Us Department Of Education Restores Student Loan Income-driven Repayment Plans: Complete Guide & Key Details

Well, folks, buckle up! The US Department of Education has been busy. They've been tinkering with those student loan repayment plans. Specifically, the ones tied to your income.

It's like a much-needed tune-up for your wallet. And maybe, just maybe, a sigh of relief for a lot of us. The Income-Driven Repayment (IDR) plans are back in the spotlight. And they're looking a little spiffier than before.

The IDR Renaissance

Remember those days of staring at a loan statement? Wishing it would just… disappear? The IDR plans are designed to make that less of a nightmare. They aim to tie your monthly payments to what you actually earn.

It’s not about magic fairy dust. It's about practical budgeting. If your income is low, your payment should be lower. It’s a concept that makes a lot of sense, right? Some might even call it… genius. (Shh, don't tell the loan servicers I said that.)

The big news is that the Department of Education is making these plans work better. They’ve done some cleaning up and streamlining. Think of it as a decluttering of your financial life. Less stress, more peace.

What's New and Shiny?

So, what are these "key details" we should be excited about? Firstly, there's a renewed emphasis on making these plans accessible. No more digging through a labyrinth of paperwork. Hopefully.

They've also addressed some of the historical hiccups. You know, those little annoyances that made people want to throw their laptops out the window. The goal is to make enrollment smoother. And the benefits more reliable.

One of the major wins is a reset for borrowers who were struggling. If you had past issues with IDR plans, there's a chance for a fresh start. It’s like hitting the undo button on some loan woes.

The "SAVE" Plan: A Star is Born?

Perhaps the most talked-about change is the implementation of the SAVE plan. This is the newest kid on the IDR block. And it’s designed to be particularly helpful.

The SAVE plan stands for Saving on a Valuable Education. Catchy, right? It's supposed to offer some of the most generous terms yet. Especially for those with lower incomes.

Under SAVE, your monthly payments are calculated based on a percentage of your discretionary income. And that percentage is pretty darn small. We're talking about 5% of your discretionary income for undergraduate loans.

What's "discretionary income," you ask? It's basically your income after certain essential needs are taken care of. Think housing, food, and, you know, that latte you absolutely deserve. The Department has a formula for it.

This means for many people, the monthly payment will be significantly lower. Like, "maybe I can afford to eat something other than ramen" lower. A true culinary revolution.

And if you have a really low income? You might even have a $0 monthly payment. Yes, you read that right. Zero. Zilch. Nada. It's almost too good to be true. But it might just be true.

"My student loan payment used to feel like a monthly tax on my dreams. Now, it feels more like a suggestion." - A hypothetical, very happy borrower.

Automatic Forgiveness? Almost!

Another juicy detail about the SAVE plan is the updated timeline for loan forgiveness. If you have a large loan balance, this could be a game-changer.

For borrowers who took out smaller loan amounts, there's a pathway to forgiveness in as little as 10 years. Ten years! That’s less time than it takes to binge-watch a really long TV series.

For those with higher balances, the forgiveness timeline is still tied to the total amount borrowed. But the terms are more favorable. They've adjusted the repayment periods. This means you'll be closer to that sweet, sweet day of freedom sooner.

And here's a little extra sparkle: interest won't grow as quickly. If your payment doesn't cover the monthly interest, the government will cover the rest. This prevents your balance from ballooning out of control. It’s like a financial growth inhibitor.

Who Benefits Most?

So, who's doing a little happy dance right now? Primarily, it’s the borrowers with lower incomes. The ones who have been struggling to make ends meet. This is for them.

It's also great news for those who borrowed smaller amounts. Or those who have been in repayment for a while. And especially those who feel like their loan balance has been taunting them.

This is also a win for borrowers who might have been intimidated by the complexity of old IDR plans. The goal is to simplify things. To make it less of a puzzle and more of a clear path.

