Should I Move 401k To Bonds

Hey there, financial explorers! Ever stare at your 401(k) statement and feel a little bit like you're trying to decipher ancient hieroglyphics? You're not alone. We all have that nest egg growing (or sometimes, just sitting there), and then comes the big question: "Should I move my 401(k) to bonds?" It sounds super grown-up, right? Like something you'd discuss over artisanal cheese and quiet jazz. But honestly, it's a question that can pop up for any of us, whether we're 25 or 55, and it’s worth understanding a bit more.

Think of your 401(k) as your personal retirement piggy bank. For a long time, you've probably been chucking money into it, and it's been invested in a mix of things. Usually, there’s a good chunk in stocks – those exciting, sometimes roller-coaster rides of company ownership. Stocks can offer some fantastic growth potential, like finding a hidden gem at a flea market that turns out to be worth a fortune. But, they can also be a bit… unpredictable. Imagine you're planting a garden. Stocks are like those ambitious tomato plants that promise juicy, ripe tomatoes, but sometimes a late frost or a pesky aphid can cause a bit of a setback.

Now, let’s talk about bonds. If stocks are the adventurous explorers of your portfolio, bonds are more like the steady, reliable librarians. They're essentially loans you make to governments or corporations. In return for lending them your money, they promise to pay you back with interest over a set period. It's like lending your neighbor a cup of sugar – they promise to return it, maybe with a little extra for your kindness. Bonds are generally considered less risky than stocks. They’re not going to skyrocket in value overnight, but they’re also less likely to plummet.

So, Why the Big Talk About Moving to Bonds?

This question usually surfaces for a few key reasons. The most common one is risk tolerance. Remember that garden analogy? If you're someone who frets over every wilting leaf and can't sleep if there's a single aphid in sight, you might be starting to feel a bit anxious about the stock market's ups and downs. Bonds offer a more predictable income stream and are generally more stable. It’s like switching from those ambitious tomatoes to a reliable crop of potatoes – less flashy, but consistently there.

Another biggie is your age and proximity to retirement. This is a really important one, so let’s dive in. When you're young and just starting out, you have a long runway ahead. That means you can afford to take on a bit more risk with your investments. If the stock market dips, you have years to recover. Think of it as having a lot of time to learn to ride a bike. You might wobble and fall a few times, but you’ve got plenty of time to get back up and keep pedaling. Your 401(k) can afford to be in those growth-oriented stocks because there's time for them to grow and for any downturns to be smoothed out.

But then, as you get closer to retirement – maybe you’re in your 50s or even early 60s – that runway starts to get shorter. The thought of a major market crash right before you need to start drawing income from your savings can be pretty terrifying. It’s like suddenly realizing you have to be at your destination in 10 minutes when you’re still 30 minutes away. You might want to slow down, take a more direct route, and avoid any potential traffic jams. That’s where bonds come into play. Shifting more of your 401(k) into bonds can help preserve your capital. It's about protecting the money you've worked so hard to save, ensuring it’s there when you need it, without the dramatic swings that stocks can sometimes bring.

Imagine you’ve saved up a substantial amount for a down payment on a house. You wouldn't want to invest that money in something super volatile right before you need it, would you? You’d probably opt for something safe and steady, like a high-yield savings account. Moving 401(k) money into bonds as retirement approaches is a similar concept – it’s about prioritizing safety and stability when the finish line is in sight.

What's the Catch? (Because There's Usually a Catch)

While bonds offer stability, they also typically offer lower potential returns compared to stocks over the long run. Remember those high-flying tomato plants? They have the potential for a bigger harvest than your reliable potatoes. If you shift all your 401(k) to bonds too early, you might miss out on significant growth opportunities. It’s like choosing to only eat plain oatmeal for breakfast every single day when there are delicious pancakes and waffles out there waiting for you. You’ll be fed, sure, but you might be missing out on some culinary joy.

Another thing to consider is interest rate risk. When interest rates go up, the value of existing bonds (especially those with lower fixed rates) can go down. It’s a bit like when new models of your favorite gadget come out – the older ones can lose some of their resale value. However, for many, the stability offered by bonds outweighs this risk, especially when viewed as part of a diversified portfolio.

So, What's the Verdict?

The truth is, there's no one-size-fits-all answer. This isn't like deciding whether to have pizza or tacos for dinner (though that’s a tough decision too!). It's highly personal. Factors like your age, your financial goals, your comfort with risk, and your overall financial situation all play a huge role.

For younger folks, a heavier allocation to stocks usually makes sense. It’s about building wealth over the long haul. Think of it as planting a forest – it takes time, but the potential rewards are massive.

As you get older and closer to retirement, gradually shifting towards a more conservative mix, including bonds, is a common and often wise strategy. It’s about protecting what you've built. This is often referred to as "de-risking" your portfolio.

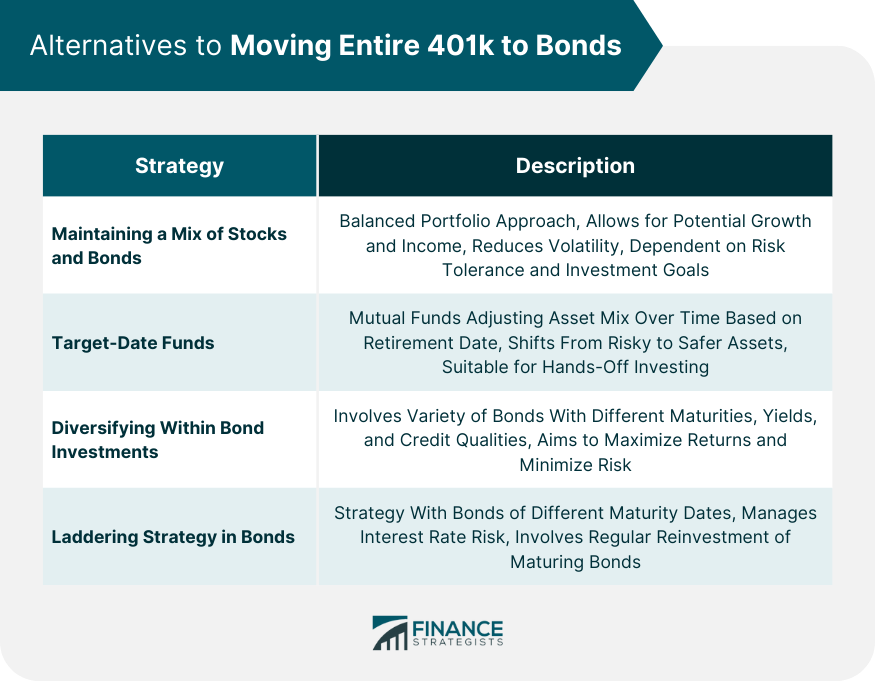

It's also rarely an all-or-nothing situation. Most people don't just have all stocks or all bonds. They have a mix. This is called diversification, and it's the financial world's version of "don't put all your eggs in one basket." A diversified portfolio can include a blend of stocks, bonds, and other investments to balance risk and return. Think of it like a well-stocked pantry – you have a little bit of everything, so you’re prepared for any mealtime need.

The best thing you can do is to take a moment, look at your own situation, and perhaps even chat with a trusted financial advisor. They can help you understand your options and create a plan that feels right for you. It's your money, and it's your future. Making informed choices now can make a world of difference later. So, don't be intimidated! A little understanding goes a long way in ensuring your retirement piggy bank is as happy and healthy as possible.