S&p 500 Performance Unpredictable Following Presidential Elections: Complete Guide & Key Details

So, you're curious about what happens to the big stock market, the S&P 500, after a presidential election? It's like trying to guess what your favorite superhero will do next – sometimes surprising, sometimes a bit of a rollercoaster!

Think of the stock market as a giant party. Everyone's buzzing, sharing news, and making decisions about where to put their money. Elections are like the ultimate party planner for this gathering, and their decisions can send ripples through the crowd.

People often assume that a certain president or party will be a guaranteed win for stocks. It's a nice, neat idea, isn't it? But as we'll see, reality loves to throw a curveball.

The Big Election Buzz

Every four years, the United States picks a new leader (or sometimes keeps the old one!). This is a huge deal, and the whole world watches. Businesses, big and small, also tune in very closely.

They're trying to figure out what the future might hold. Will taxes change? Will new rules be put in place? These are the kinds of questions that make business owners a little nervous or very excited.

And when businesses get nervous or excited, it can definitely make the S&P 500 do a little dance. Sometimes it’s a jig, sometimes it’s a more cautious shuffle.

When the Market Gets Jitters

You might think that after the election is over, things would calm down. Phew, right? Not always!

Sometimes, even after the winner is declared, the stock market can act a bit like a kid on sugar rush. It bounces around, not quite sure what to do with all the new information.

It's as if the market is saying, "Okay, new boss, what's the plan?" and it's waiting for all the details, which can take time to unfold.

The "What If" Game

A big part of the unpredictability comes from all the "what ifs" leading up to the election. People are trying to guess who will win and what policies they'll enact.

This guessing game can cause the market to move a lot, even before election day. Think of it like a race where everyone is betting on different horses, and the odds keep changing!

Investors are constantly trying to get ahead of the game, and sometimes they get it right, and sometimes they get it hilariously wrong.

Surprising Ups and Downs

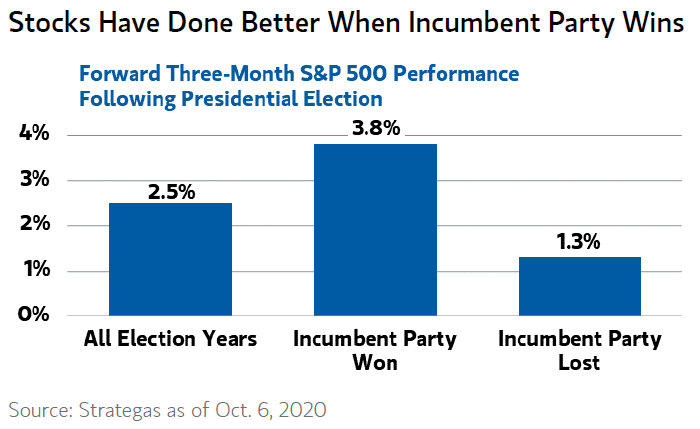

Here’s where it gets really interesting, and sometimes a little funny. You might expect the market to go up when your preferred candidate wins, or down when the other one does. But the S&P 500 doesn't always follow our personal cheers.

History shows us that the stock market can sometimes do the opposite of what many people expect. A president that was supposed to be bad for business might see the market soar, and vice versa!

It’s like ordering your favorite meal and being served something completely different, but then finding out you actually like it even more!

Looking at the Past

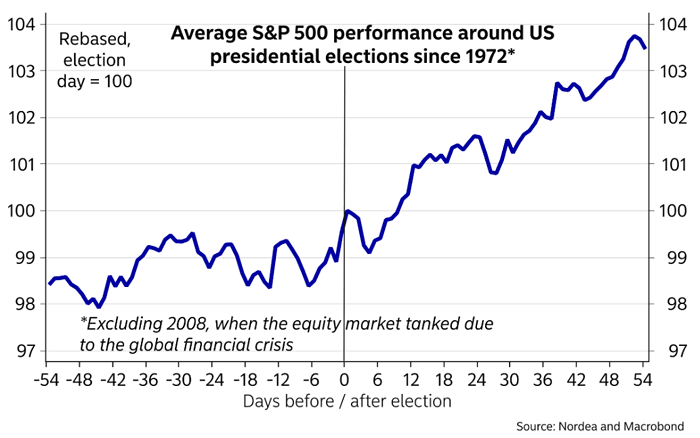

To understand this, we can look back at past elections. It's like peering through an old photo album to see how things played out before.

For example, after some elections, the market has had a "honeymoon" period where it did very well. Other times, it has been a bit more sluggish, taking its sweet time to decide how it feels.

There’s no simple rule that says, "If President X wins, the S&P 500 will do Y." It’s more like a complex recipe with many ingredients.

The "Sell the News" Phenomenon

Have you ever heard of "selling the news"? It's a real thing in the stock market world!

Sometimes, all the excitement and anticipation before an election causes the market to move in a certain direction. Then, when the actual news (the election result) happens, people who were already in the market might decide to sell and take their profits.

It’s like everyone rushing to buy a hot new toy before Christmas, and then on Christmas day, they start reselling them!

Key Details to Remember

So, what are the main takeaways from all this election-stock market chatter? Firstly, don't get too fixated on predicting the outcome based on who wins.

The market is influenced by so many things – global events, company profits, interest rates, and, yes, elections. It’s not just one single driver.

Secondly, the short-term reaction might not tell the whole story. Sometimes, the market needs a few months or even a year to really settle into a new "normal" after a presidential shift.

Why It's Not Always Predictable

One of the biggest reasons for unpredictability is that nobody, not even the smartest investors, has a crystal ball.

There are always unexpected events that can pop up and change the direction of the economy and, by extension, the stock market. A new global health crisis, a major natural disaster, or a sudden technological breakthrough – these can all have a bigger impact than an election.

It's like trying to plan a picnic during hurricane season – you can plan all you want, but Mother Nature might have other ideas.

The Long-Term Picture

While short-term fluctuations are common, many people look at the S&P 500's performance over much longer periods, like 4, 8, or even 10 years.

When you zoom out and look at these longer stretches, you often see that the market tends to grow over time, regardless of who is in the White House.

It's a bit like watching a plant grow. There will be sunny days and rainy days, but over the seasons, the plant usually keeps getting taller.

What About Your Investments?

If you're an investor, this might make you think twice about making drastic changes to your portfolio based solely on election news.

It's generally wiser to have a long-term investment plan and stick to it, rather than trying to time the market based on who is leading the country.

Think of it as building a sturdy house. You wouldn't knock down walls every time the weather forecast changes, would you?

The Human Element

Ultimately, the stock market is made up of millions of people making decisions. And humans, as we know, can be quite emotional and unpredictable!

Fear, excitement, hope, and even just plain old habit can all influence how people invest their money.

So, the S&P 500's dance after an election is a fascinating mix of economic policies, global events, and, well, the quirky, wonderful, and sometimes bewildering behavior of us humans.

The most important thing to remember is that trying to predict the stock market based on presidential elections is a bit like trying to predict the weather for next year. It's a fun thought experiment, but don't bet your farm on it!

Instead of getting caught up in the daily ups and downs, focus on understanding your own financial goals and building a strategy that makes sense for you. The election will happen, the market will react, and life will go on, likely with plenty more surprising twists and turns along the way!