Trump Executive Order Raises Alarm Over Womens Financial Independence: Complete Guide & Key Details

Hey everyone! So, you know how sometimes you hear about something happening in the news, and it sounds super official and maybe a little scary, but you're not quite sure what it actually means for you? Well, that’s what we’re diving into today with a recent Executive Order from former President Trump that’s been making some waves, especially when it comes to something as crucial as women’s financial independence. It sounds like a mouthful, right? But trust me, it’s worth untangling because it touches on things we all care about, even if it’s not always at the forefront of our minds. Think of it like this: have you ever had to manage your household budget, or maybe help a friend figure out their finances? This is kind of like that, but on a bigger, more governmental scale.

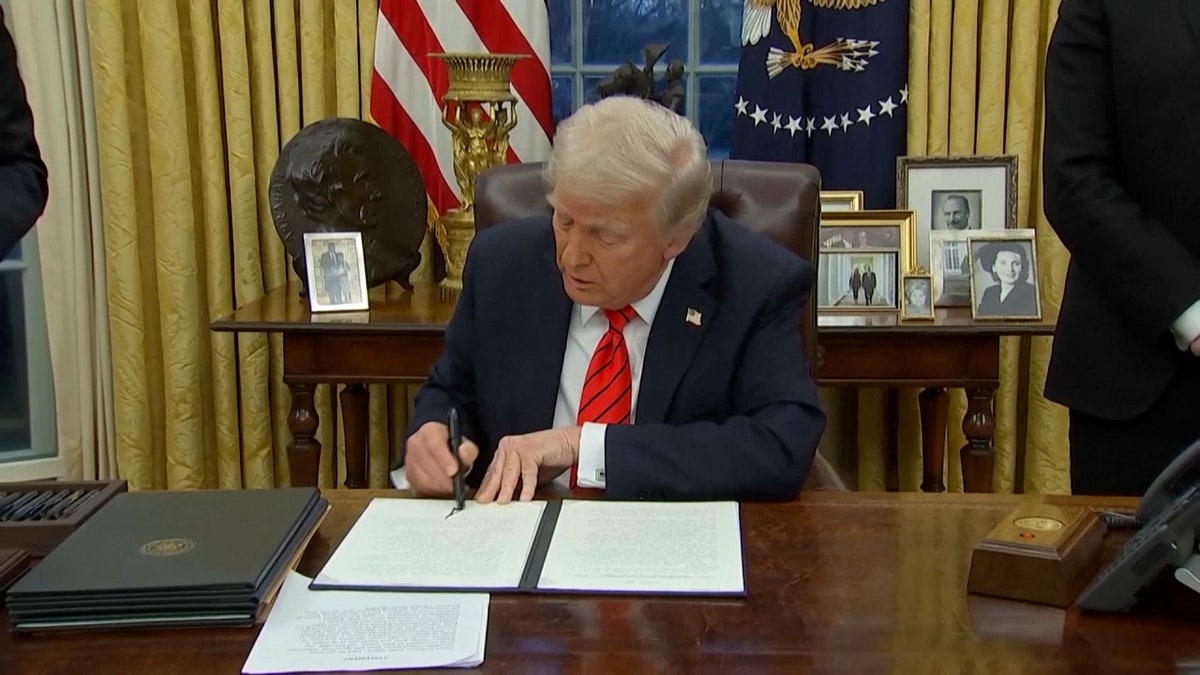

Let’s break it down, nice and easy. This particular Executive Order, signed back in 2017, was all about “Promoting Affordable Childcare and Eldercare.” Now, on the surface, that sounds pretty great, doesn't it? Who doesn't want more affordable ways to take care of our little ones or our aging parents? These are things so many of us deal with every single day. You know that feeling when you're juggling work, the kids' soccer practice, and trying to make sure Grandma has her medication on time? It’s a lot! The idea behind the order was to explore ways to make these essential caregiving services more accessible and less of a financial burden for families.

So, What’s the Big Deal About Women’s Financial Independence?

Okay, so you might be wondering, "How does childcare and eldercare connect to women’s financial independence?" This is where it gets really interesting, and honestly, a little concerning for some folks. Historically, and even still today, women often bear a larger share of caregiving responsibilities. It’s just a reality for a lot of families. This can mean taking time off work, reducing hours, or even stepping out of the workforce entirely to care for children or elderly relatives. Think of a friend who had to put her career on hold because the cost of childcare was more than she was earning. It’s a tough choice many women face.

