Truist Bank Jumbo Cd Rates Today Near Me

Alright folks, pull up a chair, grab your latte (or your decaf chai, no judgment here!), and let's talk about something that might sound about as exciting as watching paint dry: Jumbo CD rates at Truist Bank, like, right now, near us. I know, I know. You're thinking, "Is this going to be another dry lecture on compound interest and amortization schedules?" Fear not, my friends! We're going to tackle this financial beast with all the grace and humor of a squirrel trying to hoard a whole pizza.

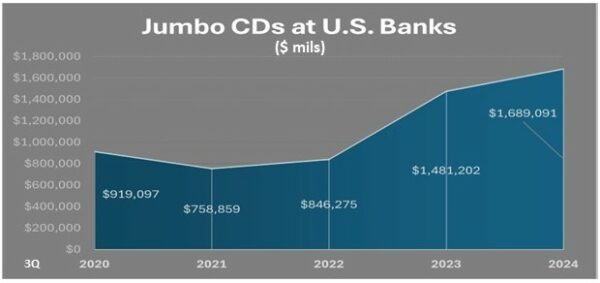

So, what exactly is a Jumbo CD? Think of it as a CD, but like, a really, really big CD. We're talking serious dough, the kind of money that makes your piggy bank weep with envy. Usually, you're looking at deposits of $100,000 or more to snag this "jumbo" status. And why would you want to do that? Well, my intrepid savers, because often, with great big deposits comes… great big rates! It’s like getting a VIP pass to the money party.

Now, the “near me” part is where things get interesting. Truist Bank, bless their organized little hearts, has branches all over the place. So, “near me” could mean your cozy corner coffee shop’s vicinity, or it could mean, you know, somewhere vaguely in the same time zone. The good news is, thanks to the magic of the internet, you don’t need to put on your explorer’s hat and trek through the wilderness to find out what Truist is offering. You can do it from the comfort of your sofa, probably while wearing pajamas that haven't seen daylight in weeks. (Again, no judgment.)

Here’s the real kicker: Jumbo CD rates are like a shy celebrity. They don’t always shout their numbers from the rooftops. They can be a bit elusive, fluctuating more than a toddler’s mood during a toy store visit. What you see today might be a distant memory by tomorrow. So, if you’re eyeing a particularly juicy rate, it’s kind of like spotting a unicorn – you should probably try to capture it before it gallops away into the financial sunset.

Let’s talk about why you’d even consider this. You’ve got a pile of cash, maybe from a windfall, a smart investment that paid off like a lottery ticket, or perhaps you’ve been diligently saving every single penny you found under your sofa cushions. Whatever the origin story, that money is just sitting there, looking a bit… bored. A Jumbo CD offers it a chance to earn a little bit of extra fun money while it chills out.

:max_bytes(150000):strip_icc()/bestjumbocdrates-32f1e698243b451aaa1575a1cdfa4a62.jpg)

Think of it this way: if your money was a person, a regular savings account would be like them lounging on the couch watching reality TV. A Jumbo CD is like them going on a well-deserved, all-expenses-paid vacation to a tropical island. They’re still relaxing, but they’re coming back with a tan and a better story to tell. And the “tide” in CD is kind of like the tide on that island – it brings in new treasures (interest!).

So, how do you actually find these elusive Truist Jumbo CD rates “near me”? It’s not as complicated as assembling IKEA furniture, I promise. Your first stop should absolutely be the official Truist Bank website. Think of it as the treasure map. They’ll usually have a section dedicated to “Savings” or “CDs.” Navigate your way there, and you should find information on their various CD offerings, including the jumbo ones.

Now, a little insider tip from your friendly neighborhood money storyteller: sometimes the best rates aren't the most obvious ones. Banks, in their infinite wisdom, might offer slightly different rates depending on the specific term length (how long you lock your money away) or if you’re a loyal Truist customer already. So, don’t just look at the first number you see. Poke around a bit. See what happens if you click on different term lengths, like 6 months, 1 year, or even those marathon 5-year CDs that feel like you’re committing to a long-term relationship with your money.

