vacancy rate is like having a full house at a party; it means everyone’s engaged and having a good time.

So, what’s the takeaway from all these numbers? For Q4 2023, the URA statistics paint a picture of a stable and growing property market, particularly for private residential properties. Prices are inching up, new units are being snapped up, and the overall sentiment is one of cautious optimism. It’s not a market that’s screaming for attention, but it’s one that’s quietly confident and holding its ground.

If you’re a buyer, this means you’re likely facing a market where prices are not plummeting, so it might be a good time to consider your options if you’ve been waiting. But remember those rising interest rates! It’s like choosing a restaurant; you want good food, but you also need to check the price and the menu carefully.

If you’re a seller, the report suggests there’s still demand out there, but the days of "sell at any price" might be over. You need to be realistic about your pricing and understand the market conditions. It’s like selling your prized possessions; you know what they’re worth, but you also need a buyer who appreciates them.

For renters, the easing of rental growth is good news, but it’s important to remember that rents are still at a high level. It’s like getting a slight discount on a very expensive item; it’s better than nothing, but it’s still a significant cost.

The URA report is a valuable tool, like a compass for navigating the often-uncharted waters of the real estate market. It provides data, trends, and insights that can help you make more informed decisions. It’s not a crystal ball, but it’s certainly better than flipping a coin!

So, as we wrap up our little dive into the URA's 4th Quarter 2023 Real Estate Statistics, remember that the property market is always a dynamic beast. It’s influenced by economic factors, government policies, and, of course, the collective aspirations of everyone looking for a place to call home. The numbers tell a story, and for Q4 2023, the story was one of steady progress and sustained interest. Now, go forth and ponder, armed with a little more knowledge and perhaps a renewed appreciation for the complexities of our urban landscape!