When affordable, accessible childcare and eldercare are not readily available, it disproportionately impacts women’s ability to participate fully in the workforce, advance in their careers, and build their own financial security. If you can’t afford to work because childcare costs are through the roof, or if you have to leave a job to care for a parent, it directly affects your paycheck, your savings, and your long-term financial future. It’s like trying to run a race with a huge weight tied to your ankle – it’s a lot harder to get ahead.

The Nitty-Gritty: What Did the Order Actually Suggest?

The Executive Order itself was more of a directive to federal agencies, asking them to look into various ways to support families. It wasn’t a direct law passed that immediately changed things. Instead, it called for recommendations and studies on how to improve access to affordable childcare and eldercare. Some of the areas it touched upon included:

- Tax credits and deductions: Think of these like a little bit of money back at tax time to help offset the costs of care.

- Encouraging employer-provided benefits: The idea here was to get companies to offer more support for their employees, like on-site childcare or flexible work arrangements.

- Streamlining regulations: This meant looking at existing rules that might be making it harder or more expensive to provide childcare services.

- Supporting state and local initiatives: The order also encouraged collaboration with governments at lower levels to find solutions.

It sounds pretty sensible, right? On the surface, many of these ideas are about making life easier for families. However, the devil, as they say, is in the details – or sometimes, in what’s not explicitly stated or prioritized.

Why the Alarm Bells? The Nuances That Matter

So, if the goal is to make care more affordable, why the concern for women’s financial independence? Here’s where the broader implications come into play. Critics of the order pointed to a few key areas that raised eyebrows:

Focus on Tax Credits vs. Direct Investment:

One of the main points of contention was the emphasis on tax credits. While tax credits can be helpful, they often benefit those who are already paying a significant amount of taxes. For lower-income families, who might need childcare assistance the most, tax credits can offer less direct relief. It's like getting a coupon for a fancy restaurant when you can barely afford groceries – it’s nice, but it doesn't solve the immediate problem.

Many advocates for women's economic empowerment argue for more direct government investment in childcare infrastructure. This could mean publicly funded childcare centers, subsidies for families, or direct payments to care providers to ensure quality and affordability. The argument is that relying too heavily on tax credits can leave the most vulnerable families behind, and in turn, disproportionately affect women who are often in lower-paying jobs or taking on more caregiving duties.

The "Market-Based" Approach:

Some also felt the order leaned towards a more "market-based" approach, encouraging private sector solutions and employer-provided benefits. While this can be beneficial, it relies on the goodwill and financial capacity of individual businesses. Not all employers can afford to offer generous childcare benefits, and market forces alone don't always guarantee affordability or accessibility for everyone. Imagine if your car insurance was solely dependent on your employer offering it – it would create a huge divide between those who have it and those who don't.

Potential for Underfunding of Crucial Services:

The concern was that the recommendations coming out of the order might not adequately address the systemic issues that contribute to the high cost of childcare and eldercare. If the solutions are too narrowly focused or don't involve significant public funding, the existing gaps in affordability and accessibility might not be closed. This could mean that women continue to face significant financial hurdles when it comes to balancing work and family responsibilities.

Why Should You Care? It's About Everyone's Future!

You might be thinking, "This sounds like a niche issue," but honestly, it's not! The financial independence of women has a ripple effect on our entire economy and society. When women are financially secure:

- Families are stronger: Two incomes, or even just one secure income from a woman who can work full-time, means a more stable household. Think of it as having a more reliable engine in your family car – it runs smoother and is less likely to break down.

- The economy benefits: When women participate fully in the workforce, they contribute to economic growth, pay taxes, and drive innovation. It’s like adding more skilled players to a sports team – the whole team performs better.

- Societal progress is boosted: When women have the financial freedom to pursue their goals, it leads to more diverse leadership, more equitable workplaces, and a more just society for everyone.

This Executive Order, while aiming to address real challenges, sparked a conversation about the best ways to achieve affordable childcare and eldercare. The debate highlights the importance of ensuring that policies designed to support families actually lead to greater economic empowerment for everyone, especially women who often carry a significant portion of the caregiving load. It’s a reminder that when we talk about "family values" or "supporting parents," we need to look closely at the practical implications for women’s financial well-being.

So, the next time you hear about an Executive Order or a new policy, take a moment to think about who it might affect and in what ways. Understanding these details, even the seemingly complex ones, helps us all be more informed citizens and advocate for a future where everyone has the opportunity to thrive financially, no matter their gender.