The Nominal Interest Rate Minus The Expected Rate Of Inflation: Complete Guide & Key Details

Alright, gather 'round, folks, and let me tell you a tale. It's a tale as old as time, or at least as old as pocket calculators and the existential dread of checking your bank balance. We're talking about something that sounds way more complicated than it is, like a fancy French pastry with a secret ingredient that turns out to be… well, flour. We're diving deep into the magnificent, the mysterious, the utterly crucial: the Nominal Interest Rate Minus The Expected Rate Of Inflation. Yeah, I know, sounds like a secret handshake for accountants. But stick with me, because understanding this is like finding out Santa Claus is real and he gives you stock tips.

Imagine you’ve got a shiny new dollar bill. You’re feeling good. You decide to put it in your piggy bank, dreaming of the day it’ll multiply. Your bank, bless its cotton socks, offers you a sweet little deal: 5% interest. Woohoo! That means your dollar will magically become $1.05 in a year. That 5%? That's your nominal interest rate. It's the headline number, the big flashy sign on the front of the bank, the promise of more money without you having to, you know, earn it by doing something strenuous like lifting heavy things or talking to Brenda from HR.

But hold your horses, moneybags. The world is a funny place, and sometimes, while your money is busy doing its little interest-generating dance, the prices of things are doing a jig of their own. Remember the good old days when a loaf of bread cost, like, a nickel? (Okay, maybe not that old, but you get the drift). That's where inflation waltzes onto the dance floor. Inflation is basically the sneaky process where your money starts buying less stuff. It’s like your dollar is shrinking, not in size, but in its ability to snag that delicious pizza or that ridiculously overpriced avocado.

Now, here's where the plot thickens, like a good gravy. That 5% nominal interest rate sounds pretty sweet, right? But what if, while your money was chilling and earning its 5%, the price of everything else shot up by, say, 3%? That means your $1.05 now buys you roughly the same amount of stuff as your original $1.00 did a year ago. It’s like you ran a marathon but ended up at the same starting line. This is where the real interest rate, our hero of the story, swoops in to save the day.

The Magic Formula Revealed! (Drumroll Please)

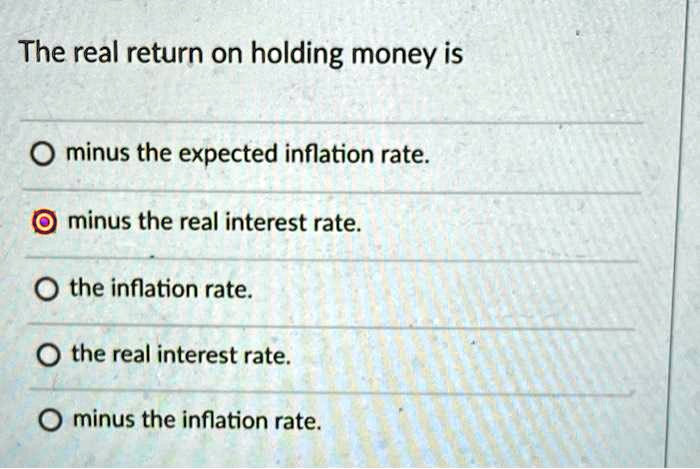

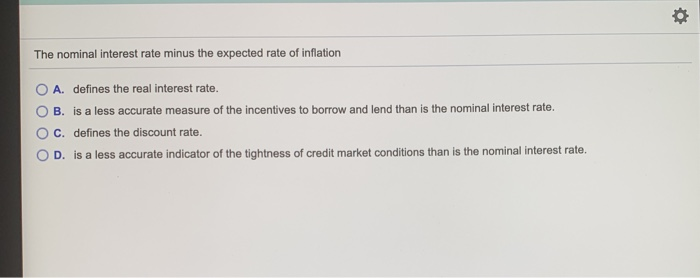

So, what's this magical subtraction we're talking about? It's simple, really. You take your nominal interest rate and you subtract the expected rate of inflation. Ta-da! What you're left with is the real interest rate. This is the actual increase in your purchasing power. It's the true gain you've made. It’s the icing on the cake, not just the slightly stale sponge underneath.

Think of it like this: If your nominal rate is 5% and you expect inflation to be 3%, your real interest rate is 5% - 3% = 2%. That 2% is the real boost to your buying power. You’re genuinely richer by that amount, not just nominally richer. It’s the difference between feeling like you’ve won the lottery and feeling like you’ve just found a slightly less crumpled dollar bill in your old jeans.

Why Should You Care About This Financial Jargon?

You might be thinking, "This is all well and good, but I'm more concerned with whether my streaming subscription is going to increase next month." And you’re right! But understanding the real interest rate helps you make smarter decisions. It’s the difference between investing in something that’s just keeping pace with inflation and something that’s actually making you wealthier.

Imagine you have two investment options. Option A offers a 4% nominal interest rate, and you expect inflation to be 3%. That’s a real return of 1%. Not exactly a rocket ship to early retirement, is it? Option B offers a 6% nominal interest rate, and you expect inflation to be 3%. That’s a real return of 3%! Suddenly, Option B is looking a lot more attractive. It’s the difference between your money slowly trudging along and your money doing a little happy dance.

And it’s not just about saving. It’s about borrowing too! If the nominal interest rate on a loan is high, but inflation is also sky-high, the real cost of borrowing might be lower than you think. It's a bit counterintuitive, like finding out that eating an entire pizza is actually good for your cholesterol (spoiler: it's not). If you borrow money when inflation is high, you're essentially paying back the lender with money that's worth less. Clever, right?

A surprising fact: During periods of very high inflation, like some countries have experienced, the real interest rate can actually be negative. This means your money is losing purchasing power even if you're earning some nominal interest. It's like trying to fill a leaky bucket with a teacup. No matter how hard you try, you're losing water.

The "Expected" Part: Where Things Get Dicey

Now, here's the kicker. The "expected" part of the expected rate of inflation. This is where things get a bit like trying to predict the weather in a hurricane while wearing a blindfold. Nobody really knows what inflation will be in the future. Economists have fancy models, they look at trends, they consult ancient scrolls, but at the end of the day, it's an educated guess. A very, very educated guess, usually. Sometimes it's right, sometimes it's as wrong as wearing socks with sandals to a black-tie event.

So, when we talk about the real interest rate, we're often talking about the ex-ante real interest rate (that's fancy talk for "before it happens"). This is based on your expectation of future inflation. Then there’s the ex-post real interest rate (fancy talk for "after it happened"), which is calculated using the actual inflation that occurred. The ex-ante is what you use to make decisions now, and the ex-post is what you use to see how well your predictions (and your investments) actually panned out.

Think of it as planning a surprise party. You have an expected outcome (everyone jumps out and cheers!). But the actual outcome might be someone showing up late, or the cake collapsing, or your cat deciding to wear the party hat. The ex-ante is the dream, the ex-post is the messy, glorious reality.

So, the next time you see an interest rate advertised, don't just get dazzled by the big number. Remember the sneaky inflation monster. Do a quick mental calculation: Nominal rate minus expected inflation. That's your real prize. It’s the true measure of whether your money is working for you or just politely taking a nap. And in the grand, often bewildering, world of finance, that little bit of clarity is worth more than gold… or at least more than a really good cup of coffee. And we all know how much that's worth, right?