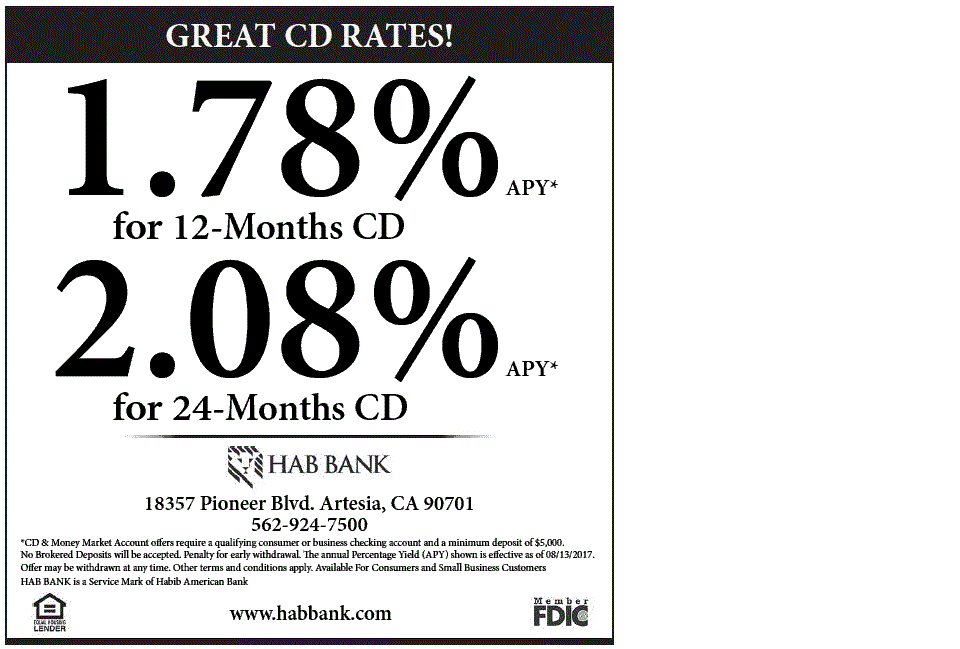

Another crucial piece of the puzzle is APY – Annual Percentage Yield. This is your magic number. It tells you the real return on your investment over a year, taking into account compounding. A higher APY means your money is working harder for you, like a caffeinated intern. Make sure you’re comparing APYs, not just the simple interest rate, to get the most accurate picture.

And let's not forget the "near me" aspect again. While the website will give you national rates, if you're keen on the absolute latest, hyper-local, "I can see it from my window" rates, you might need to give your local Truist branch a call. Imagine this: you dial, a friendly voice answers, and you casually ask, "So, about these jumbo CDs... are we talking 'buy a small island' good, or just 'upgrade my avocado toast' good?" They’ll probably chuckle and then give you the specifics.

A surprising fact for you: did you know that the concept of Certificates of Deposit has been around since the early 20th century? So, while we’re talking about fancy digital rates today, the idea of locking away your money for a better return is older than your grandma's favorite armchair! It’s a tried-and-true method, just with way better technology now.

Now, a word of caution, and this is important, folks. Jumbo CDs are not a get-rich-quick scheme. They are about steady, predictable growth for your larger sums of money. You’re sacrificing immediate access to your funds for a guaranteed return. It’s like agreeing to a delightful but firm handshake with your money. You know it’s there, it’s safe, and it’s going to do its thing.

What else should you be aware of? Early withdrawal penalties. If you break the CD contract before the term is up, it’s like trying to snatch your money back mid-vacation. Truist, like all banks, will have a penalty for that. So, make sure the money you put into a Jumbo CD is money you can afford to leave untouched for the agreed-upon duration. It’s like packing for a trip – you wouldn’t pack your toothbrush if you knew you weren’t going to brush your teeth for a month!

So, to recap our little financial adventure: Truist Jumbo CD rates today near me are best found by hitting their website first. Then, if you're feeling particularly investigative, a call to your local branch can’t hurt. Keep an eye on the APY, understand the term lengths, and remember that this is for funds you won't need in a hurry. It's a solid option for making your bigger savings work a little harder, without the roller-coaster ride of the stock market.

And who knows? With a good Jumbo CD rate, you might just find yourself with enough extra cash to finally buy that solid gold coffee mug you’ve been eyeing. Or, you know, pay your rent. Whatever floats your boat, or, in this case, whatever makes your money grow a little bit more. Happy saving, my friends!