Other IDR Plans Still Exist

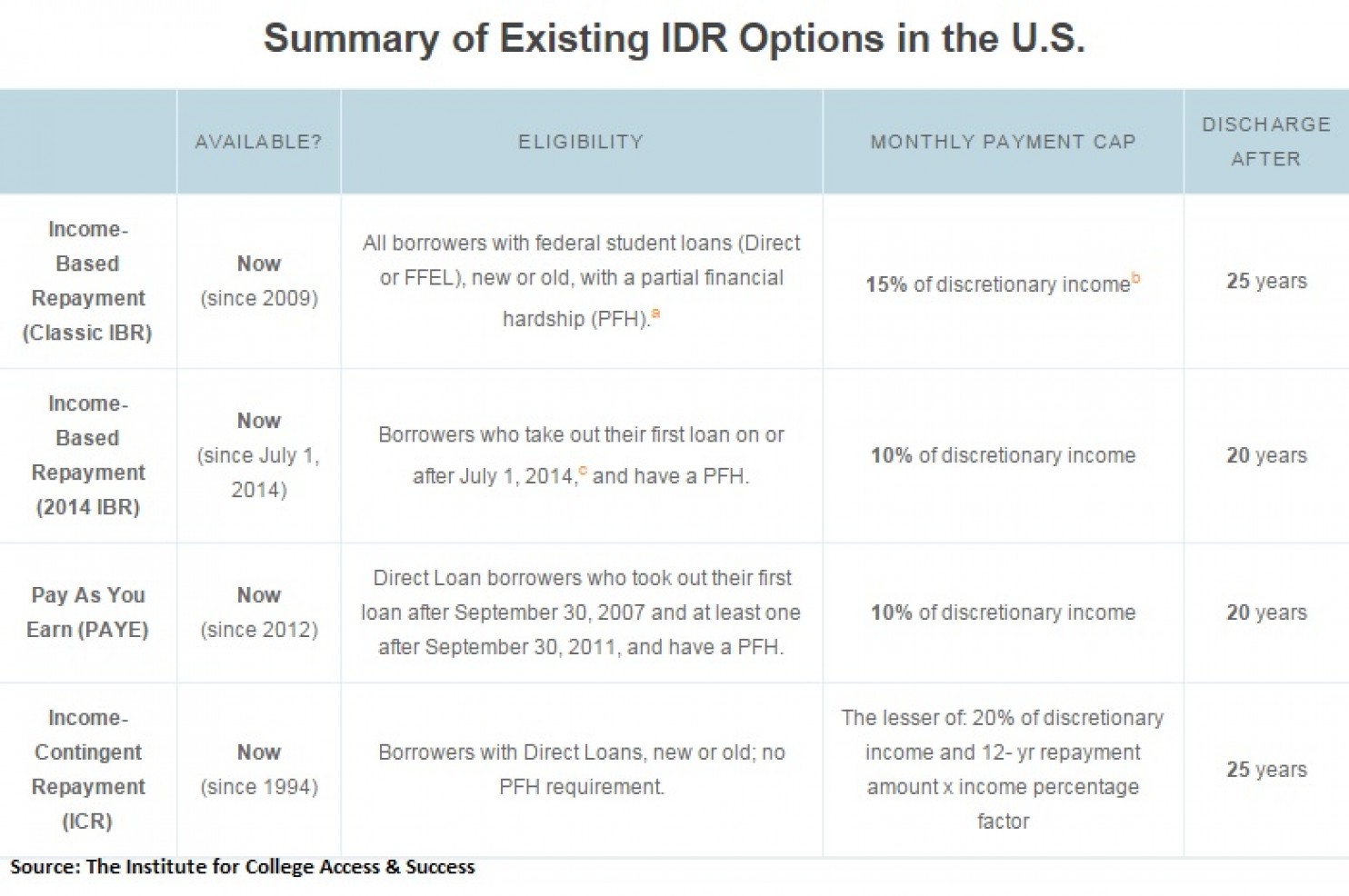

While SAVE is getting a lot of attention, don't forget about the other established IDR plans. Plans like ICR (Income-Contingent Repayment), IBR (Income-Based Repayment), and PAYE (Pay As You Earn) are still around.

The Department has been working to improve these as well. They're trying to make sure the old plans are more accurate and accessible too. Think of them as the reliable older siblings of SAVE. Still important, still useful.

Each plan has its own set of rules and benefits. The best one for you will depend on your specific loan type and your income situation. It’s a bit like choosing the right key for the right lock.

Key Takeaways for Your Brain

First things first: Check your eligibility. The US Department of Education has made it easier to see which plan might be best for you.

Don't wait around forever. If you're struggling with your payments, explore these options. The sooner you enroll, the sooner you can start seeing the benefits. It's proactive financial self-care.

Be aware of the enrollment deadlines. While many things are being improved, it's always good to stay on top of dates. Especially when it comes to your money.

And finally, don't be afraid to ask for help. Your loan servicer can guide you through the process. Or you can look for resources from reputable student loan advocacy groups. They're the unsung heroes in this whole saga.

So, there you have it. A little bit of good news for your student loan journey. The US Department of Education is working to make things more manageable. And maybe, just maybe, a little less painful. Now, go forth and explore your options! Your wallet might just thank you.