Rising Strait Of Hormuz Shipping Costs Amid Us-iran Tensions: Price/cost Details & What To Expect

Hey there, curious cats and armchair geographers! Ever wonder what it takes to get all that oil and gas from the Middle East to our pumps and power grids? It’s a pretty complex dance, and a major stage for this dance is a super narrow sliver of water called the Strait of Hormuz. Think of it like a tiny, but incredibly important, traffic jam point for global trade. And lately, this little watery highway has been getting a whole lot more interesting (and expensive!).

So, what’s the buzz? Well, as you might have picked up from the news (or just a general feeling in the air), things have been a bit tense between the United States and Iran. And when that happens, especially around such a crucial shipping route, you can bet it's going to shake things up. It’s like when your favorite coffee shop gets a new, super strict barista – suddenly, everything takes a little longer, and maybe costs a smidge more for that extra careful pour, right?

The Strait Stuff: Why Does Hormuz Matter So Much?

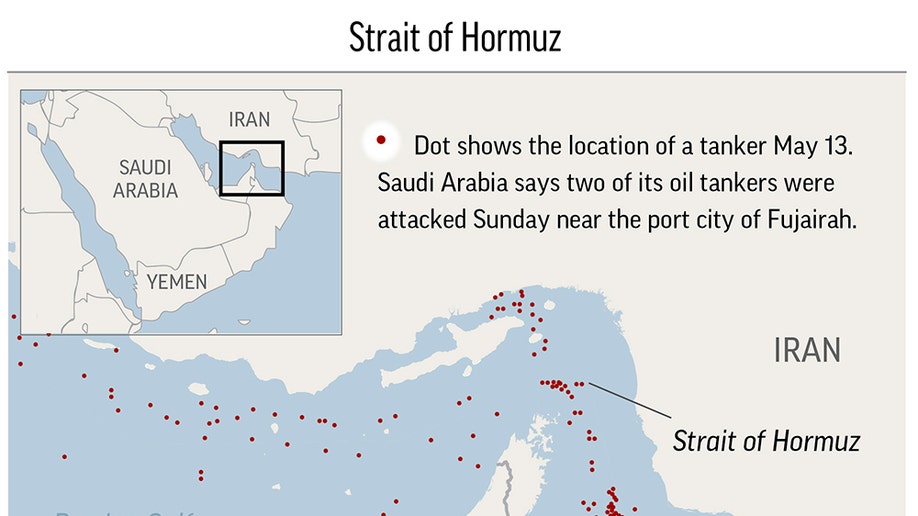

Let’s break down why this particular strait is such a big deal. The Strait of Hormuz is, quite literally, a chokepoint. Imagine a bottle with a very, very thin neck. That’s the Strait for ships carrying oil. A massive chunk of the world’s oil supply passes through it every single day. We’re talking millions of barrels. If you’re fueling up your car, heating your home, or powering your factory, there’s a good chance that energy started its journey somewhere near Hormuz.

It’s situated between the Persian Gulf and the Gulf of Oman, acting as the sole sea passage for many of the world’s largest oil producers, including Saudi Arabia, Iran, the UAE, and Qatar. So, when this waterway gets a bit choppy, it’s not just a local issue. It’s a global ripple effect, kind of like when one person in your group chat suddenly decides to start a dramatic debate and everyone else feels the pressure!

The Tension Tangle: US-Iran Vibes and Shipping Costs

Now, about those US-Iran tensions. Without getting too deep into the political weeds (because we’re here for the chill vibes and the cool economics, remember?), increased friction between these two countries can lead to heightened security concerns in the region. When there are worries about potential disruptions – think naval standoffs, mine threats, or even just increased patrols – the people running those massive oil tankers start to get a little antsy.

And what happens when you’re running a business that involves high-stakes journeys and potential risks? You factor those risks into your pricing. It’s a bit like adding a "stress tax" to the cost of doing business. Ships carrying oil through the Strait of Hormuz have to navigate these waters, and if the security situation looks dicey, the companies that own and operate these ships will likely see their insurance premiums go up. More insurance means more cost, and guess who ultimately ends up footing that bill? Yep, you and me, when we buy that gas or pay for that electricity.

Price Tags and Pockets: What Are We Talking About?

So, let’s get down to brass tacks. How much more are we actually talking about? It’s not always a simple, straightforward number, as shipping costs are influenced by a gazillion factors. But when tensions flare in the Strait of Hormuz, you can typically see a few key indicators start to climb.

One of the main things to look at is the cost of insuring these oil tankers. When the risk goes up, so does the price of that insurance. This can translate into a significant increase in the daily operating costs for a tanker. Think of it like upgrading your basic phone plan to one that includes premium international roaming – it’s essential if you need it, but it’s definitely going to cost you more each month.

Another factor is the freight rates themselves. These are the prices charged to physically move the oil from one place to another. If fewer ships are willing to brave the Strait, or if they have to take longer, more circuitous routes to avoid potential danger (which is rare, but the threat of it is enough), then the demand for available shipping capacity increases. And you know what happens when demand goes up and supply stays the same? Prices tend to soar.

While exact figures can fluctuate wildly, some reports have indicated that the cost of insuring a tanker passing through the Strait can increase by tens of thousands of dollars per voyage during periods of heightened tension. And freight rates? They can see similar percentage increases. It’s like when a popular concert ticket goes on sale – everyone wants one, and the price reflects that scarcity and demand.

What To Expect: The Ripple Effect on You

So, what does all this mean for the average person, the one who’s just trying to get through their day? Well, it’s not a direct, in-your-face increase every single time. It's more of a gradual, underlying pressure. Think of it like the price of ingredients for your favorite meal slowly creeping up at the grocery store. You might not notice it on a single apple, but over time, your grocery bill starts to look different.

For starters, you’ll likely see slightly higher prices at the gas pump. This is probably the most direct impact most people will feel. The cost of crude oil is a major component of gasoline prices, and if it costs more to get that oil to the refinery, the price of the final product will reflect that.

Beyond gasoline, these increased shipping costs can also contribute to higher prices for other goods. Remember, oil isn't just for your car. It's a vital component in the production of plastics, fertilizers, and countless other products we use every day. If it costs more to transport the raw materials for these items, those costs can eventually trickle down to the shelves in your local store.

Additionally, the economic stability of regions reliant on oil exports can be affected. If shipping becomes too risky or too expensive, it can impact the economies of countries that depend on selling their oil. This, in turn, can have broader global economic consequences that we all feel in some way.

The Big Picture: More Than Just Oil

It’s fascinating, isn’t it? How a seemingly small strip of water, coupled with geopolitical nudges, can have such a profound impact on our daily lives. It’s a testament to how interconnected our world really is. The Strait of Hormuz isn't just a shipping lane; it’s a vital artery of the global economy, and its health directly affects the well-being of countless economies and individuals around the globe.

So, the next time you’re filling up your tank, take a moment to think about that little strait. Think about the massive tankers, the intricate dance of global trade, and the subtle (and sometimes not-so-subtle) ways that international relations can influence the price you pay for everyday things. It’s a reminder that even the most seemingly distant events can have a very close-up impact. It's a complex world out there, but understanding these little-known connections makes it all a bit more interesting, wouldn't you say?